Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Donald Trump's threat to invoke a federal anti-insurrection law to expand his deployment of military personnel to U.S. cities has intensified the legal battle between the president and Democratic-led cities, as hundreds of National Guard troops from Texas on Tuesday prepared to patrol the streets of Chicago.

Donald Trump's threat to invoke a federal anti-insurrection law to expand his deployment of military personnel to U.S. cities has intensified the legal battle between the president and Democratic-led cities, as hundreds of National Guard troops from Texas on Tuesday prepared to patrol the streets of Chicago.

Trump told reporters on Monday that he would consider utilizing the Insurrection Act, a law enacted more than two centuries ago, to sidestep any court rulings restricting his orders to send Guard troops into cities over the objections of local and state officials.

"We have an Insurrection Act for a reason," Trump said. "If people were being killed and courts were holding us up, or governors or mayors were holding us up, sure, I'd do that."

The law, which gives the president authority to deploy the military to quell unrest in an emergency, has typically been used only in extreme cases, and almost always at the invitation of state governors. The act was last invoked by President George H.W. Bush during the Los Angeles riots of 1992.

Using the act would represent a significant escalation of Trump's campaign to deploy the military to the streets of Democratic cities in an extraordinary assertion of presidential power. Last week, in a speech to top military commanders, Trump suggested using U.S. cities as "training grounds" for the armed forces.

Trump has ordered Guard troops sent to Chicago, the third-largest U.S. city, and Portland, Oregon, following his earlier deployments to Los Angeles and Washington, D.C. In each case, he has done so despite staunch opposition from Democratic mayors and governors, who say Trump's claims of lawlessness and violence do not reflect reality.

In Chicago and Portland, protests over Trump's immigration policies had been largely peaceful, while both cities have seen sharp declines in violent crime so far this year, according to local officials. Clashes between protesters and federal agents, who have fired tear gas and other crowd deterrents, increased over the weekend as tensions grew over Trump's determination to send in Guard troops.

Illinois Governor J.B. Pritzker, a Democrat, accused Trump of intentionally trying to foment violence in Chicago by sending in immigration agents and Guard troops, which the president could then use to justify further militarization.

"Donald Trump is using our service members as political props and as pawns in his illegal effort to militarize our nation's cities," Pritzker told reporters on Monday.

Illinois and Chicago sued the Trump administration on Monday, seeking to block orders to federalize 300 Illinois Guard troops and send 400 Texas Guard troops to Chicago. During a court hearing, Justice Department lawyers told a federal judge that hundreds of Texas Guard troops were already in transit to Illinois.

The judge, April Perry, permitted the deployment to proceed for now but ordered the U.S. government to file a response by Wednesday.

Separately, a federal judge in Oregon on Sunday temporarily blocked the administration from sending any National Guard troops to police Portland, the state's largest city.

National Guard troops are state-based militia who normally answer to the governors of their states and are often deployed in response to natural disasters. A federal law, the Posse Comitus Act, generally bars the military from domestic law enforcement, but the Insurrection Act operates as an exception to that law.

When Brazil’s Luiz Inacio Lula da Silva and Donald Trump finally talked over their differences Monday, the man at the center of their months-long spat didn’t even merit a mention.A Trump social media post hailing the talk as “very good” didn’t include the name of Jair Bolsonaro, the former Brazilian president whose trial on coup attempt charges inspired the US leader to impose 50% tariffs on many Brazilian goods earlier this year.

And although Lula asked Trump to lift the trade levies and US restrictions on top Brazilian officials, neither Bolsonaro nor his September conviction came up in the 30-minute phone call, according to a person present for the conversation.If the call itself suggested a thaw in Brazil-US relations, the sudden sidelining of Bolsonaro offered an even clearer sign that momentum remains firmly behind Lula, the leftist leader who’d already seen his approval ratings rise amid his dispute with Trump.

The cheery statements, by contrast, left at least some Bolsonaro allies dismayed, according to a person close to the powerful conservative family who, like the others, requested anonymity to discuss internal matters.Brazilian officials are hesitant to declare premature victory. But Lula’s government saw Bolsonaro’s total absence from the discussion as an indication that Trump may be willing to turn the page on his ally, two other officials said, a development that would shift the focus from unresolvable political differences to economic matters on which there’s room to cut a deal.

That wouldn’t just remove the biggest obstacle to trade talks between the nations, as Trump explicitly imposed tariffs after Brazil’s top court refused to drop its trial against Bolsonaro.It would also give Lula the chance to fully unleash the sort of charm offensive leaders like Mexico’s Claudia Sheinbaum have used to make headway with Trump, and that has long been a key weapon in the 79-year-old Brazilian’s political arsenal.For decades, Lula has boasted a reputation as an enchanting figure capable of winning over everyone from George W. Bush to Emmanuel Macron despite sharp ideological differences or fierce policy divides.

Trump is notoriously prone to flattery, and while Lula is too proud a politician to give into the demands of any foreign leader, he’s hardly above a little puffery if he sees it as useful.On Monday’s call, Lula reminded his counterpart that Brazil runs a trade deficit with the US, part of his case that it has the commercial relationship with the US that Trump claims to want with every nation.He also cast the conversation as the chance to press reset on a 200-year allyship between the Western Hemisphere’s largest democracies, striking notes similar to those Prime Minister Keir Starmer sang about the UK-US relationship during Trump’s visit to London last month.

It was a push to build on the progress the pair of leaders made during a seconds-long encounter at the United Nations General Assembly two weeks ago, a run-in that left Trump hailing the “excellent chemistry” he’d enjoyed with Lula. They even took time to “reiterate the positive impression” each took away from it, according to a readout from Brazil’s government.It’s too early to know if Lula’s push will work. But high-level communications channels have been unclogged, with Secretary of State Marco Rubio set to spearhead ongoing negotiations with Brazil Finance Minister Fernando Haddad, Vice President Geraldo Alckmin and other officials in the coming weeks.

Lula and Trump, meanwhile, both pledged that they’d soon meet in person. Trump’s schedule is crowded, with expectations that he’ll host like-minded Argentina leader Javier Milei next week amid their own trade negotiations and talks over financial aid for the country’s ailing economy.But a sit-down with Lula is possible as soon as a summit of Southeast Asian nations in Malaysia later this month, and the Brazilian also signaled his willingness to travel to Washington for a meeting if necessary.

For months, Bolsonaro’s son Eduardo has lobbied the Trump administration to come to his father’s defense, seeing US political pressure as the only way for the former president to escape his legal woes and run against Lula again next year.Some inside the Bolsonaro family were already uncomfortable with the vibes coming out of the UN encounter, and saw the phone call and resulting statements as another indication that Trump is ready to move on, a person familiar with the situation said.

Their hope now, the person added, lies with Rubio, whose hawkish approach to Latin America’s leftist leaders has inspired expectations of a more ideologically-aligned stance toward Brazil. It’s a view shared by Eduardo Bolsonaro, who praised Rubio in a social media post Monday afternoon.But Lula’s administration senses that Trump, not Rubio, will ultimately drive the decision-making process, one of the Brazilian officials said.

And after months in which Eduardo appeared to be the only Brazilian with high-level access to Washington, it’s Lula who seems to have established a direct link to Trump himself: They exchanged phone numbers during the call, and Lula, one Brazilian official said, told Trump to call him anytime.

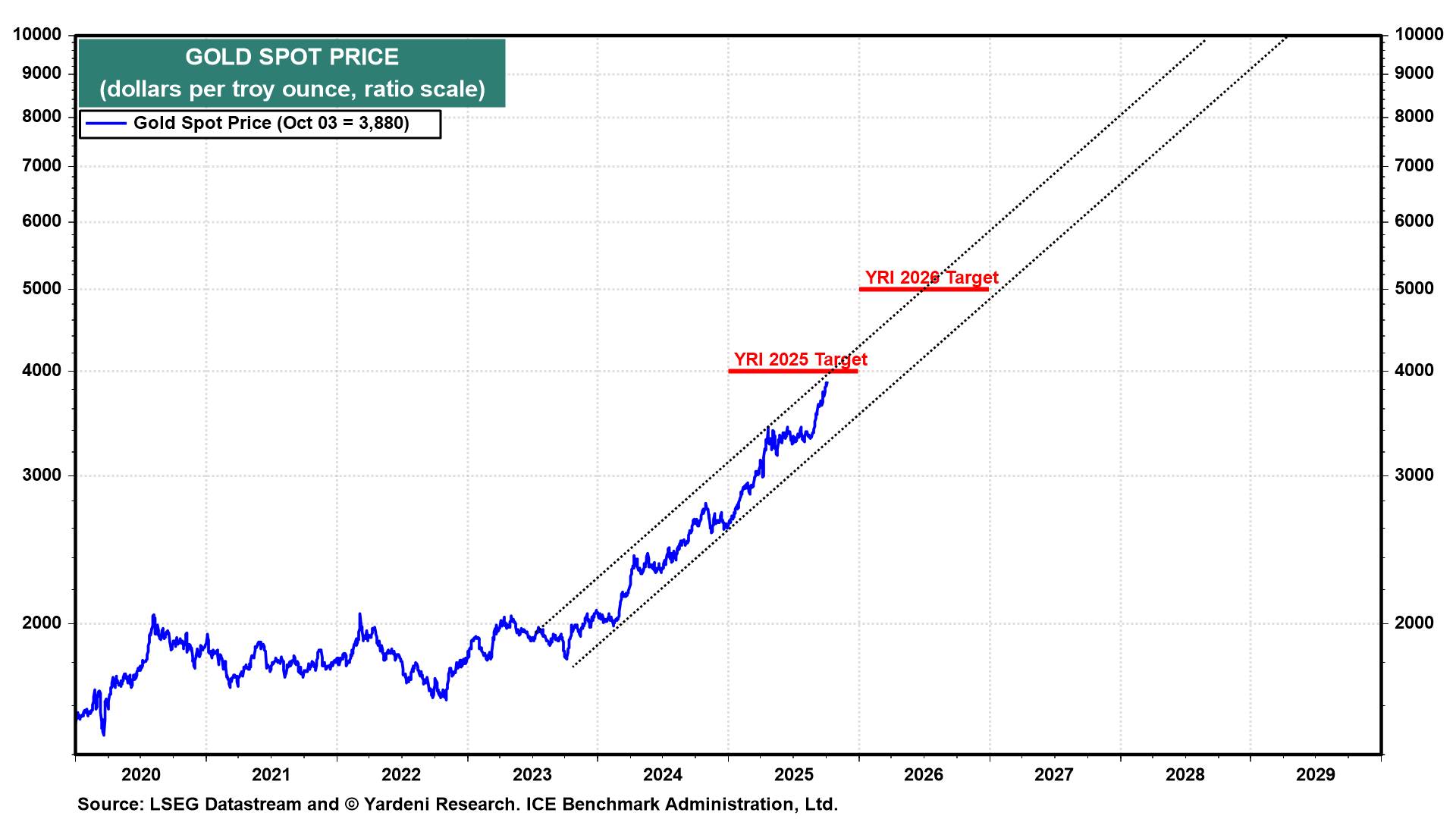

From time to time, we will review and update some of our good market calls. We hope this provides a helpful perspective on our approach to market forecasting.

Today, let’s review and update our thoughts on the outlook for Gold:

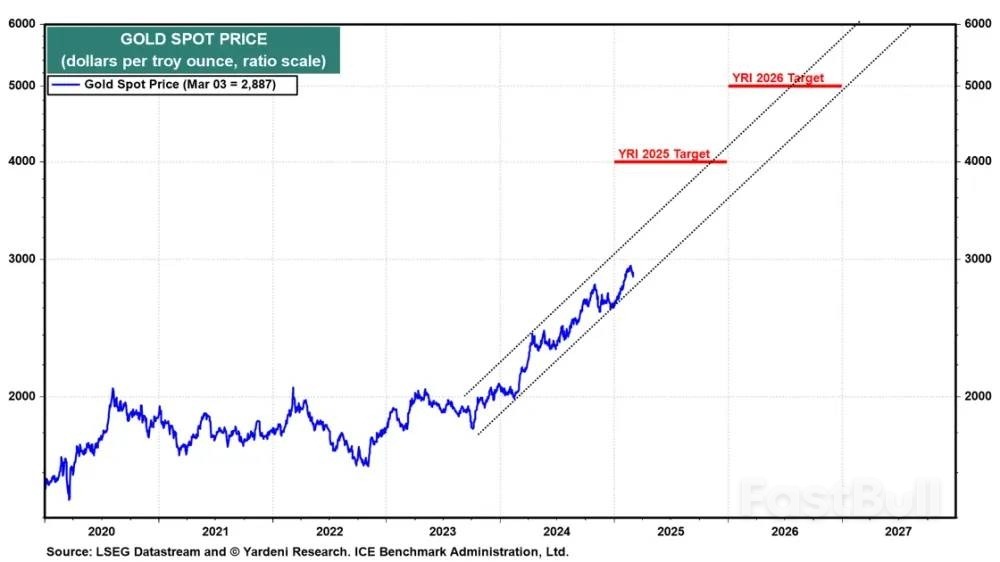

We first turned bullish on the price of gold on April 7, 2024. We noted that it was breaking out above $2000 per ounce to new record highs (chart). We wrote that "$3,000-$3,500 per ounce would be a realistic price target for gold through 2025."

On October 21, 2024, we wrote:

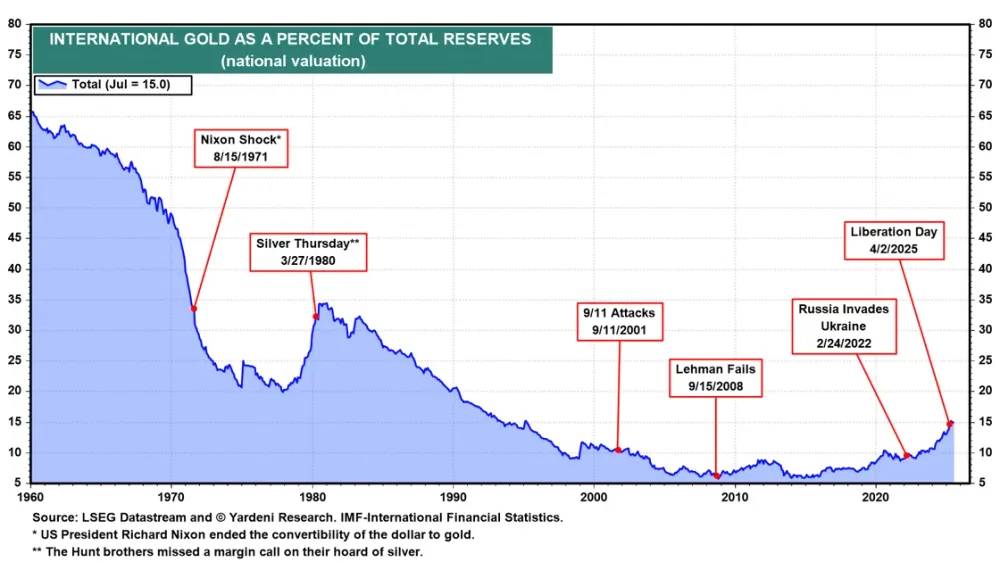

"Gold is traditionally viewed as a hedge against inflation, yet it has rallied to new highs as inflation has moderated. Perhaps gold is now a hedge against US economic sanctions. After Russia invaded Ukraine in February 2022, Russia’s foreign exchange reserves held by the US and its allies were frozen. Since then, some officials and commentators have proposed seizing those assets, which amount to nearly $300 billion, and using the proceeds to defend and rebuild Ukraine. Not surprisingly, China and other countries have been increasing their allocations of gold in their countries’ international reserves."

The price of gold had risen to $2721 at the time. On January 30, 2025, we predicted that it would rise to $3,000.

On March 3, 2025, we first provided specific year-end targets for 2025 and 2026:

"Meanwhile, the price appreciation of gold has been remarkably steady since late 2023 (chart). The recent pullback has been very moderate so far. We are targeting (not promising) a gold price of $4,000 per ounce by the end of this year and $5,000 by the end of 2026."

On July 14, 2025, we noted:

"We are still bullish on gold, though we think that the current consolidation may continue through the summer. The price has continued to be contained by its ascending channel."

On September 2, 2025, we wrote:

"We reckoned that President Donald Trump’s attempts to reorder the world’s geopolitical order, including America’s relationships with its major trading partners, might be unsettling and bullish for gold. Similarly, his attempt to order the Fed to lower interest rates would compromise its independence and be bullish for gold. In addition, the bursting of China’s housing bubble has had a significant adverse wealth effect on Chinese savers, who’ve flocked to gold as an alternative safe asset. Furthermore, the rising standard of living in India has increased wealth, thereby boosting demand for gold, which is widely regarded as a valuable asset."

We added:

"Our bullishness is supported by the ’Gold Put,’ provided by central banks that are increasing the percentage of their international reserves in gold (chart).

We also noted:

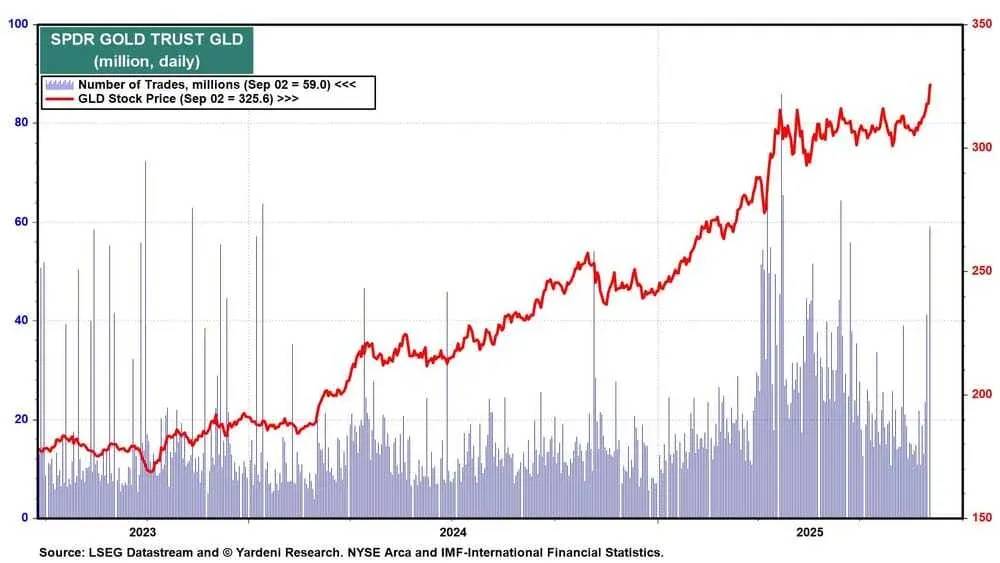

"Over the past couple of trading days, the volume in the SPDR Gold Trust ETF (NYSE:GLD) has increased significantly (chart)."

So far, so good (chart). The price of gold is within shouting distance of our $4000 target for 2025. We are now aiming for $5,000 in 2026. If it continues on its current path, it could reach $10,000 by the end of the decade.

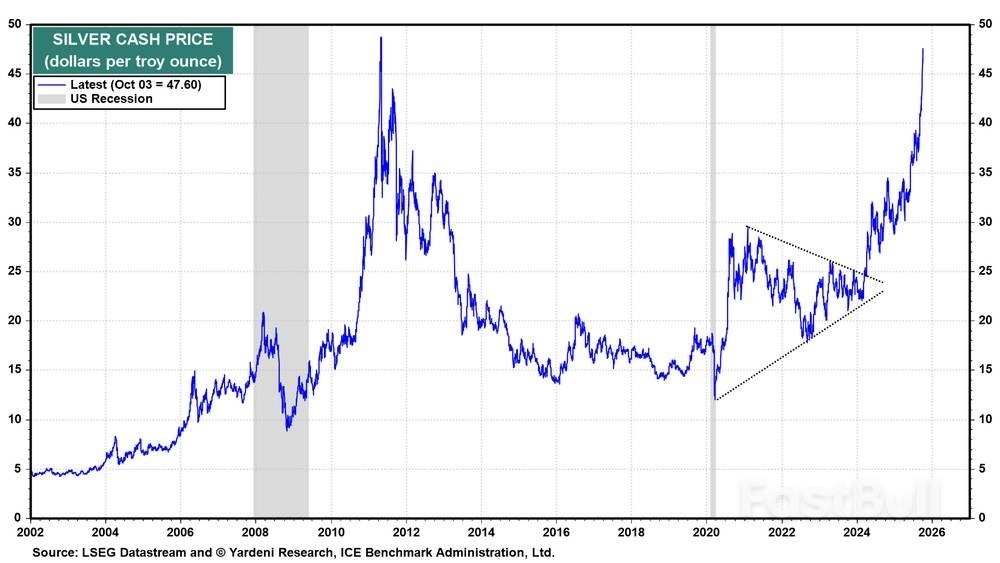

The price of silver has also soared and should continue to rise along with the price of gold, though both may be due for a pullback or at least a short period of consolidation (chart).

Hamas said on Tuesday it wants to reach a deal to end the war in Gaza based on U.S. President Trump's plan but still has a set of demands, a statement signalling that indirect talks with Israel in Egypt could be difficult and lengthy.

Senior Hamas official Fawzi Barhoum set out Hamas's position on the second anniversary of the Palestinian militant group's attack on Israel that triggered the Gaza war, and one day after the indirect negotiations began in Sharm el-Sheikh.

The talks appear the most promising yet for ending a war that has killed tens of thousands of Palestinians and devastated Gaza since the October 7, 2023 attack on Israel, in which 1,200 people were killed and 251 were taken back to Gaza as hostages.

But officials on all sides urged caution over the prospects for a rapid agreement, as Israelis remembered the bloodiest single day for Jews since the Holocaust and Gazans voiced hope for an end to the suffering brought by two years of war.

"The (Hamas) movement’s delegation participating in the current negotiations in Egypt is working to overcome all obstacles to reaching an agreement that meets the aspirations of our people in Gaza," Barhoum said in a televised statement.

He said a deal must ensure an end to the war and a full Israeli withdrawal from the Gaza Strip - conditions that Israel has never accepted. Israel, for its part wants Hamas to disarm, something the group rejects.

Hamas wants a permanent, comprehensive ceasefire, a complete withdrawal of Israeli forces from Gaza and the immediate start of a comprehensive reconstruction process under the supervision of a Palestinian "national technocratic body", he said.

Underlining the obstacles lying ahead at talks, an umbrella of Palestinian factions including Hamas issued a statement vowing "resistance stance by all means" and saying "no one has the right to cede the weapons of the Palestinian people."

Israeli Prime Minister Benjamin Netanyahu did not immediately comment on the status of the talks in Sharm el-Sheikh.

U.S. officials have suggested they want to initially focus talks on a halt to the fighting and the logistics of how the hostages and political prisoners would be released. But Qatar, one of the mediators, said many details had to be worked out, indicating there was unlikely to be an imminent agreement.

In the absence of a ceasefire, Israel has pressed on with its offensive in Gaza, increasing its international isolation and prompting pro-Palestinian protests abroad which were set to continue on Tuesday.

On the anniversary of the 2023 attack, some Israelis visited the places that were hit hardest that day.

Orit Baron stood at the site of the Nova music festival in southern Israel beside a photo of her daughter Yuval who was killed with her fiance Moshe Shuva. They were among 364 people were shot, bludgeoned or burned to death there.

"They were supposed to get married on February 14th, Valentine’s Day. And both of the families decided because actually they were found (dead) together and they brought them to us together (that) the funeral will be together," said Baron.

"They are buried next to each other because they were never separated."

Israelis are hoping the talks in Sharm el-Sheikh will soon lead to the release of all the 48 hostages still held in Gaza, 20 of whom are believed to still be alive.

"It's like an open wound, the hostages, I can't believe it's been two years and they are still not home," said Hilda Weisthal, 43.

In Gaza, 49-year-old Palestinian Mohammed Dib hoped for the end of a conflict that has caused a humanitarian crisis, displaced many Palestinians multiple times and killed more than 67,000 Palestinians, according to .

"It's been two years that we are living in fear, horror, displacement and destruction," he said.

In the latest violence, residents of Khan Younis in southern Gaza and Gaza City in the north reported new attacks by Israeli tanks, planes and boats in the early hours on Tuesday.

The Israeli military said militants in Gaza fired rockets into Israel, setting off air raid sirens at Israeli kibbutz Netiv Haasara, and that Israeli troops continued to tackle gunmen inside the enclave.

Israel and Hamas have endorsed the overall principles behind Trump's plan, under which fighting would cease, hostages go free and aid pour into Gaza. It also has backing from Arab and Western states.

But an official involved in ceasefire planning and a Palestinian source said Trump's 72-hour deadline for the hostages' return may be unachievable for dead hostages as their remains may need to be located and recovered.

Even if a deal is clinched, questions will linger over who will rule Gaza and rebuild it. Trump and Israeli Prime Minister Benjamin Netanyahu have ruled out any role for Hamas.

Another key issue is who will provide the billions of dollars need to rebuild an enclave that has mostly been turned into rubble.

Reporting by Nidal al-Mughrabi in Cairo and Maayan Luubell in Jerusalem and Reuters television in Sharm el-Sheikh and Charlotte Van Campenhout in Amseterdam; Writing by Michael Georgy, Editing by Timothy Heritage

The World Trade Organization is sharply raising its forecast for trade growth in goods this year after an unexpectedly strong first half due to rising AI-related purchases, front-loaded imports in the U.S. over tariff fears and robust developing-world trade.

The Geneva-based trade body said Tuesday its economists are increasing their prediction of growth in merchandise trade to 2.4% this year, up from 0.9% as recently as August. In April, WTO experts were actually anticipating a decline of goods trade this year of 0.2%

However, they're lowering the prediction for 2026 to 0.5%, from 1.8%.

The growth of export in services, meanwhile, is expected to come in at 4.6% in 2025 and 4.4% next year — both slower rates than the 6.8% tallied in 2024.

WTO pointed to “robust trade in artificial intelligence-related goods" that are driving the increase in merchandise trade, notably semiconductors, servers and telecommunications equipment.

Director-General Ngozi Okonjo-Iweala suggested solid trade growth among developing countries and a cool-headed reaction to sweeping — and often-varying — tariffs announced by the Trump administration earlier this year had underpinned the gains.

“Countries’ measured response to tariff changes in general, the growth potential of AI, as well as increased trade among the rest of the world — particularly among emerging economies — helped ease trade setbacks in 2025,” she said.

Despite “strong headwinds," Okonjo-Iweala said trade has shown resilience because of “importers front-loading orders to get ahead of future tariff hikes or retaliation.” U.S. inventories are at record levels by dollar value, and the value of North America’s imports surged 13.2% at an annual rate, driven by pharmaceuticals and precious metals — mostly gold.

She also attributed the gains to “soaring demand” for AI-related products behind a capital investment boom. A staggering 42% of global trade growth came from AI-related goods, she said, much higher than their 15% share in world trade.

South-South trade — among developing countries — grew 8% year-on-year in value terms in the first half of the year, while such trade involving partners other than China is growing at around 9%, WTO said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up