Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Elite investors are cashing out of Nvidia as fears of an AI bubble grow. Thiel dumped his entire stake, SoftBank sold billions, and Burry is betting against it — fueling worries the AI boom is nearing a tipping point.

US companies shed 2,500 jobs per week on average in the four weeks ended Nov. 1, according to data released Tuesday by ADP Research.

The decline suggests the labor market lost momentum in late October. ADP's monthly jobs report, which was released Nov. 5, showed private employment increased 42,000 after declining in the prior two months.

The ADP snapshot of the labor market has helped bridge the gap with official employment data delayed by the longest government shutdown in history. While funding to official statistics agencies has been restored, it's still unclear when October economic data will be issued.

On Thursday, the Bureau of Labor Statistics will issue its September jobs report, which is expected to show total US payrolls rose 55,000 from the prior month.

The weekly ADP figures follow a number of large companies announcing job cuts during the month, including Amazon.com Inc. and Target Corp. Planned layoffs were the highest for any October in more than two decades, according a report from outplacement firm Challenger, Gray & Christmas Inc.

Meanwhile, Americans have grown increasingly concerned about job security. A Harris Poll for Bloomberg News conducted on Oct. 23-25 showed 55% of employed Americans are worried about losing their job.

The House on Tuesday is expected to vote to order the Department of Justice to release all of its files on notorious sex offender Jeffrey Epstein, two days after President Donald Trump abruptly dropped his opposition to the bipartisan bill.

The measure is set to come up during the chamber's first vote series of the day around 2 p.m. ET, NBC News reported.

"Almost everybody" will vote to pass it, House Majority Whip Tom Emmer, R-Minn., told NBC on Monday night.

That wasn't always the case. The push to release the Epstein files had faced opposition from GOP lawmakers, following the lead of Trump, whose White House had warned that backing the effort would be considered a "hostile act."

A discharge petition that would have forced a vote on the bill was jammed up during the government shutdown, as House Speaker Mike Johnson, R-La., kept representatives out of session for nearly eight weeks. The prolonged absence delayed the swearing-in of Democratic Rep. Adelita Grijalva of Arizona, the final signature needed to move the petition forward.

The shutdown ended last Wednesday and Grijalva, after being sworn in, signed the discharge petition. But, with pressure mounting, Johnson said he would bring the Epstein bill to a vote earlier than expected.

The bill from Republican Rep. Thomas Massie of Kentucky and Democratic Rep. Ro Khanna of California is being brought to the floor under a procedure that will require a two-thirds majority to pass. If it succeeds, it will head to the Senate.

Trump, a former friend of Epstein's who had a falling out with him years earlier, said on the campaign trail that he would support releasing the government's files from its investigations into the wealthy and well-connected financier. Epstein died in jail in 2019 while facing federal sex trafficking charges.

But Trump's DOJ said in a July 6 memo that it had conducted an "exhaustive review" of Epstein-related matters and determined "that no further disclosure would be appropriate or warranted."

That determination, and Trump's repeated insistence that the focus on Epstein was a Democratic "hoax," has spurred outrage across the political spectrum, including from some of Trump's own supporters.

The House Oversight Committee last week released thousands of documents from Epstein's estate, including emails appearing to show Epstein discussing Trump.

Trump on Sunday night abruptly reversed course, urging House Republicans to vote in favor of the Epstein files bill.

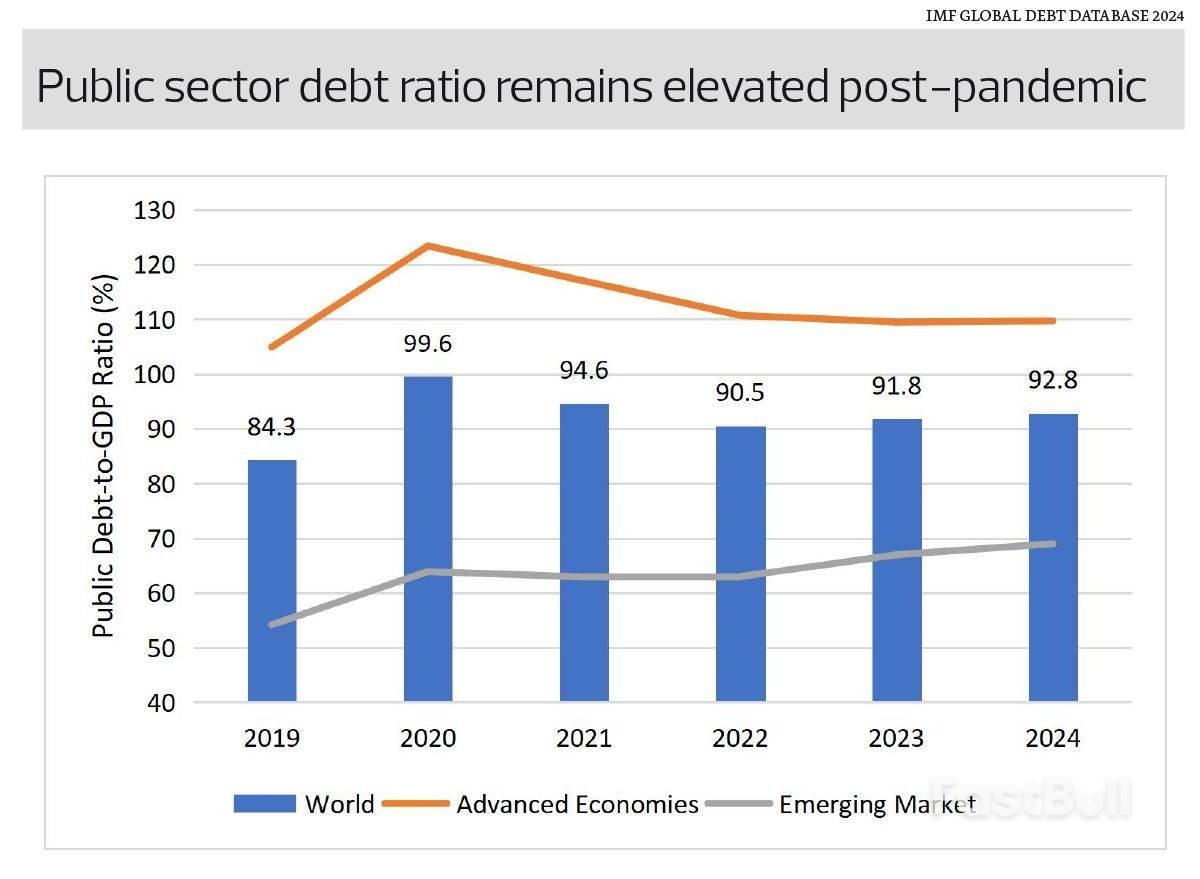

Imagine running a household where your debt grows faster than your income year after year. Eventually, something has to give. Now, scale that up to the global economy and you will see why rising public debt is something that should not be overlooked.

According to the International Monetary Fund's Global Debt Database, global public debt rose for the second consecutive year to 92.8% of GDP in 2024, up from 91.8% in 2023. Sustained borrowing has kept debt burdens elevated, and if current trends persist, global public debt could breach 100% of GDP by 2029, based on the IMF's estimate in its October 2025 Fiscal Monitor publication.

To understand how we got here, we must rewind five years. The Covid-19 pandemic triggered an extraordinary surge in government borrowing to fund rescue packages and stimulus programmes. This saw the global public debt-to-GDP ratio jump from 84.3% in 2019 to 99.6% in 2020. While stimulus measures have unwound and fiscal deficits have since narrowed, the debt itself has not gone away. There was a transitory fall in public debt to 90.5% of GDP in 2022 as stimulus unwound and GDP rebounded, but the decline stalled. Today, debt levels remain well above the 2010s average of around 80%.

First, rising interest rates are making debt more expensive. Governments that borrowed at low or near-zero rates during the pandemic are now refinancing at much higher rates, straining budgets. A good example is at home in Malaysia, where debt service charges have been rising amid a larger overall debt burden and higher interest rates. Debt servicing is projected to consume nearly 17% of government revenue in 2026, up from around 10% in the early 2010s and above the Ministry of Finance's self-imposed 15% limit.

Second, high debt reduces fiscal flexibility. Should another crisis emerge, many governments may find themselves constrained and unable to deploy large-scale stimulus measures without risking investor confidence.

Third, credit rating agencies are watching. Fitch downgraded the US' credit rating in 2023, followed by Moody's in May 2025, stripping the US of its AAA status across all major rating agencies. While markets shrugged off the downgrade, it underscores that even top-rated sovereigns are not immune.

However, debt accumulation is far from uniform and should not be overly simplified, as each country carries its own risks and challenges.

Advanced economies continue to carry outsized debt burdens, led by the US and Japan. Public debt in advanced economies averaged around 109.7% of GDP in 2024, up from 104.9% in 2019. Emerging markets, though lower, have seen much more rapid debt growth, rising from 54.2% in 2019 to 69% in 2024.

This divergence means the global average masks significant variation in fiscal risk. Advanced economies carry high debt levels but benefit from deep domestic capital markets and reserve currency status, which allow them to maintain high levels of debt. However, downside risks remain. A sudden shift in investor sentiment, political gridlock or an inflation resurgence could sharply raise borrowing costs. With such large debt stocks, even modest rate hikes can balloon interest payments. Countries with weaker fiscal anchors or slower growth may face sharper sustainability pressures, especially if slower global growth, triggered in part by US tariff hikes, forces governments to re-engage in debt-fuelled stimulus.

Emerging markets face a different set of risks. Rapid debt accumulation can erode investor confidence and raise doubts about fiscal sustainability and future economic development. While debt can fund productive investments that "pay for themselves" through higher national income, there is no guarantee that growth will outpace borrowing costs. If income growth falls short, governments may need to introduce new taxes or cut spending to service debt, which dampens long-term economic growth. These risks are amplified when debt rises at an unusually steep pace, as what is observed currently, which would then require substantial growth that may be difficult to achieve. Given the generally weaker fiscal institutions and narrower tax bases among emerging markets, even moderate debt levels can become unsustainable if growth falters or global conditions tighten.

Debt provides useful leverage, but leverage comes with risk. Think of it like a financial pressure cooker: heat builds quietly inside, even if everything looks calm on the outside. As long as the lid holds, it seems safe and will continue to produce the end product you desire. But if pressure keeps rising and no one releases the steam, the risk of a sudden blowout becomes very real. History reminds us that debt crises often erupt when least expected. Governments must continue consolidating, investors must remain vigilant, and policymakers must prepare for scenarios where debt becomes a constraint, not just a statistic.

Global markets remain under pressure today as risk sentiment deteriorates further across regions. Europe opened firmly lower, tracking the broad declines seen earlier in Asia, while U.S. futures point to another weak session. Today's tone is one of cautious de-risking, with markets showing little appetite to buy dips ahead of several major event risks.

Technology stocks continue to drive the weakness. Selling pressure on Nvidia stayed intense ahead of the company's third-quarter results due after Wednesday's close. Nvidia has been the symbolic leader of the AI-driven market rally, and the reaction to its earnings could determine whether sentiment stabilizes or slips into a deeper correction. With concerns over market breadth, excessive valuations, and shaky AI fundamentals resurfacing, traders are positioning defensively.

Attention is on Thursday's U.S. non-farm payrolls release — the first since the government reopened. Today's initial jobless claims, at 232k, and continuing claims, at 1.957m, produced almost no market reaction. That muted response raises doubts about how strongly markets will react to the delayed NFP, though the potential for a volatility shock should not be dismissed.

In Japan, the highly anticipated meeting between Prime Minister Sanae Takaichi and BoJ Governor Kazuo Ueda offered far less clarity than markets had hoped. Traders were looking for sharper messaging on policy direction given rising political pressure on the central bank. Instead, the meeting produced broad, non-committal remarks that did little to shift expectations.

Ueda reiterated that Japan's wage-price dynamics are improving thanks to both government policy and the BoJ's supportive stance. He described the central bank as "gradually adjusting" monetary support to ensure a stable path toward the 2% inflation goal. Takaichi, he said, appeared to accept his assessments. Yet nothing in his comments hinted at a change in stance or timeline.

Asked about the timing of the next rate hike, Ueda repeated that decisions will be made "appropriately" based on incoming data — a stance that leaves the market no clearer about whether a December move is even on the table. Given the political backdrop, traders remain convinced that January or later is more likely.

In FX, Dollar holds the top spot for the week so far, followed by Loonie and Sterling. At the other end of the spectrum, Aussie is the weakest performer, with Yen and Swiss Franc next in line. Kiwi and Euro sit squarely in the middle.

In Europe, at the time of writing, FTSE is down -1.39%. DAX is down -1.42%. CAC is down -1.40%. UK 10-year yield is up 0.006 at 4.543. Germany 10-year yield is down -0.015 at 2.701. Earlier in Asia, Nikkei fell -3.22%. Hong Kong HSI fell -1.72%. China Shanghai SSE fell -0.81%. Singapore Strait Times fell -0.86%. Japan 10-year JGB yield rose 0.015 to 1.749.

RBA minutes from the November 3–4 meeting underscored a Board that sees the economy as "broadly in balance" and saw no justification to adjust the cash rate at this stage. While the central projection remains aligned with the RBA's employment and inflation objectives, policymakers stressed that the next move in rates is not predetermined. Members agreed it was "not yet possible to be confident" about whether holding steady or easing further would become the more likely scenario.

The minutes outlined several conditions that could support keeping policy unchanged. One is a stronger-than-expected recovery in "demand" that lifts employment. Another is if incoming data suggest the economy's "supply capacity" is weaker than previously assessed — potentially due to persistently high inflation or softer-than-expected productivity growth. A third is a reassessment of whether monetary policy is still "slightly restrictive". Any of these outcomes, the RBA said, would "limit the scope for further easing".

But the Board also detailed circumstances that could justify another rate cut. A material weakening in the labor market remains the clearest trigger. A second downside risk is if GDP growth disappoints — for example, if households turn "more cautious about spending" than currently assumed. In these cases, excess capacity would likely reappear, cooling inflation and warranting additional support.

Overall, the minutes confirm a central bank in wait-and-see mode. The RBA is not ruling out further easing, but neither is it leaning strongly toward it. The next several months of data — particularly on productivity, inflation persistence, and household spending — will be crucial in determining whether the Board holds steady or reopens the easing path in 2026.

Daily Pivots: (S1) 154.43; (P) 154.86; (R1) 155.70;

Intraday bias in USD/JPY remains on the upside for the moment. Current rise is part of the rally from 139.87. Next target is 100% projection of 146.58 to 153.26 from 149.37 at 156.05. Break there will pave the way to 158.85 key structural resistance. However, considering bearish divergence condition in 4H MACD, firm break of 153.60 support will indicate short term topping, and bring deeper pullback to 55 D EMA (now at 151.45).

In the bigger picture, current development suggests that corrective pattern from 161.94 (2024 high) has completed with three waves at 139.87. Larger up trend from 102.58 (2021 low) could be ready to resume through 161.94 high. On the downside, break of 149.37 support will dampen this bullish view and extend the corrective pattern with another falling leg.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up