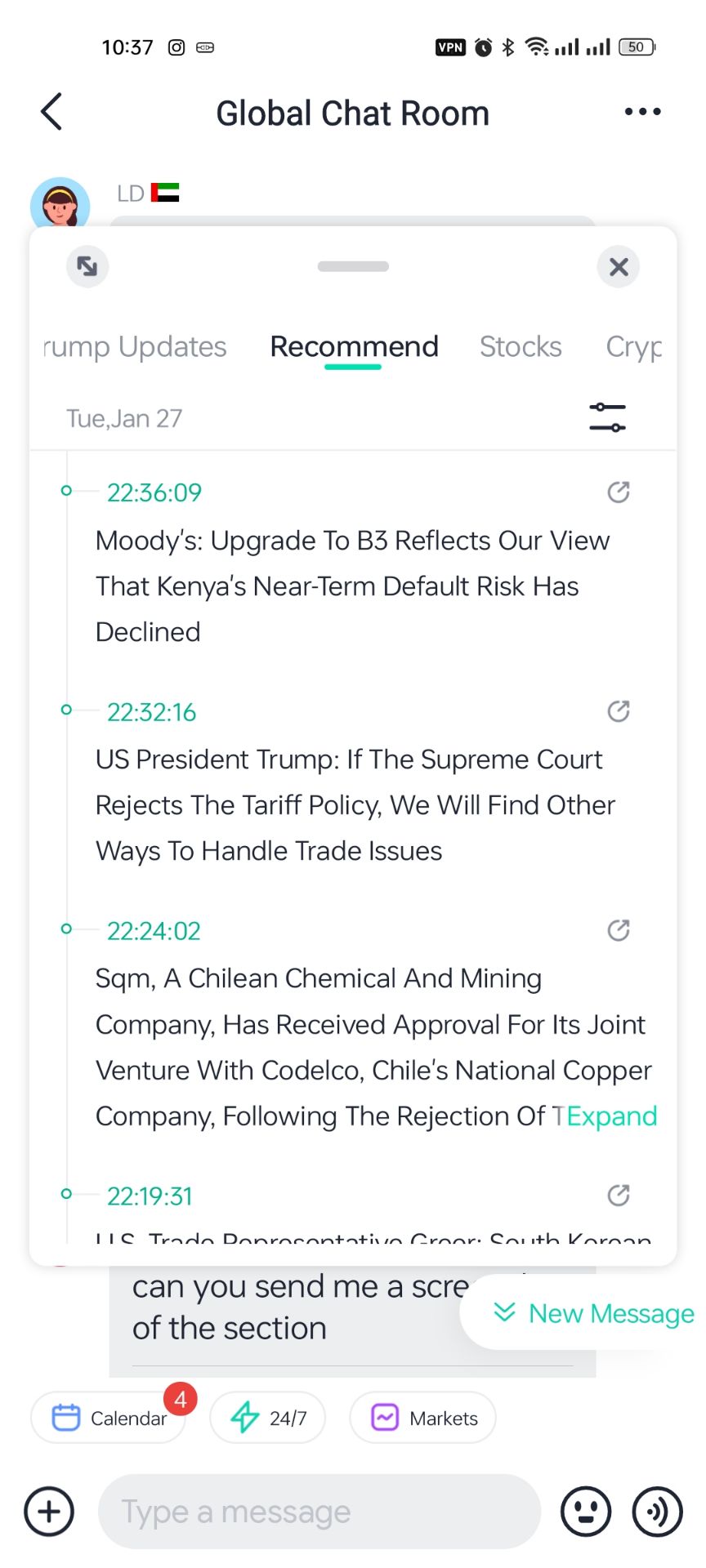

Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

UK Chancellor of the Exchequer Rachel Reeves will meet CEOs from top insurers in Downing Street on Wednesday, as she seeks to encourage more investment in the City ahead of a tricky budget later this month.

UK Chancellor of the Exchequer Rachel Reeves will meet CEOs from top insurers in Downing Street on Wednesday, as she seeks to encourage more investment in the City ahead of a tricky budget later this month.

The meeting, whose attendees will include Lloyds of London Chair Charles Roxburgh, Swiss Re AG CEO Andreas Berger and Hiscox Ltd CEO Aki Hussain, will focus on "opportunities for more investment in the London market" and Reeves will highlight recent "cuts to financial red tape," according to a statement from the Treasury.

Reeves' engagement with insurers comes just weeks before a crunch budget on Nov. 26, where she's expected to deliver a package of tax hikes and spending cuts to stabilize Britain's public finances. Reeves, who has faced criticism over the impact of tax rises at her last budget on UK business, is keen to stress her ongoing efforts to spur the British economy ahead of the budget, and her talks with insurers signal growth is her "top priority," the Treasury said.

Other attendees at Wednesday's meeting in 11 Downing Street will include Allianz UK CEO Colm Homes, Beazley Plc CEO Adrian Cox, and Jason Storah, Aviva's CEO of UK & Ireland General Insurance.

Employers have been told in a landmark government review that fixing Britain's health-related worklessness crisis will require them to spend £6bn a year on support for their staff.

In a major report before this month's budget, Charlie Mayfield warned that businesses needed to play a more central role in tackling a rising tide of ill-health that is pushing millions of people out of work.

The former chair of John Lewis, who was appointed by ministers to lead the government's Keep Britain Working review last year, said that a drastic expansion in occupational health was needed to help prevent hundreds of thousands of people from falling out of the workforce each year.

"We need to fix this," Mayfield told the Guardian. "What we are proposing is a fundamental reset in terms of how health is handled in the workplace. We're saying we have to move from [a] situation where, for most people, health is for the individual and NHS – we have to move from that position to one where health becomes a true partnership between employers, employees and the health services generally.

"That is not a small move, but a big move, and a fundamental shift."

Ministers have grown increasingly alarmed over a dramatic rise in the number of working-age adults falling out of the workforce due to health conditions over recent years, with young adults fuelling much of the increase.

As many as one in five working-age adults – more than 9 million in total – are now in a position termed by statisticians as "economically inactive", where they are neither in a job nor looking for one. For almost 3 million, the main reason is long-term sickness – the highest level on record.

In his highly anticipated report, Mayfield said the overall cost to the UK economy from this "quiet but urgent crisis" was as much as £85bn a year, in a financial blow for the exchequer, businesses and individuals.

Ministers have been focused on cutting a sharp increase in the cost of providing health-related welfare support. The report said the cost from economic inactivity due to ill-health was "unsustainable" for the state, through lost output, increased spending on welfare, and additional burdens on the NHS.

However, the focus of Mayfield's report is to tackle the rise in costs by helping individuals to stay in a job with help from a drastically improved system of workplace support.

He said a new approach to health at work was required whereby the responsibility was shared between employers, employees and the government to help slash rates of sickness absence, improve return-to-work rates, and drive up the disability employment rate.

The report found a potential benefit of up to £18bn a year for the economy and exchequer if the recommendations were applied across the workforce.

The government said more than 60 employers – including household names like British Airways, Nando's and Tesco – would take on Mayfield's recommendations in a vanguard programme over the next three years.

It said the scheme, which also involves regional mayors and dozens of small businesses from across the country, would act as early adopters to develop stronger approaches to workplace health.

Asking businesses to take on a more proactive approach could however prove contentious at a time when business groups have sounded the alarm that Labour's tax changes and employment policies have made it tougher to hire staff.

Bosses have warned the chancellor, Rachel Reeves, against hitting firms with tax increases in her 26 November budget after her £25bn increase in employer national insurance contributions (NICs) last year.

Mayfield acknowledged businesses were facing a tough environment, but said companies could see the benefits from investing in employee health and that growing provisions further was a "win-win" for firms and the economy at large.

"Employers must be in the lead. Some may resist that message amid tight margins and slow growth. But many already recognise they are carrying the cost of ill-health every day," he said.

His report recommended firms were likely to face a cost of £5-15 per employee per month to provide improved levels of occupational health – at an annual cost of about £6bn when spread across the economy at large.

For some firms, this would mark a sharp rise in spending. However, others, particularly larger employers, already spend significant sums on workplace health.

Over time, Mayfield said he envisaged the workplace health schemes provided by employers becoming certified by the government, being integrated with the NHS app and reducing – or even replacing – the need for fit notes issued by healthcare professionals.

Among other recommendations, Mayfield's review also called on ministers to consider incentivising businesses to invest in workplace health through tax cuts and rebates for paying sick pay to employees.

A lawmaker defected from Canada's opposition Conservative Party to the governing Liberals, a move that helps Prime Minister Mark Carney's minority government pass its first federal budget in an upcoming vote.

Chris d'Entremont, who represents the riding of Acadie-Annapolis in the eastern province of Nova Scotia, joined the Liberals after reviewing the federal budget they presented Tuesday. As a Conservative, he won his seat in April's closely fought federal election with just 1.1% more of the vote than the Liberal candidate.

"After five years of serving in opposition, the people of Acadie-Annapolis and all Canadians know that the moment we face today needs all of us to lead — not with complaint, but with confidence in a strong future," d'Entremont was quoted as saying in a Liberal Party statement.

A representative for the Conservative Party confirmed that d'Entremont had resigned from the party. D'Entremont himself did not respond to requests for comment.

Carney is now two seats short of a majority in Parliament, leaving him needing support from fewer lawmakers in other parties to vote for his legislation or abstain — or, as in this case, to bring them into his party.

Failure to pass major legislation such as the budget is considered a crisis of confidence and can trigger a new election.

Mori Trust Co. is looking for overseas partners to launch condominiums in Japan that can be rented out like hotel rooms, its chief executive officer said, as the company seeks to profit from the nation's tourism boom.

The developer, one of the two companies descended from the Mori real estate empire, has said it will invest ¥1.2 trillion ($7.8 billion) in projects through the fiscal year starting April 2030. A move into condo hotels is part of that spending plan. Those are condominiums typically with luxury hotel-like facilities — such as concierge desks and room service — that owners can rent out when they are away.

"We'll be working with foreign hotel operators, and we're thinking not only about urban areas but also regional properties" including resorts, said Miwako Date, the closely held Tokyo-based company's president and CEO. She declined to comment further on potential partners.

Mori Trust is trying to reap more profits by getting deeper into businesses that benefit from a jump in tourists traveling to Japan. The nation has already seen more than 30 million visitors in the year through September, the most ever for the period, according to Japan National Tourism Organization data. The government's goal is to attract 60 million visitors annually by 2030.

The developer has collaborated with Hilton Worldwide Holdings Inc., opening a condo hotel in the southern island prefecture of Okinawa in 2021 with the US hotel operator.

Condo hotels, one of Mori Trust's target investments, have been around for several decades in the US. They gained popularity in the early 2000's, but demand weakened around 2008 as the global financial crisis raged, according to real estate advisory firm Luxury Hospitality Advisors. Real estate firms selling the properties have generally targeted wealthy investors, pitching units as second homes on which buyers can earn extra rental income.

Date is the granddaughter of company founder Taikichiro Mori, an economics professor who made a successful career change to real estate development that at one point made him the world's richest person in the early-1990's according to Forbes magazine. Miwako Date took over as CEO from her father, Akira Mori, in 2016, according to the company's website.

One of the major challenges facing Japan's real estate industry is the rising cost of construction, as inflation nears decades-high levels reached earlier this year. The average price of building materials jumped by 37% as of August compared with January 2021, while total construction costs including labor expenses rose by 25-29% during the period, according to Japan Federation of Construction Contractors data.

Mori Trust has been trying to respond to rising costs by looking for ways to reduce expenditures and improve product quality, the CEO said.

"We've been doing checks like that over and over, but even as we do that, costs keep on going up," Date said. "It's like a cat-and-mouse game."

The developer is aiming for operating profit of ¥70 billion on sales of ¥330 billion by fiscal 2030, from ¥30.3 billion in profit and ¥140.2 billion in revenue in fiscal 2016 when it released its mid- to long-term business plan. That compares with operating income of ¥372.7 billion in the fiscal year ended March at Mitsui Fudosan Co., a top listed Japanese real estate firm.

Mori Trust has developed 35 hotels in Japan including Conrad Tokyo and the Tokyo Edition, Ginza, and office buildings such as Marunouchi Trust Tower Main and North in the Japanese capital's banking district.

Date said that while the office real estate market is doing well, sharp increases in rents aren't really possible. It's easier to pass on higher building costs to hotel customers, "so what we're looking at is how much new hotel development should occupy our portfolio," she said.

US President Donald Trump formally cut a fentanyl-related tariff on imports from China to 10%, delivering on a key element of the sweeping trade deal struck with Chinese leader Xi Jinping.

The move, which lowers the levy from the current 20% rate, will be effective on Nov. 10, according to an executive order issued Tuesday.

"The PRC has committed to take significant measures to end the flow of fentanyl to the United States, including stopping the shipment of certain designated chemicals to North America and strictly controlling exports of certain other chemicals to all destinations in the world," Trump said in the order.

Trump imposed the fentanyl tariff to pressure Beijing to do more to crack down on trafficking of the deadly drug and the precursor chemicals used to make it, but agreed to lower the rate following an October summit with Xi in South Korea, citing progress with China's efforts.

Trump said the State Department and Department of Homeland Security would continue to monitor China's implementation of the agreement.

"Should the PRC fail to implement its commitments as described in section 1 of this order, I may modify this order as necessary," Trump said.

The reduced rate marks a significant concession to China and is part of a broader pact between Trump and Xi that will ease trade restrictions following months of spiraling tariff announcements and export curbs between the world's two largest economies.

That agreement — intended to last for one year — stabilized what was a turbulent relationship between Washington and Beijing that had them escalating threats in a bid for leverage ahead of the summit. The Trump-Xi deal, however, falls short of any enduring pact, setting the stage for further turbulence ahead of renegotiations in a year and potential disagreements over enforcement sooner.

In addition to reducing the fentanyl rate to 10%, the truce is also expected to extend the suspension, for one year, of a separate 24% levy. But the full tariff picture remains murky; several goods are excluded from the baseline levy and other products face preexisting tariffs.

The deal eases what had been a comparative disadvantage for China over some peers. Trump's tariff rate on China — long considered America's biggest trading foe and a major geopolitical rival — is now nearly the same as the levies applied on several Southeast Asian countries.

Trump, speaking to reporters shortly after the Xi meeting, said the Chinese leader pledged that "he was going to work very hard to stop the flow" of fentanyl. Trump has said he would cut all fentanyl-related tariffs if Beijing cracks down, signaling a possible concession in future talks.

Still, Treasury Secretary Scott Bessent has warned that the fentanyl-related tariff reduction may be reviewed sooner than the one-year timeframe of the overall deal.

"We're going to set up a very strict quantitative criteria and we'll revisit it in six or 12 months to see whether they've accomplished it. And my sense is the tariffs could go up or down," Bessent told Fox News Sunday on Nov. 2.

Trump said he expects to visit China in the first half of next year, and to host Xi in the US after that trip. Those meetings will serve as crucial markers for the status of the truce. The deal also rests under a cloud of legal uncertainty with the US Supreme Court weighing the constitutionality of Trump's use of emergency powers to enact country-by-country levies.

U.S. stock futures inched lower on Tuesday evening after Wall Street suffered broad losses, as top bank executives warned of a looming market correction and investors grappled with deepening uncertainty around Federal Reserve policy.

S&P 500 Futures inched 0.2% lower to 6,789.0 points, while Nasdaq 100 Futures fell 0.4% to 25,487.0 points by 19:28 ET (00:28 GMT). Dow Jones Futures edged up 0.1% to 47,252.0 points.

In Tuesday's regular session, the S&P 500 slipped 1.2%, and the NASDAQ Composite dropped over 2%, while the Dow Jones Industrial Average fell 0.5%.

The slide came after Morgan Stanley (NYSE:MS) and Goldman Sachs (NYSE:GS) chiefs sounded alarm bells over overheated valuations and speculative trading in technology shares.

Morgan Stanley CEO Ted Pick said markets could face a drawdown of 10 %–15 %, adding that such a pullback would be a healthy normalization after months of exuberance driven by artificial-intelligence optimism.

Goldman Sachs CEO David Solomon echoed those concerns, warning that the surge in mega-cap tech stocks had created "bubble-like dynamics" that were unsustainable without stronger earnings support.

Their remarks stoked investor anxiety that Wall Street's rally, powered by the "Magnificent Seven" tech giants, may be approaching a breaking point. Several of those companies have seen market capitalizations soar to record highs this year, fueling fears of excessive concentration risk.

The warnings came as investors also faced growing uncertainty about the Fed's next policy steps. A prolonged government shutdown has left key economic data releases unavailable, depriving policymakers and traders of crucial signals about the state of the economy.

Fed officials on Monday added to the confusion. Some policymakers suggested that the central bank could consider another cut in December if inflation continues to cool, while others argued that strong job growth and resilient demand meant policy should stay restrictive for longer.

In extended trading, several tech names slumped following quarterly results. Advanced Micro Devices (AMD) (NASDAQ:AMD) dropped over 3% despite topping profit estimates, as Amazon said that it dissolved its stake in the chipmaker.

Pinterest (NYSE:PINS) tumbled roughly 20% after its quarterly revenue guidance fell short of expectations, stoking worries about a slowdown in digital advertising.

Super Micro Computer (NASDAQ:SMCI) slid 9% after issuing bleak guidance, with analysts flagging near-term delivery delays in its AI server business.

Oil fell for a second day after an industry report indicated the biggest increase in US inventories in more than three months.

West Texas Intermediate held above $60, while Brent settled at more than $64 on Tuesday. US crude inventories rose 6.5 million barrels last week, according to a document from the American Petroleum Institute seen by Bloomberg. That would be the biggest jump since July 25 if confirmed by official data later Wednesday.

Oil declined Tuesday after a global equities rally hit a speed bump and the greenback climbed to the highest in more than five months, weighing on crude and other dollar-denominated commodities. WTI has fallen 16% this year as increased production from OPEC+ and non-member nations amplified concerns over a forming glut, although prices have rebounded somewhat after the US last month announced sanctions on Rosneft PJSC and Lukoil PJSC, Russia's two biggest producers.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up