Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

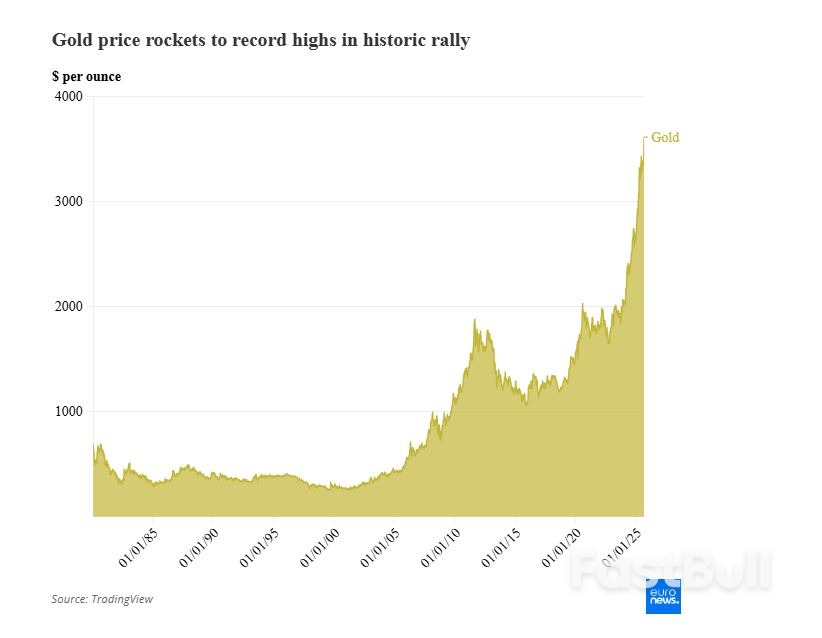

Gold is shining in 2025, outperforming all major assets. With political instability, doubts over Fed independence, and rising economic risks, gold’s role as a trusted, uncorrelated store of value has made it the safe haven of choice.

Yen rebounded broadly today, climbing to the top of the performance leaderboard as traders latched onto speculation that the BoJ may still raise rates as soon as October. A Bloomberg report citing unnamed officials suggested some policymakers favor an earlier move, with reduced concern about growth risks following the U.S.–Japan trade deal. The report noted that the key variable for policymakers is whether the drag from U.S. tariffs on Japan’s economy remains within expectations. If so, the bank could argue there is room to resume normalizing rates despite political turbulence in Tokyo.

However, the report relied on anonymous sources and came alongside conflicting headlines. Many analysts argue the resignation of Prime Minister Shigeru Ishiba and the ensuing LDP leadership contest are reasons for caution. The BoJ, they contend, is unlikely to risk tightening policy amid such political uncertainty. The central bank also has time on its side. Policymakers can afford to wait until early next year for the next hike, ensuring stability while avoiding the impression of acting in haste. For markets, this means rate expectations are likely to remain volatile as headlines shift.

Elsewhere, Euro weakened broadly, with investors still digesting the ouster of French Prime Minister François Bayrou on Monday. His government’s collapse has heightened perceptions of instability in Paris, though the turmoil alone is unlikely to drive sustained Euro weakness without broader contagion. Still, the picture of France cycling through four prime ministers in two years have weighed on confidence. With President Emmanuel Macron scrambling to find another candidate capable of surviving parliament, Euro has remained defensive.

In the wider FX market, Yen is the day’s strongest performer so far, followed by Aussie and Kiwi. Euro is the weakest, trailed by the Swiss Franc and Loonie. Dollar and Sterling sit mid-pack.

In Europe, at the time of writing, FTSE is up 0.26%. DAX is down -0.48%. CAC is up 0.31%. UK 10-year yield is up 0.012 at 4.62. Germany 10-year yield is up 0.029 at 2.674. Earlier in Asia, Nikkei fell -0.42%. Hong Kong HSI rose 1.19%. China Shanghai SSE fell -0.51%. Singapore Strait Times fell -0.25%. Japan 10-year JGB yield fell -0.03 to 1.565.

Australia’s Westpac Consumer Sentiment Index dropped -3.1% mom to 95.4 in September, reversing part of last month’s boost from the RBA’s third rate cut. While sentiment remains modestly above July levels and well above the April tariff-driven low, the index has slipped back into “cautiously pessimistic” territory. Westpac said outright optimism remains “elusive”, with households still uneasy about the path ahead despite relief from the cost-of-living crisis.

The RBA is expected to keep its cash rate steady at 3.6% when it meets later this month. Westpac noted recent data on inflation and demand came in “somewhat firmer than expected”, reinforcing the case for caution. Policymakers are seen waiting for further confirmation that underlying trends remain benign before resuming cuts.

For now, consumer recovery looks sluggish, and Westpac expects “further easing will likely be needed” to sustain momentum. It forecasts another 25bp cut in November and two additional moves in 2026, underscoring the gradual path ahead for both sentiment and policy.

Australia’s NAB Business Confidence index slipped from 8 to 4 in August, but conditions showed improvement, rising from 5 to 7. Trading remained steady at 12, while profitability rose from 2 to 4 and employment from 2 to 5. NAB Chief Economist Sally Auld said the results support the view that “the outlook for businesses continues to improve,” with both confidence and conditions now near long-run averages.

Capacity utilisation rose to 83.1% from 82.5%, staying two percentage points above its long-run norm. Capital expenditure intentions also improved, climbing from 8 to 10. Together, these suggest firms are still operating at high levels of resource use despite broader uncertainties.

At the same time, cost pressures eased further. Purchase cost growth slowed from 1.3% to 1.1%, its lowest since 2021, while labour costs moderated to from 1.9% 1.5% and product price growth dipped to from 0.8% 0.6%. The survey points to an environment of resilient business activity and capacity tightness, but with inflation pressures continuing to recede.

Daily Pivots: (S1) 147.05; (P) 147.82; (R1) 148.29;

EUR/JPY’s break of 146.65 support suggest that fall from 150.90 is resuming. Intraday bias is back on the downside, and break of 146.20 will target 100% projection of 150.90 to 146.20 from 149.12 at 144.42. Also, sustained trading below 55 D EMA (now at 147.15) will argue that whole rebound from 139.87 has completed with three waves up to 150.90. On the upside, however, break of 147.51 minor resistance will mix up the outlook again and turn intraday bias neutral.

In the bigger picture, price actions from 161.94 (2024 high) are seen as a corrective pattern to rise from 102.58 (2021 low). Decisive break of 61.8% retracement of 158.86 to 139.87 at 151.22 will argue that it has already completed with three waves at 139.87. Larger up trend might then be ready to resume through 161.94 high. In case the corrective pattern extends with another fall, strong support is expected from 38.2% retracement of 102.58 to 161.94 at 139.26 to bring rebound.

Key points:

Pakistan is spying on millions of its citizens using a phone-tapping system and a Chinese-built internet firewall that censors social media, in one of the most comprehensive examples of state surveillance outside China, Amnesty International said.The rights watchdog said in a report released on Tuesday that Pakistan's growing monitoring network was built using both Chinese and Western technology and powered a sweeping crackdown on dissent and free speech.Already restricted political and media freedoms in Pakistan have tightened in recent years, particularly after the military broke with then-Prime Minister Imran Khan in 2022, who was later jailed and thousands of his party activists were detained.

Pakistan's spy agencies can monitor at least 4 million mobile phones at a time through its Lawful Intercept Management System (LIMS), while a firewall known as WMS 2.0 that inspects internet traffic can block 2 million active sessions at a time, Amnesty said.The two monitoring systems function in tandem: one lets intelligence agencies tap calls and texts while the other slows or blocks websites and social media across the country, it said.The number of phones under surveillance could be higher as all four major mobile operators have been ordered to connect to LIMS, Amnesty technologist Jurre van Berge told Reuters.

"Mass surveillance creates a chilling effect in society, whereby people are deterred from exercising their rights, both online and offline," the report said.Amnesty said its findings draw on a 2024 Islamabad High Court case filed by Bushra Bibi, the wife of former premier Khan, after her private calls were leaked online.In court, Pakistan's defence ministries and intelligence agencies denied running or even having the capacity for phone tapping. But under questioning, the telecom regulator acknowledged it had already ordered phone companies to install LIMS for use by "designated agencies."Pakistan's technology, interior, and information ministries, as well as the telecom regulator, did not respond to questions from Reuters about the Amnesty report.

Pakistan is currently blocking about 650,000 web links and restricting platforms such as YouTube, Facebook and X, Amnesty said.The controls have hit hardest in the insurgency-hit Balochistan province, where districts have faced years-long internet blackouts, and rights groups accuse the military of disappearances and killings of Baloch and Pashtun activists, charges it denies.Amnesty said it also reviewed licensing agreements, trade data, leaked technical files and Chinese records tying the firewall supplier to state-owned firms in Beijing.

It added that the firewall is supplied by the Chinese company Geedge Networks. The company did not respond to a request for comment.Monitoring centres for mobile calls are common globally but internet filtering for the public is rare, said Ben Wagner, Professor of Human Rights and Technology at Austrian university IT:U.Having both in Pakistan "constitutes a troubling development from a human rights perspective” and "suggests greater restrictions on freedom of expression and privacy will become more common as such tools become easier to implement," he said.

Amnesty said the firewall uses equipment from U.S.-based Niagara Networks, software from Thales DIS, a unit of France's Thales, and servers from a Chinese state IT firm. An earlier version relied on Canada’s Sandvine.Niagara told Reuters it follows U.S. export rules, does not know end users or how its products are used, and only sells tapping and aggregation gear.Amnesty said the phone tapping system was made by Germany’s Utimaco and deployed through monitoring centres run by UAE-based Datafusion.

Datafusion told Amnesty that its centres are only sold to law enforcement and that it does not make LIMS, while AppLogic Networks, the successor to Sandvine, said it has grievance mechanisms to prevent misuse.The other companies named in the report did not respond to requests for comment.

Gold rose to new record high ($3659) in early Tuesday’s trading, after strong acceleration on Monday (up 1.5%) which resulted in break and close above psychological $3600 barrier.

The latest economic data from the US showed that labor market continues to weaken (weakness further accelerated in August) that adds to strong expectations for Fed rate cut in the policy meeting next week.

Growing uncertainty over political crisis in the US and the latest negative developments in France after the government collapsed, as well as fragile political situation in the UK were the main political factors.

Worsening geopolitical situation on intensifying clashed in Ukraine and the Middle East and the latest crisis in Caribbean region (Venezuela) as well as darkening economic outlook, particularly in Europe, were also behind the latest rally into safety.

Technical pictures remain firmly bullish but overbought conditions on daily chart (although RSI and Stochastic continue to head north) warn that bulls may start losing traction.

Consolidation and shallow dips would be likely scenario, as bullish sentiment remains strong in current environment.

Broken $3600 level reverted to solid support which should ideally contain dips and confirm positioning for fresh push towards targets at $3690/$3700) Fibo projection / round-figure).

Res: 3668; 3690; 3700; 3434.Sup: 3628; 3600; 3577; 3540.

The dollar hit a seven-week low on Tuesday as investors braced for U.S. data revisions that could point to a jobs market in worse shape than initially thought, shoring up the case for even deeper Federal Reserve interest rate cuts.

The dollar slumped 0.7% against the Japanese yento 146.32, its weakest level since mid-August while sterling was up 0.2% at $1.3558. The euroslipped to $1.1752 after touching its strongest level since July 24.

A Bloomberg news report that Bank of Japan officials believe it may be possible to raise the benchmark interest rate again this year also helped boost the Japanese currency.

The yen is likely to be exposed to heightened volatility due to ongoing political uncertainty and was likely helped along on Tuesday by market participants bringing forward expectations of a BoJ rate hike, said Samy Chaar, chief economist at Lombard Odier.

Against a basket of peers, the dollarslipped to a low of 97.25, its weakest since late July, ahead of the release of preliminary benchmark revisions for jobs data covering the period from April 2024 to March 2025.

Economists anticipate a downward revision of as much as 800,000 jobs, which could signal that the Fed is behind the curve in efforts to achieve maximum employment.

While the job revisions data could heighten expectations of an outsized rate cut, inflation data due later in the week could also temper those expectations, Chaar said.

U.S. producer price inflation data is due on Wednesday followed by the consumer price inflation reading on Thursday. The data points will be in focus to gauge the impact of tariffs on prices in the world's largest economy.

Traders' expectations of more aggressive Fed easing are gradually increasing. Money markets have fully priced in a 25 basis-point cut, and the odds of an outsized 50 basis-point reduction have drifted higher to nearly 12% as well, per CME's FedWatch tool.

Burgeoning expectations of policy easing by the Fed have also helped lift the spot gold price (XAU) to a record high of $3,659.10 per ounce on Tuesday.

Among other currencies, the Norwegian crownadvanced about 0.2% against both the dollar and the euroafter Norway's minority Labour Party government won a second term in power on Monday.

Political developments from Tokyo to Buenos Aires are likely to stay in focus for investors after the resignation of Japanese Prime Minister Shigeru Ishiba, the ouster of French Prime Minister Francois Bayrou and the abrupt removal of Indonesia's finance chief, all over the past few days.

"While the political uncertainty is an unfavourable development, we continue to believe that it is unlikely to be sufficient on its own to trigger a weaker euro," Lee Hardman, senior currency analyst at MUFG, said in a note.

Later this week, the European Central Bank is widely expected to keep rates unchanged at its policy meeting on Thursday.

Economists were split last month on the likelihood of further rate reductions by the ECB, but sentiment has shifted with recent data showing inflation holding close to the 2% target and unemployment at a record low.

Meanwhile, the Indonesian rupiah weakened 1% after the government replaced its finance minister on Monday. Bank Indonesia was seen buying longer-dated government bonds on Tuesday in an attempt to stabilise the market, according to two traders.

XAUUSD quotes maintain steady growth amid US dollar weakness and expectations of a Fed rate cut, with prices currently at 3,642.

XAUUSD forecast: key trading points

XAUUSD prices continue to rise for the third consecutive trading session, bolstered by growing expectations of a Federal Reserve rate cut at the upcoming meeting. The revision in forecasts followed Friday’s unexpectedly weak US employment report. Based on these figures, markets have priced in the likelihood of three rate cuts this year, including the first 25-basis-point reduction as soon as next week.

Another driver is the demand for gold as a safe-haven asset. Investors have increased their interest in the precious metal amid heightened geopolitical tensions, uncertainty over tariffs, and foreign policy risks. Since the start of the year, gold has gained 38.5%, with the rally driven by US dollar weakness, record central bank purchases, and elevated global volatility.Now, market attention is focused on upcoming US macroeconomic data. The main events will be the releases of the Producer Price Index (PPI) and Consumer Price Index (CPI) later this week. These reports could significantly reshape Federal Reserve policy expectations and determine the short-term trajectory of XAUUSD prices.

XAUUSD prices are trading within an ascending channel and testing the local support zone at 3,625 near the channel’s lower boundary.Today’s XAUUSD forecast suggests the continuation of the bullish scenario, with quotes rising towards 3,695. The Stochastic Oscillator is forming a potential buy signal: its lines have turned from oversold territory and are poised to move upwards, confirming the likelihood of a bullish recovery.A confident rebound from the support zone would further confirm the bullish scenario, opening the way for a test of the upper boundary of the bullish channel.

The current XAUUSD dynamics indicate persistent bullish sentiment, with upcoming US inflation data set to be the key factor in determining the next move. The XAUUSD price forecast suggests a high probability of continued upward momentum as long as buyers hold quotes above the 3,625 support level.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up