Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Vietnam said Wednesday that it wants its companies to buy more high-value US imports in large volumes and at a stable pace, reaffirming its opening line on trade talks with Washington to avoid punishingly high tariffs.

The Southeast Asian nation’s trade minister and top negotiator, Nguyen Hong Dien, urged the firms, including in energy, mining, telecommunications and aviation, during a meeting in Hanoi to be “proactive” to help US-Vietnam trade reach its “great potential,” the government said in a statement.

Nguyen Hong Dien also met with the US Ambassador to Vietnam, Marc Knapper, “to promote the ongoing negotiation process aimed at addressing current bilateral economic and trade issues,” it said.

Vietnam is among a group of countries opening trade talks with the US that are facing some of the steepest tariffs imposed by President Donald Trump, aimed at reviving manufacturing that moved overseas in recent decades. Trump’s main target, China, is also a major trade partner for Vietnam but has challenged its access to offshore areas both countries claim in the South China Sea.

Vietnam’s trade surplus narrowed sharply in April in what could be an early indication of the impact of higher US tariffs. The surplus in April was $577 million, compared with the $1.64 billion reported for March, according to data released by the National Statistics Office in Hanoi Tuesday.

US officials late last month had draft plans to hold negotiations with about 18 countries over three weeks, using a template that lays out common areas of concern to help guide the discussions, including on tariffs, non-tariff barriers, digital trade, economic security and commercial concerns.

The US ran a nearly $124 billion trade deficit with Vietnam last year, according to the US Trade Representative, the third-highest after China and Mexico. The surge in trading in recent years is partly due to firms leaving China to avoid Trump’s trade war during his first term. Besides being a large apparel exporter, Vietnam has also become a manufacturing base for multinational companies including Apple Inc.’s suppliers and Samsung Electronics Co.

USTR Jamieson Greer in March told Nguyen Hong Dien in Washington that Vietnam must improve the trade balance and further open its market, which the government in Hanoi pledged to do via removing tariffs on US goods and buying more from the US. Vietnam also vowed to combat trade fraud and increase monitoring of products’ origin.

Trump imposed a 46% tariff on Vietnam on April 2, which was later suspended for 90 days to allow time for talks.

In its statement Wednesday, Vietnam said it had imported in recent years billions of dollars worth of US aircraft, machinery, power transmission systems, high-end semiconductors and raw materials.

The US normalized relations with Vietnam in 1995 after lifting a trade embargo the year before, a legacy of their conflict that ended in 1973. In 2023, President Joe Biden updated the relationship to a “comprehensive strategic partnership,” Hanoi’s highest diplomatic level and one it has used for India and China.

Vietnam has previously sought to improve it export options to the US by applying for “market economy” status from Washington regulators. That request was rejected last August by the Commerce Department as critics argued the government in Hanoi controls prices and production and subsidizes enterprises that compete with American firms.

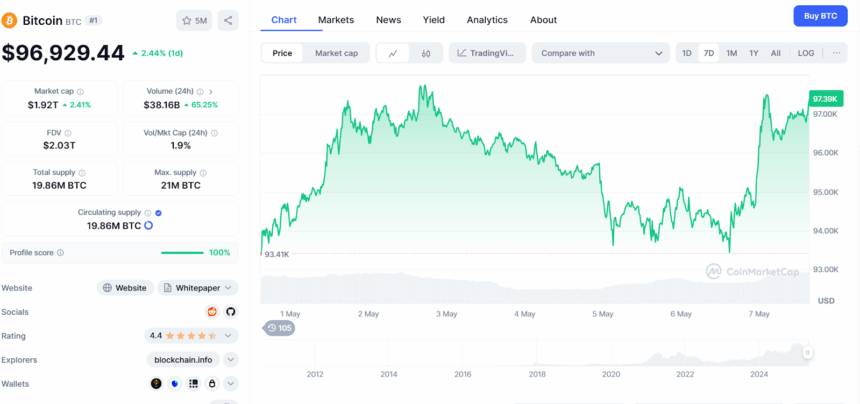

Bitcoin price has been consolidating between $93,410, and $97,000 for the past 7 days. As of now, traders are waiting on the FOMC meeting set for 2 p.m. ET today to know the next move. There’s a possibility that the BTC price will break above $100k following the meeting.

According to the data on CME FedWatch Tool, there’s a 97.7% chance the Fed will keep rates steady between 4.25% and 4.50%. Meanwhile, tension is rising as inflation stays sticky and rate-cut demands grow louder. But despite all this political pressure, Fed Chair Jerome Powell is expected to stick to his cautious approach.

At the time of writing, Bitcoin price is trading at $96,929, up 2.44% in the last 24 hours with a volume of $38.1 billion, according to CoinMarketCap.

Looking at the 4-hour chart, Bitcoin price recently bounced off a support zone at $93,000. Right now, the price is testing a resistance zone. If the price holds and gains strength, it could jump 5% toward $102,2500. If not, a drop to $88,772 is possible.

In a recent report on May 6, Crypto exchange Bitfinex confirmed that Bitc can hit a new all-time high only if the price manages to stay above the support level at $95,000. The exchange said “The $95,000 level—currently under consolidation—is a critical pivot point, acting as the lower boundary of a three-month range.” In short, if the price stays above this level may lead to a new all-time high, but dropping below could trigger a sharp fall.

Chinese President Xi Jinping flew into Moscow on Wednesday for talks with President Vladimir Putin and a pomp-filled visit that Kyiv has made clear it opposes after Ukrainian drones targeted Moscow shortly before he touched down.

Xi, whose country buys more Russian oil and gas than any other, and which has thrown Moscow an economic lifeline that has helped it navigate Western sanctions imposed over its war in Ukraine, landed at Moscow's Vnukovo-2 airport soon after Russian authorities said they had brought down another Ukrainian drone outside the capital.

It was the third day Ukraine has targeted Moscow with drones and one of Moscow's main airports was forced to temporarily suspend its activities less than three hours before Xi's arrival.

When asked during a news briefing about air attacks by both sides on each others' capitals, a spokesperson for the Chinese foreign ministry did not comment on Xi's trip, saying only that the "top priority" was to avoid an escalation in tensions.

The Kremlin said the attempted Ukrainian attacks on Moscow showed Kyiv's tendency to commit "acts of terrorism" and that Russia's intelligence services and military were doing everything necessary to ensure the security of upcoming World War Two commemorations which Xi is due to attend.

Ukrainian officials said on Wednesday that Russia had launched its own air attack on Kyiv overnight, killing a mother and her son. Russia says it only targets military objects.

Xi is the most powerful world leader expected at a military parade on Moscow's Red Square on Friday to mark the 80th anniversary of the victory of the Soviet Union and its allies over Nazi Germany.

His visit hands President Vladimir Putin an important diplomatic boost at a time when the Russian leader is keen to show his country is not isolated on the world stage. The Kremlin has touted Xi's presence, along with that of 28 other world leaders, as a sign of Russia's growing global authority.

But Ukraine's Foreign Ministry - in comments that seemed directed at China whose troops are due to march on Red Square - on Tuesday urged countries not to send their militaries to participate in the May 9 parade, saying such participation would go against some countries' declared neutrality in the war.

Moscow Mayor Sergei Sobyanin said that Russian air defence units had destroyed at least 14 Ukrainian drones headed for the Russian capital overnight. He later said at least two more had been brought down during the day.

Xi has called for talks to end the war in Ukraine and has accused the U.S. of stoking the war with weapons supplies to Kyiv. Ukrainian President Volodymyr Zelenskiy has in the past urged him to try to persuade Putin to end the war.

Xi is due to hold talks with the Russian leader on Thursday and to join other world leaders for the parade on Friday.

His visit comes as U.S. President Donald Trump is trying to push Moscow and Kyiv to find a way to end the war in Ukraine, with both sides blaming each other for a lack of progress.

Locked in a tariff war with the United States, Xi is expected to sign numerous agreements to deepen an already tight strategic partnership with Moscow, which has consistently seen China crowned Russia's biggest trading partner.

Despite recent efforts under Trump to reset U.S.-Russia ties, Putin is expected to present a united front with Xi against Washington, whose dominance and "exceptionalism" both countries have questioned, arguing for a more multipolar world.

In a signed article published by Russian media on Wednesday, Xi wrote that China and Russia must "firmly maintain the post-war international order."

"The two sides should jointly resist any attempt to disrupt and undermine China-Russia friendship and mutual trust," read the text of the article, Chinese state media reported.

Russian Foreign Ministry spokesperson Maria Zakharova called the visit "one of the central events in Russian-Chinese relations this year."

"The World War Two focus is about the post-war international order and now the U.S. is dismantling or undermining it. So China and Russia will frame themselves as the defenders of the international order and the UN system, and oppose U.S. unilateralism and hegemony," said Yun Sun, a China politics analyst at the Stimson Center in Washington.

In their talks, Putin and Xi will discuss the "most sensitive" issues, including energy cooperation and the proposed but yet to be built Power of Siberia 2 gas pipeline to China, Yuri Ushakov, a top Kremlin aide, said.

"Tomorrow we will announce next preparatory steps, both in the area of possible rebalancing measures, and also in the areas important for the further discussions," Sefcovic said during a news conference in Singapore on Wednesday, in comments reported by Reuters.

CNBC has contacted the European Commission for comment.

In a statement on Tuesday, Sefcovic said: "A negotiated solution [with the U.S.] remains our clear preference, respecting our interests and regulatory autonomy. To help get talks underway, we've scoped out ways to reduce barriers. We now need the U.S. to show it's ready for a fair, balanced deal."

Trump initially imposed a 20% "reciprocal" tariff on all goods coming from the EU but paused the measures for 90 days for negotiations, lowering the duty to 10% until that time. A 25% tariff on foreign cars and steel and aluminum imports remains in place.

The EU has currently paused its initial set of retaliatory measures — a response to the metals duties — which target around 21 billion euros ($24.1 billion) worth of U.S. goods, chiefly with a tariff rate of 25%.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up