Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

U.S. President Donald Trump doubled down on his attacks against Republican lawmaker Marjorie Taylor Greene on Sunday, dismissing her claim that his criticism was endangering her and saying he did not believe anyone was targeting her.

U.S. President Donald Trump doubled down on his attacks against Republican lawmaker Marjorie Taylor Greene on Sunday, dismissing her claim that his criticism was endangering her and saying he did not believe anyone was targeting her.

Greene said on Saturday that Trump's online criticism had unleashed a surge of threats directed at her. On Sunday morning, she told CNN that Trump calling her a traitor was the "most hurtful" part of his remarks.

Trump repeated the insult hours later. "Marjorie 'Traitor' Greene," he said, referring to the lawmaker. "I don't think her life is in danger...I don't think anybody cares about her," the president told reporters before boarding Air Force One on Sunday night for a return to Washington, D.C. from his Mar-a-Lago social club in Florida.

Greene, a U.S. House of Representatives member from Georgia who was long known as a Trump loyalist, has recently taken positions at odds with the president. She said on Saturday she has been contacted by private security firms warning about her safety and that harsh attacks against her have previously resulted in death threats.

She attributed her split with the president to her support for releasing records related to the late financier and sex offender Jeffrey Epstein.

Trump has dismissed the furor over the Epstein case as a "hoax" pushed by Democrats, but Greene on Wednesday was one of only four House Republicans who joined Democrats in signing a petition to force a vote on releasing the full Justice Department files related to Epstein.

The dramatic rupture between two longtime allies suggests a deeper fracture within Trump's Republican base and raises questions about the stability of his support on the far right of the ideological spectrum.

Trump broke with Greene on Friday night in a withering social media post in which he referred to Greene as "Wacky" and a "ranting lunatic" who complained he would not take her calls.

He continued his criticism of her with more social media posts over the weekend, calling her a "Lightweight Congresswoman," "Traitor" and a "disgrace" to the Republican Party.

The president also wrote that conservative voters in Greene's district might consider a primary challenger and that he would support the right candidate against her in next year's congressional election.

Despite his attacks on Greene, Trump on Sunday night wrote on social media that "House Republicans should vote to release the Epstein files, because we have nothing to hide ..."

Over the weekend, Trump had persistently pushed back against reporters' questions about releasing the Epstein files. Reflecting his often combative relationship with media, at one point he said "quiet, quiet piggy" in response to a question from a female reporter.

The White House did not respond to requests for comment on the clash between Greene and Trump or his remarks to the reporter.

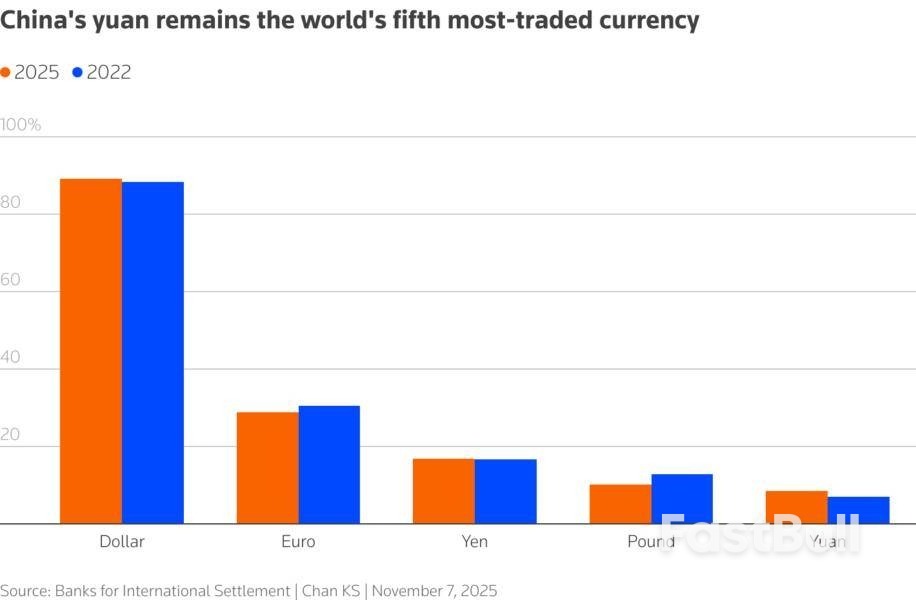

A single word often makes a big difference in Chinese policy. In previous five-year economic development plans, for example, Beijing had always reiterated it wants to "prudently promote" yuan internationalisation. In an outline of the next 2026-2030 blueprint unveiled last month, the word "prudently" has been struck out. That signals bolder designs for the renminbi, though progress will be limited so long as economic planners keep tight control over capital flows.

China's $20 trillion economy may be the second-largest in the world, but its currency was only the fifth most-traded last year, according to a September report from the Bank of International Settlements. Still, thanks to incremental policies, including currency swap deals with other central banks, the yuan now makes up 8.5% of global currency transactions, up from 7% in 2022.

For Beijing, trade settlement will probably be the next area of focus, given China's 15% share of $33 trillion of global trade by value. Notably, as part of a broader contract dispute, China's steel industry has stopped purchasing dollar-denominated iron ore from Australia's BHPsince October, according to Chinese media, citing sources, and has insisted the mining giant settle 30% of transactions in yuan going forward. Separately, Dutch chipmaker Nexperia's Chinese unit has demanded all transactions be settled in yuan, Reuters reported, citing sources, after The Hague seized control of the company's Netherlands-based parent in September, sparking a broader standoff.

These moves can have an immediate impact. Up to 12.4 trillion yuan ($1.7 trillion) of trade with China was paid in local currency last year, about 27% of the total, according to the country's central bank's yuan internationalisation report published last week. Settling 30% of imports from BHP can add another $39 billion worth of yuan-denominated transactions annually. And using renminbi will appeal to countries that want to reduce their reliance on the U.S. dollar. That includes Brazil and Russia, which exported $31 billion of soybeans and $50 billion of crude oil, respectively, to the People's Republic last year.

Chinese planners have long insisted that their plan is not to replace the greenback with a "redback". And it's unlikely they will allow the country's currency to flow freely across its borders. Still, Beijing's trade clout can help it chip away at the dollar's dominance.

Commodity news portal SteelOrbis reported on October 11 that BHP has agreed with China Mineral Resources Group to switch to yuan settlements for 30% of its spot ore trade with China, citing sources.

Separately, Dutch chipmaker Nexperia's Chinese unit has resumed supplying semiconductors to local distributors, but all sales to distributors must now be settled in yuan, Reuters reported on October 23, citing two people briefed on the matter.

A legal logjam stemming from India's slow-moving judiciary and complex tax system has locked up trillions of rupees within the South Asian nation's system of commercial tribunals, pressuring business cashflow and investment decisions.

A recent report by the think tank Daksh found that 24.72 trillion rupees ($279 billion) of business transactions remain locked in tax and other disputes in commercial tribunals across the country. These disputes include insolvency cases, debt recovery by banks and financial institutions, corporate litigation and discrepancies over the Goods and Services Tax.

A lack of technical expertise and a chronic shortage of judges have created a backlog at tribunals equivalent to 7.5% of the country's 330.68 trillion rupee gross domestic product in the fiscal year through March this year, warned Daksh, an independent research institute focused on judicial reform based in Bengaluru.

The report, published in September, highlighted that a mere 350 tribunal members are charged with handling over 356,000 pending cases involving business disputes.

"The complexities in the system allow for inefficiency, a lack of the right people and the absence of technology," Surya Prakash, one of the authors of the report, told Nikkei Asia.

Because of the inefficiency and sluggish resolutions, powerful people can exploit the system -- for example by lodging cases against competitors that are costly to defend.

"Those who have money get what they want," Prakash said. "To put it bluntly, it's a den of corruption."

According to the report, which examined 10 key commercial tribunals adjudicating disputes related to tax, customs, company law and the electricity and telecom sectors, some tribunals have introduced limited online filing and digital hearings, but most remain burdened by red tape, overlapping mandates and a lack of specialized knowledge among adjudicators.

Tribunal members are often retired judges or civil servants who are unfamiliar with the complex financial, technical or tax issues they must decide on.

The tribunals were intended to ease the burden on regular courts and offer faster resolution. Many of these quasi-judicial bodies, such as the commercial tribunal, operate under the federal government and so are much more easily influenced by the state than the broader judicial system.

"The main problem is the [commercial] judicial system. Right from the inception to operations to dispute resolution in any business, every step is touched by the judicial system in India. Hence, reforms need to start here," said Prakash.

The state of the insolvency system is directly linked to the health of the financial sector, a key engine of growth, said Sumant Batra, a veteran insolvency lawyer and former president of INSOL International, a global association of accountants and lawyers specializing in insolvency.

"Delays in deciding insolvency cases under the IBC (Insolvency and Bankruptcy Code) by the NCLT (National Company Law Tribunal) have been a matter of concern," Batra said. "A distressed asset has a life cycle. Its value gradually declines with time if distress is not addressed in a timely manner. Delays in the resolution of stressed assets have a direct bearing on the ... outcomes of the economy in general and the stakeholders in particular."

According to Daksh, nearly half the judicial posts in major commercial tribunals are vacant, while the number of pending cases is in the tens of thousands. At several benches, a single judge is handling thousands of matters.

Shiva Kirti Singh, a former Supreme Court justice who also served as chairman of the telecom disputes panel, said a major change in attitude is required if business-related litigation is to be addressed effectively. "Instead of adjudicating bodies, India should have an ombudsman-like structure to actually settle the disputes," Singh said. He also cautioned that artificial intelligence and technology-related businesses require a "competent regulatory authority" in a fast-changing world.

"They are likely going to suffer in a big way unless we have a very competent regulatory approach," Singh said.

The government is promoting India as a destination for global manufacturing and foreign capital investment through its infrastructure and Make in India initiatives. But such investments depend on efficient contract enforcement and dispute resolution, and companies face uncertainty over cash flow and project timelines if vast sums are tied up in litigation.

In the 2019 edition of the World Bank's Doing Business index, India ranked poorly on enforcing contracts, with an average resolution time of more than 1,400 days. The commercial tribunal system was meant to improve that record, but Daksh's data suggests it has merely shifted the burden.

Exacerbating the problems is the complexity of the tribunal system. Governance frameworks are inconsistent, appointment procedures differ, case tracking is largely manual and there is no unified digital registry. Appeals of tribunal decisions often end up in higher courts, adding another layer to the already congested judicial hierarchy.

Legal experts recommend an independent tribunals commission to oversee appointments, monitor performance and standardize procedures. Yet such reforms have made little headway despite repeated recommendations from the state-backed Law Commission and the Supreme Court over the past decade.

Some of the resistance comes from the bureaucracy, which continues to wield enormous control over staffing, budgets and infrastructure.

"There is no doubt in anyone's mind that the law in India is quite complex," Prakash said. "Efforts have been made to simplify the law, but it has ended up simplifying the language of the law without trying to simplify the actual complexity of the substantive things.

"Ease of doing business has come up in many discussions, but it has not really percolated down to the operational level."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up