Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

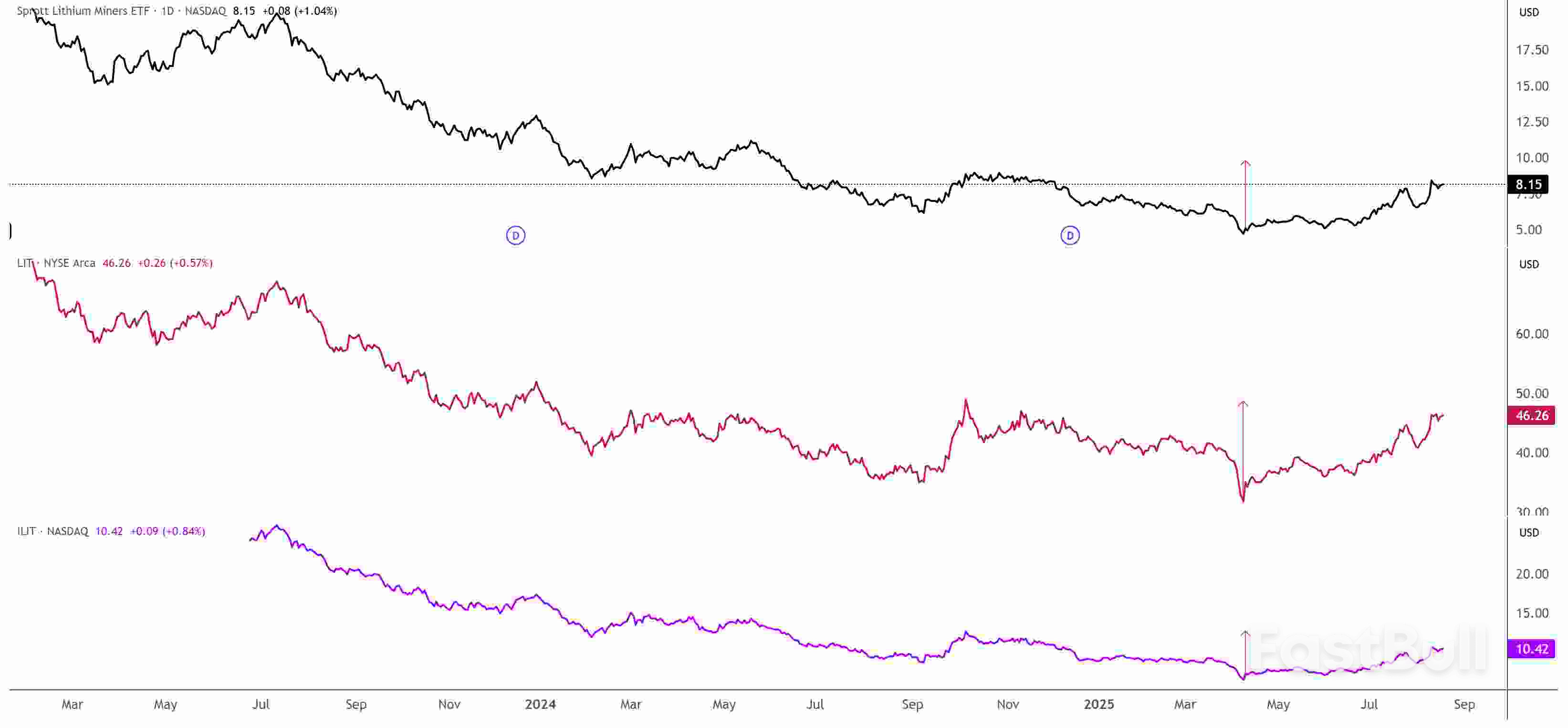

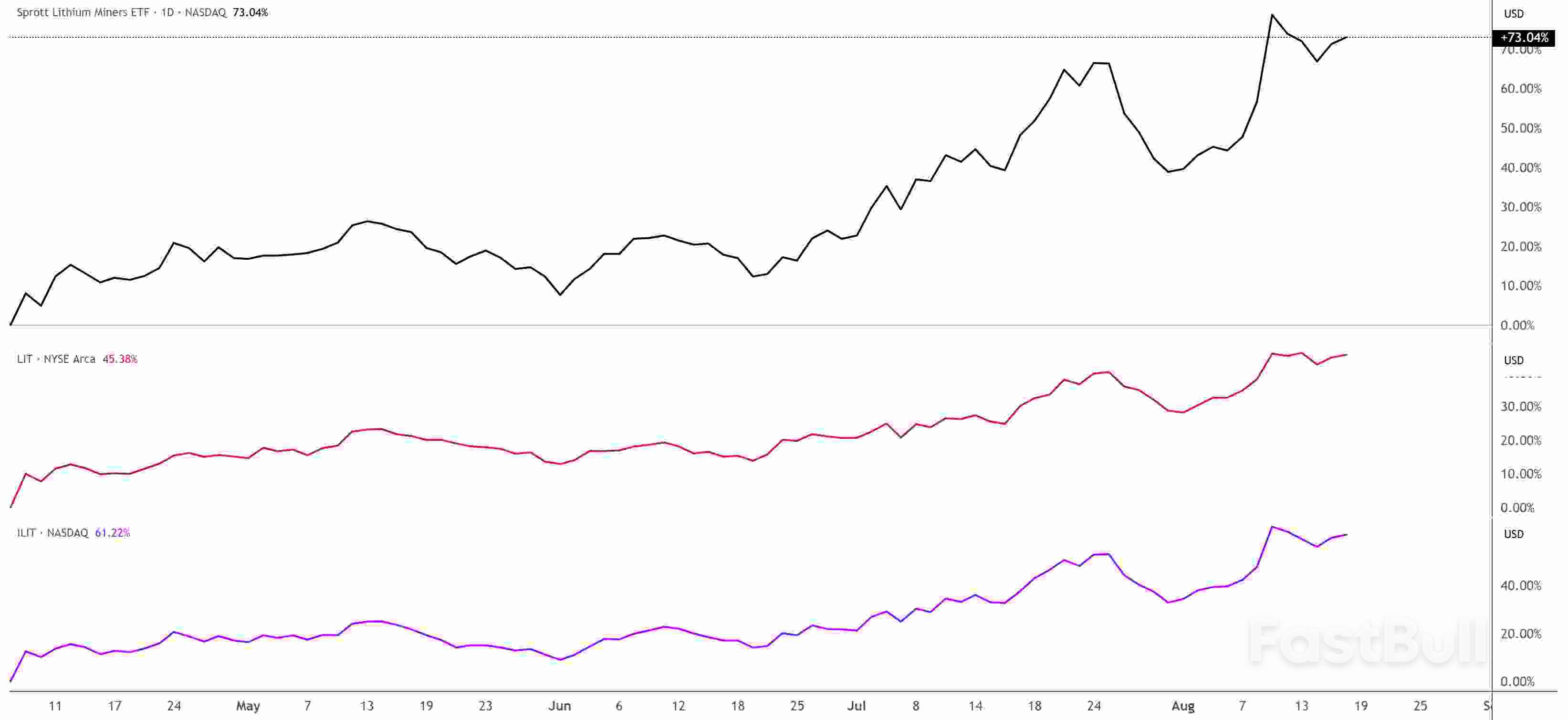

Lithium, copper, and uranium are set to soar as electrification, EVs, AI, and data centers boost demand. Tight supply and strong institutional buying support their long-term bullish outlook.

Hamas has agreed to a new proposal for a ceasefire-hostage release deal with Israel.

The “comprehensive two-stage plan” was based on a framework advanced by US envoy Steve Witkoff and presented to Hamas by Qatari and Egyptian mediators, according to the BBC.

It would see Hamas free around half of the 50 remaining Israeli hostages – 20 of whom are believed to be alive – in two stages during a 60-day temporary truce.

During that time, there would be negotiations on a permanent ceasefire and an Israeli troop withdrawal.

The Egyptian and Qatari mediators reportedly met with Hamas representatives Sunday in Cairo, and presented them with the plan.

In a post on Facebook Monday, Hamas leader Basem Naim said Hamas and other Palestinian terror groups had agreed to the deal:

“The movement has submitted its response approving the new mediators’ proposal,” Naim wrote in Arabic.

“We pray to God to extinguish the fire of this war against our people.”

The deal was reached ahead of a major Israeli offensive to occupy Gaza City and just hours after President Donald Trump said Hamas needed to be “confronted and destroyed,” Axios noted.

“We will only see the return of the remaining hostages when Hamas is confronted and destroyed!!!,” Trump posted on Truth Social Monday morning.

“The sooner this takes place, the better the chances of success will be. Remember, I was the one who negotiated and got hundreds of hostages freed and released into Israel (and America!). I was the one who ended 6 wars, in just 6 months. I was the one who OBLITERATED Iran’s Nuclear facilities. Play to WIN, or don’t play at all!”

The plan is reportedly “98 percent similar” to the last U.S.-backed proposal, but the deal fell though when Hamas refused to sign on.

Hamas said at the time that it would only free the remaining hostages if Israel agreed to end the 22-month war. But Netanyahu said that would only happen once Hamas was disarmed and released all the hostages.

On Sunday, more than 200,000 Israelis took to the streets to demand Netanyahu not launch the new offensive in Gaza, and instead sign a deal to bring back the hostages. It was the biggest anti-war protest since the beginning of the war, according to Axios.

The Gaza War began in response to Hamas’ surprise attack in southern Israel on 7 October 2023.

The terrorists killed about 1,200 people—mostly civilians—in the attack, and took another 251 hostage.

Oil prices fell on Tuesday as traders thought a possible cease-fire in Russia's war with Ukraine might lead to easing or the end to sanctions on Russian crude oil, which would in turn boost global supply.

Brent crude futures were down 50 cents, or 0.75%, at $66.10 a barrel at 10:38 a.m. CDT (1538 GMT). U.S. West Texas Intermediate crude futures for September delivery, set to expire on Wednesday, were down 72 cents, or 1.14%, at $62.70 per barrel.

The more active October WTI contract was down 66 cents, or 1.05%, at $62.04 a barrel.

"Even with this peace dividend, we have a record short position," said Phil Flynn, senior analyst with Price Futures Group. "Because of the size of the short position, people are betting on a cease-fire and if we don't get one there could be a bounce."

Following a White House meeting on Monday with Ukrainian President Volodymyr Zelenskiy and European allies, U.S. President Donald Trump announced in a social media post that he had spoken with Russian President Vladimir Putin.

Trump said arrangements were being made for a meeting between Putin and Zelenskiy, which could lead to a trilateral summit involving all three leaders.

Suvro Sarkar, lead energy analyst at DBS Bank, said Trump's softened stance on secondary sanctions targeting importers of Russian oil had reduced the risk of global supply disruptions, easing geopolitical tensions slightly.

Chinese refineries have purchased 15 cargoes of Russian oil for October and November delivery as Indian demand for Moscow's exports has fallen away, two analysts and one trader said on Tuesday.

Zelenskiy described his talks with Trump as "very good" and noted discussions about potential U.S. security guarantees for Ukraine. Trump confirmed the U.S. would provide such guarantees, though the extent of support remains unclear.

Trump has pressed for a quick end to Europe's deadliest war in 80 years, but Kyiv and its allies worry he could seek to force an agreement on Russia's terms.

"An outcome which would see a ratcheting down of tensions and remove threats of secondary tariffs or sanctions would see oil drift lower toward our $58 per barrel Q4-25/Q1-26 average target," Bart Melek, head of commodity strategy at TD Securities, said in a note.

These are some of the stocks making the biggest moves in midday trading Tuesday.

Viking Therapeutics, shares tumbled 42% after phase 2 trial results showed Viking's experimental oral obesity drug had more side effects than expected. About 20% of the patients in the trial quit using the drug due to symptom such as nausea and vomiting. On average, patients lost 12% of their starting weight after 13 weeks.

Target Hospitality, the temporary workforce housing play jumped around 6%. On Monday, Stifel upgraded Target Hospitality to buy from hold, dubbing it a "back door data center play" and lifting its target price to $11 from $7.50.

The new target price suggests about 37% upside from Monday's close. Nvidia , Advanced Micro Devices and Palantir Technologies: investors took profits in some of this year's high-flying tech stocks. Nvidia shares dropped nearly 3%, while AMD fell close to 5%. Palantir lost 7%.

Strategy , Robinhood and Mara Holdings: crypto-linked stocks dipped on Tuesday as bitcoin pulled back more than 2%. Bitcoin proxy Strategy and trading app maker Robinhood fell roughly 6% each. Bitcoin miners Mara Holdings and Riot Platforms lost more than 5% and 2%, respectively.

UnitedHealth, the health insurance giant slid more than 2% following back-to-back winning days. The stock had seen a recent resurgence after Warren Buffett revealed a stake of 5 million shares in UnitedHealth, valued at about $1.6 billion. On Friday, the stock posted a nearly 12% advance for its best day since 2020.

Intel, shares of the chipmaker jumped more than 6% after it was announced that SoftBank will make a roughly $2 billion investment in the company, paying $23 per share for Intel's common stock. This comes as the U.S. government reportedly has been considering taking a stake in Intel.

Palo Alto Networks, the cybersecurity stock gained more than 3% after the company's fiscal fourth-quarter results topped Wall Street's expectations. Palo Alto also posted better-than-expected guidance for the first quarter and full year and announced that its founder and chief technology officer, Nir Zuk, is retiring.

Fabrinet, the electronic manufacturing services company dropped 10%. Fiscal fourth quarter adjusted earnings of $2.65 per share just barely beat the $2.64 per share that analysts polled by FactSet were expecting. Revenue of $909.7 million topped the consensus estimate of $883.1 million. Additionally, the company announced upbeat earnings and revenue guidance for the first quarter.

Viking Holdings, shares fell nearly 2% after the cruise operator posted its quarterly results. Viking's second-quarter adjusted earnings of 99 cents per share came in line with analysts' expectations, according to FactSet, while its revenue for the quarter of $1.88 billion beat the $1.85 billion that was anticipated. The company also said it plans to take delivery of six river vessels during the rest of this year.

Best Buy, the consumer electronics retailer rose 3% following the launch of its third-party marketplace , which will expand its product offerings to shoppers.

Xpeng, U.S. shares of the Chinese electric car startup popped 5% on the heels of the company posting a smaller-than-expected loss for the second quarter, per FactSet. Its revenue for the period also topped analysts' estimates.

Tegna, shares climbed 4%. Television broadcaster Nexstar Media and Tegna announced Tuesday that Nexstar has agreed to acquire Tegna for $3.54 billion . The deal is expected to close by the second half of next year.

Home Depot, shares of the home improvement retailer added 3%. Despite the company missing on both lines for the first time since 2014, it maintained its full-year outlook.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up