Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

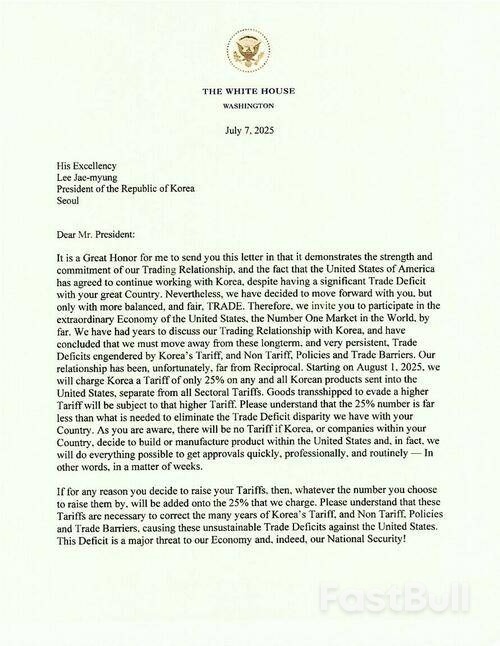

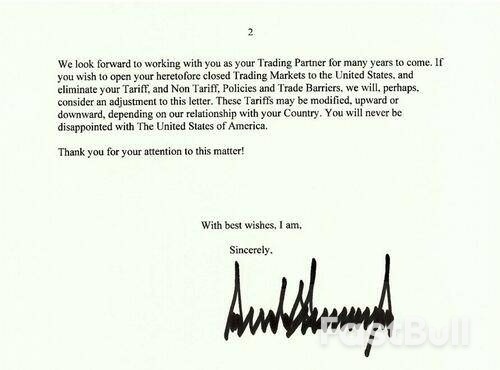

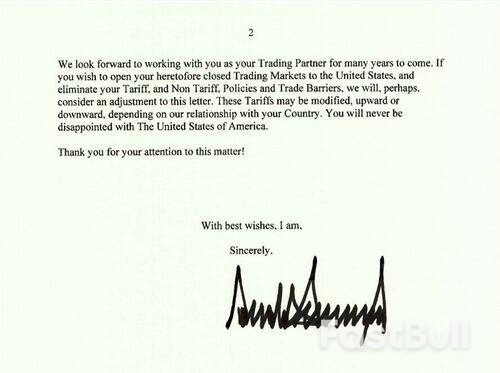

About 12 countries will receive letters from Trump, White House spokeswoman Karoline Leavitt said at a briefing without identifying them.

New Zealand’s central bank is expected to keep interest rates on hold this week amid uncertainty over the inflation outlook while leaving the door open to further easing if needed to bolster the weak economy.

The Reserve Bank’s Monetary Policy Committee will leave the Official Cash Rate at 3.25% Wednesday in Wellington, according to 19 of 23 economists surveyed by Bloomberg. Four predict a quarter-point reduction, while investors are pricing a 13% chance of a cut.

“We see the net data flow since May as dovish, easily justifying a cut,” said Sharon Zollner, chief New Zealand economist at ANZ Bank in Auckland. “Indeed, we think the RBNZ should cut. However, on balance we think the Committee will decide it is prudent and low-cost to wait for more data on inflation – and inflation expectations – before cutting in August.”

The RBNZ has slashed its benchmark by 225 basis points since August last year, and said in May that the full impact of that easing has yet to flow through to households. While recent indicators suggest economic growth is sluggish, inflation has quickened to 2.5% and policymakers are wary of price expectations lifting again.

The RBNZ will publish its decision at 2 p.m. local time Wednesday. Because it is a rate review rather than a Monetary Policy Statement, there is no press conference and the bank won’t update its economic forecasts.

The Reserve Bank of Australia, which is less advanced in its easing cycle than the RBNZ, is expected to lower its cash rate by 25 basis points to 3.6% later today.

After delivering a sixth straight cut on May 28, RBNZ Governor Christian Hawkesby said policymakers no longer had an explicit easing bias and a reduction in July was “not a done deal.” One unidentified member of the six-strong MPC also voted against a cut at that meeting.

The RBNZ nevertheless lowered its forecast track for the OCR, suggesting it sees a chance of the benchmark falling below 3% later this year or early in 2026.

Investors are betting on a cut to 3% in coming months and see a 60% chance of one further reduction next year, swaps data show.

While the economy posted better-than-expected growth of 0.8% in the first quarter and business confidence is improving, the housing and labor markets remain soft and global uncertainty around US tariffs is clouding the outlook.

Economists predict that growth slowed in the second quarter. The manufacturing and services industries contracted in May and a majority of firms reported a reduction in their own trading in the three months through June, according to a business survey.

“We continue to believe the economy requires lower interest rates ahead and we still forecast a 2.75% OCR low point,” said Doug Steel, senior economist at Bank of New Zealand in Wellington.

The latest string of weak data probably won’t be enough to “spook the MPC into continuing its easing cycle on Wednesday,” he said. “But the rapid loss of momentum adds to the case that further rate cuts will be required in due course.”

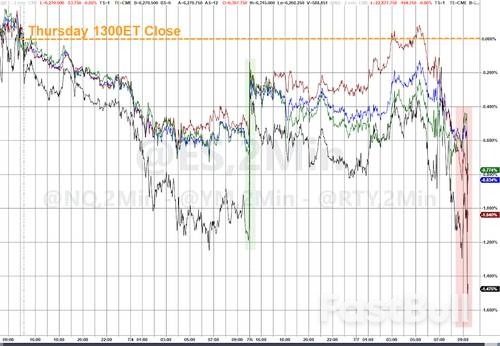

U.S. main equity indexes, the S&P 500 and Nasdaq, fell to session lows after the Trump administration released tariff letters to a handful of countries, citing "persistent trade imbalances" and the failure to reach trade deals before the July 9 deadline. The tariffs are expected to take effect on August 1.

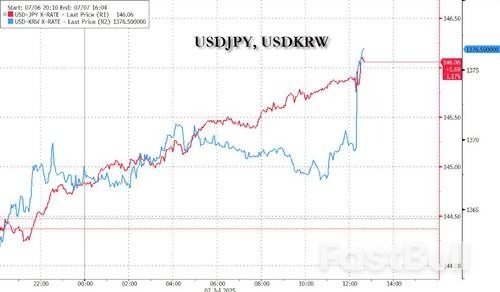

The first two trade letters were sent to South Korea and Japan, imposing a 25% tariff on all goods, effective August 1.

Here are the key points from the letter addressed to South Korea that was posted on President Trump's Truth Social page:

The U.S. views the trade relationship as unbalanced and non-reciprocal.

The 25% tariff applies to all Korean goods, unless they are produced within the U.S.

The tariff is separate from sectoral tariffs and will be increased if Korea retaliates with its own tariff hikes.

The U.S. encourages Korea to open its markets and remove trade barriers—offering a possible tariff reduction if this happens.

The trade deficit is framed as a national security threat.

Here are the key points from the letter addressed to Japan that that was posted on Trump's Truth Social page:

A 25% tariff will be imposed on all Japanese products entering the U.S. starting August 1, 2025.

This tariff applies separately from all existing sectoral tariffs.

The U.S. cites Japan’s tariffs, non-tariff policies, and trade barriers as causes of a persistent and unsustainable trade deficit; The U.S. claims the relationship has been non-reciprocal for too long.

No tariffs will apply if Japanese companies manufacture products within the U.S.

If Japan raises its tariffs, the U.S. will add that amount to the existing 25% tariff.

The U.S. expresses willingness to reconsider or adjust tariffs if Japan opens its markets and removes trade barriers.

The instant reaction in U.S. markets was traders hitting the 'sell button,' with the S&P 500 and Nasdaq sliding to session lows.

Both yen and won tumbled on the news...

All in all, this is a trade ultimatum from the Trump administration to South Korea, Japan, and other countries, pressuring them to reduce trade barriers and tariffs and to reshore manufacturing in the U.S. The letter signals a broader 'America First' agenda and tariff diplomacy, aimed at reducing trade deficits by penalizing countries with perceived unfair trade practices. We suspect the other letters will be sent out shortly.

Vietnam has become the benchmark—both the ceiling for countries striking deals with the U.S. Trump is giving Japan and South Korea a final three-week deadline to reach a deal—failure to do so could mean severe consequences.

Trade tensions are back in view as the 90-day deadline to reciprocal tariffs (which sparked a painful but extremely short market correction) approaches on July 9, with Trump pledging to start issuing unilateral rates to dozens of countries in the coming days. Stocks retreated at the start of a potentially volatile week as US trading partners rushed to finalize trade deals with the Trump administration ahead of the Wednesday deadline. However, one potential offset is that there are increasingly suggestions that August 1st might be the new July 9th (more below).

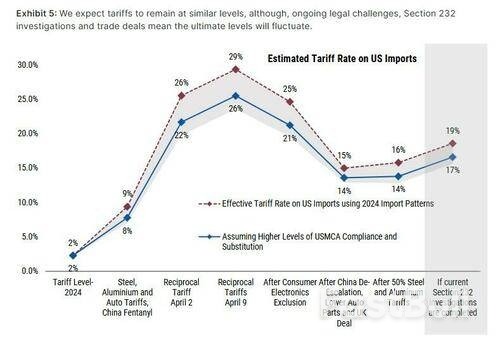

As a benchmark, DB's economists believe the current effective tariff rate is around 15% (same as Morgan Stanley, see chart below), which is obviously a good deal below the implied rate from Liberation Day, but well above the low single figures before Trump returned to office. It is good news for markets that Section 899 (the revenge tax) has been consigned to the history books after not making it into the tax bill. It's also good news that Bessent has recently sounded more positive on the direction of travel in recent talks.

However, with financial conditions easy again and with the S&P 500 back at all-time highs, it wouldn't be a surprise to see the Trump Administration take a tough stance with those who they don't think negotiations are going in the right direction (this was discussed over the weekend in "The Risk For Stocks Is That The Administration Decides It Was Correct All Along On Tariffs").

President Trump said at the end of last week that by the July 9 deadline, tariffs would be "fully covered and they’ll range in value from maybe 60 or 70% tariffs to 10 and 20%." Then over the weekend he said that he'd “signed some letters and they’ll go out on Monday – probably 12”. Overnight this was firmed up to noon Washington time today, so expect a flurry of headlines at noon!

On Thursday Trump mentioned that the letters could go out on the Friday holiday and apply from August 1st if no deal can be made. This gave some comfort that there could be yet another extension and time to do deals. Bessent has also reiterated over the weekend that some countries would be able to negotiate a three-week extension to August 1st. So maybe we'll just be here again in three weeks when everyone is on the beach apart from the trade negotiators.

Bessent also said Trump will send letters to trading partners notifying them if no deal is reached, they will revert to April 2nd tariff levels while also adding that they are close to several deals and expect to see some big announcements in the next days. Furthermore, Bessent said 100 smaller countries will get set a tariff rate and many never even contacted the US.

For Europe, Bloomberg reported that the union is willing to accept a 10% universal tariff if exemptions for areas such as autos (25%) and steel and aluminum (50%) are provided. For Japan, the mood turned negative last week as President Trump said that they should "pay 30%, 35%, or whatever the number is that we determine, because we also have a very big trade deficit with Japan." On the bright side, Treasury Secretary Bessent said they were "very close" to a deal with India, and on Thursday the US reached a trade deal with Vietnam.

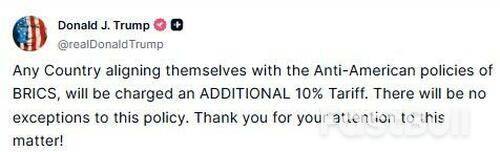

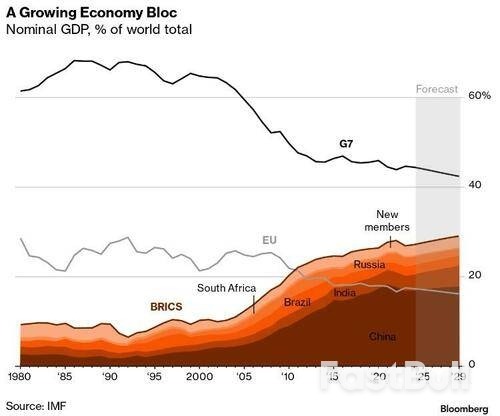

Then overnight Trump posted on social media that "Any Country aligning themselves with the Anti-American policies of BRICS, will be charged an ADDITIONAL 10% Tariff”

This follows a BRICs summit in Rio over the weekend where the group leaders, including China and India, condemned and called for a "just and lasting" resolution to conflicts across the Middle East.

Courtesy of Newsquawk, here is a summary of all the latest trade/tariff news from the weekend and this morning:

European stocks traded in a mixed manner Monday as investors awaited U.S. President Donald Trump’s July 9 deadline for trade agreements with a great deal of uncertainty.

The DAX index in Germany gained 1.2%, the CAC 40 in France climbed 0.4%, while the FTSE 100 in the U.K. fell 0.2%.

With just a couple of days to go until the U.S. president‘s deadline, global investors are on edge to see if the United States forges any agreements with trading partners as they seek to avoid higher levies.

Trump paused many of the harshest U.S. tariffs for 90 days after his April 2 "Liberation Day" announcement roiled global markets in order to provide time for countries to negotiate trade deals.

Trump said on Sunday his administration was close to finalising deals with several trade partners and will send letters notifying others by July 9 of higher rates that will kick in from August 1.

However, it remains unclear just how high Trump’s tariffs will be. The president had in April unveiled tariffs ranging from 10% to 50% on major economies, but he has since added to the confusion by mentioning that some tariffs could reach 60% or 70%.

He also threatened an extra 10% tariff on countries aligning themselves with the "anti-American policies" of the BRICS, a group the U.S. itself is in tariff talks with.

German industrial production rose more than expected in May thanks to the automotive industry and energy production, the federal statistics office said on Monday.

Production rose by 1.2% over the previous month, above the flat figure expected.

British house prices stagnated month-on-month during June, figures from Halifax showed on Monday, with the mortgage lender revising up May’s reading to show a 0.3% drop rather than a 0.4% drop.

The data underlined the subdued state of Britain’s housing market following an increase in tax on property transactions that took effect in April.

In the corporate sector, French software firm Capgemini (EPA:CAPP) said on Monday it has entered a deal to acquire New York-listed outsourcing firm WNS Holdings (NYSE:WNS) for $3.3 billion.

Capgemini aims to create a consulting business service focused on guiding enterprises on how to reform their operations using AI, which it said would attract "significant" investments.

Shell (AS:SHEL) said it expects a weaker second quarter driven by lower trading performance in its Integrated Gas and Chemicals and Products segments.

After initially declining, crude prices rose on Monday following OPEC+’s announcement of plans to increase output more than expected in August, sparking concerns that the market may become oversupplied.

At 11:48 ET, Brent futures gained 1.2% to $69.15 a barrel and U.S. West Texas Intermediate crude futures increased 1.6% to $67.53 a barrel.

The Organization of Petroleum Exporting Countries and allies, a group known as OPEC+, announced on Saturday that it will increase oil output by 548,000 barrels per day (bpd) in August.

The hike is larger than the 411,000 bpd increases already implemented for May, June, and July.

The group also warned that it will consider another 548,000 bpd hike in September at the next meeting on August 3.

The decision marks a continued rollback of the voluntary 2.2 million bpd in cuts that major producers like Saudi Arabia and Russia had initiated earlier this year to support prices.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up