Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Wall Street futures rose on Sunday evening as resurgent bets on a December interest rate cut by the Federal Reserve helped spur a rebound from recent losses, with investors watching for a recovery in battered technology stocks.

Wall Street futures rose on Sunday evening as resurgent bets on a December interest rate cut by the Federal Reserve helped spur a rebound from recent losses, with investors watching for a recovery in battered technology stocks.

Futures rose after a positive Friday session on Wall Street, as investors welcomed comments from some Fed officials calling for an interest rate cut in December. Mixed readings on the labor market also spurred bets on more easing by the Fed.

Focus is now on a slew of key economic readings due this week, as the government releases data for September, which was delayed by a prolonged shutdown.

S&P 500 Futures rose 0.6% to 6,657.0 points by 18:28 ET (23:28 GMT). Nasdaq 100 Futures rose 0.8% to 24,489.75 points, while Dow Jones Futures rose 0.4% to 46,491.0 points.

Bets on a December interest rate cut rebounded sharply in recent sessions, with some dovish-leaning commentary from Fed officials sparking the recovery last week.

New York Fed President John Williams called for a rate cut in December, contrasting more cautious comments from other Fed officials and presenting a split outlook among Fed members on the December decision.

Williams was among the few Fed officials calling for a December cut. But his comments saw bets on a rate cut sharply rebound.

Traders are pricing in a 67.3% chance the Fed will cut rates by 25 basis points during its December 10-11 meeting, up sharply from a 39.8% chance seen last week, CME Fedwatch showed.

A host of long-delayed economic readings due this week are set to offer some cues on the U.S. economy and the Fed decision.

Producer inflation, retail sales, and industrial production prints for September are due on Tuesday, while third-quarter gross domestic product data is due on Wednesday.

Any signs of a cooling labor market and economic growth are likely to further the case for more easing by the Fed.

But the central bank is still seen flying blind into the December meeting, due to a lack of economic readings for October.

Wall Street indexes rose sharply on Friday, rebounding from recent losses on hopes of lower interest rates in the near-term. But technology shares lagged, amid losses in major chipmakers, especially NVIDIA Corporation (NASDAQ:NVDA).

The S&P 500 surged nearly 1% to 6,602.99 points on Friday. The NASDAQ Composite jumped 0.9% to 22,273.08 points, while the Dow Jones Industrial Average rose 1.1% to 46,245.41 points.

Wall Street indexes were battered by an extended rout in tech shares over the past two weeks, with positive earnings from Nvidia doing little to support the sector. Questions over rising chip inventory levels and the company's allegedly circular financing in its customers also weighed.

Heightened concerns over an artificial intelligence-fueled valuation bubble in the sector were the biggest driver of tech's losses in recent weeks, as investors locked in profits from a near three-year rally.

Among the factors driving equity market swings recently and since summer, monetary policy – and very recently, the fear of a misstep in monetary policy – has been particularly powerful.

Last week was particularly bruising, with pronounced swings lower in some corners of financial markets.

U.S. cyclical stocks have erased much of their post-summer rally relative to defensive stocks, and under the hood, technology stocks and consumer discretionary have been especially weak, notwithstanding punchy earnings from Nvidia and a broadly decent sweep of U.S. macro data, respectively.

From the bird's eye view of an asset allocator, cross-asset volatility is also higher, though not alarmingly so. For example, equity, rates and oil volatility (as measured by the VIX, MOVE and OVX indexes, respectively) have retraced half (or just over half) of where they were at the peaks of the 'liberation day' sell-off in early April.

It also has not been 'all risk off': government bonds haven't meaningfully rallied (Japanese bonds have in fact sold off, pushing long-end yields to post-Global Financial Crisis highs), index credit spreads remain generally contained, and areas like emerging markets have outperformed.

In our view, fears around a near-term Federal Reserve 'policy mistake', akin to say late 2018, have been an important factor driving markets recently. Current odds—at less than 40%—of a December rate cut being priced into Fed Funds futures are at the lowest since March. Just four weeks ago, a 25bp rate cut was fully baked-in, at 100%.

As the odds of a December rate cut have been rapidly pared back, so, too, have equity prices, especially those more sensitive to domestic policy rates. The recent sell-off in Home Depot, for example, began around 48 hours after expectations of a Fed rate cut in December peaked in mid-October on a 'Powell pivot', and accelerated more recently on weak earnings—and more hawkish Fed commentary.

While other factors have been at play, including concerns around credit and returns on invested AI capex, policy has been a chief driver of market returns more broadly for much of 2025.

A simple Principal Component Analysis (PCA) model comprised of 20 cross-market variables distilled into growth, inflation and policy demonstrates how expectations around monetary policy both underpinned the post-summer rally in risk assets, and has driven the recent sell-off.

Market-implied growth has softened gradually, consistent with soft labor indicators, but resilient GDP and consumer spending data have precluded a deeper slowdown being priced in. And, despite a notable increase in effective U.S. tariff rates, market-implied inflation has stood broadly pat this year, with only a modest uptick since August.

Notably, what has been taken away for December has been more than given back for 2026. To be sure, as December rate cut expectations have been clipped back, more meaningful monetary easing has been priced for 2026—around 90bps at the time of writing, 20bp more than a fortnight ago. And insofar as we and markets expect the Fed to cut into firm and even rising economic and earnings growth over the course of 2026, a policy-induced sell-off should be short-lived, creating an opportunity to play the long game.

Rates pivoting lower without recession tends to be positive for stocks, and nominal GDP growth above 4% tends to limit bear market risks. Importantly, notwithstanding data gaps from the U.S. government shutdown, current and leading indicators signal recovery, not recession, for the U.S. And the combination of productivity-led gains (and resulting inflation-light growth) with weaker labor allows for easier policy, especially monetary policy.

This in turn sets a constructive backdrop for risk assets, and indeed longer-duration fixed income where negative carry positions turn positive as the Fed eases. We would seek to use periods of market weakness to lean into favored positions in both equities and fixed income.

For the most part, expected returns from being long an asset, excluding commodities of the major blocs, tend to be a function of two things: anticipated cash flows and the discount rate applied to those cash flows. Although stock markets are emphatically not the economy, firm nominal growth tends to equal firm nominal corporate earnings.

On cue, the third-quarter corporate earnings season in the U.S. revealed 12% EPS growth for the S&P 493 stocks (ex. the 'Mag 7' mega-cap technology companies), the fastest clip since Q2 2022. Strikingly, and unlike 2022 when earnings for the Mag 7 companies were contracting by mid-double digits, Mag 7 earnings also continue to grow: a healthy 23% was reported for Q3 2025.

A high conviction view held by our Asset Allocation Committee has been an expected broadening out of equity markets as earnings prospects converged. This has evolved from the Mag 7 to the S&P 493 a year ago, to Europe, Japan and emerging markets over the course of 2025. And while we have recently moved Europe back to at-target, we continue to favor index and key equity sector exposure in Japan and select emerging markets.

To be sure, in comparing areas such as IT, communication services or even industrials, performance in markets including Japan, China and Korea (particularly) have dwarfed the U.S. in both equal-weighted and market cap terms by sector. And these remain our favored areas to gain market exposure.

Key points:

China's Premier Li Qiang pitched closer collaboration to German Chancellor Friedrich Merz in new energy, smart manufacturing, biomedicine and intelligent driving during a meeting on Sunday on the sidelines of the G20 summit, Xinhua reported.

Relations between the world's second- and third-largest economies have improved significantly over the past month, after Chinese export curbs on chips and rare earths caused major disruptions for German firms and German Foreign Minister Johann Wadephul to cancel a visit to Beijing last month due to China rejecting all but one of his meetings.

German Finance Minister Lars Klingbeil made the first official visit of Merz's premiership last week, stabilising ties by meeting China's top economic official Vice Premier He Lifeng, as U.S. President Donald Trump's tariffs weigh on the two major exporters.

Merz is also expected to visit China soon.

Li said he "hoped Germany would maintain a rational and pragmatic policy toward China, eliminate interference and pressure, focus on shared interests, and consolidate the foundation for cooperation," a state media readout released late on Sunday quoted China's second-ranking official as saying.

For all the friction over Beijing's support for Russia and its actions in the Indo-Pacific, and Berlin's vocal criticism of China's human rights record and state-subsidised industrial policy, the two countries remain bound by a vast and mutually advantageous commercial relationship.

"China is willing to work with Germany to seize future development opportunities ... in emerging fields such as new energy, smart manufacturing, biomedicine, hydrogen energy technology, and intelligent driving, Li said in Johannesburg, South Africa, which is hosting the first G20 summit on the continent.

China bought $95 billion worth of German goods last year, around 12% of which were cars, Chinese data shows, putting it among the $19 trillion economy's top 10 trading partners. Germany purchased $107 billion of Chinese goods, mostly chips and other electronic components.

But Berlin stands out for China as an investment partner, having injected $6.6 billion in fresh capital in 2024, according to data from the Mercator Institute for China Studies, accounting for 45% of all foreign direct investment into China from the European Union and the United Kingdom.

For Germany, China represents a practically irreplaceable auto market, and is responsible for almost a third of German automakers' sales. German chemicals and pharmaceuticals firms also have a large presence in the country, although they are facing increasing pressure from domestic competitors.

Key Points:

USD/JPY hovers in 2024's intervention zone of 155-160 on Monday, November 24, raising risks of government action to bolster the Japanese yen.

Prime Minister Sanae Takaichi's fiscal stimulus announcement leaves the yen in a precarious position. Fading bets on a December Bank of Japan rate hike and a potential pullback in inflationary pressures could weaken the yen, sending USD/JPY higher.

The USD/JPY rally to a 10-month high of 157.893 on Thursday and Friday's sharp pullback underscored market sensitivity to yen intervention warnings and dovish Fed rhetoric. Last week's USD/JPY movements set the stage for a volatile session on Monday, November 24.

USDJPY – Daily Chart – 241125 – Fiscal Stimulus and Dovish Fed

USDJPY – Daily Chart – 241125 – Fiscal Stimulus and Dovish FedPrime Minister Sanae Takaichi's cabinet approved a ¥21.3 trillion ($136 billion) stimulus package on Friday, November 21. The package comprises ¥900 billion in special account spending, ¥2.7 trillion in tax cuts, and ¥17.7 trillion in spending. The fiscal package aligns with Prime Minister Takaichi's support for fiscal policy and ultra-loose monetary policy.

Unlike fiscal stimulus packages in other countries that typically fuel inflation, Japan's package aims to combat higher prices. Notably, the ¥2.7 trillion in tax breaks includes abolishing a gasoline sales tax surcharge and raising the income threshold for income tax. Economists view these measures as having a low impact on near-term demand.

However, economists have raised concerns about the ¥20,000 per child under 18 cash handout, which may boost demand and inflationary pressures. While the package seeks to provide near-term relief, structural components such as tax cuts may lift demand and fuel inflation later.

Crucially, the package has raised criticism over fiscal sustainability, sending Japanese Government Bond (JGBs) yields soaring, reflecting waning confidence in the yen. 10-year yields hit their highest since 2008, while 40-year yields reached historic highs above 3.6%.

Robin Brooks, Senior Fellow at the Brookings Institution, commented on the fiscal stimulus package and yen weakness, stating,

"Japan's Yen in real effective terms is almost as weak as Turkish Lira, which is the world's weakest currency after Erdogan eviscerated his central bank. Japan is in denial on debt. Sanae Takaichi's fiscal stimulus makes this worse…"

"Sanae Takaichi, the "Iron Lady of Japan," has revived Abenomics-style stimulus that will expand global liquidity through fiscal easing and ultra-loose credit. Her policies strengthen the yen carry trade and the U.S. dollar, gold's pullback should not be a surprise. Contrary to popular belief, the "death of the dollar" is greatly exaggerated. King Dollar is alive and well."

On Monday, November 24, debates over the fiscal stimulus package and BoJ commentary will influence USD/JPY trends. Traders should also monitor yen intervention warnings from the Japanese government if USD/JPY climbs toward 160.

Meanwhile, US economic data will also play a crucial role in driving USD/JPY trends through its impact on Fed rate expectations.

Economists forecast the Chicago Fed National Activity Index (CFNAI) to drop from -0.12 in August to -0.2 in October. Furthermore, economists expect the Dallas Fed Manufacturing Index to rise from -5.0 in October to -1.0 in November.

CFNAI will likely face greater scrutiny given that the index captures the entire US economy, including manufacturing and services. Economists view the CFNAI as a broader economic barometer since it considers production, employment, personal income, and sales. By contrast, the manufacturing sector contributes around 10% to the US GDP.

A sharper-than-expected fall in the CFNAI could signal a loss of economic momentum midway through Q4, supporting a more dovish Fed policy stance. USD/JPY may drop toward 155 on a lower CFNAI reading.

Beyond the data, traders should closely monitor FOMC members' speeches after last week's shift in sentiment toward Fed rate cuts. According to the CME FedWatch Tool, the chances of a December Fed rate cut jumped from 44.4% on November 14 to 71.0% on November 21.

Growing support for a December cut could weaken demand for the US dollar and push USD/JPY toward 150.

USDJPY – Daily Chart – 241125

USDJPY – Daily Chart – 241125Indian Prime Minister Narendra Modi and Canadian Prime Minister Mark Carney agreed to resume discussions on a bilateral free trade deal, the latest sign of warming relations between the two countries.

The talks were announced after Modi and Carney met on the sidelines of the Group of 20 (G20) Summit in South Africa. The leaders decided to "begin negotiations on a high-ambition Comprehensive Economic Partnership Agreement," according to a statement from India's Ministry of External Affairs.

Carney also accepted Modi's invitation to visit India early next year.

The goal is for bilateral trade to reach US$50 billion (RM207.61 billion) by 2030, the Indian government said. The two countries exchanged about C$31 billion (US$22 billion) in goods and services last year, according to Canadian official data.

Canada and India have sought a trade deal before, but diplomatic relations ruptured in 2023 after then-Canadian prime minister Justin Trudeau and other officials said there was evidence that the Indian government orchestrated the killing of a Sikh activist in the Vancouver region. Canadian police have laid criminal charges in the case, with a trial pending.

Indian officials have long complained that Canada doesn't do enough to crack down on active Sikh separatist groups that want to disrupt Indian politics.

Since taking over from Trudeau in March, Carney has sought to restore normal relations. Both governments named new ambassadors this summer.

Speaking to reporters just ahead of his meeting with Modi, Carney said it was important to get better trade access to "one of the world's largest and fastest-growing economies".

The two countries' law enforcement and national security agencies are also continuing to have conversations, he said.

Canada, which sells the vast majority of its exports to the US, is trying to diversify markets because of protectionism from Washington. Carney has set an ambitious goal of doubling non-US exports by 2035.

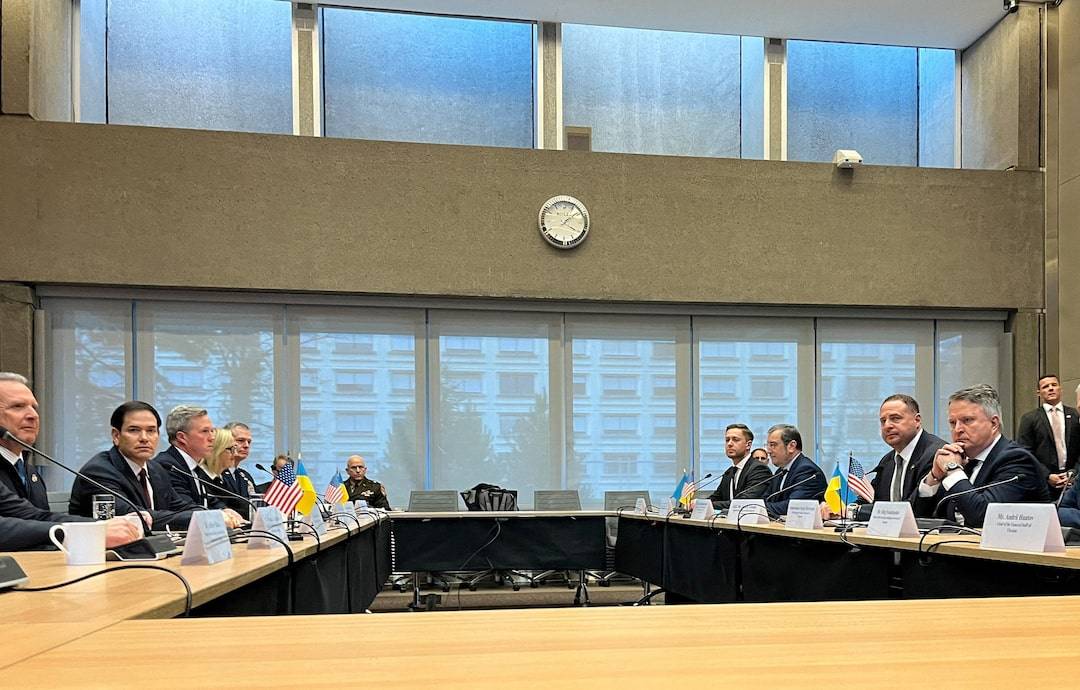

The United States and Ukraine said they had created an "updated and refined peace framework" to end the war with Russiathat apparently modified an earlier plan drafted by the Trump administration which Kyiv and its allies saw as too sympathetic to Moscow.

In a joint statement released after talks in Geneva between U.S. and Ukrainian delegations, the two sides said their discussion was "highly productive" and said they would continue in coming days. They did not provide specifics about a host of issues that must be resolved, including how to guarantee Kyiv's security from the threat posed by Russia.

U.S. Secretary of State Marco Rubio, who led the talks, said work remained to be done on questions including the role of NATO, but that his team had narrowed down unresolved issues in a 28-point peace plan for Ukraine championed by President Donald Trump.

"And we have achieved that today in a very substantial way," Rubio told reporters at the U.S. mission in Geneva.

Earlier, Trump said Ukraine had not been grateful for American efforts over the war, prompting Ukrainian officials to stress their gratitude to the U.S. president for his support.

European officials joined the U.S. and Ukrainian delegations for talks after crafting a modified version of the U.S. plan that pushes back on proposed limits to Kyiv's armed forces and mooted territorial concessions.

The European plan proposes that Ukraine be granted a larger military than under the U.S. plan and that talks on land swaps should start from the front line rather than a pre-determined view of which areas should be considered Russian.

Trump has said Ukrainian President Volodymyr Zelenskiy has until Thursday to approve the plan, which calls on Ukraine to cede territory, accept limits on its military and renounce ambitions to join NATO.

For many Ukrainians, including soldiers fighting on the front lines, such terms would amount to capitulation after nearly four years of fighting in Europe's deadliest conflict since World War Two. Trump has said his proposal is not a final offer.

Rubio said the United States still needed time to address the pending issues. He hoped a deal could be reached by Thursday but suggested that it could also take longer.

U.S. and Ukrainian officials were discussing the possibility of Zelenskiy travelling to the United States, maybe as early as this week, to discuss the U.S. peace plan with Trump, two sources familiar with the matter said on Sunday.

The main idea is that they would discuss the most sensitive issues in the peace plan, such as the matter of territory, one of the sources said. There is no confirmed date for now, the source added.

The main talks between U.S. and Ukrainian officials got under way in a stiff atmosphere at the U.S. mission, soon after Trump complained in a Truth Social post that Ukraine's leadership had shown "zero gratitude" to the U.S. for its efforts and Europe continued to buy Russian oil.

Rubio interrupted the meeting to speak to reporters, saying the talks had been probably the best the U.S. had held with Ukraine since Trump returned to power.

"Obviously this will ultimately have to be signed off with our presidents, although I feel very comfortable about that happening given the progress we've made," said Rubio.

Andriy Yermak, head of the Ukrainian delegation, was at pains to thank Trump for his commitment to Kyiv during the brief interlude. Minutes later, Zelenskiy also thanked Trump.

Yermak did not reappear with Rubio when the talks ended.

Rubio has departed Geneva en route back to Washington, a senior State Department official said.

Since the U.S. plan was announced, there has been confusion about who was involved in drawing it up. European allies said they had not been consulted.

Before heading to Geneva, Rubio insisted on X that Washington had authored the plan after remarks from some U.S. senators suggesting otherwise.

Senator Angus King said Rubio had told senators the plan was not the administration's position, but "essentially the wish-list of the Russians."

The draft U.S. plan, which includes many of Russia's key demands and offers only vague assurances to Ukraine of "robust security guarantees", comes at a perilous moment for Kyiv.

Russia has been making gains on parts of the front, albeit slowly and, according to Western and Ukrainian officials, the advances have been extremely costly in terms of lives lost.

The transportation hub of Pokrovsk has been partially taken by Russian forces and Ukrainian commanders say they do not have enough soldiers to prevent small, persistent incursions.

Ukraine's power and gas facilities have been pummelled by drone and missile attacks, meaning millions of people are without water, heating and power for hours each day.

Zelenskiy himself has been under pressure domestically after a major corruption scandal broke, ensnaring some of his ministers and people in his close entourage.

He has warned that Ukraine risked losing its dignity and freedom - or Washington's backing - over the U.S. plan.

Kyiv had taken heart in recent weeks after the United States tightened sanctions on Russia's oil sector, the main source of funding for the war, while its own long-range drone and missile strikes have caused considerable damage to the industry.

But the draft peace plan appears to hand the diplomatic advantage back to Moscow. Ukraine relies heavily on U.S. intelligence and weapons to sustain its war against Russia.

Officials from the United States, Europe, and Ukraine met in Geneva on Nov. 23 to discuss Washington's draft plan to end Russia's war in Ukraine.

President Trump said on Nov. 21 that Ukrainian President Volodymyr Zelenskyy had until Thursday to approve the 28-point plan, which would compel Ukraine to renounce ambitions to join NATO, accept limits on its military, and cede territory.

European allies said they were not consulted while Washington was drafting the plan, leading to some confusion as to which parties were involved in formulating it.

Rep. Eugene Vindman (D-Va.) told MSNBC that he believed the plan was "basically drafted by Putin."

As Ryan Morgan reports for The Epoch Times, Secretary of State Marco Rubio, on Nov. 22, disputed claims that President Donald Trump's latest plan to end the fighting in Ukraine amounts to a wish list for Russia.

"The peace proposal was authored by the U.S.," Rubio wrote in a post on X on Saturday evening.

Rubio added that the proposal incorporated input from both the Russian and Ukrainian sides in the conflict, but his choice of words was careful:

"It is based on input from the Russian side. But it is also based on previous and ongoing input from Ukraine."

Earlier on Saturday, PBS NewsHour correspondent Nick Schifrin reported that Rubio had made indications to Sens. Mike Rounds (R-S.D.) and Angus King (I-Maine) that a leaked version of the 28-point proposal was not produced by the Trump administration.

"MORE from [King]: 'The leaked 28-point plan, which, according to [Rubio], is not of the administration's position--it is essentially the wish list of the Russians," Schifrin wrote in a post on X on Saturday night.

Even before Rubio responded, State Department deputy spokesman Tommy Pigott said the allegations Schifrin was raising were "blatantly false."

"As Secretary Rubio and the entire Administration has consistently maintained, this plan was authored by the United States, with input from both the Russians and Ukrainians," Pigott wrote in an X post.

While the White House has yet to formally release the proposal, The Associated Press and other publications have published draft versions of the 28-point plan.

As we detailed previously, among other items, the published draft points indicated the United States would recognize Crimea, Luhansk, and Donetsk as de facto territories of Russia, and freeze the conflict along the current battle lines in Kherson and Zaporizhzhia, effectively locking in Russian territorial gains throughout the course of the nearly four-year conflict.

The plan also appears to rule out Ukrainian entry into the North Atlantic Treaty Organization (NATO), and NATO will agree not to expand any further, while Russia will agree not to invade any more countries. Further, the plan states Ukraine will receive security guarantees, but will also have to cap the size of its military force.

Zelenskyy celebrated Sunday's meeting in Geneva and said, "It is good that diplomacy has been reinvigorated and that the conversation can be constructive."

"The Ukrainian and American teams, as well as the teams of our European partners, are in close contact, and I do hope that there will be a result. The bloodshed must be stopped, and we must ensure that the war is never reignited," he wrote on social media.

"I am awaiting the results of today's talks and hope that all participants will be constructive. We all need a positive outcome."

The Ukrainian president had individually thanked all of Kyiv's allies present at the meeting in Geneva in various posts on X late Saturday and early on Sunday.

Turkish President Tayyip Erdogan said he would have a phone call with Putin on Monday to discuss efforts to end the war in Ukraine, adding that he would also request the resumption of a deal for safe passage of grains in the Black Sea. Turkey, a NATO member, has kept up cordial relations with both Ukraine and Russia during the nearly four-year-long war, offering military assistance to Ukraine but not joining the West in sanctioning Moscow. Turkey has hosted three rounds of peace negotiations between Moscow and Kyiv in Istanbul and has offered to also host a leaders meeting. During a press conference at the G20 summit in South Africa on Sunday, Erdogan said the 2022 Black Sea grain deal that was negotiated between Turkey and the United Nations could demonstrate a path forward for a peaceful end to the war in Ukraine.

"We were able to succeed in this up to a certain point and it did not continue after. Now, during the discussions we will have tomorrow, I will again ask Mr. Putin about this. I think it would be very beneficial if we can start this process," he said.

Faced with a Thanksgiving holiday deadline, European officials are racing to buy Ukrainian President Volodymyr Zelenskiy more time with their own counter-proposal.

Europe's 24-point counter-proposal for a "peace plan."

1. End the war and create arrangements meant to prevent any repeat, establishing a permanent framework for "lasting peace and security."

2. Both sides commit to a full, unconditional ceasefire — in the air, on land, and at sea.

3. Immediate talks begin on the technical setup for monitoring the ceasefire, with U.S. and European participation.

4. A U.S.-led international monitoring mission is introduced, relying mainly on satellites, drones, and remote tools, with an on-the-ground component to investigate alleged violations.

5. A mechanism is created for filing and investigating ceasefire violations and discussing "corrective measures."

6. Russia must "unconditionally" return all deported or "illegally displaced" Ukrainian children, under international supervision.

7. Full prisoner exchange under the "all for all" principle. Russia must also release all civilian detainees.

8. After the ceasefire stabilizes, both sides take humanitarian steps, including allowing family visits across the line of contact.

9. Ukraine's sovereignty is reaffirmed; Ukraine cannot be forced into neutrality.

10. Ukraine receives legally binding security guarantees from the U.S. and others — effectively an Article 5-style arrangement.

11. No restrictions are placed on Ukraine's armed forces or its defense industry, including foreign military cooperation.

12. Security guarantors form an ad-hoc group of European and willing non-European states. Ukraine decides which foreign forces, weapons, and missions it allows on its territory.

13. Ukraine's NATO membership depends only on internal Alliance consensus.

14. Ukraine becomes an EU member.

15. Ukraine remains a non-nuclear state under the NPT.

16. Territorial issues are addressed only after a full unconditional ceasefire.

17. Territorial negotiations start from the current line of control.

18. Once agreed, neither Russia nor Ukraine may alter territorial arrangements by force.

19. Ukraine regains control of the Zaporozhye Nuclear Power Plant (with U.S. involvement) and the Kakhovka Dam, under a special transfer mechanism.

20. Ukraine receives unhindered access on the Dnieper River and control of the Kinburn Spit.

21. Ukraine and its partners conduct unrestricted economic cooperation.

22. Ukraine is fully rebuilt and financially compensated — including through frozen Russian sovereign assets, which remain blocked until Russia pays compensation.

23. Sanctions imposed on Russia since 2014 may be partially and gradually eased only after a "sustainable peace," with automatic snap-back if the deal is violated.

24. Separate talks begin on European security architecture with all OSCE states.

"As delusional as you'd expect from Delulu Land. They still haven't grasped that the side losing the war isn't the one that gets to make demands."

Meanwhile, Zelenskiy is battling a corruption scandal that threatens to engulf his powerful chief of staff, Andriy Yermak. So he's feeling the heat, too, back home.

Finally, while speaking with reporters earlier in the day, Trump said the current plan doesn't represent his final offer.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up