Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The diverging signals came as the US made key progress with China, as the nations agreed to a framework and implementation plan to ease tariff and trade tensions.

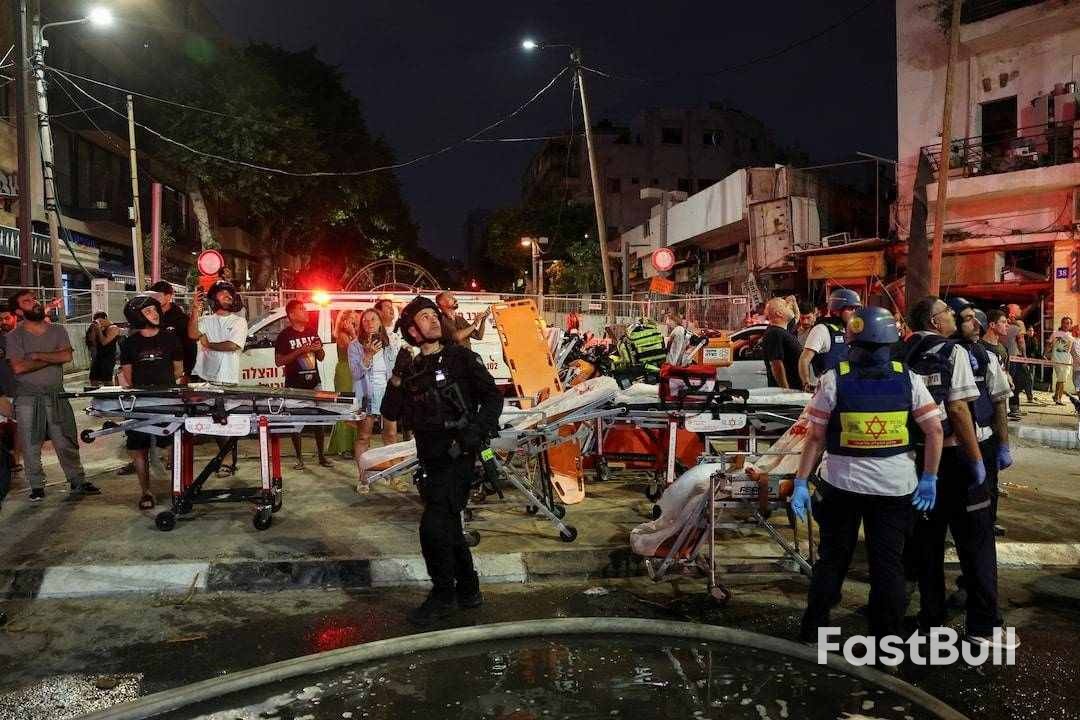

An Israeli strike hit Iran's state broadcaster on Monday as Iran called on U.S. President Donald Trump to force a ceasefire in the four-day-old aerial war, while Israel's prime minister said his country was on the "path to victory".

Israeli forces stepped up their bombardment of Iranian cities, while Iran proved capable of piercing Israeli air defences with one of its most successful volleys yet of retaliatory missile strikes.

"If President Trump is genuine about diplomacy and interested in stopping this war, next steps are consequential," Iran's Foreign Minister Abbas Araqchi said on X.

"Israel must halt its aggression, and absent a total cessation of military aggression against us, our responses will continue. It takes one phone call from Washington to muzzle someone like Netanyahu. That may pave the way for a return to diplomacy."

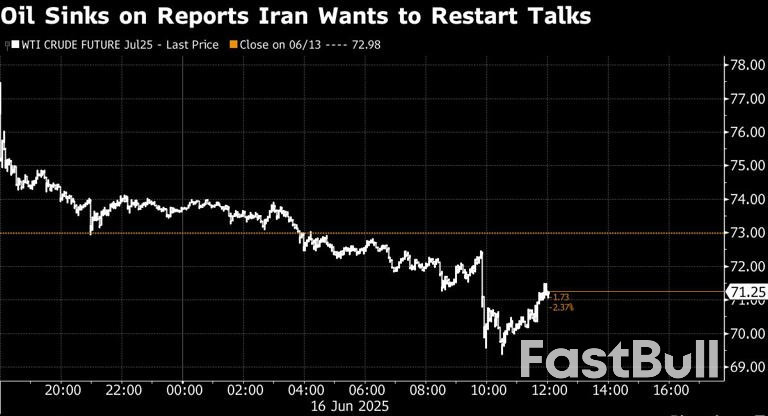

Sources told Reuters that Tehran had asked Qatar, Saudi Arabia and Oman to press Trump to use his influence on Israel to push for an immediate ceasefire. In return, Iran would show flexibility in nuclear negotiations, said the two Iranian and three regional sources.

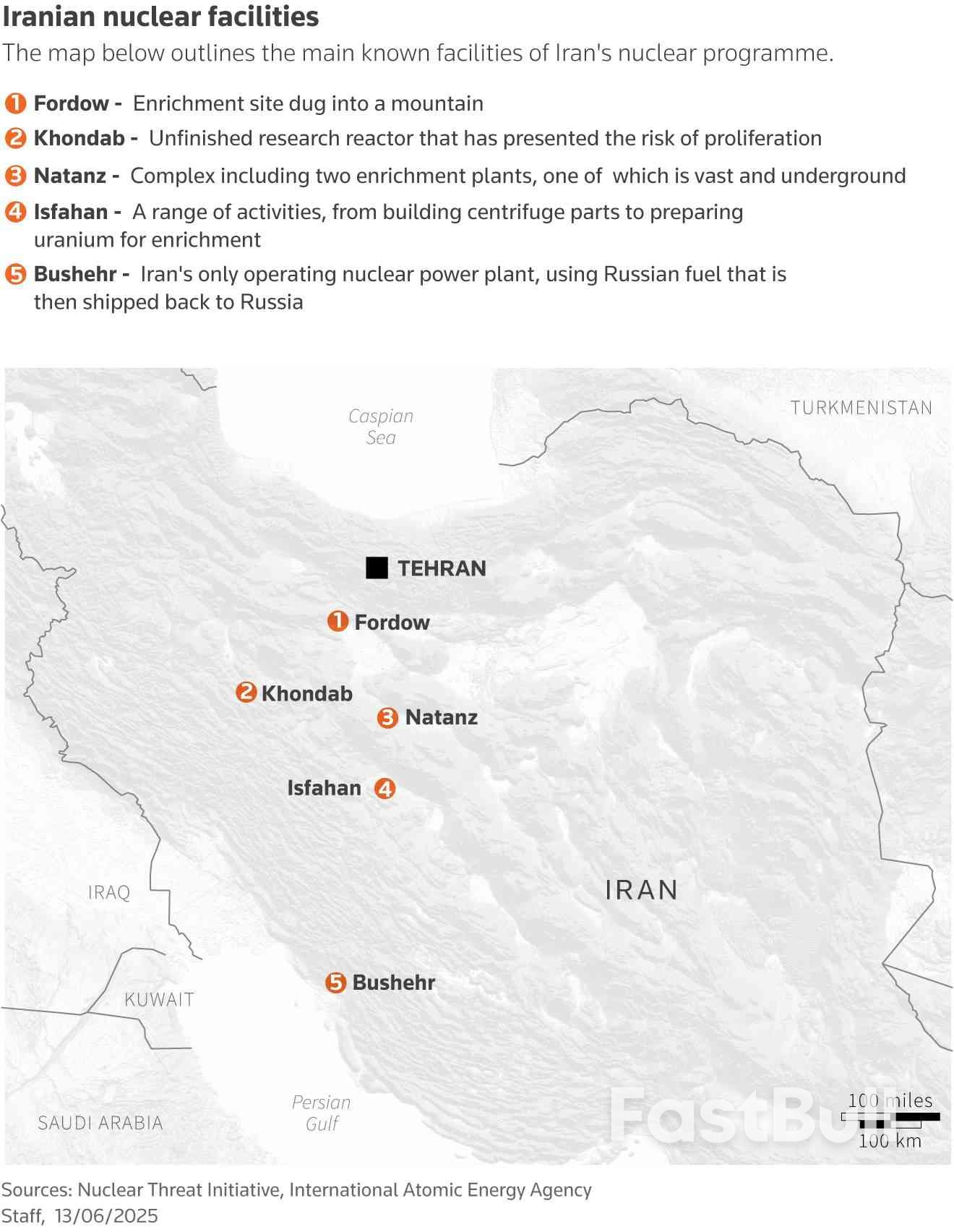

Israeli Prime Minister Benjamin Netanyahu told troops at an air base that Israel was on its way to achieving its two main aims: wiping out Iran's nuclear programme and destroying its missiles.

"We are on the path to victory," he said. "We are telling the citizens of Tehran: ‘Evacuate’ — and we are taking action."

Late on Monday, Israel said it had hit Iran's broadcasting authority, and footage showed a newsreader hurrying from her seat as a blast struck. Iran's State News Agency also reported the strike.

Israel's defence minister said Israel had attacked the broadcaster after the evacuation of local residents.

Meanwhile, Iranian state media reported that Iran was preparing for the "largest and most intense missile attack" yet against Israel.

Israel launched its air war on Friday with a surprise attack that killed nearly the entire top echelon of Iran's military commanders and its leading nuclear scientists. It says it now has control of Iranian airspace and intends to escalate the campaign in coming days.

Tehran's retaliation is the first time in decades of shadow war and proxy conflict that missiles fired from Iran have pierced Israeli defences in significant numbers and killed Israelis in their homes.

Iran says more than 224 Iranians have been killed, most of them civilians. Media published images of wounded children, women, and the elderly from cities across the country.

State TV broadcast scenes of collapsed presidential buildings, burned-out cars, and shattered streets in Tehran. Many residents were trying to flee the capital, describing queues for petrol and bank machines that were out of cash.

"I am desperate. My two children are scared and cannot sleep at night because of the sound of air defence and attacks, explosions. But we have nowhere to go. We hid under our dining table," Gholamreza Mohammadi, 48, a civil servant, told Reuters by phone from Tehran.

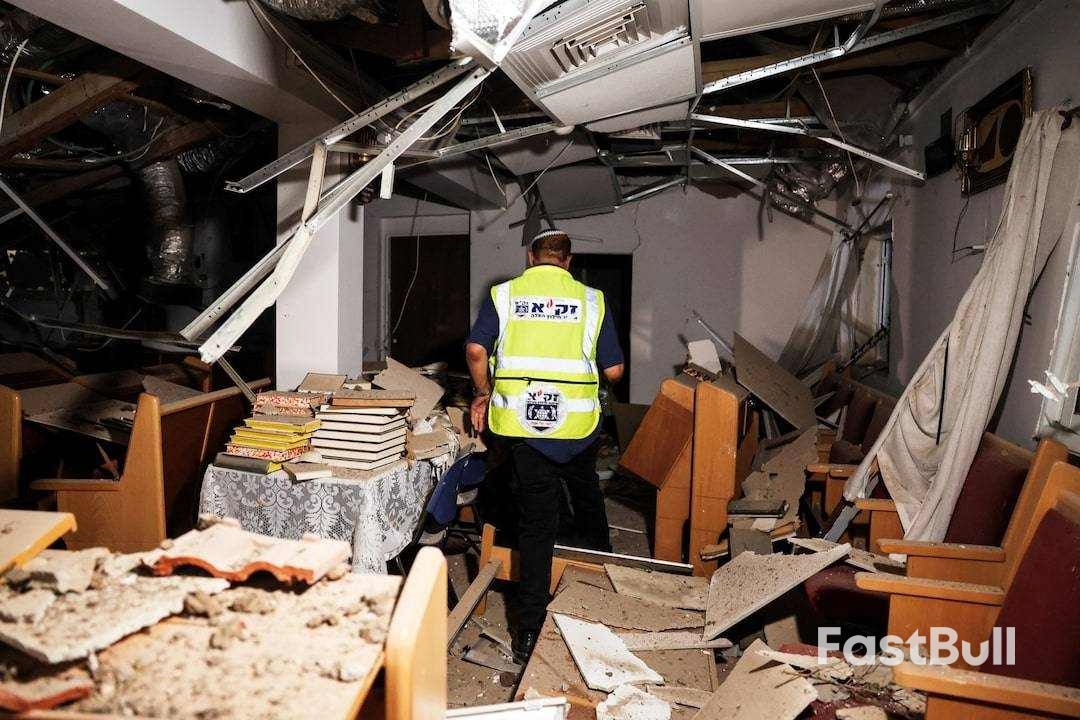

In Israel, 24 people have been killed so far in Iran's missile attacks, all of them civilians. Round-the-clock television images showed rescuers working in ruins of flattened homes.

[1/17]A drone photo shows the damage over residential homes and a school at the impact site following a missile attack from Iran on Israel, in Bnei Brak, Israel June 16, 2025. REUTERS/Chen Kalifa Purchase Licensing Rights, opens new tab

"It's terrifying because it's so unknown," said Guydo Tetelbaum, 31, a chef in Tel Aviv who was in his apartment when the alerts came in shortly after 4 a.m. (0100 GMT). He tried to reach a shelter but his door was blown in.

Trump has consistently said the Israeli assault could end quickly if Iran agrees to U.S. demands that it accept strict curbs to its nuclear programme.

Talks between the United States and Iran, hosted by Oman, had been scheduled for Sunday but were scrapped, with Tehran saying it could not negotiate while under attack.

On Monday, Iranian lawmakers floated the idea of quitting the nuclear non-proliferation treaty, a move bound to be seen as a setback for any negotiations.

'TEHRAN WILL PAY THE PRICE'

Before dawn on Monday, Iranian missiles struck Tel Aviv and Haifa, killing at least eight people and destroying homes. Israeli authorities said seven of the missiles fired overnight had landed in Israel. At least 100 people were wounded.

Iran's Revolutionary Guards said the latest attack employed a new method that caused Israel's multi-layered defence systems to target each other so missiles could get through.

"The arrogant dictator of Tehran has become a cowardly murderer who targets the civilian home front in Israel to deter the IDF," Israeli Defence Minister Israel Katz said.

"The residents of Tehran will pay the price, and soon."

Global oil prices shot up on Friday at the prospect of conflict disrupting supplies from the Gulf. Prices eased on Monday, suggesting traders think exports could be spared despite Israeli attacks that hit domestic Iranian oil and gas targets.

The sudden killing of so many Iranian military commanders and the apparent loss of control of airspace could prove to be the biggest test of the stability of Iran's system of clerical rule since the 1979 Islamic Revolution.

Iran's network of regional allies who could once have been expected to rain rockets on Israel - Hamas in Gaza and Hezbollah in Lebanon - have been decimated by Israeli forces since the start of the Gaza war.

Netanyahu has said that, while toppling the Iranian government is not Israel's primary aim, it believes that could be the outcome.

Iran's currency has lost at least 10% of its value against the U.S. dollar since the start of Israel's attack.

Art teacher Arshia, 29, told Reuters his family was leaving Tehran for the town of Damavand, around 50 km (30 miles) to the east, until the conflict was over.

"My parents are scared. Every night there are attacks. No air raid sirens, and no shelters to go to. Why are we paying the price for the Islamic Republic's hostile policies?" said Arshia, who withheld his surname for fear of reprisal from authorities.

the main known facilities of Iran's nuclear programme.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up