Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

South Korea Services Output MoM (Nov)

South Korea Services Output MoM (Nov)A:--

F: --

P: --

Russia IHS Markit Services PMI (Dec)

Russia IHS Markit Services PMI (Dec)A:--

F: --

P: --

Turkey Economic Sentiment Indicator (Dec)

Turkey Economic Sentiment Indicator (Dec)A:--

F: --

P: --

Brazil Unemployment Rate (Nov)

Brazil Unemployment Rate (Nov)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index YoY (Oct)

U.S. S&P/CS 10-City Home Price Index YoY (Oct)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Oct)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Oct)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Oct)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Oct)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Oct)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Oct)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Oct)

U.S. FHFA House Price Index YoY (Oct)A:--

F: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Oct)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Oct)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Oct)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Oct)A:--

F: --

U.S. FHFA House Price Index (Oct)

U.S. FHFA House Price Index (Oct)A:--

F: --

P: --

U.S. FHFA House Price Index MoM (Oct)

U.S. FHFA House Price Index MoM (Oct)A:--

F: --

U.S. Chicago PMI (Dec)

U.S. Chicago PMI (Dec)A:--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Nov)

Brazil CAGED Net Payroll Jobs (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

FOMC Meeting Minutes

FOMC Meeting Minutes U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

South Korea CPI YoY (Dec)

South Korea CPI YoY (Dec)A:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Dec)

China, Mainland NBS Manufacturing PMI (Dec)A:--

F: --

P: --

China, Mainland Composite PMI (Dec)

China, Mainland Composite PMI (Dec)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Dec)

China, Mainland NBS Non-manufacturing PMI (Dec)A:--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Dec)

China, Mainland Caixin Manufacturing PMI (SA) (Dec)A:--

F: --

P: --

Turkey Trade Balance (Nov)

Turkey Trade Balance (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

South Africa Trade Balance (Nov)

South Africa Trade Balance (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

South Korea Trade Balance Prelim (Dec)

South Korea Trade Balance Prelim (Dec)--

F: --

P: --

Indonesia Core Inflation YoY (Dec)

Indonesia Core Inflation YoY (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Dec)

Indonesia Inflation Rate YoY (Dec)--

F: --

P: --

Turkey Manufacturing PMI (Dec)

Turkey Manufacturing PMI (Dec)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Dec)

Brazil IHS Markit Manufacturing PMI (Dec)--

F: --

P: --

Mexico Manufacturing PMI (Dec)

Mexico Manufacturing PMI (Dec)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Dec)

South Korea IHS Markit Manufacturing PMI (SA) (Dec)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Dec)

Indonesia IHS Markit Manufacturing PMI (Dec)--

F: --

P: --

India HSBC Manufacturing PMI Final (Dec)

India HSBC Manufacturing PMI Final (Dec)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Dec)

Russia IHS Markit Manufacturing PMI (Dec)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Dec)

U.K. Nationwide House Price Index MoM (Dec)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Dec)

U.K. Nationwide House Price Index YoY (Dec)--

F: --

P: --

Turkey Manufacturing PMI (Dec)

Turkey Manufacturing PMI (Dec)--

F: --

P: --

Italy Manufacturing PMI (SA) (Dec)

Italy Manufacturing PMI (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Dec)

Euro Zone Manufacturing PMI Final (Dec)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Nov)

Euro Zone M3 Money Supply (SA) (Nov)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Nov)

Euro Zone 3-Month M3 Money Supply YoY (Nov)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Nov)

Euro Zone Private Sector Credit YoY (Nov)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Nov)

Euro Zone M3 Money Supply YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

As Warren Buffett steps down as CEO of Berkshire Hathaway at age 95, global business leaders celebrate his legacy of plain-spoken wisdom, ethical capitalism, and long-term investment principles that have reshaped the financial world....

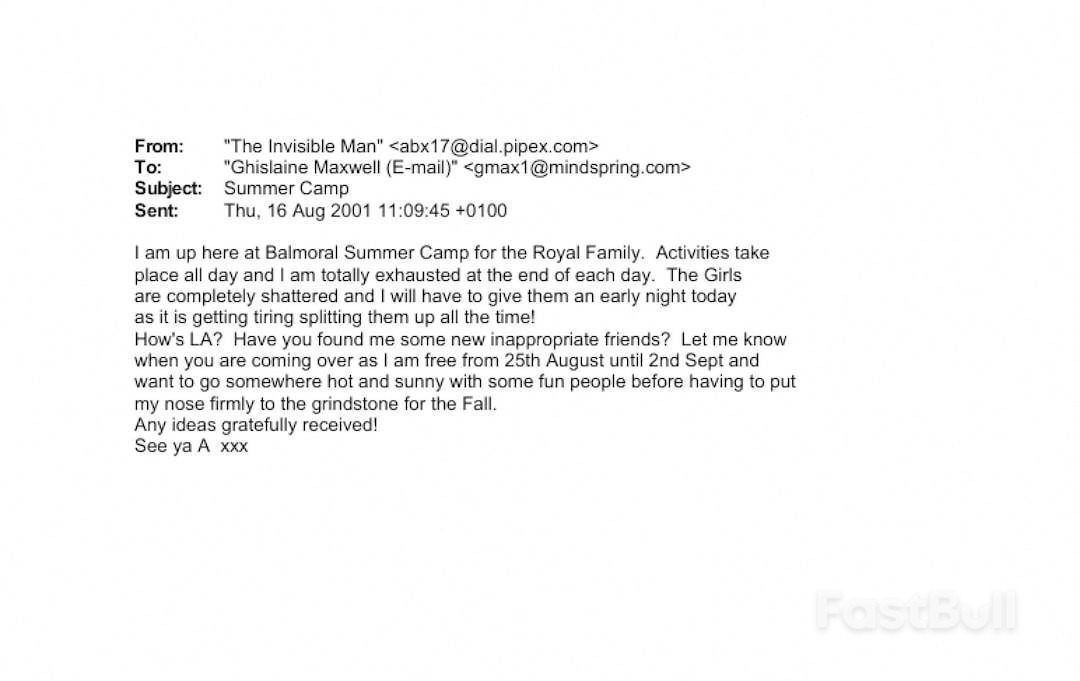

The U.S. Justice Department revealed it has 5.2 million pages of Epstein files left to review and needs 400 lawyers from four different department offices to help with the process through late January, according to a government document reviewed by Reuters on Tuesday.

This is likely to extend the final release of the documents to much later than expected after a December 19 deadline set by Congress, the document said.

The White House and the Justice Department did not immediately respond to Reuters' requests for comment.

The Trump administration ordered the Justice Department to release the files tied to criminal probes of Jeffrey Epstein, the late financier and convicted sex offender, who was friends with U.S. President Donald Trump in the 1990s, in compliance with a transparency law passed by Congress last month.

Collectively, the Criminal Division, the National Security Division, the FBI and the US Attorney's office in Manhattan are providing 400 attorneys to review the files, the document said, a more precise, and potentially much larger, figure than previous estimates from the department.

The review will occur between January 5-23, the document added.

Department leaders are offering telework options and time off awards as incentives for volunteers, the document said, adding that lawyers who assist will be expected to devote three to five hours a day to review about 1,000 documents a day.

The DOJ said last week it had uncovered more than a million additional documents potentially linked to Epstein.

So far, the disclosures have been heavily redacted, frustrating some Republicans and doing little to quell a scandal that threatens the party ahead of the 2026 midterm elections.

The law, approved by Congress with broad bipartisan support, requires all Epstein-related files to be made public, despite Trump's months-long effort to keep them sealed. Under the statute, all documents were to be released by December 19, with redactions to protect victims.

Trump knew Epstein socially in the 1990s and early 2000s. He has said their association ended in the mid-2000s and that he was never aware of the financier's sexual abuse.

Epstein was convicted in Florida in 2008 of procuring a person under the age of 18 for prostitution. The Justice Department charged him with sex trafficking in 2019. Epstein was found dead in 2019 in a New York jail and his death was ruled a suicide.

In a message shared on X last week, the Justice Department said, opens new tab, "We have lawyers working around the clock to review and make the legally required redactions to protect victims, and we will release the documents as soon as possible. Due to the mass volume of material, this process may take a few more weeks."

India extended a tariff on steel imports for three years, marking the nation's latest effort to shield its domestic industry from a glut.

An import levy of 11% to 12% was proposed for some products, the finance ministry said in an order on Tuesday (Dec 30). The measures were first introduced in April for 200 days.

India is the latest country to respond to a global oversupply that's driven prices to multi-year lows, with elevated flows from China. A surge in cheap imports from the top producer has hurt local producers, including JSW Steel Ltd, while forcing some smaller mills to shut down even as domestic demand stays firm.

India's steel industry has expanded rapidly over the past decade, yet its output remains just a fraction of China's. Producers are betting on long-term gains driven by accelerating urbanisation and industrial growth. The duty offers long-awaited relief for mills, which have been pushing for action.

Indian steelmakers' shares rose on Wednesday, with state-owned Steel Authority of India Ltd gaining as much as 4.2%, Tata Steel Ltd up as much as 3.2% and JSW Steel rallying more than 5%.

China will implement more proactive policies in 2026 aimed at supporting long-term growth, with its economy expected to meet Beijing's growth target of about 5% this year, state media reported President Xi Jinping as saying on Wednesday.

The economy is expected to have grown to about 140 trillion yuan ($20 trillion) in 2025, Xi said in his address at a New Year's tea party of top Chinese Communist Party officials, state broadcaster CCTV said.

"Our country's economy is expected to move forward under pressure...showing strong resilience and vitality," Xi said in his speech.

The country will promote effective qualitative improvement and reasonable quantitative growth in the economy, Xi said, while maintaining social harmony and stability.

China's economy is expected to meet its "around 5%" growth target for 2025, even as momentum faltered towards year-end, weighed down by soft household consumption, persistent deflation and a prolonged property sector crisis.

Xi's message reinforces recent government pledges to roll out measures for boosting people's incomes and supporting consumption and investment to drive growth.

The central government has allocated 62.5 billion yuan from special treasury bond proceeds to local governments to fund the consumer goods trade-in scheme next year, confirming that Beijing would continue to spur household demand through the programme.

China's state planner has also released early investment plans for 2026, including two major construction projects, involving about 295 billion yuan in central budget funding, in its latest effort to boost investment and support economic growth.

($1 = 6.9885 yuan)

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up