Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

US President Donald Trump says he’s ready to ease sanctions on Syria. He won’t be able to do it quickly.

US President Donald Trump says he’s ready to ease sanctions on Syria. He won’t be able to do it quickly.

The American leader sat down with Syrian counterpart Ahmed Al-Sharaa in Riyadh on Wednesday — the first meeting between heads of the two countries in 25 years — after unexpectedly saying he would drop all sanctions against the war-ravaged country and even look to normalize relations.

The move was seen as a highlight of Trump’s trip to the Arabian Peninsula this week, but actual implementation will be a protracted and thorny challenge. The White House also made clear it’s not a one-way street, saying the president urged Sharaa to take steps in return, including helping to fight terrorism and agreeing ties with Israel.

US Secretary of State Marco Rubio will have to wade through layers of strict restrictions imposed on Syria over the past 45 years — covering everything from finance to energy — and met his counterpart Asaad Al-Shaibani on Thursday in Turkey.

“President Trump has made clear his cessation of sanctions is meant to help stabilize and move Syria toward peace,” National Security Council spokesman James Hewitt said in a statement. “The State Department prepared for this moment by engaging across the U.S. government and our foreign partners since the fall of the Assad regime to review options and timing on sanctions relief.”

Trump can lift sanctions issued by executive order but some will need a vote in Congress to be repealed, according to Caroline Rose, a Syria expert and research director at the Washington-based New Lines Institute.

“The road ahead with sanctions relief will be long and complicated,” she said. “There are still many sceptics to Syria normalization and sanctions relief, particularly among Republican Party members.”

Another issue is that Sharaa, Shaibani and many other members of the present Syrian government are former commanders of an Al-Qaeda-affiliated group implicated by the United Nations Security Council in war atrocities. Sharaa, who previously ran an Islamist protostate in northwest Syria, overthrew long-time former President Bashar Al-Assad in December after a rebel offensive.

“There’s a lot that needs to be done, including by the Syrian administration,” Saudi Arabia’s Foreign Minister Faisal bin Farhan told reporters Wednesday. “Syria won’t be alone — the kingdom and the rest of our international partners will be at the forefront of those supporting this effort and economic rebirth.”

One immediate boost for Sharaa’s government will come from supporter Qatar, which has US backing to begin dispersing almost $30 million a month for civil servant salaries, according to two people involved in finalizing the arrangement and two others with knowledge of the matter.

That will provide at least a start for the new Syrian administration, which is faced with an economy devastated by more than a decade of war and in need of as much as $400 billion for rebuilding costs, according to the Carnegie Endowment for International peace.

“We welcome all investors: children of the nation inside and outside, our Arab and Turkish brothers and friends from around the world,” Sharaa said in a speech on Wednesday night.

Supporters of Sharaa inside and out of Syria, including Saudi Arabia, see Trump’s move as a brave decision that isolates extremists within the Syrian leader’s Islamist-dominated administration. The move also excludes Iran, Assad’s main patron, and helps ensure China doesn’t make significant inroads.

Investment opportunities will instead fall to regional powers friendly to the US, like Saudi Arabia, Turkey and the United Arab Emirates.

“The main concern in the business community has been that we don’t want to be seen working with what has been designated as a terrorist government by the West,” said Majd Abbar, a Dubai-based Syrian-American information-technology executive, who has lobbied officials in Washington to lift sanctions and met with Sharaa multiple times.

“Now that these sanctions will be lifted, everyone is going to jump on board to invest in Syria,” he said. “It’s practically a white canvas — there’s nothing there.”

Syria, which is technically still at war with Israel, has been under myriad US sanctions since its 1979 designation by Washington as a state sponsor of terrorism.

Relations thawed in the 1990s when Damascus joined the US-led coalition that ousted Saddam Hussein from Kuwait and engaged in peace talks with Israel. But after replacing his father in 2000, Assad deepened ties with Iran and was accused by the US of supporting the insurgency in Iraq following the 2003 US-led invasion.

That triggered additional sanctions by Washington, and further rounds followed from 2011 when Assad mounted a brutal crackdown against his opponents, spawning a decade-long conflict that killed almost 500,000 people and displaced millions more. Just before his toppling in December, the US renewed the 2019 Caesar Syria Civilian Protection Act, which penalizes anyone that does business with the Syrian government except for exempted humanitarian reasons.

Before Trump’s announcement, many in his administration, such as Sebastian Gorka, were strongly opposed to removing sanctions or dealing with Sharaa, seeing him as a committed jihadist who is masking his real intentions. The State Department had demanded Sharaa’s government show progress on a number of critical issues as a precondition for the lifting of sanctions.

At their meeting in Riyadh, Trump urged Sharaa to take certain steps, according to a White House readout of the conversation, which was attended by Saudi Crown Prince Mohammed bin Salman. Those include the deportation of Palestinian militants and other foreign fighters from Syria, helping with the effort to prevent the resurgence of Islamic State and normalizing relations with Israel.

Israel was quick to intervene militarily after Assad’s ouster, launching a series of airstrikes on arms-storage sites and extending its occupied land in Syria’s southwest. It also stepped in to defend the Druze community after violent clashes between the minority group and government forces.

The country’s attitude toward Syria “is more sceptical, we are approaching matters in a slower manner,” Danny Danon, Israel’s ambassador to the United Nations, told Army Radio on Thursday. “We want to see that there really is stability in Syria, that this regime doesn’t only talk, it also takes action.”

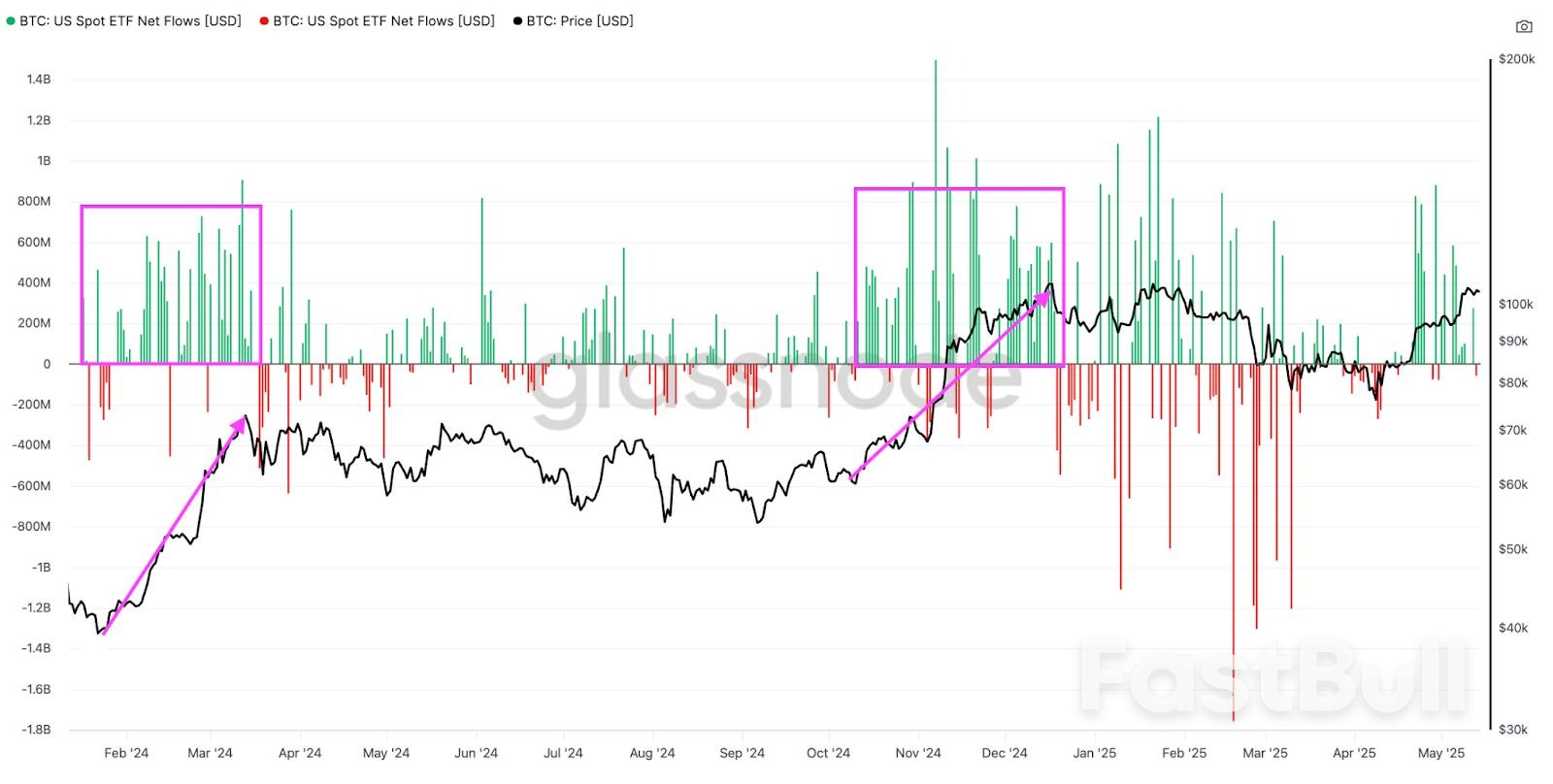

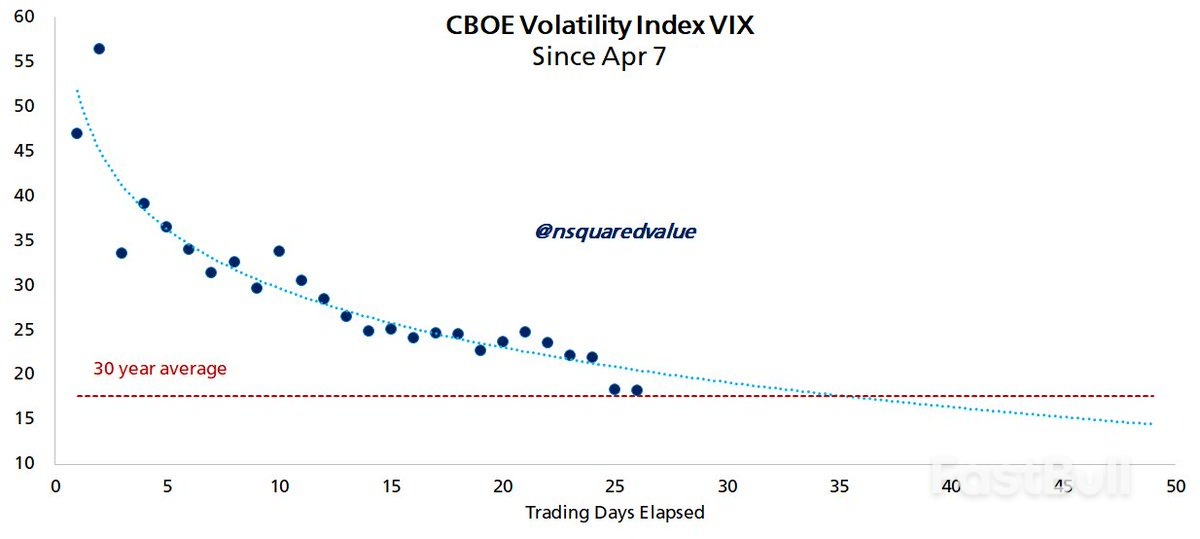

CBOE Volatility Index. Source: Timothy Peterson

CBOE Volatility Index. Source: Timothy Peterson

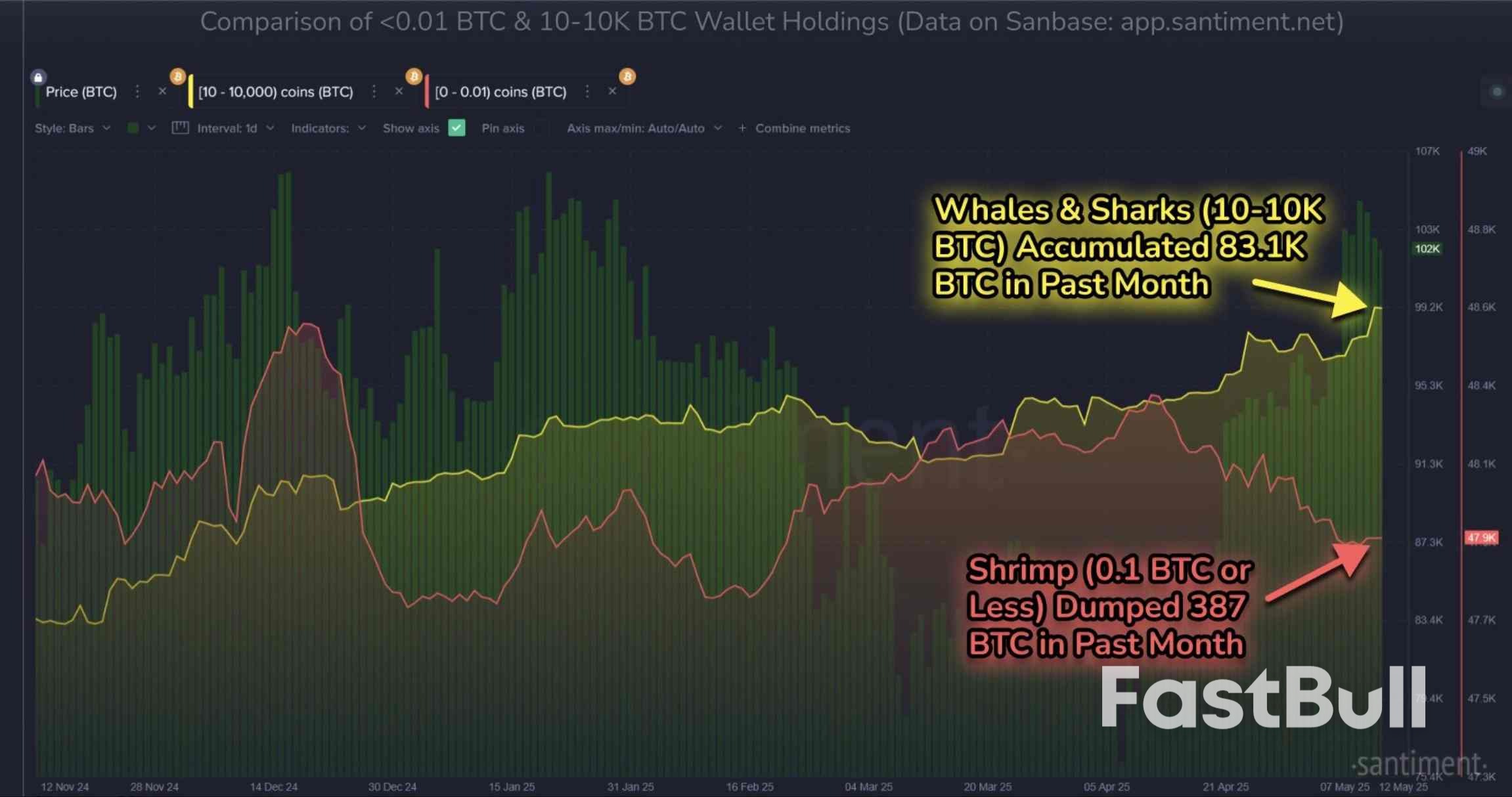

Bitcoin 10-10,000 BTC chart holdings. Source: Santiment

Bitcoin 10-10,000 BTC chart holdings. Source: Santiment

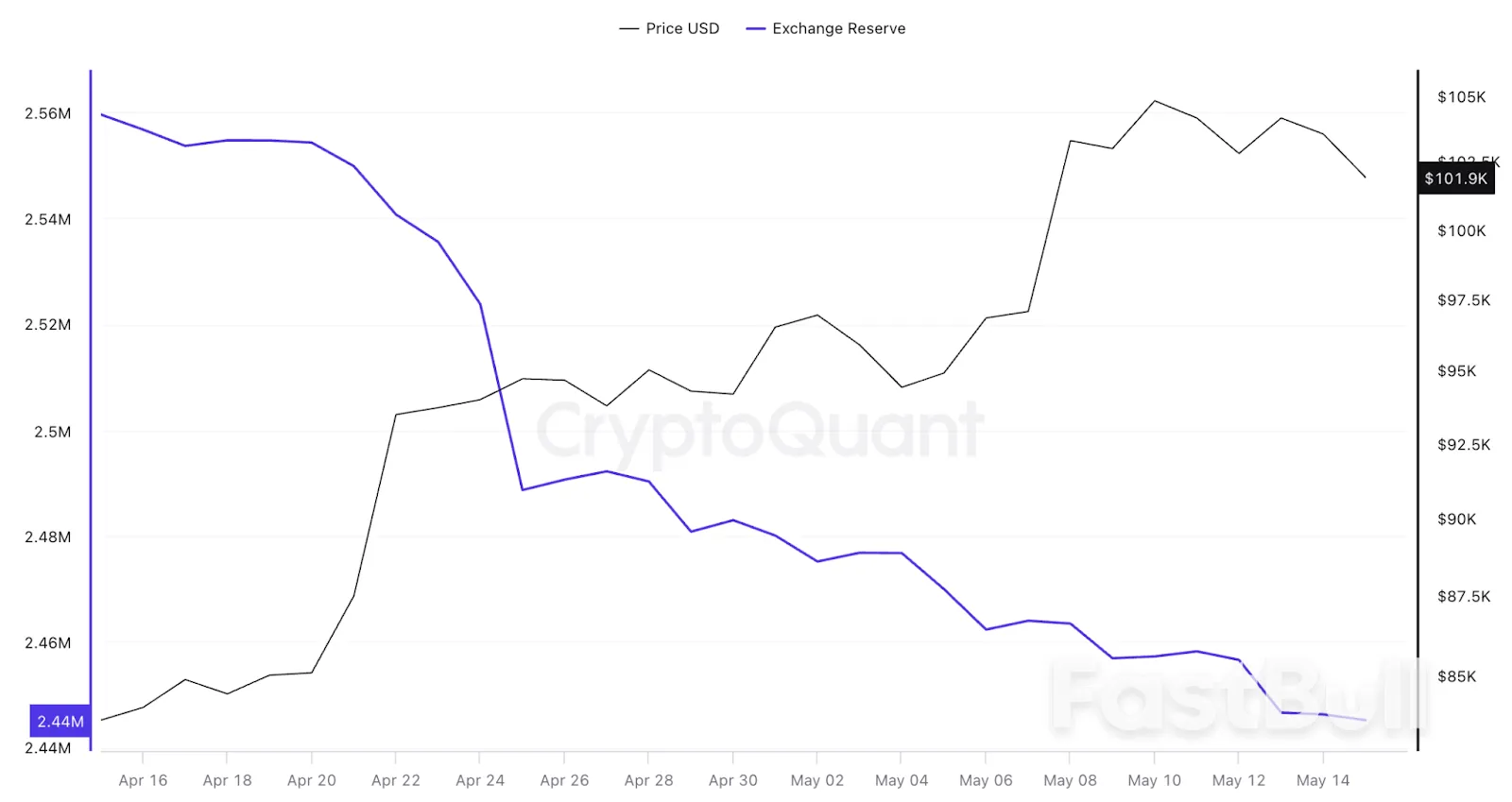

Source: Ted Boydston

Source: Ted Boydston

The AUDUSD continues to face strong resistance at the 200-day moving average, which capped rallies both on Monday and again today at the session high of 0.6457. Sellers leaned into that level, keeping upside momentum in check and maintaining the bearish pressure.

On the downside, a cluster of moving averages, all broken on the move lower, sits between 0.6419 and 0.6437 and now acts as a key resistance zone. This area includes:

● The 200-hour MA at 0.64376

● The 100-hour MA at 0.64254

● The 100-bar MA on the 4-hour chart at 0.6419

After the fall, the low price reached 0.6401, just above the psychological 0.6400 level, where support buyers emerged. However, the rebound stalled at 0.6422, unable to reclaim the broken MAs—giving sellers a short-term advantage below this cluster.

To shift the bias back to the upside, the pair needs to sustain a move above 0.6437, and then break through the 200-day MA at 0.6457. That would open the door toward 0.6513, the high for the year.

Conversely, a break below 0.6400 could see further downside toward the next support at 0.6388, followed by the broader swing area between 0.6321 and 0.63437. Beyond that, key support targets include:

● The 100-day MA at 0.62951

● The 38.2% retracement of the April rally at 0.62844

U.S. stocks fell Thursday, handing back some of the week’s hefty gains, as investors digest corporate earnings as well as weak economic data, raising slowdown fears.

At 09:35 ET (13:35 GMT), the Dow Jones Industrial Average fell 180 points, or 0.4%, the S&P 500 index dropped 15 points, or 0.3% and the NASDAQ Composite slipped 85 points, or 0.5%.

Despite today’s losses, the main averages are still on course for healthy gains this week as the trade deal between China and the U.S. eased fears of a prolonged tariffs war, potentially hitting economic growth.

With the trade turmoil seemingly settling down, investors are turning their attention to the economic data slate, looking for signs of damage being done to the world’s largest economy.

The latest producer price index showed that factory gate prices slumped on a monthly basis in April, in the latest sign of cooling inflationary pressures.

The producer price index for final demand fell 0.5% in April, the first monthly fall since 2023, after the previous month’s figure was revised to flat from a fall of 0.4%.

Taking out more volatile items like fuel and food, so-called “core” PPI also fell on a monthly basis, down 0.4%.

Data released earlier this week showed that the more widely-watched consumer price index grew by 2.3% in the 12 months to April, compared with expectations that it would match March’s pace of 2.4%.

It was the lowest annual rate of inflation since February 2021, shortly before pent-up pandemic-fueled demand and supply constraints led to soaring prices.

Additionally, retail sales fell 1.0% on the month in March, a more substantial loss than the 0.5% expected.

A surge of buying before the implementation of Trump’s punishing tariffs led to the largest increase in the metric in more than two years in March. Separate surveys have indicated that households have widely been anticipating that the levies will push up prices.

Elsewhere, Federal Reserve Chair Jerome Powell is set to deliver remarks at a conference in Washington, D.C. Last week, the Fed left interest rates unchanged, with Powell noting strength in the broader economy but rising risks from inflation and unemployment.

The main corporate release Thursday comes from retail giant Walmart (NYSE:WMT), with the retail giant posting better-than-anticipated first-quarter earnings, although its finance chief warned that tariff tensions could soon drive prices higher..

Known for its low prices and massive selections, Walmart has become something of a bellwether for shopper sentiment. In February, the company issued downbeat guidance for the year, although CFO John David Rainey said American consumers remain "resilient" and focused on value.

Elsewhere, Chinese e-commerce titan Alibaba (NYSE:BABA) missed earnings expectations for its fiscal fourth quarter on both the top and bottom line, while agricultural equipment manufacturer Deere & Company (NYSE:DE) reported better-than-expected second quarter results, but lowered the bottom end of its full-year net income forecast range amid challenging market conditions.

Cisco Systems (NASDAQ:CSCO) raised its annual results forecast, betting on steady demand from cloud customers for its networking equipment, driven by the artificial intelligence boom.

UnitedHealth (NYSE:UNH) stock slumped after the Wall Street Journal reported the company was being investigated by the Department of Justice over alleged criminal fraud involving Medicare.

The investigation marks a new headwind for UnitedHealth, which is already nursing a sharp selldown in its shares this year on concerns over government scrutiny, weakening financials, and signs of internal strife. The company abruptly replaced its CEO this week.

Foot Locker (NYSE:FL) stock soared after Dick’s Sporting Goods (F:DKS) confirmed it is exploring a deal to buy the company for roughly $2.3 billion.

Oil prices fell sharply Thursday, extending recent losses, as the growing expectations for a potential U.S.-Iran nuclear deal added to demand concerns following a surprise build in U.S. inventories.

At 09:35 ET, Brent futures dropped 2.5% to $64.45 a barrel, and U.S. West Texas Intermediate crude futures fell 2.4% to $61.56 a barrel.

Both benchmarks lost just under 1% on Wednesday, ending a four-day rally and slipping from the two-week high reached earlier this week.

A U.S.-Iran nuclear deal could potentially allow Tehran to export more of its crude into the world market, loosening the global crude supply-demand balance.

Additionally, data from the Energy Information Administration showed crude stockpiles rose by 3.5 million barrels in the week ended May 9, suggesting that demand may be cooling in the world’s largest energy consumer.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up