Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Gold rose to two-week high on Tuesday, driven by fresh wave of risk aversion sparked by growing uncertainty on decision of President Trump to fire a Fed Governor Cook.

Gold rose to two-week high on Tuesday, driven by fresh wave of risk aversion sparked by growing uncertainty on decision of President Trump to fire a Fed Governor Cook.

Trump’s conflict with the US policymakers is escalating again, after a campaign to remove Fed Chair Powell, which Trump eventually sidelined, but remained on track to secure dovish majority in the FOMC after failing to convince them for more radical rate cuts.

Fresh strength cracked important barrier at $3385 (upper triangle boundary / Fibo 76.4% of $3408/$331 bear-leg) but was so far unable to break higher.

Technical picture on daily chart is still mixed with positive signals from today’s formation of bullish engulfing pattern (still to be confirmed) and price action being underpinned by thick daily cloud, while neutral momentum studies and overbought Stochastic offset positive impact.

Repeated daily close above broken Fibo 50% ($3360) will be a minimum requirement to keep near-term bias with bulls, while close above $3371 (broken Fibo 61.8%) would boost optimism for push through triangle’s upper trendline and expose key resistances at $3400/08 (psychological / Aug 8 top).

Res: 3385; 3400; 3408; 3431.Sup: 3371; 3360; 3353; 3348.

In Jackson Hole last week, the Fed chairman said that a weak labour market would slow down inflation, which is rising due to tariffs. The central bank could now throw the US economy a lifeline in the form of monetary policy easing. This news allowed EURUSD to soar above 1.17 on Friday.

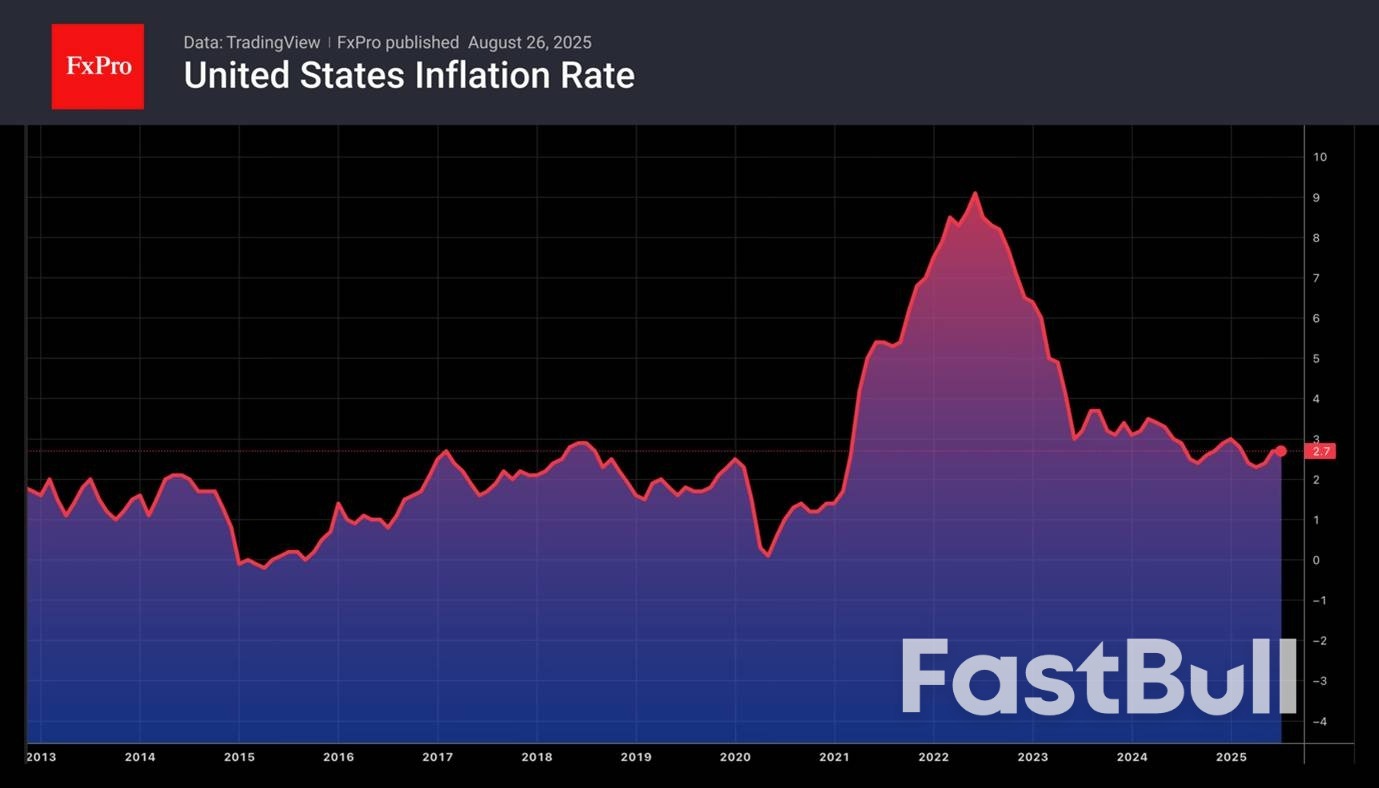

However, history shows that the Fed is sometimes wrong. In 2021 to 2022, it also discussed transitory inflation and delayed the start of the monetary tightening cycle. What if high prices are here to stay in the US economy? The market began to doubt the veracity of Jerome Powell’s speech, bringing the Euro-Dollar pair back down to earth.

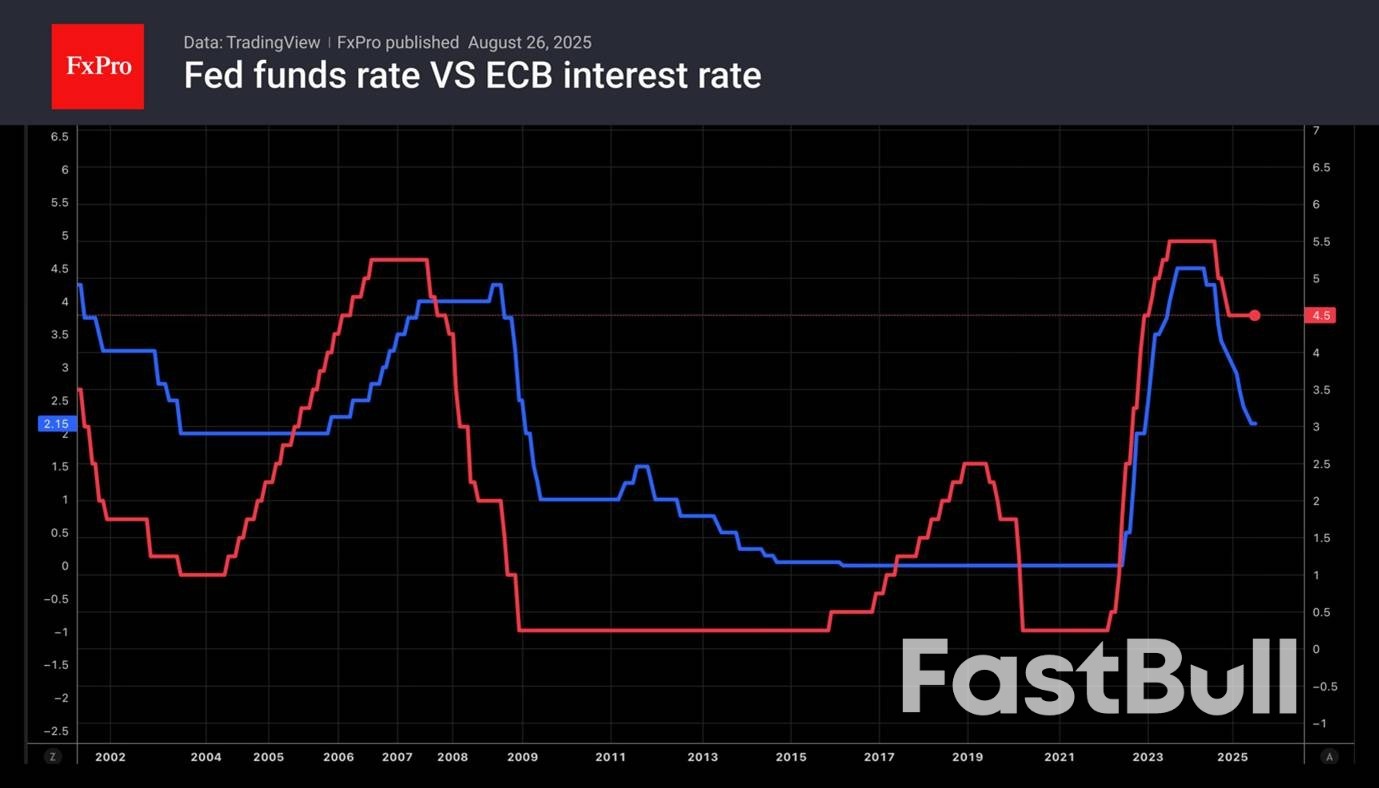

In fact, due to Donald Trump’s policies, the United States risks facing negative net immigration in 2025. As a result, according to Apollo research, non-farm employment would grow by an average of 24,000 per month. In 2015-2024, the figure increased by 155,000. The Fed will have to cut rates, but at the same time, the ECB will keep them unchanged if the eurozone economy accelerates due to Germany’s fiscal stimulus.

The divergence in monetary policy among the world’s leading central banks paints a bullish outlook for EURUSD. The uptrend will remain in place, and pullbacks will be actively bought, especially since Donald Trump’s attacks on the Fed are undermining confidence not only in the US central bank but also in the US dollar.

The US president has announced the dismissal of FOMC member Lisa Cook. If she is unable to defend herself in court, the Fed’s independence will be threatened, and the central bank will become a puppet of the White House. Aggressive rate cuts will fuel inflation. In such conditions, it will become extremely dangerous to keep your money in the United States, since capital outflows will put downward pressure on the US dollar.

Technically, a return of EURUSD above its fair value of 1.165 and resistance at 1.169 will open the way for the main currency pair to resume its upward trend.

Britain’s dysfunctional property-rental market has endured successive governments attempting reform of its almost feudal system of amateur landlordism. Smaller landlords, with four or fewer properties, account for more than half of the 4.7 million households in the private rental sector.Attempts to professionalize the industry have come at a huge cost to low-income families, and recent data make it clear exactly what’s going wrong and how it’s fast becoming a financial disaster for the government.

Private sector rental data for July from the Office for National Statistics show rents are stabilizing, with the first monthly fall in London for four years. Across the country average rents are 6% higher than last year, but this is down from 6.7% in June. Supply and demand are moving into equilibrium. The July housing survey from the Royal Institution of Chartered Surveyors revealed the depth of the crisis. A gauge showing the net balance of new landlord instructions — when properties are placed with estate agents for rental — last month dropped to minus 31%, the weakest in at least 30 years (barring April 2020’s Covid plunge, which was rapidly reversed).

According to the real estate agent Savills, the private rental sector lost 290,000 properties between April 2021 and last October during a period in which, according to the Office for National Statistics, the UK’s population increased by more than 2 million. It’s worth noting at the same time 53,000 new-build rentals were added. However, many of these new corporate landlords offer amenities, such as gyms and concierges, only accessible to higher earners, while most of the properties lost in London have been at the cheaper end dominated by smaller landlords, according to Savills.

The stark reality is that many of those displaced by this landlord exodus — which we’ve explained as recently as April and as far back as May 2023 — are no longer in a financially strong enough position to compete for homes in this shrinking private market, where rents have surged 40% since Covid, their unmet housing demand is reflected in social and economic stress rather than clearly showing up in rental agent metrics. Rough sleeping is a very visible problem. Few Londoners will be surprised that the number of people living on the capital’s streets has increased by 26% over the past year.

Less apparent is the spike in waiting lists for housing at affordable rents. Councils put that number at a staggering 1.33 million. Even this huge figure is almost certainly a significant underestimate as councils are obliged to house the homeless and will do everything in their power to manage their liability downwards.

The cost of temporary accommodation is huge and in recent years has begun to stress council budgets in areas of the country that haven’t previously reported significant problems. According to the New Economics Foundation, the south coast city of Southampton spent £23,000 ($31,000) in 2018/19 on nightly paid emergency accommodation. In the first nine months of 2024 that cost hit £700,000.

All this is happening just as UK living standards are under renewed pressure, with private sector pay growth slowing below 5%, and inflation set to rise to as high as 4% in September, according to Bloomberg Economics. In data released Monday, real wage increased fell to a 1.5% annual pace in the second quarter, a notable slowdown from the 5% pace that Labour inherited when it took power just over a year ago. Deutsche Bank AG economists expect this to slow further to just 0.5% by year end.This financial crunch also creates another delicate and expensive problem. It is increasingly pushing local councils, seeking to house the homeless, into direct competition for already costly hotel rooms with the national government looking for accommodation for asylum seekers. Clearly this situation is not financially, socially or politically sustainable. Government can’t magic up additional supply in the quantities required to satisfy a growing populace - but what it certainly should be doing is oiling the wheels and coordinating national and local efforts. Instead the opposite is happening.

First and foremost, the Local Housing Allowance, a measure used to calculate housing benefit for low income families, has been allowed to lag far behind actual rents. Only 5% of London’s housing stock is currently accessible to those on benefits. Increasing the LHA would allow stressed families to return to the private sector until such time as the government makes good on its pledge to increase rental supply.

Secondly, most of the measures aimed at increasing tenant security in recent years have achieved precisely the opposite. Instead, it’s created a hard-to-deny impression upon landlords that they are viewed a scourge on society. Understandably, they’ve been voting with their feet, exacerbating the supply problem.

It’s a tough pill to swallow, but until others step up with the required investment, pragmatism is required. The government has already done this to a certain degree by retaining Serco Group Plc, a major UK facility manager, to seek out accommodation for asylum seekers, usually by targeting discouraged small landlords. Yet this removes further private rental supply even without landlords actually selling up.

For wealthier tenants there’s more choice and the quality is rising. It’s also a great time to buy, with private landlords actively selling homes that typically formed the first step on the housing ladder. For poorer tenants though, and especially the homeless, things have never been tougher. This creates not just personal catastrophes but a burgeoning national financial crisis.

US orders for business equipment increased in July by more than projected, suggesting companies are moving forward on investment plans as some of the trade and tax policy uncertainty gradually diminishes.

The value of core capital goods orders, a proxy for investment in equipment that excludes aircraft and military hardware, increased 1.1% last month after a revised 0.6% decrease in June, Commerce Department figures showed Tuesday.

Bookings for all durable goods — items meant to last at least three years and including orders for commercial aircraft and military equipment — fell 2.8%. Earlier this month, Boeing Co. reported a fewer orders in July than in June.

Non-defense capital goods shipments including aircraft, which feed directly into the equipment investment portion of the gross domestic product report, rose 3.3%. Rather than orders, which can be canceled, the government uses data on shipments as an input to GDP.

Despite the gain, economists expect business investment to be soft for the remainder of the year before picking up in 2026 as companies take advantage of tax provisions after President Donald Trump signed the One Big Beautiful Bill. In the first half of this year, companies were largely cautious about capital spending because of erratic tariff announcements and concerns about demand.

In addition to a Boeing-related surge in business investment in the first quarter, companies ramped up spending on equipment to speed the use of artificial intelligence. AI and similar capital expenditures have the potential of boosting productivity for companies aiming to offset higher costs, including import duties.

The durables report showed orders for electrical equipment, computers, machinery and metals increased last month. Bookings for motor vehicles also picked up.

The government’s report showed core capital goods shipments, a less volatile metric that excludes planes and military hardware, rose 0.7% after an upwardly revised gain in the previous month.

Economists prefer the core equipment shipments figure to gauge underlying capital investment since there are extremely long times between ordering aircraft and military hardware and the actual shipment taking place.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up