Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Oct)

U.S. Average Hourly Wage MoM (SA) (Oct)A:--

F: --

P: --

U.S. Average Hourly Wage YoY (Oct)

U.S. Average Hourly Wage YoY (Oct)A:--

F: --

P: --

U.S. Retail Sales (Oct)

U.S. Retail Sales (Oct)A:--

F: --

P: --

U.S. Core Retail Sales MoM (Oct)

U.S. Core Retail Sales MoM (Oct)A:--

F: --

U.S. Core Retail Sales (Oct)

U.S. Core Retail Sales (Oct)A:--

F: --

P: --

U.S. Retail Sales MoM (Oct)

U.S. Retail Sales MoM (Oct)A:--

F: --

U.S. Private Nonfarm Payrolls (SA) (Oct)

U.S. Private Nonfarm Payrolls (SA) (Oct)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Oct)

U.S. Average Weekly Working Hours (SA) (Oct)A:--

F: --

P: --

U.S. Labor Force Participation Rate (SA) (Nov)

U.S. Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

U.S. Retail Sales YoY (Oct)

U.S. Retail Sales YoY (Oct)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Oct)

U.S. Manufacturing Employment (SA) (Oct)A:--

F: --

U.S. Government Employment (Nov)

U.S. Government Employment (Nov)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Dec)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Dec)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Dec)

U.S. IHS Markit Composite PMI Prelim (SA) (Dec)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Dec)

U.S. IHS Markit Services PMI Prelim (SA) (Dec)A:--

F: --

P: --

U.S. Commercial Inventory MoM (Sept)

U.S. Commercial Inventory MoM (Sept)A:--

F: --

P: --

BOC Gov Macklem Speaks

BOC Gov Macklem Speaks Argentina GDP YoY (Constant Prices) (Q3)

Argentina GDP YoY (Constant Prices) (Q3)A:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

Australia Westpac Leading Index MoM (Nov)

Australia Westpac Leading Index MoM (Nov)A:--

F: --

Japan Trade Balance (Not SA) (Nov)

Japan Trade Balance (Not SA) (Nov)A:--

F: --

P: --

Japan Goods Trade Balance (SA) (Nov)

Japan Goods Trade Balance (SA) (Nov)A:--

F: --

P: --

Japan Imports YoY (Nov)

Japan Imports YoY (Nov)A:--

F: --

P: --

Japan Exports YoY (Nov)

Japan Exports YoY (Nov)A:--

F: --

P: --

Japan Core Machinery Orders YoY (Oct)

Japan Core Machinery Orders YoY (Oct)A:--

F: --

P: --

Japan Core Machinery Orders MoM (Oct)

Japan Core Machinery Orders MoM (Oct)A:--

F: --

P: --

U.K. Core CPI MoM (Nov)

U.K. Core CPI MoM (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

U.K. Core Retail Prices Index YoY (Nov)

U.K. Core Retail Prices Index YoY (Nov)--

F: --

P: --

U.K. Core CPI YoY (Nov)

U.K. Core CPI YoY (Nov)--

F: --

P: --

U.K. Output PPI MoM (Not SA) (Nov)

U.K. Output PPI MoM (Not SA) (Nov)--

F: --

P: --

U.K. Output PPI YoY (Not SA) (Nov)

U.K. Output PPI YoY (Not SA) (Nov)--

F: --

P: --

U.K. Input PPI YoY (Not SA) (Nov)

U.K. Input PPI YoY (Not SA) (Nov)--

F: --

P: --

U.K. CPI YoY (Nov)

U.K. CPI YoY (Nov)--

F: --

P: --

U.K. Retail Prices Index MoM (Nov)

U.K. Retail Prices Index MoM (Nov)--

F: --

P: --

U.K. CPI MoM (Nov)

U.K. CPI MoM (Nov)--

F: --

P: --

U.K. Input PPI MoM (Not SA) (Nov)

U.K. Input PPI MoM (Not SA) (Nov)--

F: --

P: --

U.K. Retail Prices Index YoY (Nov)

U.K. Retail Prices Index YoY (Nov)--

F: --

P: --

Indonesia 7-Day Reverse Repo Rate

Indonesia 7-Day Reverse Repo Rate--

F: --

P: --

Indonesia Deposit Facility Rate (Dec)

Indonesia Deposit Facility Rate (Dec)--

F: --

P: --

Indonesia Lending Facility Rate (Dec)

Indonesia Lending Facility Rate (Dec)--

F: --

P: --

Indonesia Loan Growth YoY (Nov)

Indonesia Loan Growth YoY (Nov)--

F: --

P: --

South Africa Core CPI YoY (Nov)

South Africa Core CPI YoY (Nov)--

F: --

P: --

South Africa CPI YoY (Nov)

South Africa CPI YoY (Nov)--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Dec)

Germany Ifo Business Expectations Index (SA) (Dec)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Dec)

Germany Ifo Current Business Situation Index (SA) (Dec)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Dec)

Germany IFO Business Climate Index (SA) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Nov)

Euro Zone Core CPI Final MoM (Nov)--

F: --

P: --

Euro Zone Labor Cost YoY (Q3)

Euro Zone Labor Cost YoY (Q3)--

F: --

P: --

Euro Zone Core HICP Final YoY (Nov)

Euro Zone Core HICP Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Nov)

Euro Zone Core HICP Final MoM (Nov)A:--

F: --

P: --

Euro Zone Core CPI Final YoY (Nov)

Euro Zone Core CPI Final YoY (Nov)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Nov)

Euro Zone HICP MoM (Excl. Food & Energy) (Nov)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Nov)

Euro Zone CPI YoY (Excl. Tobacco) (Nov)--

F: --

P: --

Euro Zone HICP Final YoY (Nov)

Euro Zone HICP Final YoY (Nov)--

F: --

P: --

Euro Zone HICP Final MoM (Nov)

Euro Zone HICP Final MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

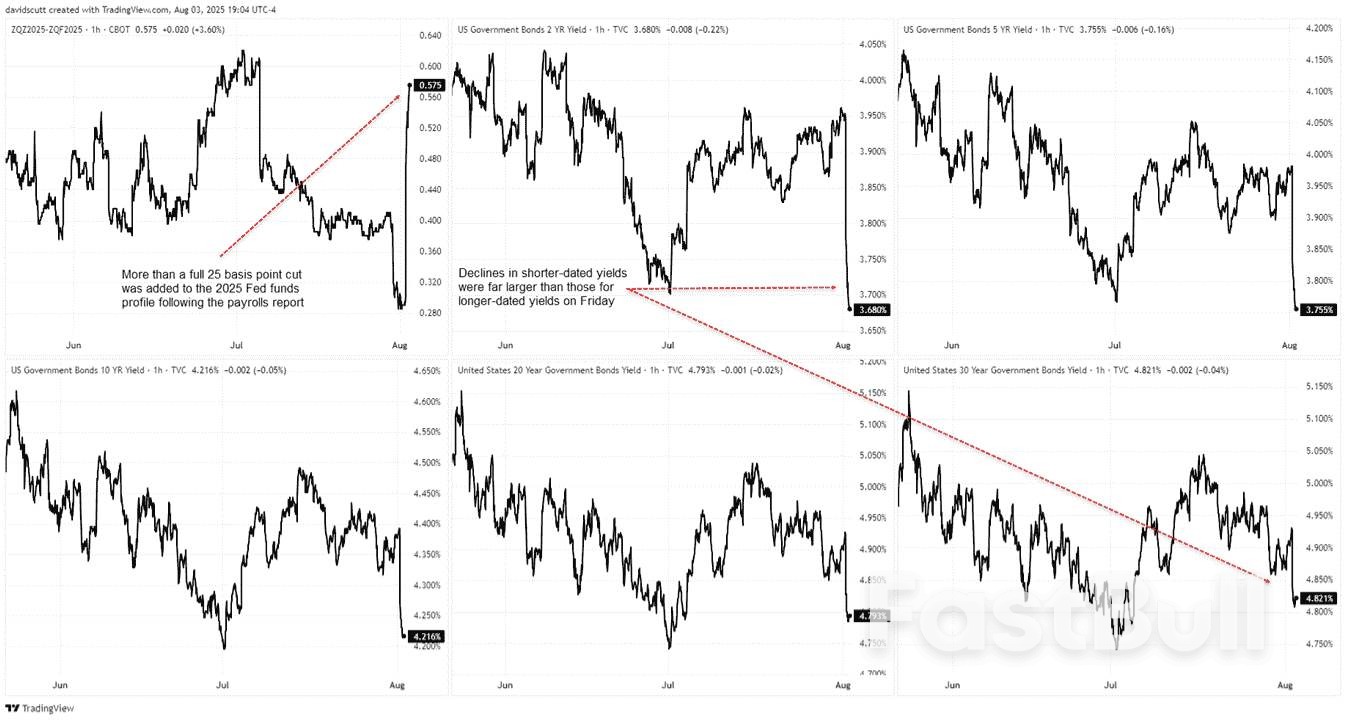

On Friday, markets were shaken by much worse-than-expected U.S. jobs data. Fewer jobs were added than expected, and past numbers were revised lower. This increased chances of a Fed rate cut in September. The U.S. dollar dropped sharply, while gold jumped higher. Stocks, oil, and Bitcoin all fell, as investors grew more worried about global trade tensions and a slowing economy.

It was a very volatile week for financial markets. Things started off strong with a trade deal between the U.S. and Europe, but confidence dropped quickly after President Trump announced new global tariffs on August 1. Canada will now face a 35% tariff, up from 25%, and other countries could see tariffs as high as 41% starting August 7 unless new deals are made. This hurt investor sentiment and caused stock markets in Asia and Europe to fall.

The U.S. Federal Reserve decided to keep interest rates unchanged. Fed Chair Jerome Powell said they need more data before making any changes. The U.S. dollar rose earlier in the week thanks to strong GDP data. In Japan, the Bank of Japan also kept rates steady and raised its inflation outlook, but didn’t signal any rate hikes, which caused the yen to weaken. President Trump continued to pressure the Fed to lower interest rates.

On Friday, markets were shaken by much worse-than-expected U.S. jobs data. Fewer jobs were added than expected, and past numbers were revised lower. This increased chances of a Fed rate cut in September. The U.S. dollar dropped sharply, while gold jumped higher. Stocks, oil, and Bitcoin all fell, as investors grew more worried about global trade tensions and a slowing economy.

Markets This Week

The Dow Jones fell every day last week after starting with a key reversal pattern—making a new high but closing lower on Monday. What began as normal profit-taking turned into heavier selling on Friday due to weaker-than-expected U.S. employment data and the announcement of new tariffs on multiple countries as trade talks continued. The drop appears slightly oversold in the short term, but the full impact of the jobs report and trade tensions is still uncertain. Volatility is likely to remain high this week, creating range-trading opportunities. Medium-term traders should be cautious about buying at current levels and may want to wait for further weakness or consider selling into any short-term rebound. Resistance levels are at 44,000, 44,500, and 45,000, while support lies at 43,000, 42,000, and 41,750.

The Nikkei 225 gave up all of its gains from the July 23 U.S.–Japan trade deal last week, falling back to the key 40,000円 level. Although the Bank of Japan maintained a cautious stance on raising interest rates—causing the yen to weaken—the sharp drop in USD/JPY and U.S. equities on Friday pushed the Nikkei lower into the weekend. Despite the decline, the 10-day moving average remains in a bullish trend, and as long as the yen doesn’t strengthen further, a rebound this week is likely. Resistance is seen at 41,000円 and 42,000円, while support lies at 40,000円, 39,200円, and 39,000円.

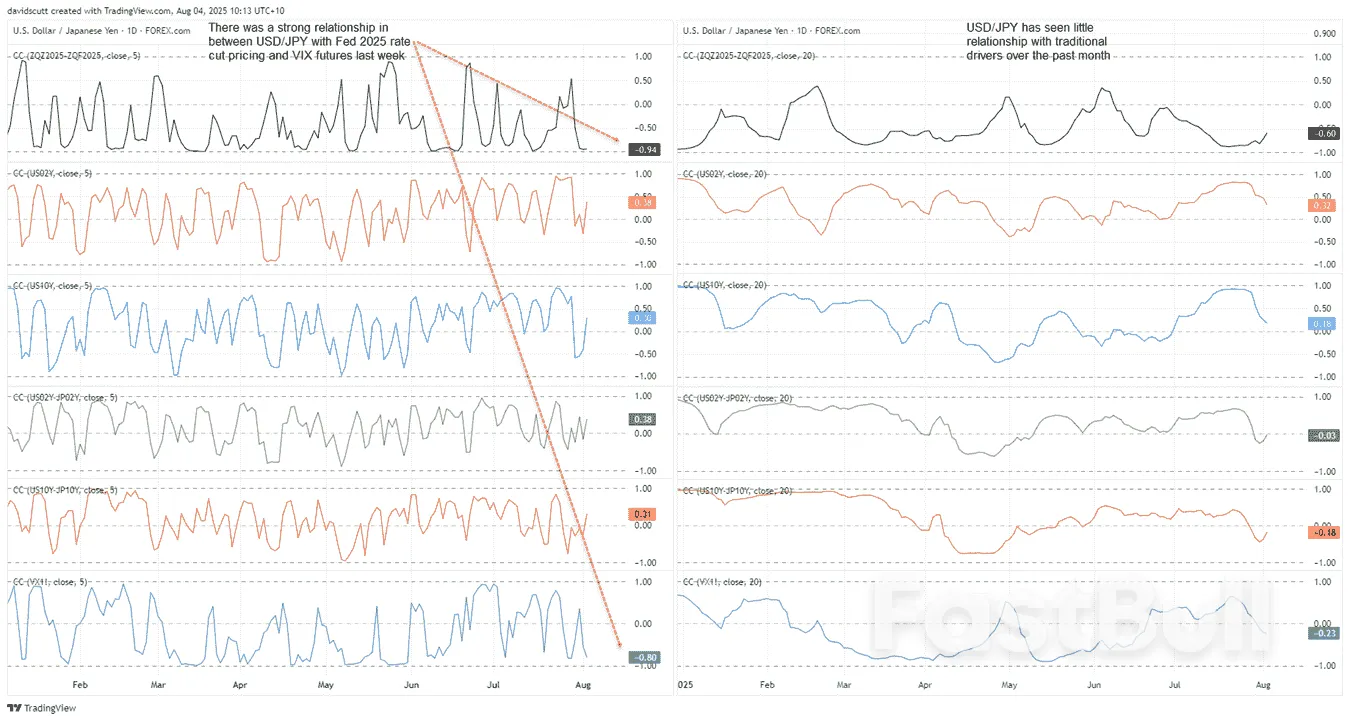

USD/JPY surged above 150 last week, raising concerns within the Japanese government as strong U.S. economic data and cautious comments from Fed Chair Powell on cutting rates supported the dollar. At the same time, the Bank of Japan signaled it still needs more time before raising rates, adding to the upward pressure. However, all gains were wiped out after much weaker-than-expected U.S. employment data triggered steady selling into the weekend. It’s unclear if this weak trend in U.S. data will continue, but with few major releases scheduled this week, USD/JPY is likely to trade sideways in a broad range. There is a risk of another sharp sell-off if negative headlines emerge around U.S. trade talks. Resistance is seen at 148, 149, and 150, while support lies at 147, 146, and 145.

Gold spent most of last week under pressure, testing the lower end of its recent range as a stronger U.S. dollar triggered steady selling. However, much weaker-than-expected U.S. employment data reversed the dollar’s strength and sparked heavy gold buying, pushing prices higher by the end of the week. Renewed trade tensions also supported demand for safe-haven assets, bringing buyers back into the market. While gold remains well supported on dips and trade risks are a positive factor, the short-term outlook is slightly overbought, suggesting some consolidation may occur. Resistance is at $3,400 and $3,450, with support at $3,300 and $3,250.

Crude oil briefly moved above the $70 resistance level midweek after stronger-than-expected U.S. GDP data boosted expectations for oil demand. However, sentiment quickly shifted as President Trump announced increased tariffs on Canada and other countries, and weaker U.S. employment data triggered aggressive selling, pushing prices back toward the middle of the recent range. Ongoing tariff concerns may limit further upside, and with strong support holding around $65, range trading remains the most effective strategy for now. Resistance is seen at $70, $75, and $80, while support continues to hold at $65 and $60.

Bitcoin dropped every day over the past five days, making it the worst 5-day stretch since June. Ongoing debate in the U.S. government about how to regulate crypto has created uncertainty, causing big investors to pull back. The Federal Reserve delaying interest rate cuts also hurt Bitcoin, since it tends to do better when rates are expected to fall. Selling picked up after President Trump announced new tariffs and weak U.S. jobs data added to market worries. In the short term, prices may fall further, but the market looks oversold, so short-term traders might find chances to buy if prices start to bounce. Medium-term investors may want to wait until there’s more clarity on U.S. trade policy and the economy. Resistance is at $120,000, $125,000, and $150,000, with support at $112,000, $110,000, and $105,000.

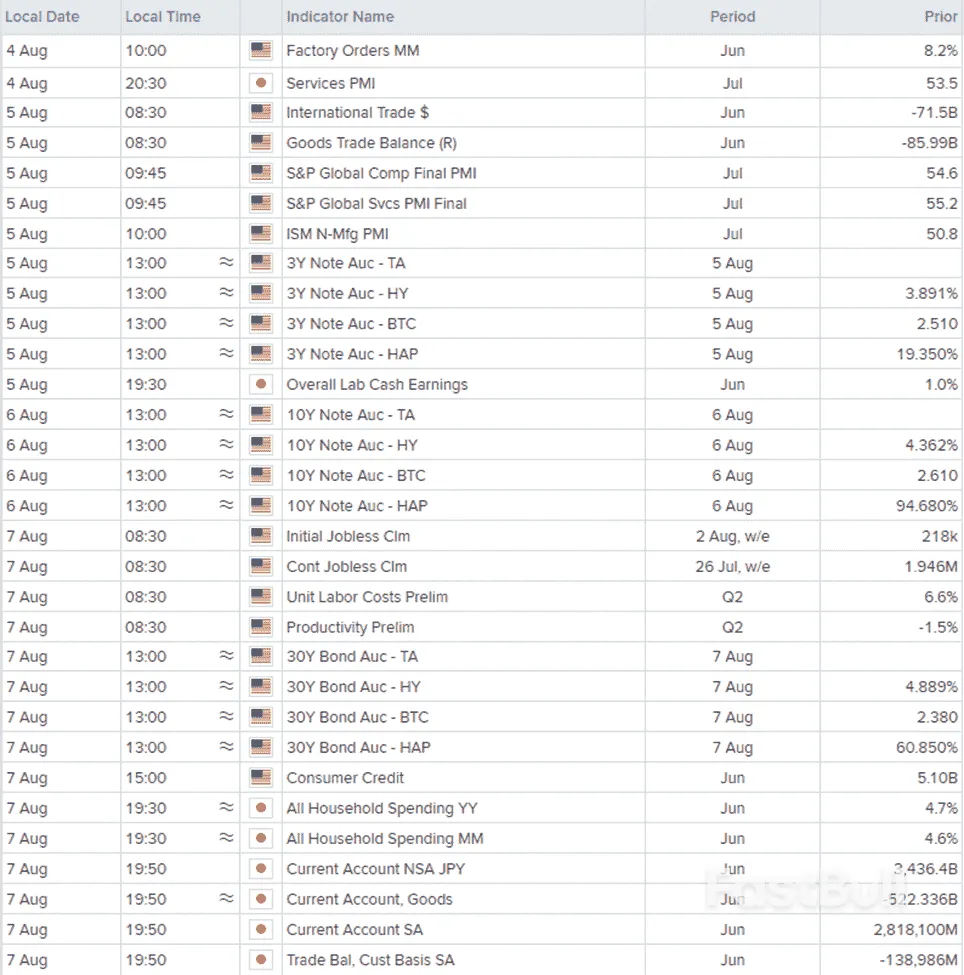

This Week’s Focus

This week could bring more sharp market moves, even though the economic calendar is relatively light. The main scheduled event is the Bank of England meeting on Thursday, where a 0.25% rate cut is widely expected. PMI data from several major economies will also be released, offering clues about global growth. But the bigger focus will be on how markets react to last Friday’s sell-off—whether it signals the beginning of a new trend or was just a short-term move.

U.S. trade policy is likely to dominate sentiment, with President Trump continuing to pressure other countries to negotiate on his terms. Traders will be watching closely for any new headlines or developments on tariffs and trade deals. With uncertainty high and momentum shifting, this could be a volatile week as bulls and bears compete to set the next direction

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up