Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

16th April 2025 – (Washington) The U.S. government has levied a 125% equivalent tariff on Chinese goods, further augmented by a previously imposed 20% tariff related to the fentanyl issue.

The USD remains underpressure against most major currencies although the fundamental backdropremains unclear. The most popular narrative is that everyone is selling USassets, and the greenback is losing its reserve status as a consequence of theaggressive trade war.

Such big claims aregenerally made at near term tops or bottoms, so it calls for caution. Anyway, that’s thetrend for now and we will need some catalyst to reverse it. Maybe positive newson trade negotiations front could see the market scale back the rate cutexpectations for the Fed and provide a relief rally for the greenback.

For now, we got just a couple of disappointing headlines with the US banning the sale of Nvidia chips to China and European officials suggesting that the tariffs could stay as negotiations stall. We will see how things will evolve in the next days and weeks.

On the JPY side, thecurrency has been driven mainly by global events rather than domesticfundamentals. It’s been supported more by the risk-off flows rather thaninterest rates expectations as the market doesn’t see the BoJ hiking ratesanymore this year. In fact, BoJGovernor Ueda today sounded like more tightening now is out of question andthe central bank might even resort to some easing in case things deterioratefurther.

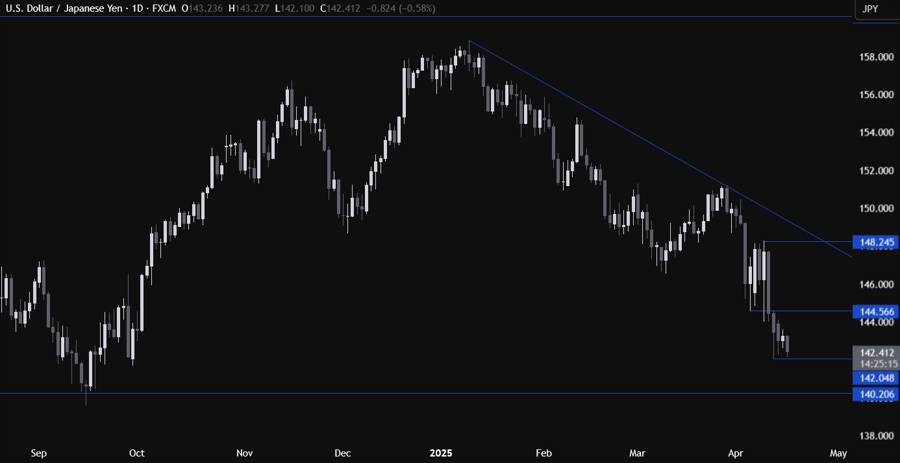

On the daily chart, we cansee that USDJPY continues its downward trajectory towards the 140.00 handle. Ifthe price gets there, we can expect the buyers to step in with a defined riskbelow the level to position for a rally back into the major trendline. The sellers, on the other hand,will want to see the price breaking lower to increase the bearish bets into newlows.

On the 4 hour chart, we cansee that the price rolled back to the 142.05 low as the selling pressure returned.From a risk management perspective, the sellers will have a better risk toreward setup around the 144.56 level to position for further downside. Thebuyers, on the other hand, will want to see the price breaking above the 144.56level to start targeting a bigger pullback into the 148.25 level next.

On the 1 hour chart, we cansee that the recent low around the 142.00 handle has been holding up prettywell. This is where we can expect the buyers to step in with a defined riskbelow the level to position for a pullback into the 144.56 level. The sellers,on the other hand, will look for a break lower to increase the bearish betsinto the 140.00 handle next. The red lines define the average daily range for today.

Headline prices rose 2.6% YoY last month, cooler than both market expectations, and the BoE's forecasts. Meanwhile, excluding food and energy, core CPI rose by 3.4% YoY over the same period, while the closely watched services CPI metric rose 4.7% YoY, also cooler than the Bank's expectations, and the lowest level so far this year.

This latter print is of particular importance, given the Bank of England's well-telegraphed focus on the risks of inflation persistence, and ongoing concern, particularly among the MPC's hawks, over the potential of stubborn price pressures becoming embedded within the UK economy. Concerns which may now begin to subside, though the trend in data is of course more important than just a single print.

On the whole, though, today's figures do little to materially shift the policy outlook for the 'Old Lady'. A 25bp cut at the next meeting, on 8th May, remains pretty much a certainty, though the pace of easing beyond then is likely to remain relatively gradual, with further cuts likely to be delivered on a quarterly basis, particularly with headline inflation still on a trajectory towards the 4% mark during the summer.

Nevertheless, risks to this outlook tilt firmly in a more dovish direction, amid mounting downside growth risks, stemming primarily from the tariffs imposed by President Trump. Were policymakers to become increasingly confident that those risks of inflation persistence had abated to a sufficient degree, a more rapid pace of policy normalisation could be on the table, though the bar for the Bank to deliver cuts at consecutive meetings still seems to be a relatively high one for the time being.

Bessant reiterated his respect for the Fed's independence in determining monetary policy, calling it a "treasure chest that must be guarded," but he also noted that in the area of regulatory policy, "more discussion can be had" given that the Fed is one of several bank regulators.

It is worth mentioning that Bessant was previously a supporter of calling on Trump to exert more influence on the Federal Reserve. In an interview with the media in October last year, he also suggested that "(US President Trump) could set up a 'shadow' chairman by nominating the next Federal Reserve chairman in advance. Once there is a 'shadow' Federal Reserve chairman and forward guidance, no one will really care about Powell's remarks anymore."

When Bessant was nominated for Treasury Secretary last year, some market rumors also believed that Bessant might take the helm of the Federal Reserve in the future.

Wall Street analysts believe that in the last year of his term, Powell is facing the most difficult policy decision of his career. The "tariff storm" launched by the Trump administration has simultaneously triggered dangerous expectations of soaring inflation and economic recession. This storm caused by trade policy has pushed the Federal Reserve into the most severe policy dilemma in 40 years - it must deal with a possible economic recession while curbing inflation expectations.

Former Federal Reserve economist Trezzi warned that "the current situation is more serious than expected. The Trump administration has brought the worst shock to the Federal Reserve, and they are now powerless to do anything."

Nick Timiraos, a reporter for the Wall Street Journal and known as the "Federal Reserve's mouthpiece," pointed out that Powell is facing an increasingly difficult task.

Fed officials are paying particular attention to consumers, investors and businesses' expectations of inflation in the coming years because they believe these expectations may have self-fulfilling properties. Timiraos likened the Fed's problem to a choice a goalkeeper makes when facing a penalty kick: do you dive to the left and focus on inflation, or dive to the right to address weak growth?

According to the schedule, Federal Reserve Chairman Powell will deliver a speech at the Chicago Economic Club on Thursday. The market expects that he may express his latest views on topics such as the path of monetary policy, the impact of tariff policy, and the recent turmoil in the U.S. bond market, which will provide investors with the latest reference for monetary policy.

It is worth noting that on April 4, Eastern Time, before Powell's public speech, US President Trump posted on social media that now is a great time for Federal Reserve Chairman Powell to cut interest rates. He urged Powell to "stop playing politics" and immediately lower the benchmark interest rate because the US inflation rate has fallen.

"Energy prices are down, inflation is down, even egg prices are down 69%, jobs are up, all in 2 months - a huge win for America. Powell, cut rates, and stop playing politics!"

Earlier, Trump also retweeted a video that suggested the president was intent on suppressing financial markets as part of a strategy to force Powell to lower interest rates.

It is also worth mentioning that on the 14th, Eastern Time, Federal Reserve Board Governor Waller said at an event that if Trump’s tariff policy leads to economic challenges, it will be necessary to consider lowering interest rates.

According to Yicai Global, Waller, who is expected to take over as Fed chairman after Powell's term ends in 2026, proposed two potential tariff scenarios. The "high tariff" scenario would be an effective average tariff of 25% on all U.S. imports. In this high tariff scenario, core personal consumption expenditure inflation (PCE), the inflation measure that the Fed pays the most attention to, could surge to 5%, but this would be "temporary" and the Fed could "review" it without raising interest rates. In the second scenario, the average tariff rate eventually drops to 10%. He said that in this "small tariff" scenario, the Fed may be more patient with policy and cut interest rates in the second half of this year.

Waller said the economy could slow if Trump's high tariffs persist for a while, so a rate cut would be necessary even if the import taxes caused inflation to surge. "If the slowdown were severe and threatened a recession, then I would expect support for faster and larger cuts in the (Federal Open Market Committee) policy rate," Waller said in a speech at an event in St. Louis.

Recently, Ki Young Ju, the CEO of CryptoQuant, indicated that bear markets may have begun, allowing short sellers, especially in altcoins, to capitalize on his insights. Nevertheless, this view is not universally accepted. Historically, significant recoveries often occur after steep downturns, reminiscent of the market behavior noted in mid-2021.

As Mister Crypto analyzed the current situation, he identified unrealized losses in Bitcoin’s circulating supply, cautioning those who predict a continued downturn. Interestingly, only 24% of the circulating Bitcoin is in unrealized loss, a figure suggesting that the market might merely be experiencing a routine dip within a broader bull market cycle.

Despite the prevailing fears linked to tariffs and other adverse news, many expect a rise in cryptocurrency prices. Historical trends indicate that that such recoveries are typical; as markets improve, past suffering often fades from memory. Moustache emphasized this with visual data, predicting an upward trajectory.

Monitoring indicators closely, Jelle noted that Bitcoin has recently surged above a critical moving average for the third time, suggesting a possible end to the downtrend. The significant observation is that this key average is no longer declining.

With Bitcoin holding steady around $85,000, the interest in altcoins remains subdued, but many market watchers are cautiously optimistic about the potential for a rally in the near term.

The project, reportedly led by Bill Zanker—a longtime associate who has previously worked with Donald Trump on NFT collections and the Trump memecoin—is expected to debut by the end of April 2025.

Insiders describe the game as a digital real estate experience where players earn virtual currency by moving pieces around a digital board and building properties in a virtual city, evoking similarities to Monopoly Go!. However, Zanker’s spokesperson has denied that the game is directly modeled on Monopoly Go!, calling such claims “hearsay” while confirming the game is in development.

This new game is part of a broader expansion of Trump-branded crypto ventures, which include NFT collections, a memecoin, a decentralized finance platform called World Liberty Financial, a stablecoin, and a Bitcoin mining company involving Trump’s sons Eric and Donald Jr. The Trump family’s growing involvement in crypto coincides with President Trump’s administration advocating for deregulation and strategic initiatives to strengthen the U.S. position in digital finance, including plans for a national crypto reserve.

Despite the buzz, some in the crypto community remain cautious, raising questions about the game’s economic model and potential intellectual property issues. Hasbro, the owner of Monopoly, has not licensed its intellectual property to any Trump-affiliated group for this crypto project. Attempts to reacquire rights to the 1989 Trump-branded Monopoly game were reportedly unsuccessful.

Bill Zanker, known for his entrepreneurial ventures since the 1980s, reconnected with Trump in recent years to launch various crypto products, including NFTs and the Trump memecoin, which attracted significant attention but also controversy.

This upcoming crypto game marks the latest move by the Trump family into blockchain and digital assets, combining traditional real estate-themed gameplay with emerging crypto technology. More details are expected to be revealed upon the game’s official launch later this month.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up