Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

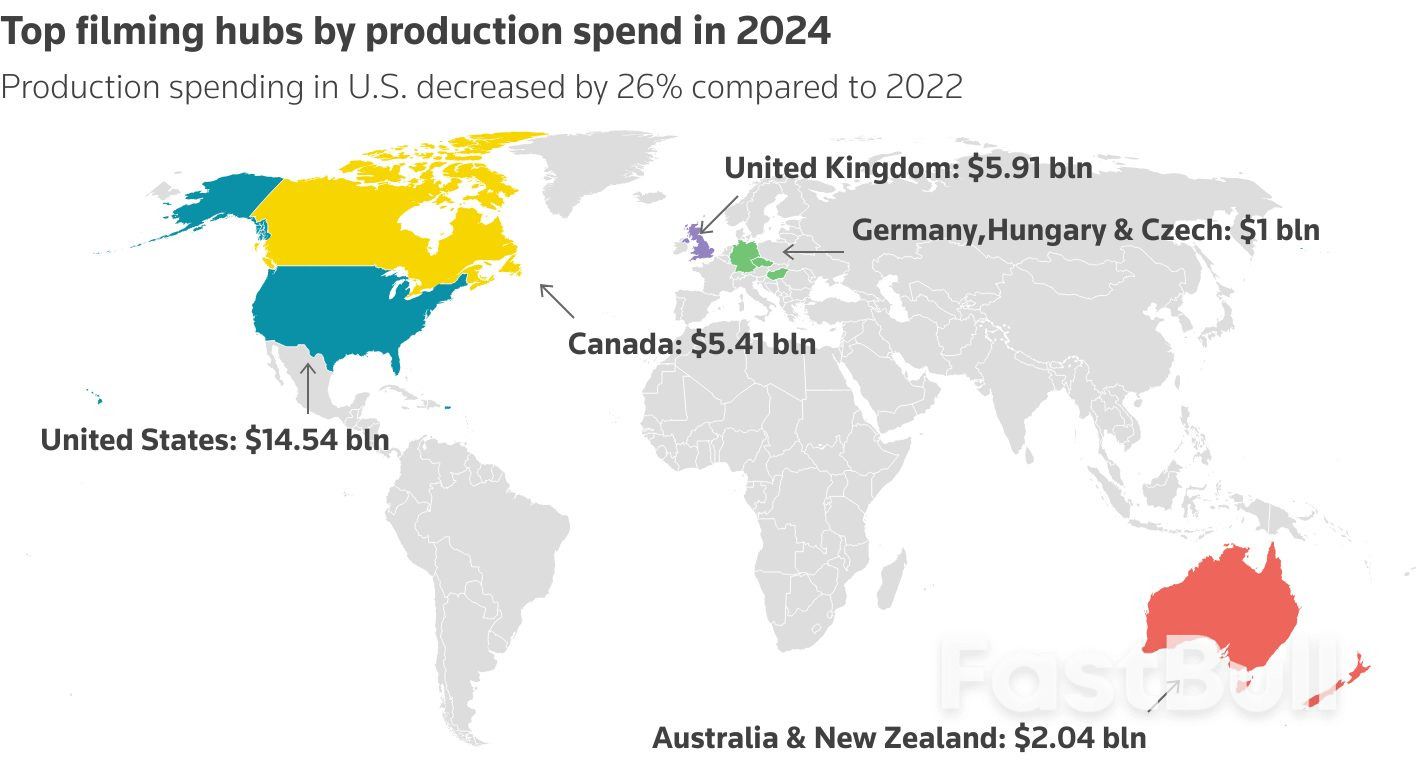

U.S. media stocks fell after Trump proposed a 100% tariff on foreign-made films, sparking global industry concerns over rising costs, disrupted production, potential retaliation, and unclear enforcement details.

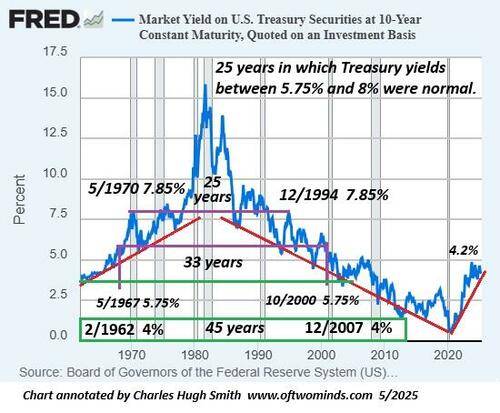

As a result of recency bias, where we assume the recent past is a permanent state of affairs, many believe near-zero interest rates are "normal." They aren't. As the chart of 10-year US Treasury yields--a proxy for interest rates throughout the economy--illustrates, rates in the 3% or lower were an anomaly that only occurred in the relatively brief period of 2011-2022.

For the five decades between 1960 and 2007, interest rates of 4% and higher were the norm. These included the glorious decades of stable growth and rising stocks / housing valuations--the 1960s, 1980s, 1990s and up to 2007, just before the financial crisis of 2008-09.

For 33 of those years, interest rates of 5.75% or higher were the norm, from 1967 to 2000. No one said that the economy would collapse if interest rates didn't drop to 3%, for it was understood that super-low interest rates would ignite inflation and incentivize destructive speculative excesses.

For the 25 years between 1970 and 1994, rates between 5.75% and 8% were normal. The 10-year Treasury yield is now around 4% to 4.2%--far lower than what was considered normal for 25 years.

It's long been noted that interest rate cycles tend to run for decades, not years. Interest rates rose for around 25 years, and then declined for 40 years from 1981 to 2020--a period that was longer than average, thanks to the dominance of central bank monetary policies, or perhaps more accurately, the growing dependence of economies on extraordinarily low interest rates for their "growth."

If history is any guide, interest rates will rise back to the historic range between 5.75% and 8% and linger there for the better part of two decades. Alternatively, rates break above that range and skyrocket into the realm of debt / inflationary crises.

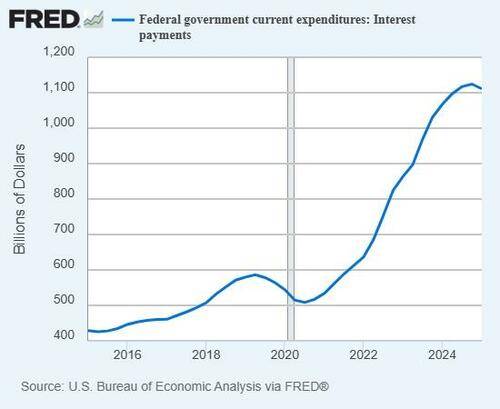

The return of Treasury yields to the historically "normal" range of 4% and higher has doubled the Federal interest payments on Federal debt. It was easily predictable that super-low interest rates would encourage an orgy of borrowing and spending of all that "nearly free money," which is precisely what happened.

The interest paid by households has also soared for the same reason: not just because interest rates rose, but because the borrowed money (debt) being serviced exploded higher due to low interest rates.

Higher debt / interest payments squeeze out other spending. Debt payments come first, or the entity defaults on its debts and enters bankruptcy--a bankruptcy that tends to bankrupt the lenders who will be lucky to collect pennies on every dollar they lent out.

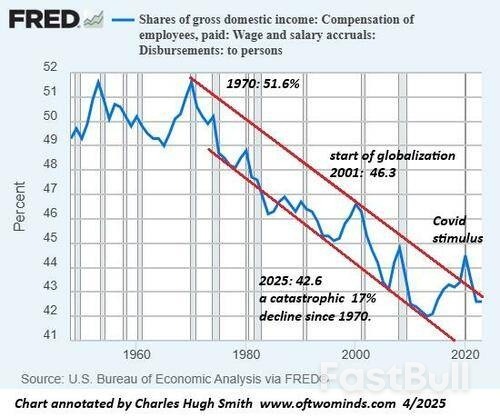

Households are going to have a hard time servicing debt and spending more as rates rise, for wage earners' share of the economy has been in a freefall for 50 years. Less income + higher debt service payments = lower discretionary income to spend + inability to borrow more money to spend = recession.

Interest rates are linked to inflation, but they're also linked to risk. The cost of money isn't simply tied to inflation expectations--it's also tied to speculative excesses blowing credit-asset bubbles which implode, destroying the phantom wealth generated by the bubble.

The lenders that survive the implosion are wary of lending money to all but the most conservative, risk-averse, creditworthy borrowers backed by ample collateral. That excludes the majority of households and enterprises.

The ISM Services increased 0.8 points to 51.6 in April, beating expectations of a small decline. Eleven of eighteen industries reported growth in April, up from ten in March, though still below the 14 reporting expansion in January and February.

Business activity declined, falling 2.2 points to 53.7. New orders increased to 52.3, ending a streak of monthly declines and reversing a particularly weak reading (50.4) last month. The imports index registered a large decline (-8.3), falling to 44.3 and sending the sub-index into contractionary territory.

The employment index increased to 49.0 but remains in contractionary territory, suggesting services payrolls continued to decline in April. However, the employment index has signaled contraction several times since early 2024, while the labor market continued to expand.

The prices paid sub-component jumped up to 65.1 from 60.9 April, suggesting price pressures are heating up in the service sector.

The service sector expanded in April, but the details are less encouraging. While the overall index improved, business activity declined and it looks as though the service sector is feeling the effects of tariffs coming into place in April, cutting activity and imports at the same time.

Most respondents in this survey reported challenges to their operations and pricing from tariffs. The combination of areas which registered gains (new export orders, inventories, and prices) is indicative of businesses trying to get ahead of retaliatory tariffs or other policy changes and could foreshadow a deeper decline in the coming months. More importantly, the sharp increase in prices, coupled with the decline in activity, suggests the service sector could also be moving towards stagflation, something we have already seen in manufacturing.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up