Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

South Africa Trade Balance (Nov)

South Africa Trade Balance (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

South Korea Trade Balance Prelim (Dec)

South Korea Trade Balance Prelim (Dec)A:--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Dec)

South Korea IHS Markit Manufacturing PMI (SA) (Dec)A:--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Dec)

Indonesia IHS Markit Manufacturing PMI (Dec)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Dec)

India HSBC Manufacturing PMI Final (Dec)A:--

F: --

P: --

U.K. Nationwide House Price Index MoM (Dec)

U.K. Nationwide House Price Index MoM (Dec)A:--

F: --

P: --

U.K. Nationwide House Price Index YoY (Dec)

U.K. Nationwide House Price Index YoY (Dec)A:--

F: --

P: --

Turkey Manufacturing PMI (Dec)

Turkey Manufacturing PMI (Dec)A:--

F: --

P: --

Italy Manufacturing PMI (SA) (Dec)

Italy Manufacturing PMI (SA) (Dec)A:--

F: --

P: --

Euro Zone Manufacturing PMI Final (Dec)

Euro Zone Manufacturing PMI Final (Dec)A:--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Nov)

Euro Zone M3 Money Supply (SA) (Nov)A:--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Nov)

Euro Zone 3-Month M3 Money Supply YoY (Nov)A:--

F: --

P: --

Euro Zone Private Sector Credit YoY (Nov)

Euro Zone Private Sector Credit YoY (Nov)A:--

F: --

P: --

Euro Zone M3 Money Supply YoY (Nov)

Euro Zone M3 Money Supply YoY (Nov)A:--

F: --

P: --

U.K. Manufacturing PMI Final (Dec)

U.K. Manufacturing PMI Final (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Dec)

Brazil IHS Markit Manufacturing PMI (Dec)A:--

F: --

P: --

Canada Manufacturing PMI (SA) (Dec)

Canada Manufacturing PMI (SA) (Dec)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Dec)

U.S. IHS Markit Manufacturing PMI Final (Dec)A:--

F: --

P: --

Mexico Manufacturing PMI (Dec)

Mexico Manufacturing PMI (Dec)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Japan Manufacturing PMI Final (Dec)

Japan Manufacturing PMI Final (Dec)--

F: --

P: --

China, Mainland Caixin Composite PMI (Dec)

China, Mainland Caixin Composite PMI (Dec)--

F: --

P: --

China, Mainland Caixin Services PMI (Dec)

China, Mainland Caixin Services PMI (Dec)--

F: --

P: --

Indonesia Trade Balance (Nov)

Indonesia Trade Balance (Nov)--

F: --

P: --

Indonesia Core Inflation YoY (Dec)

Indonesia Core Inflation YoY (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Dec)

Indonesia Inflation Rate YoY (Dec)--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Dec)

Saudi Arabia IHS Markit Composite PMI (Dec)--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Dec)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Dec)--

F: --

P: --

Turkey CPI YoY (Dec)

Turkey CPI YoY (Dec)--

F: --

P: --

Turkey PPI YoY (Dec)

Turkey PPI YoY (Dec)--

F: --

P: --

U.K. Mortgage Approvals (Nov)

U.K. Mortgage Approvals (Nov)--

F: --

P: --

U.K. M4 Money Supply MoM (Nov)

U.K. M4 Money Supply MoM (Nov)--

F: --

P: --

U.K. Mortgage Lending (Nov)

U.K. Mortgage Lending (Nov)--

F: --

P: --

U.K. M4 Money Supply (SA) (Nov)

U.K. M4 Money Supply (SA) (Nov)--

F: --

P: --

U.K. M4 Money Supply YoY (Nov)

U.K. M4 Money Supply YoY (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. ISM Inventories Index (Dec)

U.S. ISM Inventories Index (Dec)--

F: --

P: --

U.S. ISM Output Index (Dec)

U.S. ISM Output Index (Dec)--

F: --

P: --

U.S. ISM Manufacturing PMI (Dec)

U.S. ISM Manufacturing PMI (Dec)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Dec)

U.S. ISM Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Dec)

U.S. ISM Manufacturing New Orders Index (Dec)--

F: --

P: --

Japan Monetary Base YoY (SA) (Dec)

Japan Monetary Base YoY (SA) (Dec)--

F: --

P: --

Japan Foreign Exchange Reserves (Dec)

Japan Foreign Exchange Reserves (Dec)--

F: --

P: --

U.K. BRC Shop Price Index YoY (Dec)

U.K. BRC Shop Price Index YoY (Dec)--

F: --

P: --

Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction Yield--

F: --

P: --

India HSBC Services PMI Final (Dec)

India HSBC Services PMI Final (Dec)--

F: --

P: --

India IHS Markit Composite PMI (Dec)

India IHS Markit Composite PMI (Dec)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Dec)

South Africa IHS Markit Composite PMI (SA) (Dec)--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The S&P 500 Index climbed at the open on Friday as investors bought tech stocks ahead of next week's massive CES conference and cheered signs President Donald Trump was easing up on tariff policies.

The S&P 500 Index climbed at the open on Friday as investors bought tech stocks ahead of next week's massive CES conference and cheered signs President Donald Trump was easing up on tariff policies.

The S&P 500 advanced 0.6% at 9:53 a.m. in New York, with six of 11 sectors in the green, led by tech and communications. Health care and real estate led declining sectors. The tech-heavy Nasdaq 100 Index added 1.2%. The Philadelphia Semiconductor Index rose as much as 4.5%, its highest intraday gain since Nov. 24.

The S&P 500 had ended 2025 around 1% below its Dec. 24 record, capping the year with four days of declines. Even so, there's still room for optimism about a "Santa Claus rally," as there are still two days left in the traditional period. Volume is likely to stay light; on Wednesday, it had trailed the 20-day average by around 45%.

"When markets are highly concentrated and near all-time highs, the right question to ask is 'what could go wrong?'" JPMorgan Chase & Co.'s Michael Cembalest writes in his outlook for 2026. Cembalest focuses on four risks: US power generation; China's ability to scale its "technology moat"; China's approach to Taiwan, and the "ultimate profits earned on $1.3 trillion in hyperscaler capital spending and R&D since 2022."

Bloomberg's Magnificent Seven Index rose more than 1% ahead of next week's CES tech conference in Las Vegas, which kicks off the year with a showcase of new technology. Advanced Micro Devices Inc. jumped 5.9%, with CEO Lisa Su due to speak Monday night. Nvidia Corp. added 3.0%. Its CEO, Jensen Huang, is set to make several appearances at the event, and will likely focus on data centers, physical AI and robotics, according to Wedbush Securities tech analyst Dan Ives.

Tesla Inc. was little changed even as it reported disappointing fourth-quarter deliveries, falling 16% year-on-year. It had been expected to report a roughly 11% drop. Earlier this week, Tesla took the unusual step this week of publishing its own average of analyst estimates that was even more pessimistic, calling for a 15% decline.

Wayfair Inc. and RH rose after Trump's latest tariff moves, which included delaying hikes on items like upholstered furniture and reducing anti-dumping tariffs on some Italian pasta.

Next week, watch for results from early banking reporter Jefferies Financial Group Inc. and Friday's jobs report.

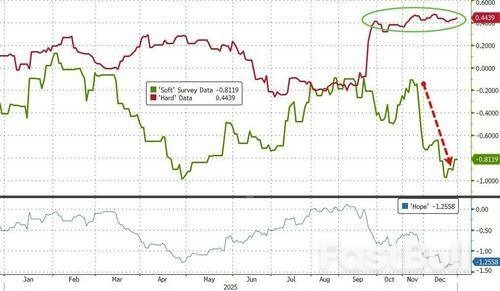

With 'hard' data showing resilience into year-end, 'soft' survey data has cratered (not helped by the government shutdown)...

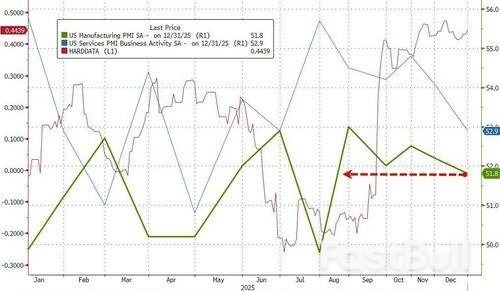

...and this morning brings more weakness as S&P Global's US Manufacturing PMI (final print for December) dipped to 51.8 - its lowest since July (the only contractionary - sub-50- month of 2025)...

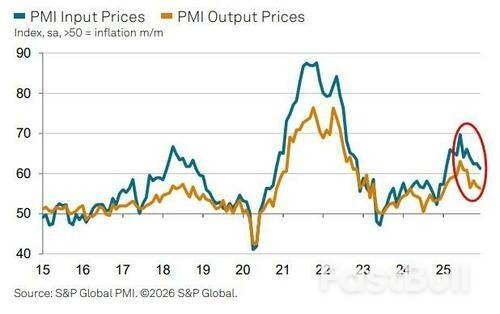

The latest survey showed a weaker gain in production, amid a renewed contraction in new order books – the first in exactly a year. International sales continued to fall, in part linked to tariffs, which also continued to push up operating expenses at an elevated pace. That said, although remaining historically elevated, both input and output prices rose at their slowest rates for 11 months.

"Although manufacturers continued to ramp up production in December, suggesting the goods producing sector will have contributed to further robust economic growth in the fourth quarter, prospects for the start of 2026 are looking less rosy," according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

"Something of a Wiley E Coyote scenario has developed, whereby – just like the cartoon character continues to run despite chasing the roadrunner off a cliff– factories are continuing to produce goods despite suffering a drop in orders."

The gap between growth of production and the drop in orders is in fact the widest seen since the height of the global financial crisis back in 2008-9:

"Unless demand improves, current factory production levels are clearly unsustainable."

Payroll numbers will also be adversely impacted if production capacity has to be scaled back.

"A key factor causing concern over sales is the extent to which producers are having to pass higher costs on to customers in the form of raised prices, with higher costs continuing to be overwhelmingly blamed on tariffs," says Williamson.

"Some encouragement comes from input cost inflation moderating in December to the lowest recorded since last January.

But...

However, while this cost trend suggests the tariff impact on inflation peaked back in the summer, costs are still rising month-on-month at an elevated rate to suggest that US firms continue to face higher cost growth than competitors in most other major economies."

So, choose your own adventure: Hard or Soft data?

Chinese multi-asset funds trounced their global peers last year with a simple strategy: bet big on tech stocks.

The country dominated the rankings of the world's most successful cross-asset mutual funds managing more than $500 million, taking 13 of the top 20 spots, according to Bloomberg data. Seven of the Chinese funds delivered returns of more than 100% over the course of the year.

The approach of many of these firms was cross-asset in name only. They overwhelmingly put their money into China's stock market, riding a boom in shares linked to artificial intelligence.

Many even flocked to the same handful of shares: Optical communications firm Eoptolink Technology Inc., which jumped more than 400% last year, was one of the top holdings of all 13 of the leading funds. Shares of rival Zhongji Innolight Co. were owned by a dozen of them.

The performance of these funds underscores just how profitable bets on AI have been over the past 12 months, even as US President Donald Trump's unpredictable trade policies rattled global markets. After buzz about Chinese AI start-up DeepSeek opened the year, Trump quickly became the No. 1 fixation for traders. By the end of 2025, though, AI was once again the dominant theme.

That helped cement a startling turnaround in China's stock market, which rose for two years in a row after a long slump fueled by Covid-19 and anxiety about economic growth. The MSCI China Index ended the year up 28%, its best annual performance since 2017.

"Multi-asset fund performance in 2025 with exposure to China and particularly China tech has been stellar given the severe underperformance from 2021 through to late 2024," said George Boubouras, head of research at K2 Asset Management Ltd in Melbourne.

Maxwealth Fund Management Co. was one of the standout performers in the country. Its Science and Technology Zhixuan Mixed Launched Fund, which had assets of around 11.5 billion yuan ($1.6 billion) at the end of the third quarter, generated total returns of 231% in 2025.

A 9 billion yuan vehicle managed by Tebon Fund Management Co. soared 129%, helped by a 583% rise in the shares of circuit board manufacturer Victory Giant Technologies Guizhou Co. Maxwealth and Tebon didn't respond to requests for comment.

Efforts in Beijing to drive more long-term capital into the stock market helped the rally. Mutual funds were pushed to increase their local equities holdings by at least 10% annually for three years, while large state-owned insurers were told to invest 30% of new policy premiums from 2025. Regulators also unveiled a two-year strategy in October to make it easier for qualified foreign institutional investors to enter the local market.

Other top-performing multi-asset funds for the year included two from Turkey that topped the list, alongside precious metals funds from Greece, France, and two from Japan that surged as gold and silver rallied to record highs.

President Volodymyr Zelenskiy named Ukraine's defence spy chief as his top adviser on Friday, placing a popular military leader at the centre of decision-making as Kyiv seeks to strengthen its defences against Russia and its hand in U.S.-backed peace talks.

The appointment of Kyrylo Budanov, a decorated war veteran widely respected by Ukrainians, as presidential chief of staff marks a significant shift for a position traditionally occupied by a civilian mainly focused on domestic politics.

Budanov, 39, replaces longtime Zelenskiy confidante Andriy Yermak, a widely criticised power broker who resigned in November amid a corruption scandal that fuelled public anger as Ukraine fights for survival against Russia.

Zelenskiy will be hoping the appointment can help restore trust in his leadership and state institutions at a difficult moment, with Russia advancing on the battlefield and the U.S. pressuring Kyiv to quickly end the nearly four-year war.

Writing on X, Zelenskiy said Ukraine "needs greater focus" on security, the military and diplomacy.

"Kyrylo has specialized experience in these areas and sufficient strength to deliver results," Zelenskiy wrote on X.

In a statement, Budanov said he had accepted the offer and would focus on the "strategic security of our state".

Budanov has headed the Defence Ministry's Main Directorate of Intelligence (HUR) since 2020 and brings a track record of overseeing covert and other operations against Russian forces.

He has also led talks with Russia on the exchange of prisoners of war.

Budanov makes frequent media appearances and is known for his restrained style and often cryptic commentary about suspected Ukrainian actions inside Russia.

In a 2023 interview with Reuters, he said his public profile was a critical part of the "information battle" against Moscow.

Budanov, who has survived numerous assassination attempts, began his career as a special forces operative and served in the east after Russia illegally annexed Crimea and its proxies took over Ukraine's eastern fringes. He was wounded three times.

Yermak, Budanov's predecessor, was dubbed Ukraine's "grey cardinal" because of his behind-the-scenes power and influence. He quit on November 28, hours after anti-corruption agents searched his home.

Investigators have been probing a purported $100 million kickback scheme in the energy sector allegedly involving Zelenskiy's former business partner and senior officials.

Yermak, who was also Kyiv's lead negotiator in peace talks, has not been named as a suspect. But lawmakers and even some in Zelenskiy's party had demanded his ouster even before his home was raided, arguing that he bore responsibility as the president's right-hand man.

Japanese Prime Minister Sanae Takaichi described her call with President Donald Trump as "extremely meaningful" and announced plans to visit the United States this spring at Trump's invitation.

"At President Trump's invitation, we also concurred to coordinate in detail to realize my visit to the United States this spring," Takaichi wrote in a Friday post on X.

The conversation between the two leaders comes amid heightened tensions in the region following recent Chinese military drills around Taiwan.

This marks the second call between Trump and Takaichi in recent months. In late November, the US president briefed the Japanese leader on his conversation with Chinese President Xi Jinping and provided updates on US-China relations.

The latest discussion takes place as the US and Japan work to accelerate a plan for Tokyo to invest $550 billion in the United States as part of a broader trade agreement aimed at lowering tariffs. According to the arrangement, Trump will make the final decision on investment approvals based on committee recommendations.

Japanese Prime Minister Sanae Takaichi said she had an "extremely meaningful" call with President Donald Trump and would visit the US leader later this year amid heightened tensions in the region sparked by recent Chinese military drills around Taiwan.

"At President Trump's invitation, we also concurred to coordinate in detail to realize my visit to the United States this spring," Takaichi wrote in a Friday post on X.

The call between the two allied leaders comes after China's military simulated a blockade of Taiwan, a self-governing island Beijing claims as its territory, for two days with live-fire exercises. China also launched long-range projectiles into the Taiwan Strait — one of the world's busiest shipping lanes — for the first time since 2022.

Trump initially dismissed the drills as a continuation of longstanding Chinese activity and touted his "great relationship" with Chinese President Xi Jinping. The US State Department, however, in a statement on New Year's Day accused Beijing of increasing "tensions unnecessarily."

Relations between Japan and China have also frayed in recent weeks after Takaichi publicly said Tokyo could deploy its military if Beijing attacked Taiwan. Beijing responded by unleashing a wave of punitive measures, including curbing imports of Japanese seafoods and discouraging Chinese residents from visiting.

Takaichi has refused to retract her comments, saying that Japan's policy on Taiwan is unchanged.

Trump and Takaichi also spoke in late November, when the US president briefed her on a call with Xi and the latest on US-China relations.

More broadly, the recent Chinese drills pose a test of Trump's support for Taiwan after the US in December approved an $11 billion weapons package for the island, drawing Beijing's ire. China has launched a diplomatic push to stabilize ties with the US while also trying to make clear to Washington that it sees Taiwan as a red line.

The Trump-Takaichi call also comes as the US and Japan move to expedite a plan for Tokyo to invest $550 billion in the US, part of a broader trade agreement to lower tariffs. The final green light for investments will be given by Trump based on recommendations from a committee.

Israeli media is reporting that Israel and the United States have reached an understanding to give Hamas a two-month ultimatum to finally and fully disarm. The reports say the agreement came immediately after an overnight meeting between Israeli Prime Minister Benjamin Netanyahu and US President Donald Trump at Mar-a-Lago at the start of the week.

The move is being described as a fixed deadline rather than an opening for negotiations. Israeli and US teams are already reportedly working simultaneously to determine what they describe as "practical disarmament." This after Hamas has effectively been defeated since it launched the brutal Oct.7, 2023 terror assault on southern Israel.

Source: Washington Post/Getty Images

Source: Washington Post/Getty ImagesAnother key focus is the dismantling of Hamas's underground tunnel network throughout Gaza, which Israeli officials consider a core element of the group's military strength.

Hamas has throughout the Gaza war proven itself effective in guerilla and insurgency tactics, utilizing small teams to maneuver quickly in and out of the tunnels, even at times taking out IDF tanks with IEDs. Sometimes bombs are even attached to Israeli armor vehicles by hand in these ambushes, after which a Hamas militant darts back into an underground tunnel, as has been demonstrated in various videos.

Sources quoted by Israel Hayom said Israeli officials doubt Hamas that would be willing or able to relinquish most of its weapons or military capabilities within the two-month window.

From the perspective of Hamas leadership, the moment it fully gives up its weapons means the group is effectively dead and will have no more influence to govern in the future.

But this is also exactly what the US-Israeli plan and the ceasefire calls for: the effective end of Hamas rule in governance in the Gaza Strip forever.

PM Netanyahu while giving media interviews during his December US trip described that Hamas still possesses "around 60,000" Kalashnikov rifles and "hundreds of kilometers" of tunnels.

He has vowed that Hamas disarmament can be achieved "the easy way" or the hard way - that is through military force. But as of last summer, Hamas was insistent that it will never give up its weapons.

There's also the possibility that Hamas leadership won't be able to induce all of its fighters and 'ground troops' to give up their weapons - again, as they would fear being tracked down and killed by Israeli forces.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up