Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Input PPI MoM (Not SA) (Dec)

U.K. Input PPI MoM (Not SA) (Dec)A:--

F: --

U.K. Core CPI MoM (Dec)

U.K. Core CPI MoM (Dec)A:--

F: --

P: --

U.K. Retail Prices Index MoM (Dec)

U.K. Retail Prices Index MoM (Dec)A:--

F: --

P: --

U.K. Input PPI YoY (Not SA) (Dec)

U.K. Input PPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.K. CPI YoY (Dec)

U.K. CPI YoY (Dec)A:--

F: --

P: --

U.K. Output PPI MoM (Not SA) (Dec)

U.K. Output PPI MoM (Not SA) (Dec)A:--

F: --

P: --

U.K. Output PPI YoY (Not SA) (Dec)

U.K. Output PPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.K. Core Retail Prices Index YoY (Dec)

U.K. Core Retail Prices Index YoY (Dec)A:--

F: --

P: --

U.K. Core CPI YoY (Dec)

U.K. Core CPI YoY (Dec)A:--

F: --

P: --

U.K. Retail Prices Index YoY (Dec)

U.K. Retail Prices Index YoY (Dec)A:--

F: --

P: --

Indonesia 7-Day Reverse Repo Rate

Indonesia 7-Day Reverse Repo RateA:--

F: --

P: --

Indonesia Loan Growth YoY (Dec)

Indonesia Loan Growth YoY (Dec)A:--

F: --

P: --

Indonesia Deposit Facility Rate (Jan)

Indonesia Deposit Facility Rate (Jan)A:--

F: --

P: --

Indonesia Lending Facility Rate (Jan)

Indonesia Lending Facility Rate (Jan)A:--

F: --

P: --

South Africa Core CPI YoY (Dec)

South Africa Core CPI YoY (Dec)A:--

F: --

P: --

South Africa CPI YoY (Dec)

South Africa CPI YoY (Dec)A:--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report U.K. CBI Industrial Output Expectations (Jan)

U.K. CBI Industrial Output Expectations (Jan)A:--

F: --

U.K. CBI Industrial Prices Expectations (Jan)

U.K. CBI Industrial Prices Expectations (Jan)A:--

F: --

P: --

South Africa Retail Sales YoY (Nov)

South Africa Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. CBI Industrial Trends - Orders (Jan)

U.K. CBI Industrial Trends - Orders (Jan)A:--

F: --

P: --

Mexico Retail Sales MoM (Nov)

Mexico Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Industrial Product Price Index YoY (Dec)

Canada Industrial Product Price Index YoY (Dec)A:--

F: --

Canada Industrial Product Price Index MoM (Dec)

Canada Industrial Product Price Index MoM (Dec)A:--

F: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Pending Home Sales Index YoY (Dec)

U.S. Pending Home Sales Index YoY (Dec)A:--

F: --

P: --

U.S. Pending Home Sales Index MoM (SA) (Dec)

U.S. Pending Home Sales Index MoM (SA) (Dec)A:--

F: --

P: --

U.S. Construction Spending MoM (Oct)

U.S. Construction Spending MoM (Oct)A:--

F: --

U.S. Pending Home Sales Index (Dec)

U.S. Pending Home Sales Index (Dec)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

South Korea GDP Prelim YoY (SA) (Q4)

South Korea GDP Prelim YoY (SA) (Q4)--

F: --

P: --

South Korea GDP Prelim QoQ (SA) (Q4)

South Korea GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Japan Imports YoY (Dec)

Japan Imports YoY (Dec)--

F: --

P: --

Japan Exports YoY (Dec)

Japan Exports YoY (Dec)--

F: --

P: --

Japan Goods Trade Balance (SA) (Dec)

Japan Goods Trade Balance (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Not SA) (Dec)

Japan Trade Balance (Not SA) (Dec)--

F: --

Australia Employment (Dec)

Australia Employment (Dec)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Dec)

Australia Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

Australia Unemployment Rate (SA) (Dec)

Australia Unemployment Rate (SA) (Dec)--

F: --

P: --

Australia Full-time Employment (SA) (Dec)

Australia Full-time Employment (SA) (Dec)--

F: --

P: --

Turkey Consumer Confidence Index (Jan)

Turkey Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Capacity Utilization (Jan)

Turkey Capacity Utilization (Jan)--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Jan)

Turkey Late Liquidity Window Rate (LON) (Jan)--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Jan)

Turkey Overnight Lending Rate (O/N) (Jan)--

F: --

P: --

Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

U.K. CBI Distributive Trades (Jan)

U.K. CBI Distributive Trades (Jan)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Jan)

U.K. CBI Retail Sales Expectations Index (Jan)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)--

F: --

P: --

Canada New Housing Price Index MoM (Dec)

Canada New Housing Price Index MoM (Dec)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Real GDP Annualized QoQ Final (Q3)

U.S. Real GDP Annualized QoQ Final (Q3)--

F: --

P: --

U.S. PCE Price Index Final QoQ (AR) (Q3)

U.S. PCE Price Index Final QoQ (AR) (Q3)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Nov)

U.S. Personal Outlays MoM (SA) (Nov)--

F: --

P: --

U.S. Core PCE Price Index YoY (Nov)

U.S. Core PCE Price Index YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

US forces seized a Venezuelan oil tanker, escalating sanctions enforcement amid post-Maduro political shifts.

The Trump administration's campaign to control Venezuela's oil industry has escalated, with the US military seizing another oil tanker at sea as part of its ongoing sanctions enforcement.

US military officials confirmed on Thursday that forces had boarded the crude oil tanker Veronica, which marine records indicate sails under a Guyanese flag. The pre-dawn operation marks the latest move by the United States to clamp down on Venezuelan oil shipments following the capture of President Nicolás Maduro earlier this month.

The US Southern Command announced the seizure on social media, stating that marines and sailors boarded the vessel in a "flawlessly executed operation." The post included black-and-white aerial footage that appeared to show personnel descending from a helicopter onto the tanker's deck.

Kristi Noem, the homeland security secretary, confirmed the action and described the vessel as part of a "ghost fleet" of foreign-flagged tankers operating in defiance of a US "quarantine" on sanctioned vessels in the Caribbean.

The operation was a joint effort involving the US Coast Guard, the Department of Homeland Security, and the Department of Justice. According to the Southern Command, forces launched from the aircraft carrier USS Gerald R Ford and seized the Veronica without incident.

While officials did not specify the exact location of the seizure, marine traffic data shows the 815-foot vessel's last known position 12 days ago was off the coast of Venezuela. Shipping documents indicate the tanker left Venezuelan waters empty in early January and had not returned.

The capture of the Veronica is the sixth known seizure of a foreign-flagged oil tanker by the US military since it began tightening its grip on Venezuela's oil sector. This series of interdictions falls under a broader initiative named Operation Southern Spear.

Just last Friday, the Southern Command announced the boarding of another vessel, the Olina, near Trinidad, also launched from the USS Gerald R Ford. This follows the high-profile seizure of the Russian-flagged tanker Marinera on January 7, which was pursued across the Atlantic for over two weeks while being shadowed by a Russian submarine. The UK's Ministry of Defence confirmed it assisted in that operation.

In its announcement, the Southern Command stated, "The Department of War is unwavering in its mission to crush illicit activity in the Western Hemisphere." The US has accused Venezuela of using false-flag tankers or vessels with cancelled registrations to circumvent sanctions.

These military actions coincide with significant political maneuvering in Washington. The announcement of the Veronica's seizure came just before President Trump's scheduled meeting with María Corina Machado, the Venezuelan opposition leader and 2025 Nobel Peace Prize winner, to discuss the country's future.

However, the Trump administration has politically recognized Maduro's former vice-president, Delcy Rodríguez, as Venezuela's interim leader, effectively sidelining Machado. On the day of Maduro's capture, Trump called Machado a "nice woman" but claimed she lacked the "respect" to govern.

As part of its strategy, the Trump administration has moved to control the global distribution of Venezuelan oil. The president announced an agreement with the country's interim leaders to provide up to 50 million barrels of crude oil to the United States and signed an executive order to "safeguard" Venezuelan oil revenues in US-controlled accounts.

Félix Plasencia, Venezuela's ambassador to the UK and an ally of Rodríguez, was also expected in Washington on Thursday to discuss the next steps for the nation's future with administration officials.

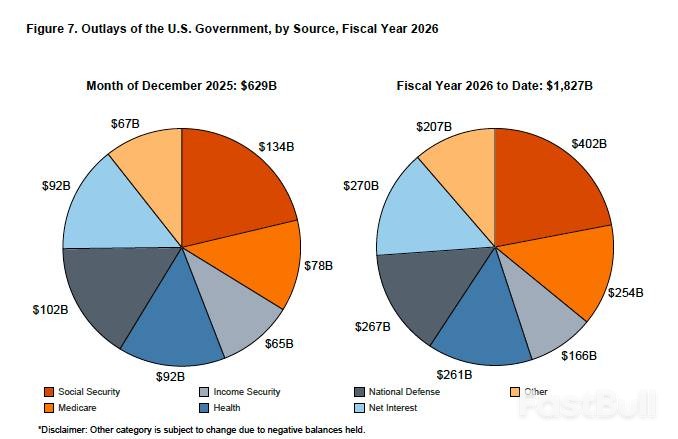

Despite a surge in tariff collections, the U.S. federal government continues to operate with a massive budget deficit. The shortfall in December hit a record $144.75 billion for the month, a 68% increase compared to December 2024.

While calendar effects and delayed payments can distort a single month's data, a wider view of the first three months of fiscal year 2026 reveals the underlying trend. Over this quarter, the budget gap did narrow by about 15% compared to the same period last year, thanks in part to higher tariff receipts.

However, this improvement offers little comfort. The deficit for the last three months still stands at an enormous $602.38 billion.

Over the first quarter of fiscal 2026, the U.S. Treasury collected $90 billion in tariffs—a substantial jump from the $20.8 billion collected during the same period in fiscal 2025. Yet, recent data suggests this revenue stream may have already hit its ceiling.

Customs receipts have shown a declining trend over the quarter:

• October: $31.4 billion (record high)

• November: $30.76 billion

• December: $27.9 billion

While total government revenue has increased, reaching $1.23 trillion in the first three months of fiscal '26 (a 13% rise), the plateauing tariff income undermines any political promises that this revenue could fund dividends for taxpayers or pay down the national debt. The math simply doesn't support these claims while the government runs such a large deficit.

The increase in tariff revenue has helped mask the fundamental problem: the federal government's spending continues to grow.

In December alone, government outlays reached $629.13 billion. This brought the total spending for the first three months of the fiscal year to $1.83 trillion, an increase of about 2% from the previous year.

This rise in spending occurred even as data began to reflect budget cuts at the EPA and the Department of Education. Despite some rhetoric about fiscal responsibility from the Trump administration and President Biden’s debt ceiling deal (the Fiscal Responsibility Act), meaningful reductions have not materialized.

So-called "cuts," like those in the Big Beautiful Bill, were often reductions from projected future spending increases, meaning actual expenditures still rise, just at a slower pace. The government spent over $7 trillion last year, averaging $19.2 billion per day, and there appears to be little political will to address this trajectory.

The consequences of this spending are clear in the national debt, which surged past $38 trillion on October 21 and now stands at $38.4 trillion.

Servicing this debt has become one of the government's largest expenses, second only to Social Security. In December, interest payments alone cost the Treasury $153.92 billion, bringing the quarterly total to $354.58 billion. For fiscal year 2025, the interest on the national debt cost taxpayers $1.2 trillion.

To put this in perspective, December's spending on interest surpassed outlays for other critical areas:

• Interest on Debt: $153.92 billion

• Social Security: $134 billion

• National Defense: $102 billion

• Medicare: $78 billion

This problem is set to worsen. Much of the existing government debt was financed at low interest rates. As these bonds mature, they must be replaced with new debt at today's much higher rates, locking in greater interest costs for the foreseeable future. Even with the Federal Reserve cutting rates, Treasury yields have pushed higher as demand for U.S. debt weakens, making it even more expensive for Uncle Sam to borrow.

Data Interpretation

Political

Commodity

Forex

Remarks of Officials

Economic

Central Bank

Middle East Situation

Energy

Daily News

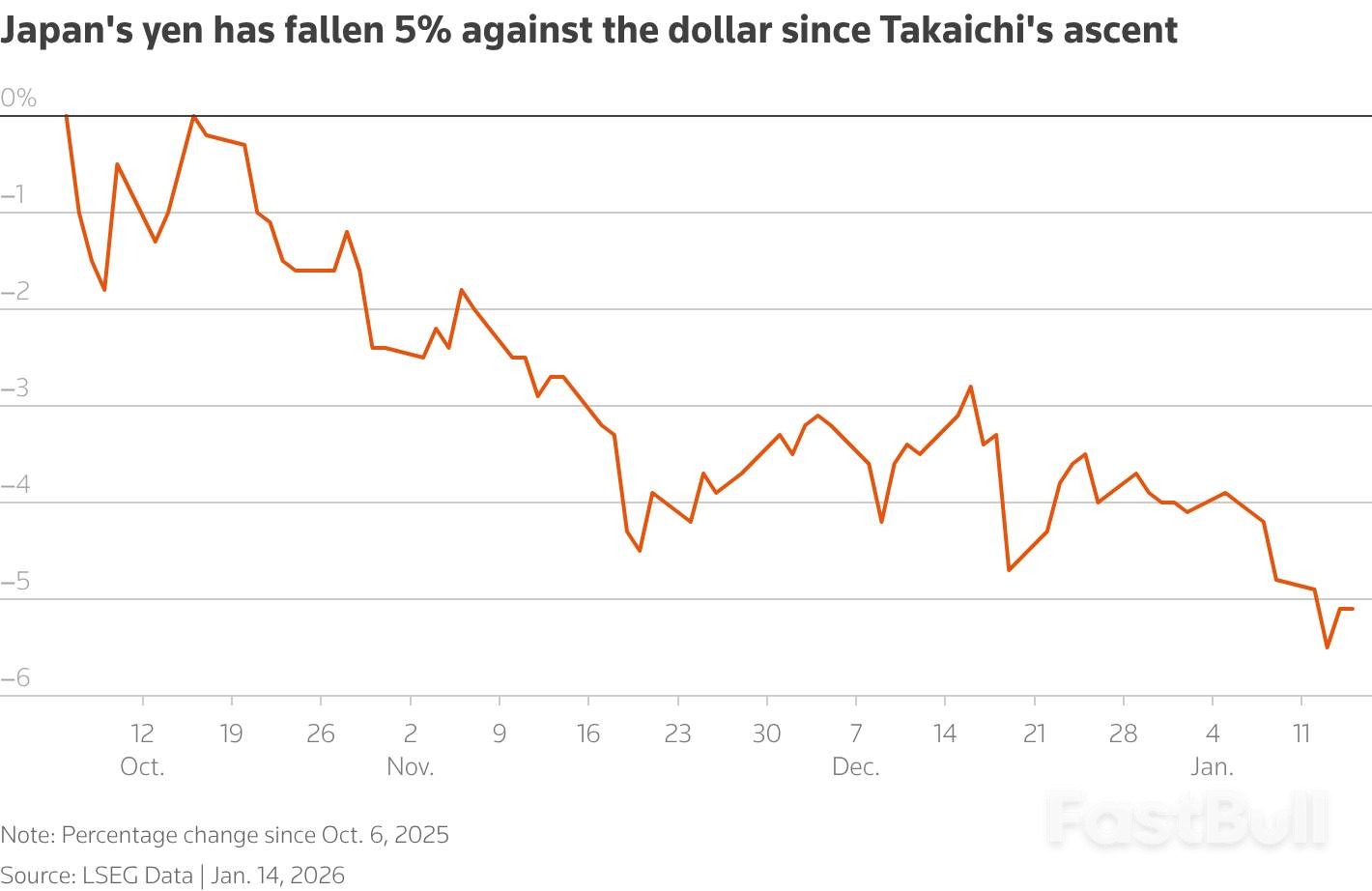

Global markets showed signs of strength as the artificial intelligence trade found new momentum, but the main focus for investors has shifted to the Japanese yen and the growing possibility of government intervention.

Japanese Finance Minister Satsuki Katayama intensified market speculation on Friday, stating that Tokyo "won't rule out any options" to address the yen's ongoing weakness. This statement is the latest in a series of verbal warnings from Japanese authorities this week aimed at slowing the currency's decline, which has already fallen about 1% this year.

The yen did see a brief rally on Friday, partly boosted by a Reuters report suggesting some Bank of Japan policymakers believe an interest rate hike could happen sooner than markets anticipate. Despite this, the currency remains near the critical 160-per-dollar level after hitting an 18-month low earlier in the week, reviving talk that direct intervention could be imminent.

Recent pressure on the yen stems from the prospect of a snap election in Japan next month. Investors anticipate that Prime Minister Sanae Takaichi could secure a stronger mandate to implement additional economic stimulus. However, officials must weigh the benefits of a weaker yen against the rising cost of imported fuel, food, and raw materials, which could drive up consumer prices.

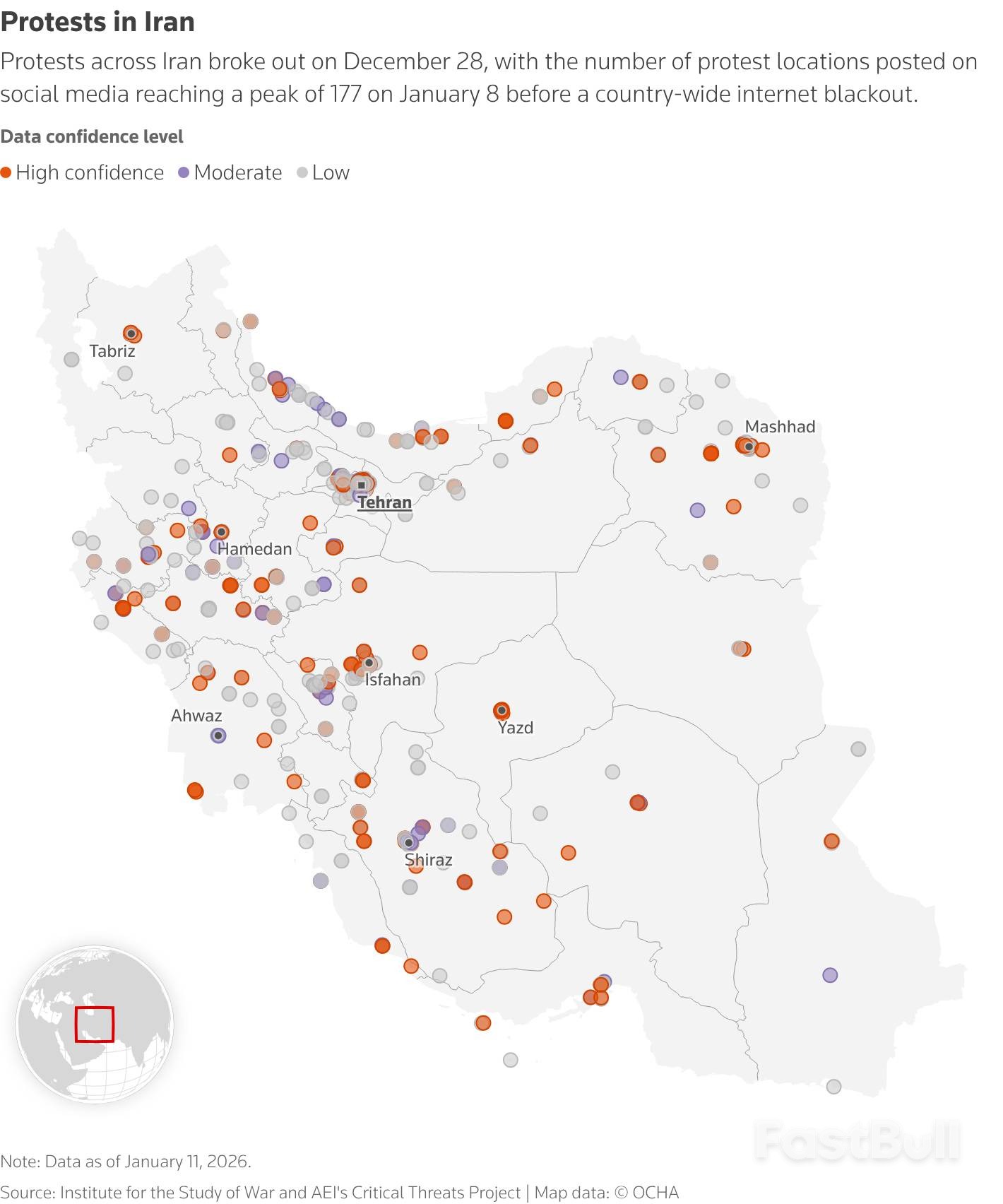

In other markets, oil prices continued their steep decline from the previous session. The rally in safe-haven assets like gold and silver also paused after U.S. President Donald Trump adopted a more measured stance on the unrest in Iran.

Trump commented that he was told the killings in Iran's crackdown on protests were subsiding and that he did not believe there was a current plan for large-scale executions. His wait-and-see posture eased immediate geopolitical tensions that had previously driven investors toward safer assets.

The U.S. dollar maintained its position near a six-week high as a string of positive economic data on Thursday led investors to scale back their expectations for Federal Reserve rate cuts this year.

According to the CME FedWatch tool, markets are now pricing in a 67% probability that the Fed will hold rates steady in April, a significant increase from 37% a month ago. The odds of rates remaining unchanged in June have also risen to 37.5%, up from 17% last month.

Traders will be monitoring several key developments that could influence markets on Friday:

• Speeches from Federal Reserve officials Collins, Bowman, and Jefferson.

• The release of U.S. industrial production data for December.

• The National Association of Home Builders' (NAHB) housing market index for January.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up