Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bankruptcies at First Brands and Tricolor highlight strain in low-income auto credit, with rising delinquencies and high costs, though broader U.S. credit markets stay stable.

Gold (XAUUSD) remains in focus after setting a fresh record high Tuesday, as the precious metal is on track for its seventh consecutive week of gains.

Recent buying in the commodity has been fueled by a softer U.S. dollar ahead of an expected interest rate cut by the Federal Reserve next month and mounting concerns over a possible government shutdown. A weaker dollar lifts demand for dollar-priced bullion from foreign buyers, while safe-haven demand has increased amid the risk of a shutdown starting Wednesday and unresolved geopolitical tensions in the Middle East and Europe.

The price of gold has soared 45% since the start of the year and 10% over the past month, far outpacing the gains of major stock indexes. Spot gold was up slightly at around $3,850 an ounce in recent trading.

Below, we analyze the technicals on gold’s weekly chart and identify key price levels to watch out for amid the precious metal’s bull run.

After breaking out from a four-month consolidation period in early September, the price of gold has continued to trend strongly higher in recent weeks.

While the relative strength index confirms the bullish momentum, the indicator also nears a stretched reading that has preceded several pauses in the precious mental’s uptrend over the past 18 months.

Let’s apply technical analysis to forecast where the commodity’s bullish price move may be headed next and also point out support levels worth watching during future pullbacks.

To forecast where gold’s uptrend may be headed in coming weeks bulls remain in control of the price action, investors can use bars pattern analysis, a technique that studies prior trends to project future directional movements.

When applying the analysis, we take the precious metal’s strong trending move from early January to late April and overlay it from the start of the current uptrend. This forecasts a target of around $4,365, implying about 13% upside from Tuesday’s trading levels.

We selected the earlier move because it started with eight consecutive green weekly bars, closely mimicking gold’s latest advance, which is on track to record its seventh consecutive higher weekly close.

The first support level to watch sits around $3,450. Retracements to this area would likely attract buying interest near the upper range of the recent four-month consolidation period.

Bulls’ failure to defend this key level could see the commodity’s price retreat to $3,120. This location on the chart may provide support near the May low, which currently sits just above the upward sloping 50-week moving average.

Finally, a more-significant decline opens the door for a retest of lower support around $2,790. Investors could look for longer-term buy-and-hold opportunities in this area near last year’s notable October peak.

A Doji candle is a technical analysis tool reflecting the uncertainties in the market. Although it provides strong signals, it should be used with other patterns or technical indicators. Why do traders look for Dojis when trading stocks, commodities, and currencies?

A Doji is a pattern that consists of a single candle. It looks very different from other candlesticks. Therefore, traders of any level of experience can determine it on a price chart. The Doji has a tiny body comprising equal or almost equal open and close prices and long shadows. What does a Doji candlestick mean? A short body informs traders about the indecision of buyers and sellers as none of them can drive the market. Long shadows reflect a market uncertainty. The longer the shadows, the more significant the market uncertainties.

How Can You Spot a Doji Candle?

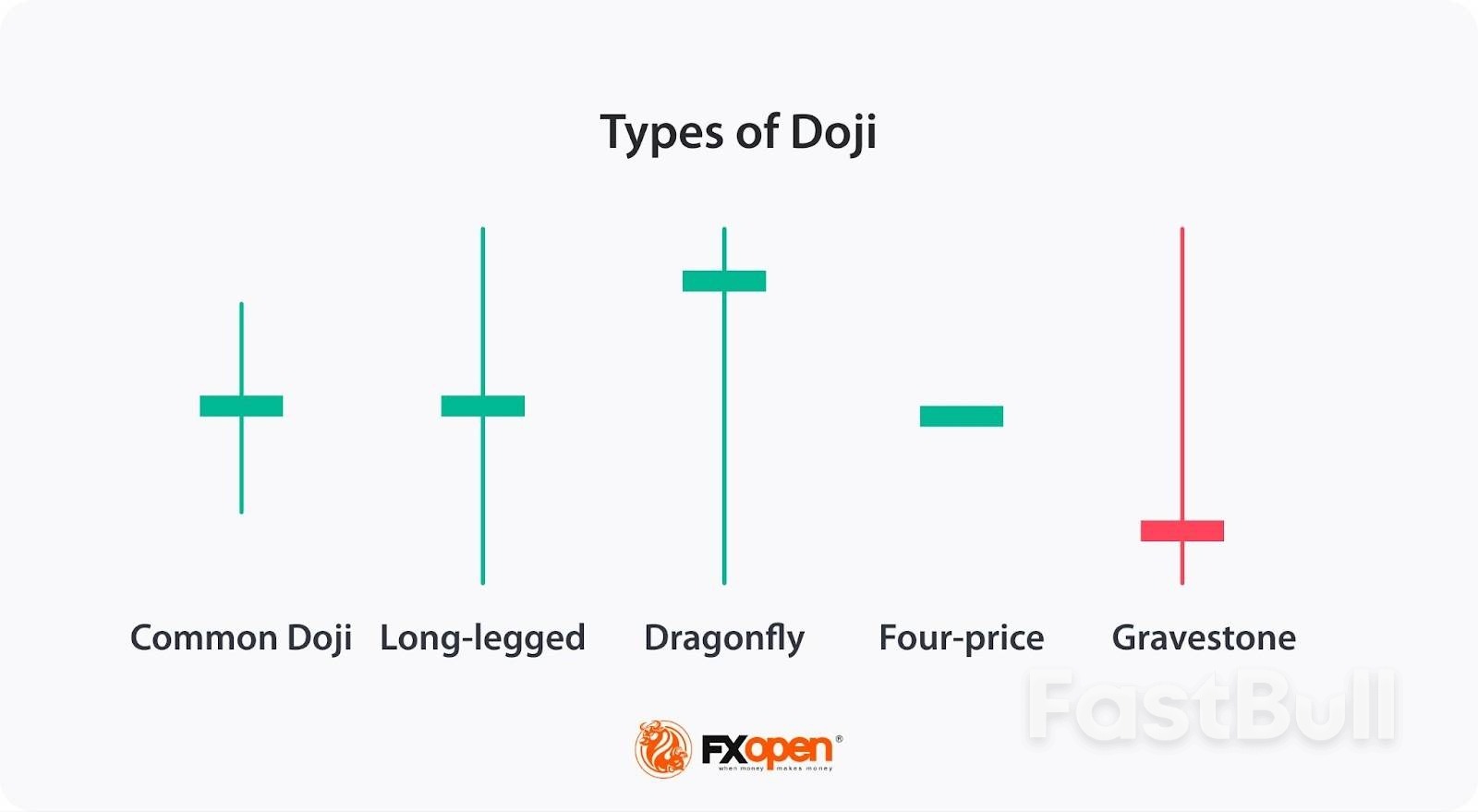

The most common types of Doji candles are standard, long-legged, Dragonfly, Gravestone, and four-price.

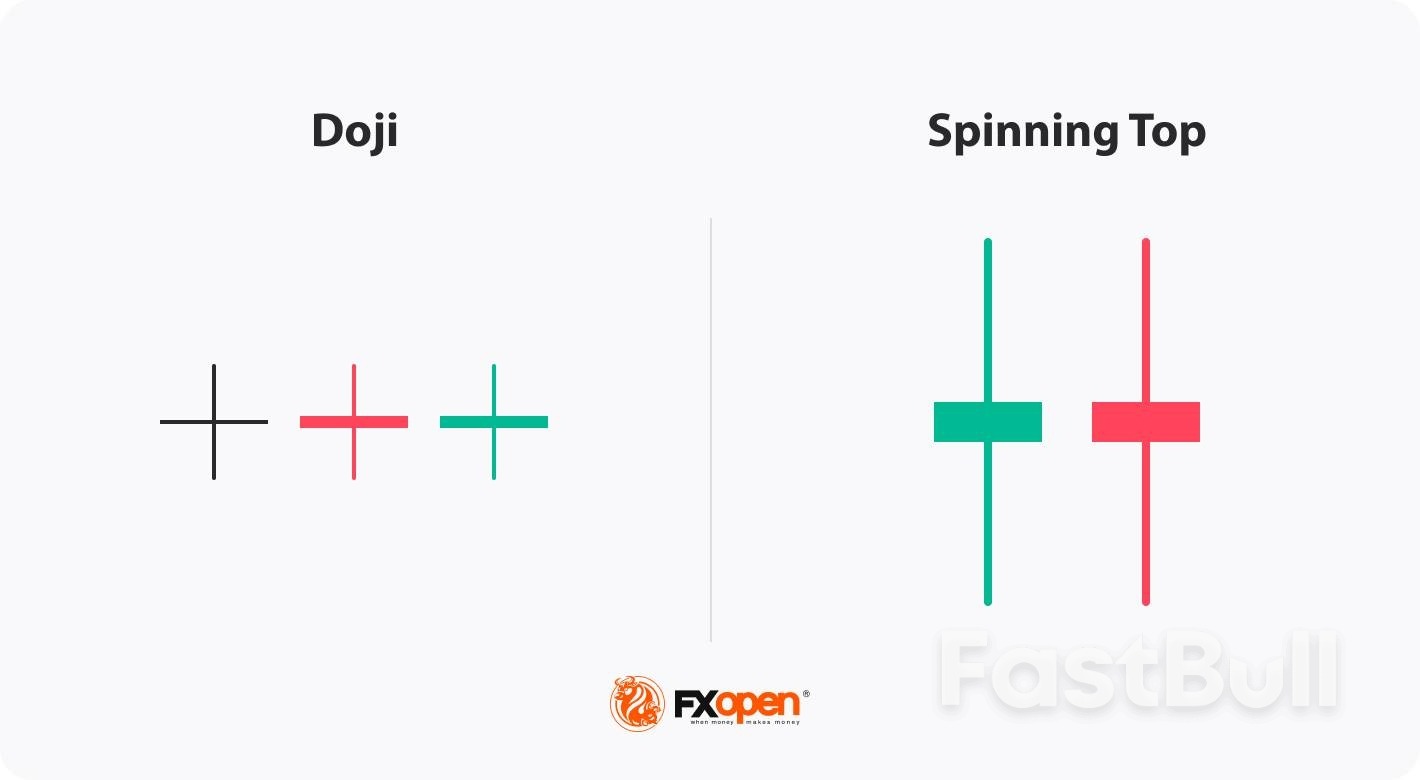

Traders may confuse Dojis with Spinning Tops as they look very similar. The theory suggests that Doji’s open and close prices are equal or nearly equal. Therefore, a Doji has a tiny body, so the difference between open and close rates is barely noticeable. A Spinning Top has a small body but the difference between the open and close rates is visible.

Traders may be caught in a trap if they rely solely on a Doji candle, meaning they need to combine Dojis with other technical tools to get reliable signals. These are some basic rules traders apply when reading a Doji candlestick pattern’s signals:

Trend strength. The first thing traders consider is the trend. Doji candles can appear before the continuation and reversal of a trend. If the market rises for an extended period, a newly formed Doji may be a sign of bull exhaustion. Conversely, appearing in a prolonged downtrend, it may signal an upcoming trend reversal. If the candle is visible in a newly formed trend, the trend will likely continue.

Additional indicators. If you find a Doji setup, it may be helpful to look for additional signals of other patterns or technical indicators. To confirm reversals, traders usually implement oscillators such as MACD, Stochastic, and RSI, which reflect overbought/oversold conditions, and indicators such as Average Directional Index that reflect the trend strength. Support and resistance levels can also be helpful when identifying trend reversals. The lack of a reversal confirmation may be a sign of a sideways movement or a trend continuation.

Doji candles can be observed across various timeframes, but their reliability increases in higher timeframes, such as the 4-hour, daily, or weekly charts. In these periods, Doji patterns hold more significance due to the larger sample of market data they encompass, reducing the noise found in shorter timeframes like the 1-minute or 5-minute charts.

Traders tend to use Dojis on these higher timeframes to capture key market reversals or trend continuations with more confidence. In contrast, Dojis on lower timeframes can be less dependable because they often form due to temporary price fluctuations and minor market indecision.

Understanding the broader market context is key when interpreting Doji candles. A Doji by itself provides limited insight, but when viewed within the larger market environment, its signals can become more meaningful.

The broader market sentiment can impact how Doji candles are interpreted. In a strong bull market, a bearish Doji candle may signal a temporary pause rather than a full reversal, especially if there is no significant change in overall sentiment. Similarly, in a bearish environment, a bullish Doji may suggest indecision but not necessarily a complete trend shift. Observing market news, events, or fundamental data can provide additional clues about the market’s direction.

Major economic reports, interest rate decisions, and geopolitical developments can influence the formation of Doji candles. For instance, during the release of critical economic data, Doji patterns may appear as traders hesitate to commit to a direction until the news is fully digested. Traders often avoid making decisions based on Dojis during such high-volatility periods, preferring to wait for the market to settle before drawing conclusions.

A Doji’s reliability also depends on the phase of the trend. In a well-established trend, Dojis can serve as a signal of market exhaustion, suggesting a possible reversal or slowdown. However, during periods of consolidation or ranging markets, Dojis might simply indicate ongoing indecision, reflecting sideways price action without any imminent breakout.

Dojis can be found in different market conditions and their signals will vary significantly.

A Doji can appear in up- and downtrends.

On the chart above, the EUR/USD pair formed a spinning top and two forex Doji candlesticks, a Gravestone and a Dragonfly at the end of a downtrend (1). At that time, the RSI indicator was in the oversold area, and the pair was near the lower band of the Bollinger Bands indicator. After, the market turned around.

However, if you have noticed, there was another Dragonfly Doji several candles ahead (2). Then, the RSI indicator was also in the oversold area, and the price was near the lower band of the Bollinger Bands indicator. You could wait for the RSI to leave the oversold zone to avoid a losing buy trade.

The previous example can be used to explain another standard theory that a more significant number of Dojis results in a more reliable signal. However, while the last example confirms the theory, another refutes it.

On the chart above, there are three Dojis — long-legged and two Gravestones (1), formed after a downtrend. However, their appearance didn’t lead to a trend reversal — it was a medium-term consolidation ending with a continuation of a downtrend. The consolidation was confirmed by the lack of signals from common trend reversal indicators — the MACD and the RSI.

While Doji candle patterns can be useful in trading, there are several common mistakes traders make when interpreting them. Here are some pitfalls to avoid:

A Doji isn't a common instrument to determine market direction. Still, it may be used as a barometer of the market sentiment that may lead to particular price movements. The theory suggests that traders do comprehensive analysis and combine Dojis with other technical tools before they enter or exit the market.

FAQ

What Does a Doji Candle Indicate?

A Doji candle signals market indecision, as the opening and closing prices are nearly identical. It often represents a balance between buyers and sellers, leading to a potential reversal or continuation depending on the broader market context and trend.

Is a Doji Candle Bullish or Bearish?

A Doji candle is neither inherently bullish nor bearish. Its interpretation depends on its position within a trend. In an uptrend, it may suggest a bearish reversal, while in a downtrend, it could signal a bullish reversal. In either scenario, it may also signal a period of market indecision.

What Does a Doji Mean in a Downtrend?

In a downtrend, a Doji often signals that the sellers are losing strength, hinting at a potential bullish reversal. However, confirmation through other technical indicators is often sought before acting on this signal.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up