Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Trump prefers straight tariff over complex negotiations.US clinched big trade deals with EU, Japan already.Now letters going out to smaller countries with firm tariff rate.

PresidentDonald Trumpsaid on Monday most trading partners that do not negotiate separate trade deals would soon face tariffs of 15% to 20% on their exports to the United States, well above the broad 10%tariffhe imposed in April.

Trump told reporters his administration will notify some 200 countries soon of their new "world tariff" rate.

"I would say it'll be somewhere in the 15 to 20% range," Trump told reporters, sitting alongside British Prime Minister Keir Starmer at his luxury golf resort in Turnberry, Scotland. "Probably one of those two numbers."

Trump, who has vowed to end decades of U.S. trade deficits by imposing tariffs on nearly all trading partners, has already announced higher rates of up to 50% on some countries, including Brazil, starting on Friday.

The announcements have spurred feverish negotiations by a host of countries seeking lower tariff rates, including India, Pakistan, Canada, and Thailand, among others.

The U.S. president on Sunday clinched a huge trade deal with the European Union that includes a 15% tariff on most EU goods, $600 billion of investments in the U.S. by European firms, and $750 billion in energy purchases over the next three years.

That followed a $550-billion deal with Japan last week and smaller agreements with Britain, Indonesia, and Vietnam. Other talks are ongoing, including with India, but prospects have dimmed for many more agreements before Friday, Trump's deadline for deals before higher rates take effect.

Trump has repeatedly said he favors straightforward tariff rates over complex negotiations.

"We're going to be setting a tariff for essentially, the rest of the world," he said again on Monday. "And that's what they're going to pay if they want to do business in the United States. Because you can't sit down and make 200 deals."

Canadian Prime Minister Mark Carney said on Monday trade talks with the U.S. were at an intense phase, conceding that his country was still hoping to walk away with a tariff rate below the 35% announced by Trump on some Canadian imports.

Carney conceded this month that Canada - which sends 75% of its exports to the United States - would likely have to accept some tariffs.

Wall Street equities rose slightly while European stock indexes turned lower and the euro took a tumble on Monday as investors greeted a trade agreement between the U.S. and European Union with cautious relief at the start of an action-packed week for markets.

The weekend's framework trade deal, which European Commission President Ursula von der Leyen described as the best the bloc could get, will impose a 15% import tariff on most EU goods and see the EU spend $600 billion on U.S. investments while opening up some important parts of its market.

While the accord may avert a damaging standoff between the trading partners, which account for almost a third of global trade, some European capitals complained it was lopsided in favor of Washington.

Monday's modest equity reaction followed a series of record highs for the S&P 500 and Nasdaq, thanks to solid quarterly earnings so far, bets on megacaps and artificial intelligence stocks as well as optimism that the U.S. would ultimately reach agreements with its trading partners.

The removal of uncertainty for the U.S.-EU relationship was a relief for investors, according to Phil Orlando, chief market strategist at Federated Hermes, who saw the 15% tariff as a lot better than "some of the ridiculous numbers that were being thrown around back in the first week in April."

"You've got some certainty going forward, and you've got numbers that seem reasonable," said Orlando, while noting that Monday's modest reaction made sense after recent gains and ahead of a big week for economic releases, major earnings reports and a U.S. Federal Reserve meeting.

Orlando said that at this point he would not be "throwing massive amounts of money" into a market where the S&P 500 has risen 32% since its April lows.

"Our view is that you need to be patient. You absolutely could have a little bit of a hiccup here, consolidation and some digestion. We still think the market is going to work higher, longer term," he said.

This week traders are waiting for interest rate decisions from the U.S. Federal Reserve and the Bank of Japan, the monthly U.S. non-farm payrolls report, and earnings from megacap companies Apple (AAPL.O), Microsoft (MSFT.O), and Amazon (AMZN.O).

The Fed has been cautious on any rate cuts as officials have said they want to determine the impact of tariffs on inflation before they ease rates further. But the Fed's stance has led to tensions with the White House with President Donald Trump repeatedly lashing out at Fed Chair Jerome Powell for not cutting rates.

On Wall Street at 11:03 a.m. the Dow Jones Industrial Average (.DJI), fell 8.27 points, or 0.02%, to 44,894.24, the S&P 500 (.SPX), rose 4.91 points, or 0.08%, to 6,393.48 and the Nasdaq Composite (.IXIC), rose 62.76 points, or 0.30%, to 21,170.54.

MSCI's gauge of stocks across the globe (.MIWD00000PUS), fell 1.79 points, or 0.19%, to 939.47.The pan-European STOXX 600 (.STOXX), index fell 0.27%, while Europe's broad FTSEurofirst 300 index (.FTEU3), fell 5.16 points, or 0.24%

And meanwhile, other countries are still scrambling to make deals ahead of Trump's August 1 deadline. Europe's deal follows U.S. pacts with Japan, Indonesia and the Philippines made last week. But talks between the U.S. and China in Stockholm on Monday are expected to lead to the two sides extending their trade truce for another 90 days.

In currencies, the dollar rose against major currencies after the weekend's trade pact, with investors also looking to this week's U.S. and Japanese central bank meetings.

The dollar index , which measures the greenback against a basket of currencies including the yen and the euro, rose 0.75% to 98.33.The euro was down 0.92% at $1.1632 while against the Japanese yen , the dollar strengthened 0.43% to 148.3.

Apolline Menut at fund manager Carmignac meanwhile called it a win for the U.S., given the forced purchases of U.S. energy and military equipment and zero tariff retaliation by Europe.

"This isn’t a trade breakthrough - it’s damage control for the sake of diplomatic pragmatism," she said. "The economic cost may sting, but the strategic calculus is brutally rational."

In Treasuries, the yield on benchmark U.S. 10-year notes rose 2.6 basis points to 4.412%, from 4.386% late on Friday while the 30-year bond yield rose 2.4 basis points to 4.9533%.

The 2-year note yield, which typically moves in step with interest rate expectations for the Federal Reserve, rose 1.7 basis points to 3.934%, from 3.917% late on Friday.

In energy markets, oil prices rose after the U.S.-EU deal and Trump's announcement he would set for Russia to end its war in Ukraine or face severe tariffs.

U.S. crude rose 1.86% to $66.36 a barrel and Brent rose to $69.68 per barrel, up 1.81% on the day.

In precious metals, gold fell to a near three-week low as the trade accord lifted the dollar and risk sentiment, while investors awaited fresh cues on rate policy from this week's Federal Reserve meeting.

Spot gold fell 0.83% to $3,308.34 an ounce. U.S. gold futures fell 0.25% to $3,325.50 an ounce.

US and Chinese trade negotiators are meeting this week for at least two days of trade talks as most of the immediate term focus — at least from markets — remains on whether recent de-escalatory signals between the two superpowers will translate into a further delay of punishing additional tariffs.

Trump officials also hope this third gathering of the trade teams in recent months will provide an opportunity to pivot to longer-term issues even as a short-term deadline of Aug. 12 remains front of mind.

The talks are being closely watched for whether they move the countries toward a face-to-face later this year between Presidents Trump and Xi Jinping as well as whether negotiators can solidify recent gains, such as a lessening of tensions around semiconductors and rare earth minerals.

"We have a good relationship with China," President Trump said Monday just after his team stepped into the talks.

He signaled his focus could be on market access, saying "I'd love to see China open up their country."

Chinese state media also confirmed Monday that talks were underway at the Rosenbad building in Stockholm without providing additional details.

The talks come during another crucial week for Trump's trade agenda, with a separate deadline looming this Friday for other countries to strike a deal after a pact was announced with the European Union Sunday setting 15% tariffs. Other major trading partners from Canada to South Korea are still in talks.

Yet the recent momentum on trade for Trump could have a limited impact on the more complex talks with China.

Zoe Liu, a senior fellow at the Council on Foreign Relations, noted on Yahoo Finance Monday morning that she does not think "the EU's model is going to be a good template for U.S.China negotiation" — pointing to how China has already proved a willingness to retaliate and that the country has key points of leverage and "knows exactly where to hit back."

Terry Haines, Pangaea Policy Founder, added that potential carrots from China could also have less impact.

He noted how foreign investment has been a key piece of recent deals — both with Europe and another pact with Japan — but that in the China context "they don't want Chinese investment in a lot of areas" — citing an effort to remove the influence of Chinese money in areas ranging from social media app TikTok to land purchases in the US.

Overall talks seen as 'going in the right direction'

The China talks are being led on the US side by Treasury Secretary Scott Bessent with He Lifeng, the China's vice premier for economic policy, representing his country

The STOXX 600 posted its best first-quarter relative to the S&P 500 in a decade - but is now clocking an 8.4% gain in 2025, just a touch ahead of the S&P 500's 8.2% rise.

The European Union over the weekend reached a framework deal with the U.S. for tariffs of 15%. But optimism has been building for some time that the two sides would avert a damaging trade war and the data points to an economy that is holding up for now. Investors are warming to four key themes at play under the surface of the European stock market.

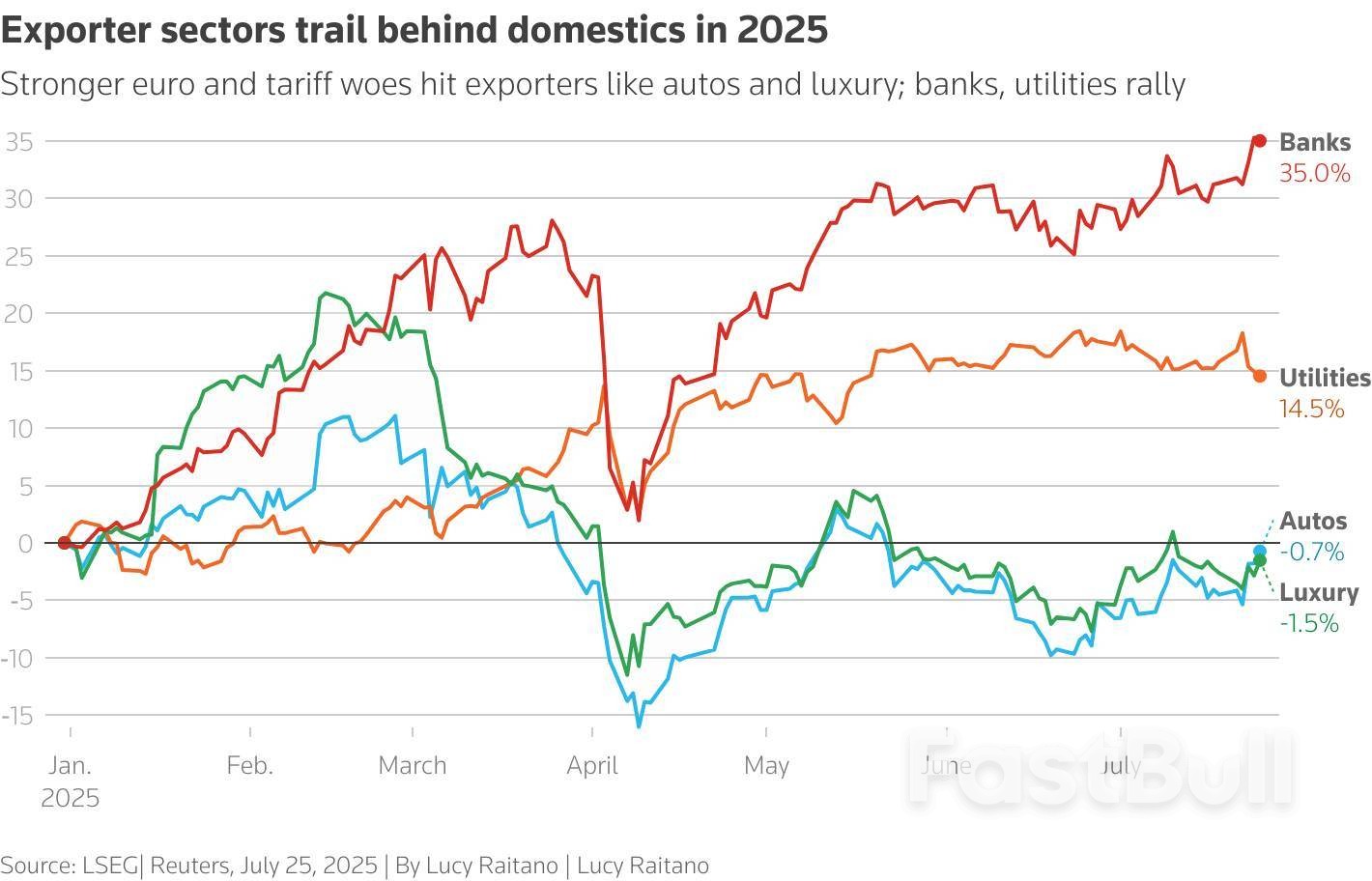

1) EXPORTERS LAG DOMESTIC-FOCUSED STOCKS

A performance gap has emerged between euro zone domestic-focused stocks and exporters, all thanks to a stronger euro, which has risen 13.4% versus the dollar in 2025 , hurting exporter earnings.

Trade-sensitive sectors like autos and consumer durables have fallen behind, while domestically-oriented stocks like banks and utilities have soared.

A STOXX autos basket , opens new tab added over 3% last week after news of a U.S.-Japan trade deal, but is still about 1% lower in 2025, a stark contrast to a 35% increase in bank stocks, opens new tab and 15% surge in utilities.

Line chart showing the year-to-date performance of autos, luxury, utilities and bank stocks in Europe

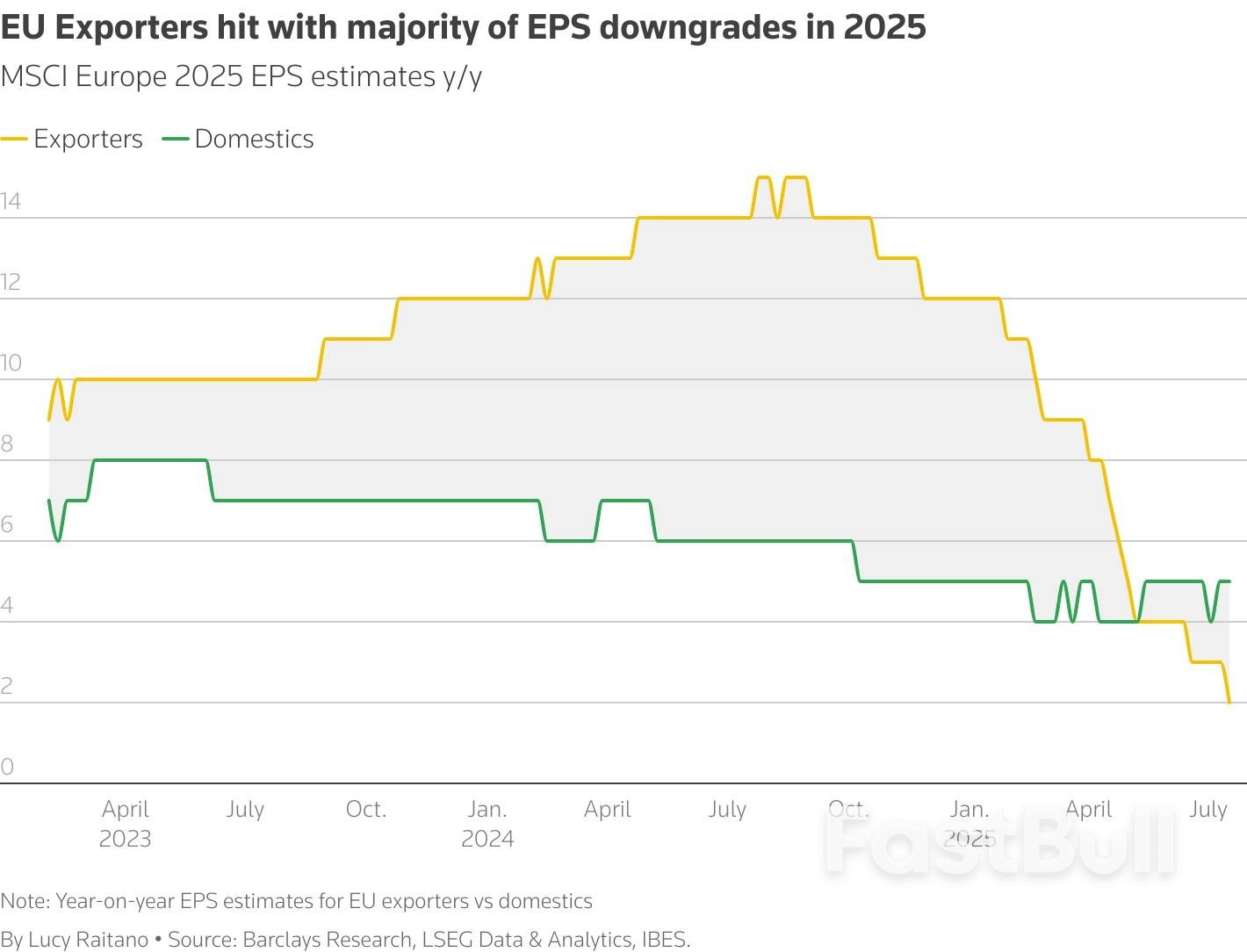

Analysts have been revising down overall 2025 earnings forecasts in Europe, but zooming in, there is a clear split between the pace of earnings revisions for euro zone exporters versus domestic plays, with the forward EPS of exporters dropping at an accelerated pace.JPMorgan equity strategists advise clients to keep favouring domestics over exporters in their non-U.S. portfolios, while Barclays equity strategists say the current positioning gap is so extreme that the risk of a reversal is rising.

Line chart shows year-on-year EPS estimates revisions for both EU exporters versus EU domestics, with exporters showing a more dramatic drop in 2025 versus domestics

Helen Jewell, CIO of BlackRock Fundamental Equities EMEA, flagged select opportunities in the export-focused luxury and semiconductor sectors.

"If we get some resolution of where the tariffs are and if we get some sort of levelling out of the dollar, I think these names will start to perform well, and that could potentially be the second leg for the European story,” Jewell said.

2) HALO EFFECT

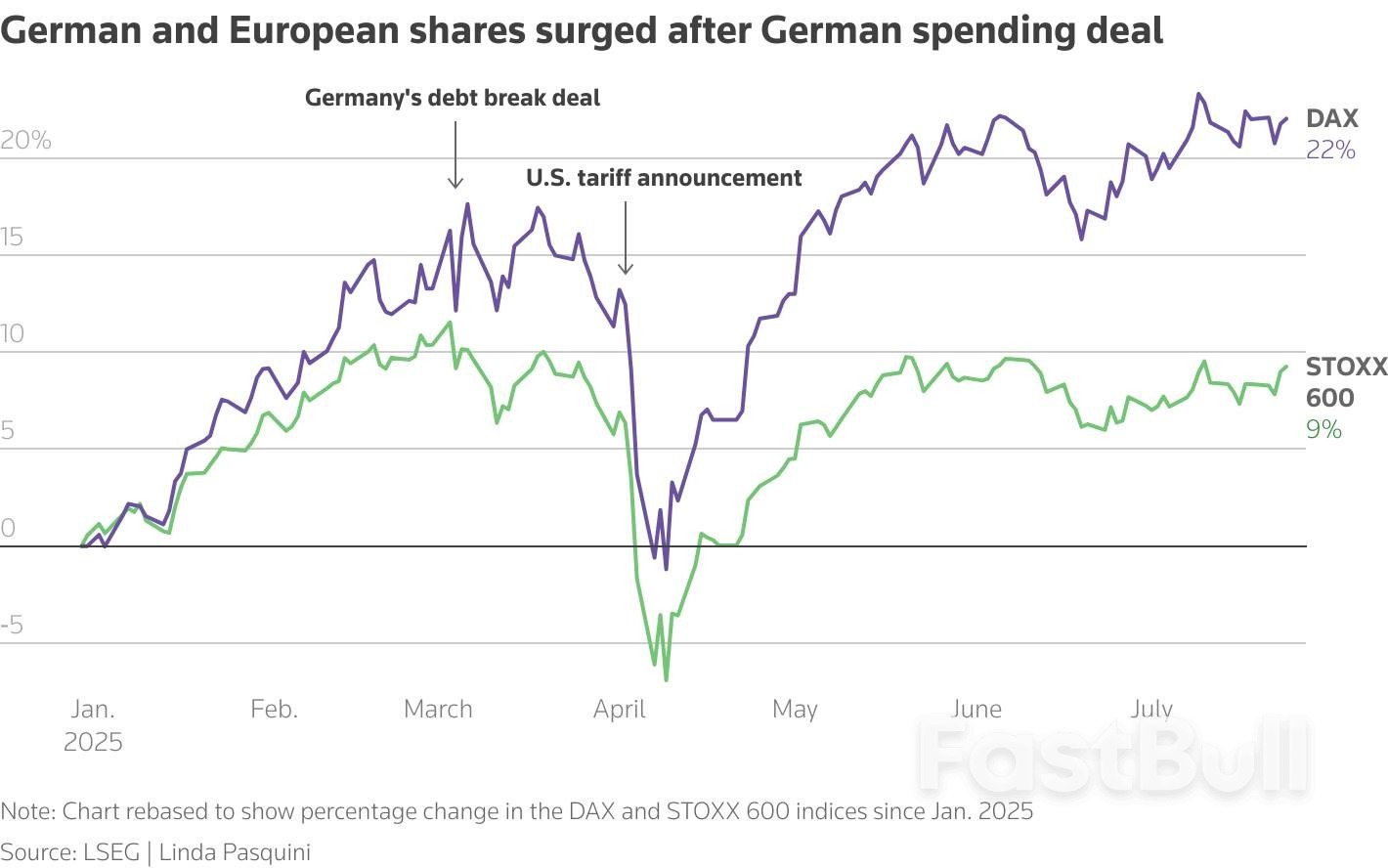

Germany's massive spending plans, aimed at boosting the country's economy after decades of fiscal conservatism, brought optimism to broader European markets, as EU companies are set to benefit from increased spending on defense and infrastructure.The U.S. tariff announcement in April caused a massive stock sell-off, but the German DAX , has since recovered to touch a fresh year high in July. Midcap stocks , have followed a similar path. Both indexes are up over 20% this year and set for their strongest annual performance since 2019.

"The relevance of Germany as a market for EU countries is great," Uwe Hohmann, equity strategist at Metzler Capital Markets said, pointing to the country's strong trade relationship with other EU states.Germany's spending plans will have a modest effect on European growth, according to the European Commission's spring economic forecasts, but the market impact is expected to be profound.

"...the optimism around the German fiscal balance will still be the main driver of European markets in the next years," said Nabil Milali, portfolio manager at Edmond de Rothschild Asset Management, warning however that money will not concretely flow into the economy until 2026 at least.A potential deterioration in trade relationships with the U.S. or China could dampen sentiment on European equity markets, at least in the short term.

"It would then only and mostly solely depend on what's going on in the German political arena, which is, I think, probably not good enough on a standalone basis to support an overall positive trend," said Hohmann.

Chart shows percentage change in the DAX and STOXX 600 indices since Jan. 2025

3) SMALL CAPS STEAL THE SPOTLIGHT

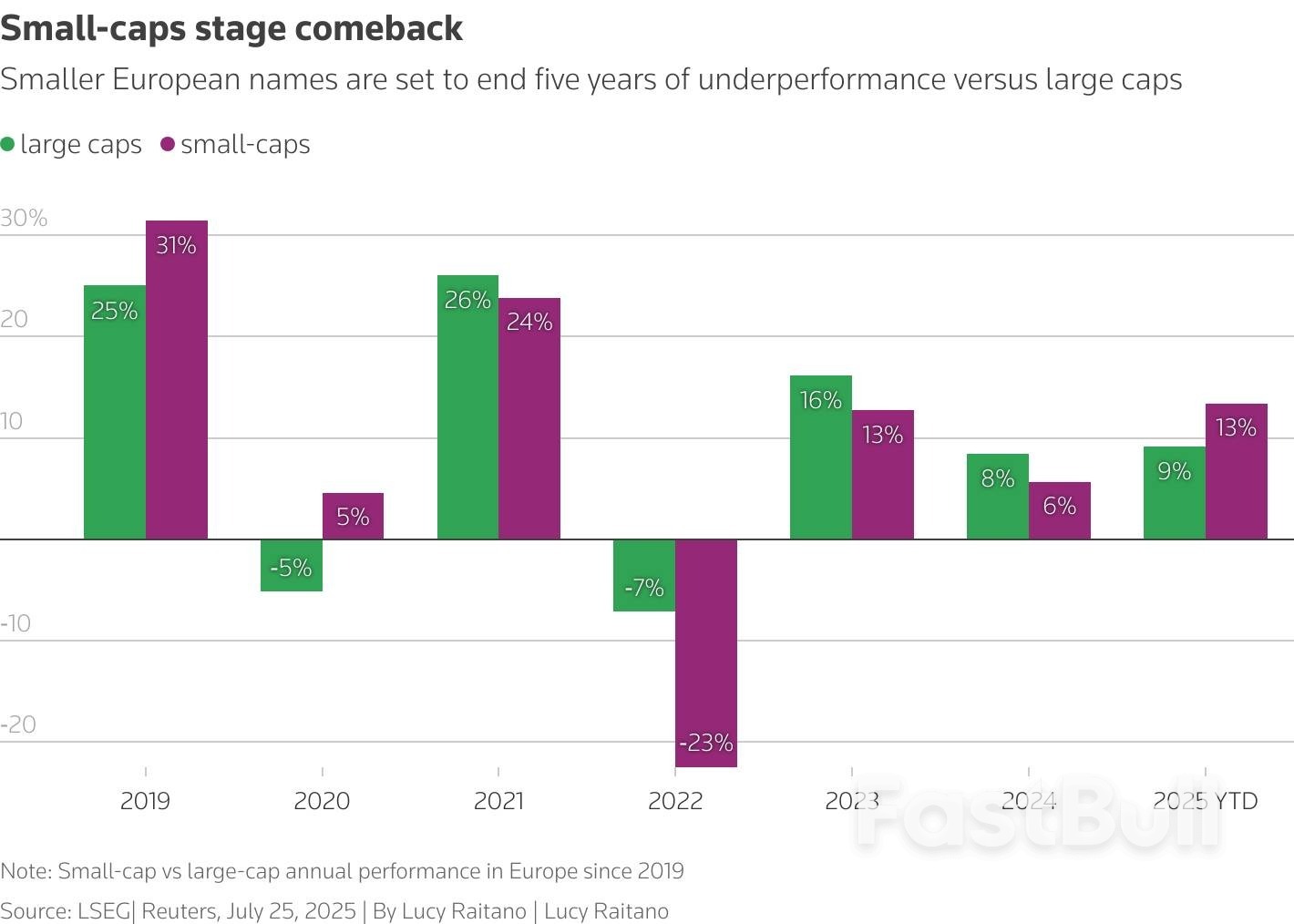

European small-caps are on track to outperform large-caps in Europe for the first time since 2020.

A basket of European small caps, opens new tab is up 13.4% in 2025, outperforming its large cap counterpart , opens new tab which is up 9.1%, for the first time since 2020. Since April, Graham Secker, head of equity strategy, Pictet Wealth Management said a stronger euro and better economic outlook have driven the small-cap turnaround."European small-caps were the proverbial value-trap: you're cheap but you stay cheap until something changes," said Secker, adding that in illiquid areas of the market, it doesn't take much to move the dial."There has been a lot of interest with the fiscal stimulus announcement out of Germany for revisiting German mid- and small-caps, as probably the cleanest way to play the fiscal push that's coming through Europe," Secker said.

Bar chart comparing the annual performance of European small cap stocks versus large cap stocks, with small caps posting their first outperformance vs larger ones since 2019

4) SMALLER MARKETS ALSO PACK A PUNCH

Talking size, some smaller markets have also been outperforming the wider European landscape this year.

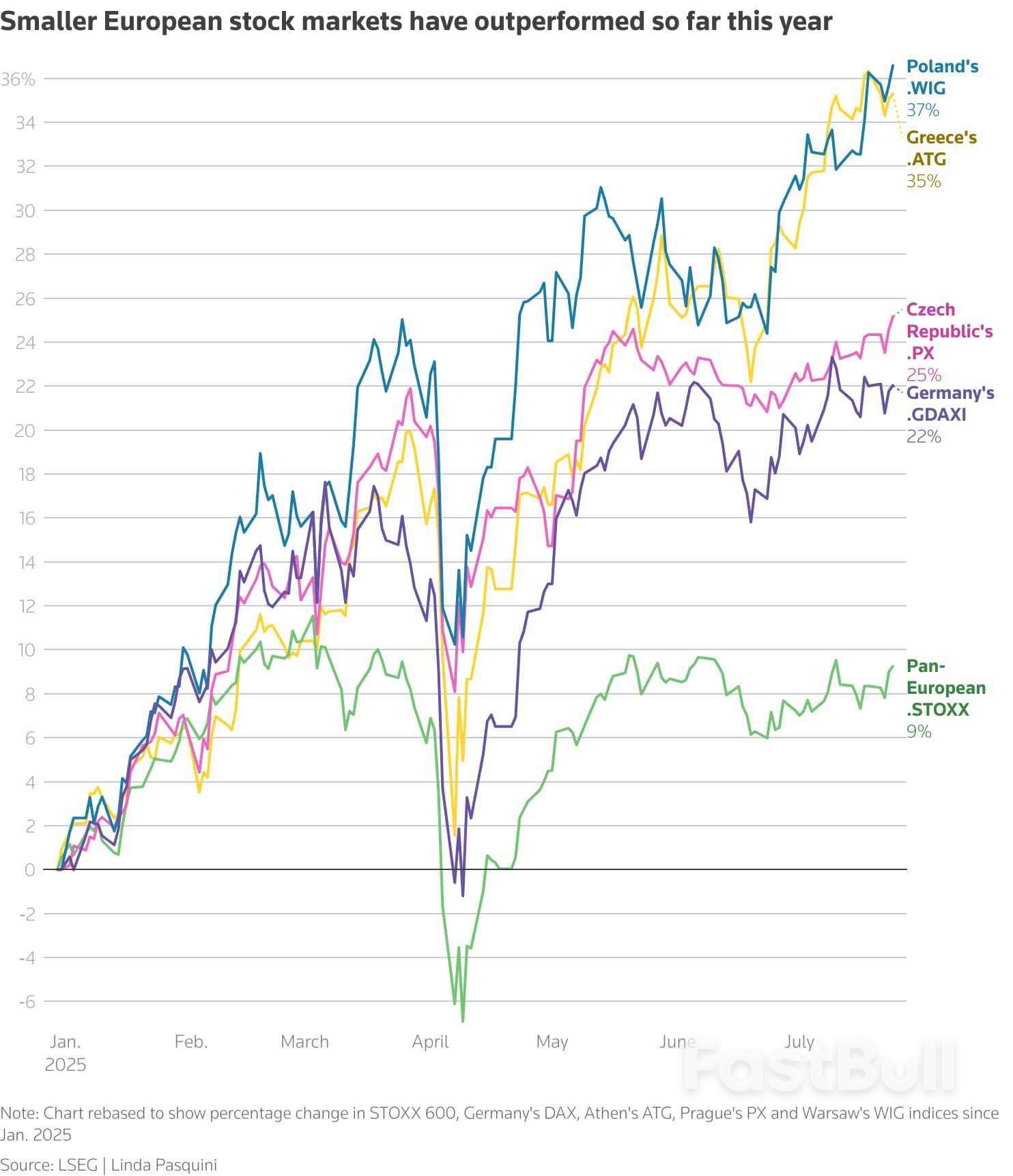

Indexes in Czech Republic opens new tab, Greece, opens new tab and Poland , opens new tab have added 25%, 35% and 37%, respectively, compared with an 8% rise in the STOXX 600.

"I think the positioning of investors is going more and more towards these smaller markets" which are benefiting from sectorial factors and higher exposure to the domestic economy, said Edmond de Rothschild's Milali.

Chart shows percentage change in STOXX 600, Germany's DAX, Athen's ATG, Prague's PX and Warsaw's WIG indices since Jan. 2025

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up