Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

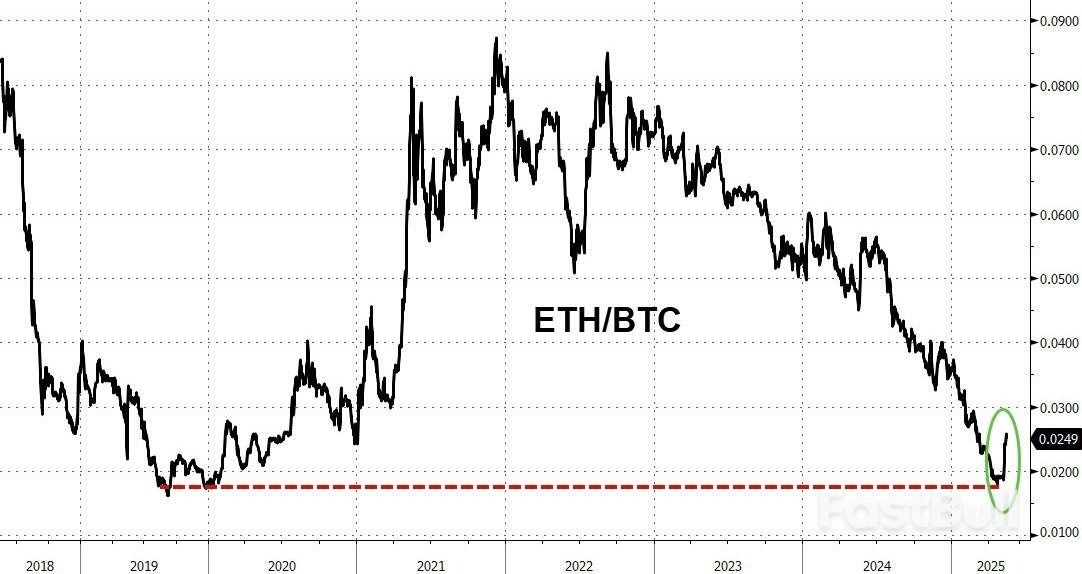

Ethereum, caught between its Layer 2 roadmap and limited ETF traction comparatively, was "stuck somewhere in the middle," they added - neither the best store of value.

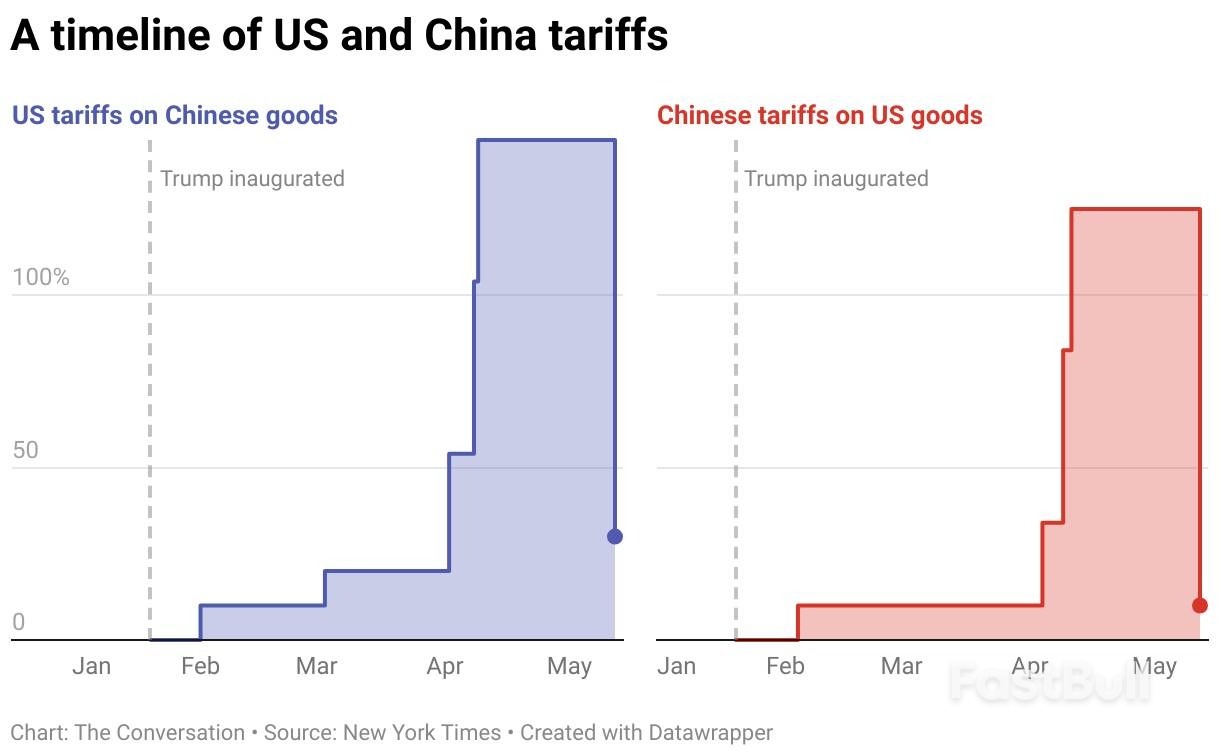

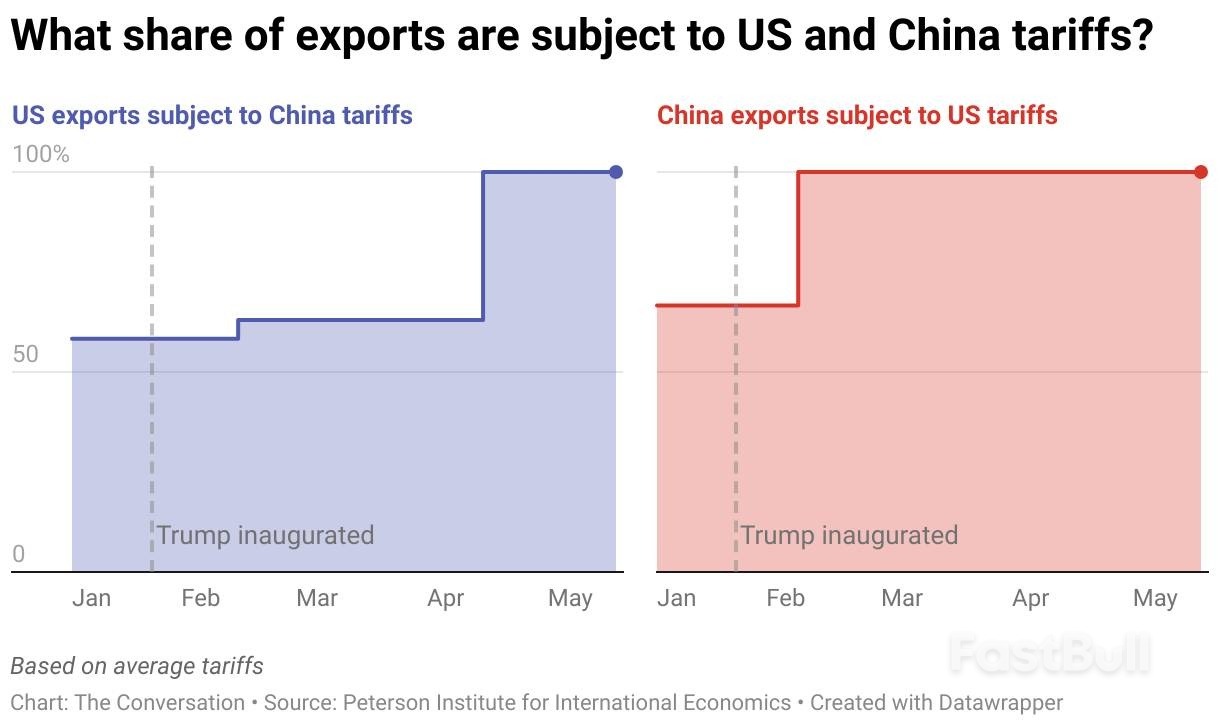

Defying expectations, on May 12 the United States and China announced an important agreement to de-escalate bilateral trade tensions after talks in Geneva, Switzerland.

The good news is their recent tariff increases will be slashed. The U.S. has cut tariffs on Chinese imports from 145 percent to 30 percent, while China has reduced levies on U.S. imports from 125 percent to 10 percent. This greatly eases major bilateral trade tensions, and explains why financial markets rallied.

The bad news is twofold. First, the remaining tariffs are still high by modern standards. The U.S. average trade-weighted tariff rate was 2.2 percent on January 1 2025, while it is now estimated to be up to 17.8 percent. This makes it the highest tariff wall in the United States since the 1930s.

Overall, it is very likely a new baseline has been set. Bilateral tariff-free trade belongs to a bygone era.

Second, these tariff reductions will be in place for 90 days, while negotiations continue. Talks will likely include a long list of difficult-to-resolve issues. China’s currency management policy and industrial subsidies system dominated by state-owned enterprises will be on the table. So will the many non-tariff barriers Beijing can turn on and off like a tap.

China is offering to purchase unspecified quantities of U.S. goods in a repeat of the China-U.S. “Phase 1 deal” from Trump’s first presidency, which was not implemented. On his first day in office in January, amid a blizzard of executive orders, Trump ordered a review of that deal’s implementation. The review found China didn’t follow through on the agriculture, finance, and intellectual property protection commitments it had made.

Unless the United States has now decided to capitulate to Beijing’s retaliatory actions, it is difficult to see Washington being duped again.

Failure to agree on these points would reveal the ugly truth that both countries continue to impose bilateral export controls on goods deemed sensitive, such as semiconductors (from the U.S. to China) and processed critical minerals (from China to the U.S.).

Moreover, in its so-called “reciprocal” negotiations with other countries, the United States is pressing trading partners to cut certain sensitive China-sourced goods from their exports destined for U.S. markets. China is deeply unhappy about these U.S. demands and has threatened to retaliate against trading partners that adopt them.

Overall, the announcement is best viewed as a truce that does not shift the underlying structural reality that the United States and China are locked into a long-term cycle of escalating strategic competition.

That cycle will have its ups (the latest announcement) and downs (the tariff wars that preceded it). For now, both sides have agreed to announce victory and focus on other matters.

For the U.S., this means ensuring there will be consumer goods on the shelves in time for Halloween and Christmas, albeit at inflated prices. For China, it means restoring some export market access to take pressure off its increasingly ailing economy.

As neither side can vanquish the other, the likely long-term result is a frozen conflict. This will be punctuated by attempts to achieve “escalation dominance,” as that will determine who emerges with better terms. Observers’ opinions on where the balance currently lies are divided.

Along the way, and to use a quote widely attributed to Winston Churchill, to “jaw-jaw is better than to war-war.” Fasten your seat belts, as there is more turbulence to come.

Significantly, the United States has not (so far) changed its basic goals for all its bilateral trade deals. Its overarching aim is to cut the goods trade deficit by reducing goods imports and eliminating non-tariff barriers it says are “unfairly” prohibiting U.S. exports. Washington also wants to remove barriers to digital trade and investments by tech giants and “derisk” certain imports that it deems sensitive for national security reasons.

The agreement between the U.S. and United Kingdom last week clearly reflects these goals in operation. While the U.K. received some concessions, the remaining tariffs are higher, at 10 percent overall, than on April 2 and subject to U.S.-imposed import quotas. Furthermore, the U.K. must open its market for certain goods while removing China-originating content from steel and pharmaceutical products destined for the United States.

For Washington’s Pacific defense treaty allies, including Australia, nothing has changed. Potentially difficult negotiations with the Trump administration lie ahead, particularly if the U.S. decides to use security dependencies as leverage to wring concessions in trade. Japan has already disavowed linking security and trade, and their progress in negotiations should be closely watched.

The United States has previously paused high tariffs on manufacturing nations in Southeast Asia, particularly those used by other nations as export platforms to avoid China tariffs. Vietnam, Cambodia, and others will face sustained uncertainty and increasingly difficult balancing acts. The economic stakes are higher for them.

They, like the Japanese, are long-practiced in the subtle arts of balancing the two giants. Still, juggling ties with both Washington and Beijing will become the act of an increasingly high-wire trapeze artist.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up