Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The USMCA pact binding the U.S., Mexico and Canada to tariff-free trade is in fresh jeopardy ahead of a 2026 review.

The Trump administration is signaling that it could withdraw entirely and renegotiate large parts of an existing trade accord with the Canada and Mexico next year, underscoring its volatile approach even among trusted trade partners.

In an interview with Politico, U.S. Trade Ambassador Jamieson Greer floated the possibility of the U.S. exiting the U.S.-Canada-Mexico trade agreement that Trump negotiated in his first term. The three countries are set to enter fresh talks in July to update the agreement, if necessary.

Trump, though, might take a wrecking ball to the entire trade deal in pursuit of something he perceives as fairer.

"The president's view is he only wants deals that are a good deal," Greer said. "The reason why we built a review period into USMCA was in case we needed to revise it, review it or exit it."

Greer added that the Trump administration might simply split the agreement in two and negotiate with Mexico and Canada separately.

Trump blew up trade talks with Canada in October over a Canadian TV ad that borrowed from President Ronald Reagan to criticize his signature tariffs. Those discussions have been paused ever since, and Canadian Prime Minister Mark Carney has expressed no rush on his end to revive the talks.

"Our relationship with the Canadian economy is totally different than our relationship with the Mexican economy," Greer told Politico. "I mean, the labor situation is different. The stuff that's being made is different. The export and import profile is different. It actually doesn't make a ton of economic sense why we would marry those three together."

The USMCA represents the biggest trade achievement for Trump in his first term. In 2020, it replaced the North American Free Trade Agreement that he relentlessly attacked first as a 2016 presidential candidate and later on as president.

It enabled $1.8 trillion in cross-border, tariff-free trade from the U.S. to Mexico and Canada in 2022, according to government data. Much of U.S. exports to both countries consisted of services exports including professional and financial services.

The U.S. has kept 50% tariffs on Canadian steel and aluminum in tandem with a 25% tariff on Canadian imports. By comparison, Mexico has largely been spared from Trump's tariffs, with the bulk of its goods still entering the U.S. duty-free since they comply with U.S. origin rules under the USMCA agreement.

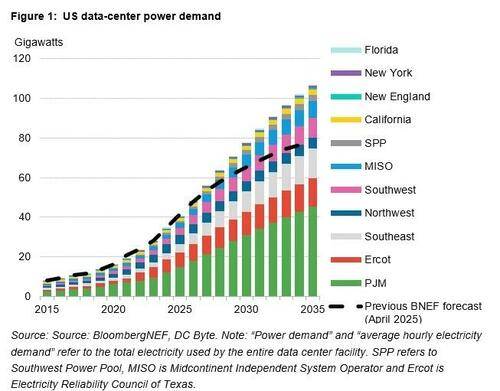

BNEF's report comes as some energy industry analysts and executives warn that an artificial intelligence bubble or speculative data center proposals could be fueling excessive load growth projections.

A report from Grid Strategies released last month said utility forecasts of 90 GW additional data center load by 2030 were likely overstated; market analysis indicates load growth in that time frame is likely closer to 65 GW, it said.

A July report from the Department of Energy estimated an additional 100 GW of new peak capacity is needed by 2030, of which 50 GW is attributable to data centers. Those facilities could account for as much as 12% of peak demand by 2028, according to Lawrence Berkeley National Laboratory.

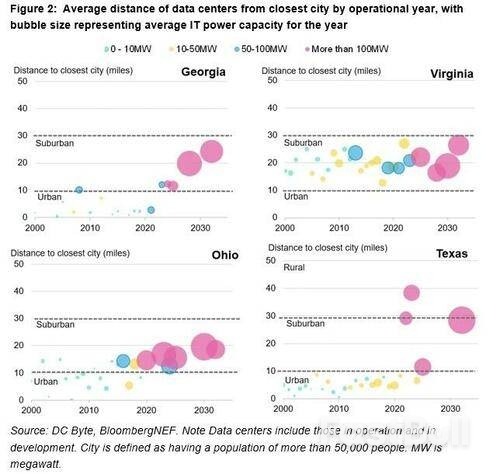

BNEF's data center project tracker shows the industry diversifying beyond traditional data center hubs like Northern Virginia, metro Atlanta and central Ohio into exurban and rural regions served by existing fiber-optic trunk lines for data traffic.

A map of under-construction, committed and early-stage projects shows gigawatts of planned data center capacity spreading south through Virginia and the Carolinas, up through eastern Pennsylvania and outward from Chicago along the Lake Michigan shore. More data centers are also planned for Texas and the Gulf Coast states.

Much of the capacity is poised to materialize on grids overseen by the PJM Interconnection, the Midcontinent Independent System Operator and the Electric Reliability Council of Texas. BNEF predicts PJM alone could add 31 GW of data center load over the next five years, about 3 GW more than expected capacity additions from new generation.

With the expected surge, the North American Electric Reliability Corp. warned late last year of "elevated risk" of summer electricity shortfalls this year, in 2026 and onward in all three regions.

Some experts disputed NERC's methodology, however. MISO's independent market monitor said in June that the group's analysis was flawed and that MISO was in a better position than grid regions not expected to see exponential data center growth, like ISO New England and the New York Independent System Operator.

Other technology and energy system analysts expect a significant amount of proposed data center capacity to dissipate in the coming years due to chip shortages, duplicative permit requests and other factors.

In July, London Economics International said in a report prepared for the Southern Environmental Law Center that meeting projections for U.S. data center load in 2030 would require 90% of global chip supply — a scenario it called "unrealistic."

Patricia Taylor, director of policy and research at the American Public Power Association, told Utility Dive earlier this year that it's common for data center developers to "shop around" the same project across neighboring jurisdictions.

Still, U.S. grid operators face an "inflection moment" as they balance the desire to accommodate large-scale data centers with the obligation to ensure reliable service for all customers, BNEF said.

Last week, Bitcoin (BTC) rose nearly fifteen percent to over $93,000. However, this recovery didn't last. BTC experienced heavy selling on Monday, falling to $84,000, marking a rough start to both the week and December, the last month of the year.

However, this selling wave was short-lived. Bitcoin and altcoins quickly recovered after two days of declines.

As BTC surged back above $93,000, these sudden price swings have divided the market. Some analysts say the decline could continue, while others argue that Bitcoin is holding onto a strong support area and a bottom is near.

At this point, Bitfinex analysts also took the side that argued that the bottom was near.

Bitfinex argued in its weekly Alpha report that the Bitcoin price is showing signs of bottoming out.

The exchange pointed to several indicators, including excessive deleveraging, capitulation by short-term holders, and seller exhaustion, where selling pressure is rapidly diminishing, suggesting that Bitcoin is very close to the cycle bottom.

"The recent recovery aligns with our previous view that the market is approaching a local bottom in terms of time, although we don't yet know if we've seen a bottom in terms of price."

According to Bitfinex analysts, these factors suggest that the Bitcoin price has entered a stabilization phase, creating the necessary conditions for a sustained recovery in the short term.

While Bitfinex analysts stated that there are many indicators pointing to a bottom in Bitcoin, one analyst said that it is too early to say that Bitcoin has reached the bottom.

It's Too Early to Talk About a Bottom in Bitcoin!

Cryptocurrency analyst Ted Pillows argued in his latest analysis that it is too early to confirm a bottom has formed for Bitcoin because the asset has not yet established clear support.

Pillows noted that his bottom predictions were weakened as BTC failed to hold key support levels like $100,000, $95,000, and $90,000 and easily fell below them.

Stating that BTC is currently stuck at the $93,000-$94,000 level and cannot create a stable support, the analyst said that an upward break of this level again would open the door to $100,000.

On the other hand, a rejection from this level could push Bitcoin back below the $90,000 level.

Saudi Arabia cut the price of its main crude grade to Asia to the lowest level in five years, amid persistent signs of a surplus in global oil markets.

State producer Saudi Aramco will reduce the price of its flagship Arab Light crude grade to a 60 cents premium to the regional benchmark for January, according to a price list seen by Bloomberg. That's the lowest since January 2021. The cut was fractionally bigger than an expected 30 cents a barrel reduction, according to a survey of refiners and traders.

The Organization of the Petroleum Exporting Countries and its allies affirmed over the weekend a previous decision to pause production increases in the first quarter of next year. They will then consider resuming a program to roll back output quotas as the group seeks to reclaim market share. OPEC+ is eyeing weaker seasonal demand during winter months across much of Asia, Europe and North America.

Crude prices are down about 16% this year as booming supply from the Americas in tandem with hikes from the OPEC+ grouping itself exceeded subdued demand growth. The International Energy Agency has predicted a record glut in 2026, while Wall Street banks including Goldman Sachs Group Inc. see futures heading lower. Oil markets have also had to navigate the impacts of global trade disputes, wars and sanctions through this year.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up