Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The FTSE 100 was flat as consumer and healthcare gains offset declines in energy, mining, and defense. Hot UK inflation fueled concerns over BoE policy, lifting sterling but pressuring homebuilders on mortgage fears.

President Donald Trump will tap his top economic advisor Kevin Hassett to be the next Fed chair, according to respondents to a special Jackson Hole Edition of the CNBC Fed Survey. But when asked who the president should pick, Hassett ranked a more distant fourth.

Hassett, the director of the National Economic Council, firmly led the pack when asked who the president will choose from among 11 names currently being considered. He was followed by Fed Governor Christopher Waller and former Fed Governor Kevin Warsh.

But when asked who the president "should" pick, Warsh took the No. 1 spot, closely followed by Waller and former St. Louis Fed President James Bullard. Fed Vice Chair for Supervision Michelle Bowman was in fifth after Hassett.

"I think that Trump's familiarity with (Hassett) in the job that he did during the pandemic makes him a high candidate for Trump, who appreciates and awards loyalty," said Richard Steinberg, senior global market strategist with Focus Partners Wealth.

While maintaining that Hassett is qualified, Allen Sinai of Decision Economics said he's concerned about Fed independence if he gets the job.

"The politics of low interest rates for political reasons — a very strong view and push by the Trump administration — is a macro risk if it is seen in markets as a takeover by the administration," Sinai said.

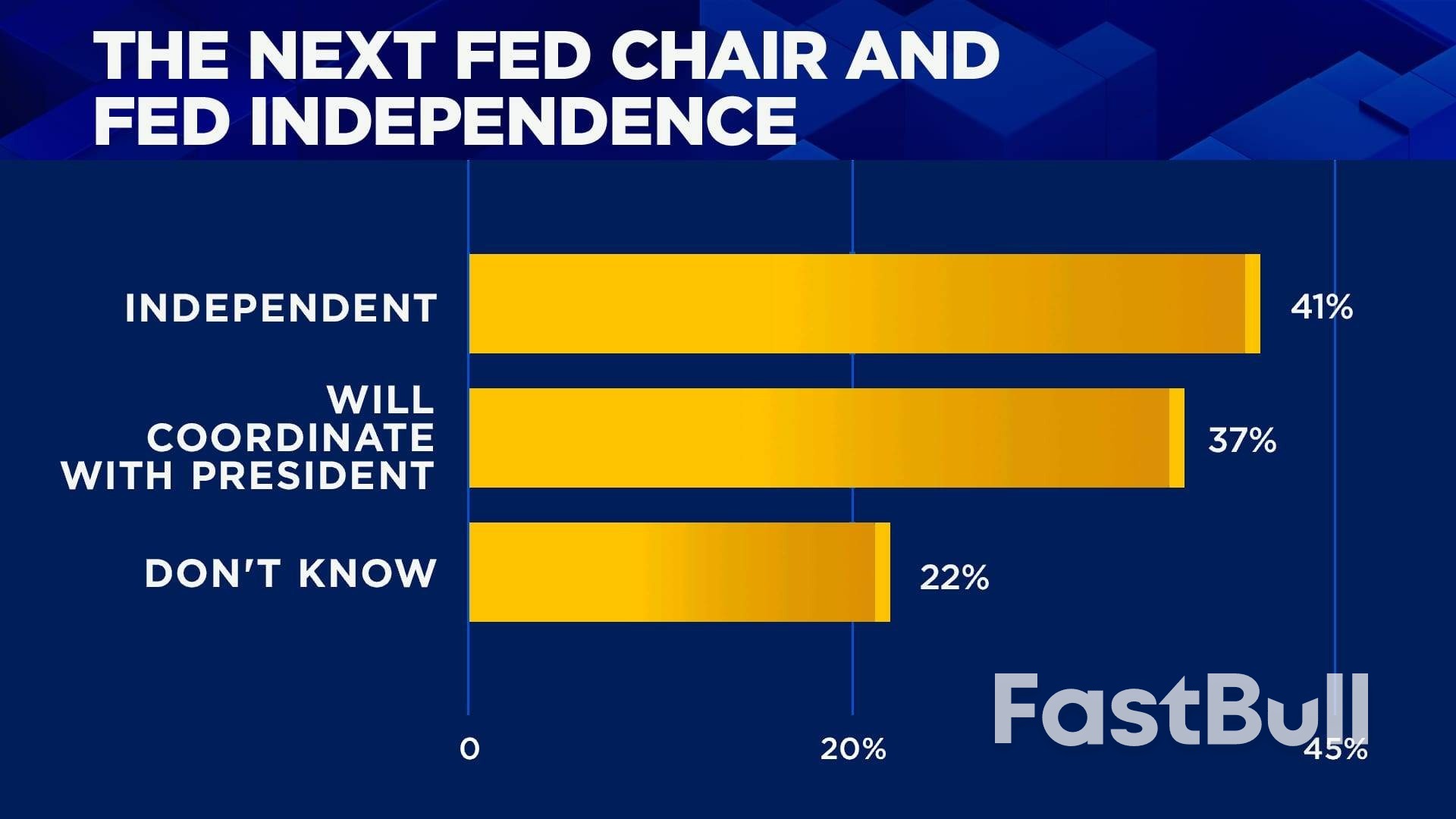

In the survey, 41% of respondents think the next Fed chair will conduct monetary policy independently of the president and 37% said it would be in coordination; 22% were unsure.

Trump has campaigned hard for the Fed to cut rates, repeatedly insulting Powell, but Powell and the Federal Open Market Committee have so far resisted because of concern over potential inflation from tariffs.

Bowman and Waller both dissented in July in favor of a rate cut.

Survey respondents see two rate cuts this year from the Fed --- in September and December --- but also high inflation.

The forecast for the consumer price index 12-month inflation rate remains at around 3% this year and 2.9% in 2026, suggesting the Fed will have to deal with above-target inflation for a while. Nearly two-thirds of respondents believe "substantial" impacts from tariffs on inflation are yet to come.

"The Fed is caught between a rock and two hard places," said Richard Bernstein, CEO of Richard Bernstein Advisors. "Political pressure to cut rates and fiscal stimulus coming vs. the ongoing strength in the leading indicators of employment and inflation."

As a result, Powell may not be as dovish about rate cuts as markets hope in his Jackson Hole, Wyo. speech. The Fed gathers each August for a symposium at which there are no votes but the chair traditionally delivers a keynote speech that often has indicated what's ahead.

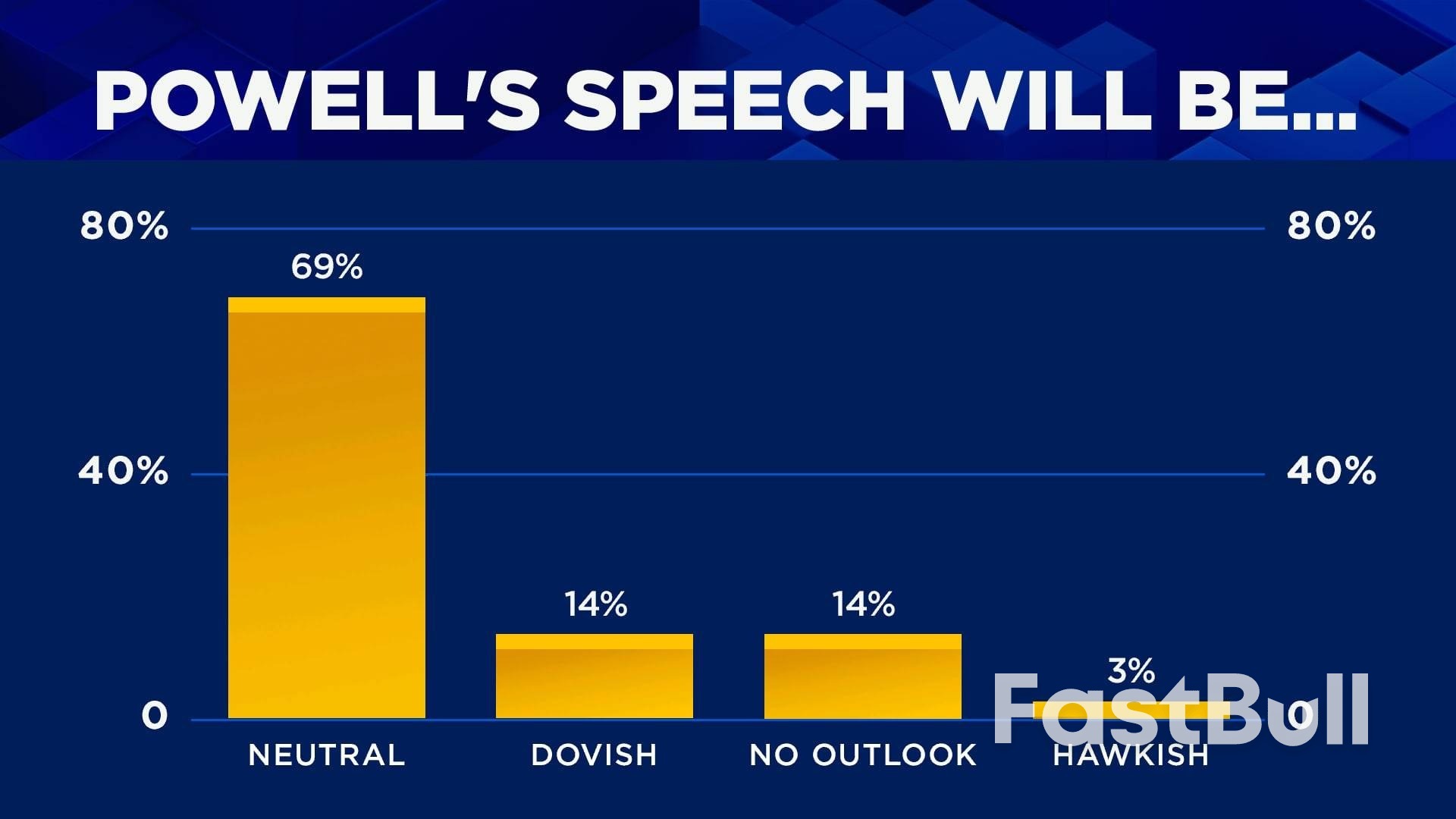

Almost 70% of respondents think the Fed chair will be neutral in his comments with 14% believing he will be dovish. Another 14% think he won't even discuss monetary policy or the economic outlook.

"Powell's comments at Jackson Hole may be more balanced than the market is currently anticipating as he needs to weigh both downside risks to employment and upside risks to inflation," said Douglas Gordon, managing director at Russell Investments.

Powell could discuss the Fed's effort to revisit its long-term strategy, with some expectation he addresses the Fed's controversial average inflation targeting.

Respondents are divided over how to fix the central bank or whether it needs fixing at all. Just 11% say the Fed process of making monetary policy needs major reforms with 85% saying it needs either modest or little to no reform.

On specific issues, a 41% plurality say the Fed should get rid of the dot plot where Fed officials anonymously indicate individual forecasts for the funds rate. But 37% say keep it as is, with another 19% saying it should be kept with individual forecasts linked to the rate outlook.

When it comes to the 2% inflation target, 52% want to retain it but 44% want the Fed to adopt a range from about 1.4% to 2.7%.

A 44% plurality want to eliminate the Fed's average inflation targeting, while 37% want to keep it.

In average inflation targeting, the Fed takes account for prior misses in hitting its target, and could tolerate higher inflation for a while to account for inflation having run below target in previous years. Some have said this led the Fed to be more tolerant of inflation during the pandemic and slowed its decision to tighten policy.

US President Donald Trump said on Tuesday that US Federal Reserve chair Jerome Powell is "hurting" the housing industry "very badly", and repeated his call for a big cut to US interest rates."Could somebody please inform Jerome "Too Late" Powell that he is hurting the Housing Industry, very badly? People can't get a Mortgage because of him. There is no Inflation, and every sign is pointing to a major Rate Cut," Trump wrote on Truth Social.

Inflation is well off the highs seen during the pandemic, but some recent data has given a mixed picture and inflation continues to track above the Fed's 2% target range.Trump's latest salvo against Powell comes ahead of the Fed chair's Friday speech at the annual Jackson Hole central banking symposium, where investors will cleave to his every word for hints on his economic outlook and the likelihood of a coming reduction to short-term borrowing costs.

Investors and economists are betting the Fed will cut rates by a quarter of a percentage point next month with perhaps another reduction of similar size to come later in the year, far less than the several percentage points that Trump has called for.Trump's Treasury Secretary, Scott Bessent, has promoted the idea of a half-point rate cut in September.

The US central bank cut its policy rate half a percentage point last September, just before the presidential election, and trimmed it another half of a percentage point in the two months immediately following Trump's electoral victory, but has held it steady in the 4.25%-4.50% range for all of this year. Fed policymakers have worried that Trump's tariffs could reignite inflation and also felt the labour market was strong enough not to require a boost from lower borrowing costs.

The consumer price index (CPI) rose 0.2% in July, with the 12-month rate through July at 2.7%, unchanged from June. Core CPI, which strips out the volatile food and energy components, increased 3.1% year-over-year in July. Based in part on that data, economists estimated the core personal consumption expenditures (PCE) price index rose 0.3% in July. That would raise the year-on-year increase to 3% in July. The PCE is a key measure tracked by the Fed against its own 2% inflation target.

And despite a moderate rise in overall consumer prices in July, producer and import prices jumped, a suggestion that higher consumer prices could be coming as sellers pass higher costs onto households. The inflation picture comes amid a picture of a possible cooling in the labour market, with declines in monthly job gains, although the unemployment rate, at 4.2%, remains low by historical standards.Trump's online attacks on the Fed and Powell more typically focus on the cost that higher interest rates mean for US government borrowing. High mortgage rates are a key pain point for potential homebuyers who are also facing high and rising home prices due to a dearth of housing supply.

Mortgage rates can be loosely tied to the Fed's overnight benchmark rate but more closely track the yield on the 10-year Treasury note, which typically rises and falls based on investors' expectations for economic growth and inflation. A Fed rate cut does not always mean lower long-term rates — indeed after the Fed cut rates last September, mortgage rates, which had been on the decline, rose sharply.In recent weeks the most popular rate — the 30-year fixed mortgage rate — has drifted downward but, at around 6.7% most recently, is still much higher than it had been before inflation took off after the pandemic shock and the Fed began its rate-hike campaign in 2022.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up