Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

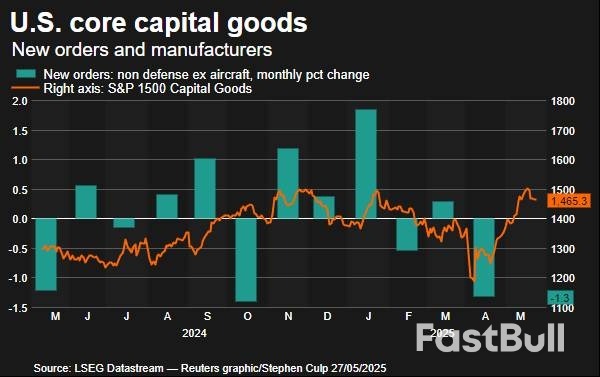

New orders for key U.S.-manufactured capital goods plunged by the most in six months in April amid mounting uncertainty over the economy because of tariffs, suggesting business spending on equipment weakened at the start of the second quarter.

The report from the Commerce Department on Tuesday also showed shipments of these goods falling last month. Economists said President Donald Trump's flip-flopping on import duties was making it difficult for businesses to plan ahead. That has been evident in the deterioration in sentiment among businesses.

"I have predicted for months that business investment will be the main driver of a softer economic performance this year, as executives postpone their capital projects until they have more clarity on policy," said Stephen Stanley, chief U.S. economist at Santander U.S. Capital Markets. "These data offer the first confirming evidence of that hypothesis."

Non-defense capital goods orders excluding aircraft, a closely watched proxy for business spending plans, tumbled 1.3% last month. That was the largest drop since last October and followed an upwardly revised 0.3% gain in March, the Commerce Department's Census Bureau said. Economists polled by Reuters had forecast these so-called core capital goods orders dipping 0.1% after a previously reported 0.2% drop in March.

Core capital goods shipments slipped 0.1% after increasing 0.5% in March. Nondefense capital goods orders slumped 19.1%. Shipments of these goods rebounded 3.5% after falling 1.1% in March. Front-running by businesses eager to avoid higher prices from Trump's sweeping tariffs on imports contributed to business spending on equipment, mostly information processing equipment, surging at its fastest rate in 4-1/2 years in the first quarter.

That helped to limit the drag on gross domestic product from a flood of imports. Trump has delayed higher import duties on most countries until July. The White House this month announced a deal with Beijing to slash tariffs on Chinese goods to 30% from 145% for 90 days.

The truce in the trade war between Washington and Beijing helped to lift consumer confidence in May after deteriorating for five straight months. Consumers, however, continued to worry about tariffs raising prices and hurting the economy.

The Conference Board's consumer confidence index increased 12.3 points to 98.0 this month, blowing past economists' expectations for an improvement to 87.0.

But concerns about the labor market lingered, even as consumers planned to spend more over the next six months on big-ticket items such as motor vehicles and household appliances, take vacations and buy houses.

The survey's so-called labor market differential, derived from data on respondents' views on whether jobs are plentiful or hard to get, narrowed to 13.2 from 13.7 in April. This measure correlates with the unemployment rate in the Labor Department's monthly employment report.

Trump last week ratcheted up his trade war, proposing a 50% tariff on European Union goods starting June 1 and threatened Apple (AAPL.O), opens new tab with a 25% duty on any iPhones manufactured outside the United States. Trump at the weekend, however, backed off his threat against the EU, restoring a July 9 deadline.

Stocks on Wall Street were trading higher. The dollar rose against a basket of currencies. U.S. Treasury yields fell.

Economists are anticipating a period of volatility for business spending, with the pauses in higher tariffs for Chinese and EU products seen unleashing a fresh round of front-loading. Ultimately, they expect investment to soften this year.

Trump sees tariffs as a tool to, among other things, revive a long-declining U.S. industrial base, a feat that economists argue would be difficult to achieve in the short-term because of structural issues, including labor shortages.

While orders for computers and electronic products rebounded 1.0% last month, bookings for communications equipment decreased 2.6%. Electrical equipment, appliances and components orders fell 0.2%. But orders for machinery increased 0.8% as did those for fabricated metal products.

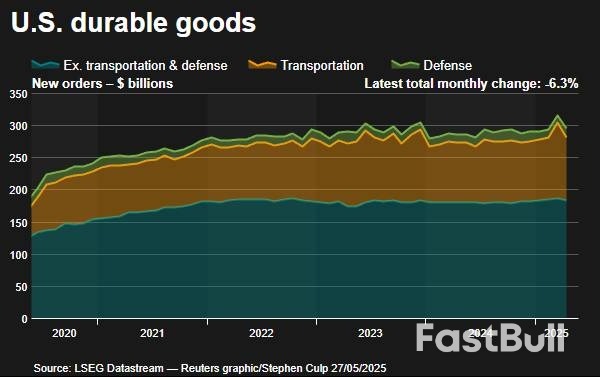

Orders for durable goods, items ranging from toasters to aircraft meant to last three years or more, dropped 6.3% last month after a slightly upwardly revised 7.6% rise in March.

Durable goods orders were previously reported to have jumped 7.5% in March. They were last month weighed down by a decline in orders for commercial aircraft as well as the fading boost from the tariff-related front-running.

Boeing (BA.N), opens new tab reported on its website that it had received only eight aircraft orders in April, down from 192 in March. Orders for motor vehicles and parts decreased 2.9%.

Overall transportation orders plummeted 17.1% after soaring 23.5% in March. The Atlanta Federal Reserve lowered its second-quarter GDP growth estimate to a 2.2% annualized rate on the data from a 2.4% pace earlier. The economy contracted at a 0.3% rate in the January-March quarter.

Some economists expect business spending on equipment to hold up if companies more or less maintain the first quarter's robust pace of front-running of imports.

"It is not until this import-driven boost fades later this year that we expect investment growth in that category to slow sharply," said Thomas Ryan, an economist at Capital Economics. "We expect business equipment investment to flatline in the second half of the year."

The tariff-driven economic uncertainty and higher mortgage rates are weighing on demand for homes, resulting in a rise in supply that is curbing house price growth. New housing inventory is at levels last seen in 2007, while the supply of previously owned homes is the highest in more than four years.

A third report from the Federal Housing Finance Agency showed house prices increased 3.7% in the 12 months through March after advancing 3.9% in February.

"Prospects for house prices do not look strong," said Carl Weinberg, chief economist at High Frequency Economics. "A new slowing trend is emerging as the economy slows and real incomes falter."

Wall Street stocks climbed on Tuesday after U.S. President Donald Trump stepped back from his threat to impose 50% tariffs on the European Union, easing trade tensions and boosting sentiment as markets reopened after the Memorial Day break.

On Sunday, Trump restored a July 9 tariff deadline to allow for talks between Washington and the 27-nation European bloc.

He had initially threatened EU tariffs on Friday, alongside announcements of higher levies on Apple'siPhones.

"The threat of 50% tariffs on the EU is likely a negotiation tactic to force dialogue on difficult issues such as non-tariff barriers," Glenmede analysts said in a note.

Asian and European markets were mixed after rising on Monday, although moves in U.S. assets were more pronounced as traders returned after the long weekend.

At 11:22 a.m. ET, the Dow Jones Industrial Averagerose 507.15 points, or 1.22%, to 42,111.45, the S&P 500gained 91.87 points, or 1.58%, to 5,894.63, and the Nasdaq Compositeadded 373.75 points, or 2.00%, to 19,110.68.

Most megacap and growth stocks jumped with Nvidia, up 2.9%, leading gains. The AI bellwether is slated to report quarterly earnings after markets close on Wednesday.

All 11 S&P sub-sectors moved higher, with consumer discretionaryand information technologybeing the biggest gainers.

Long-dated U.S. Treasury yields dipped, while those on the 30-year note (US30YT=RR) were set for their biggest one-day fall since mid-April, mimicking a steep price rally in longer-term Japanese debt.

In economic data, minutes from the U.S. Federal Reserve's last policy meeting are scheduled for release on Wednesday.

An index tracking consumer confidence rose to 98 in May, a Conference Board report showed. Economists polled by Reuters had expected the index to stand at 87.

A number of Fed officials are expected to speak through the week. Minneapolis Fed President Neel Kashkari on Tuesday called for holding interest rates steady until the impact of higher tariffs on inflation became clear.

Personal Consumption Expenditure data - the Fed's favored inflation indicator - for May as well as a second estimate of first-quarter GDP are also scheduled to be released later this week.

Wall Street witnessed sharp weekly losses on Friday as worries about mounting U.S. debt and Trump's latest trade policy shakeup sparked a broad selloff. His sweeping tax bill - which is expected to substantially expand federal debt - won a crucial House vote last Thursday.

Equities have witnessed immense volatility since the start of the year, with the S&P 500 falling almost 19% in April from its February record highs. However, the benchmark is now about 4% away from its highs as easing trade concerns and tame inflation data spurred a risk-on rally.

Temu-parent PDD Holdingsdropped 15.3% after reporting a 47% fall in first-quarter profit and missed quarterly revenue estimates.

Advancing issues outnumbered decliners by a 5.38-to-1 ratio on the NYSE and by a 2.95-to-1 ratio on the Nasdaq.

The S&P 500 posted 18 new 52-week highs and no new lows, while the Nasdaq Composite recorded 73 new highs and 41 new lows.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up