Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

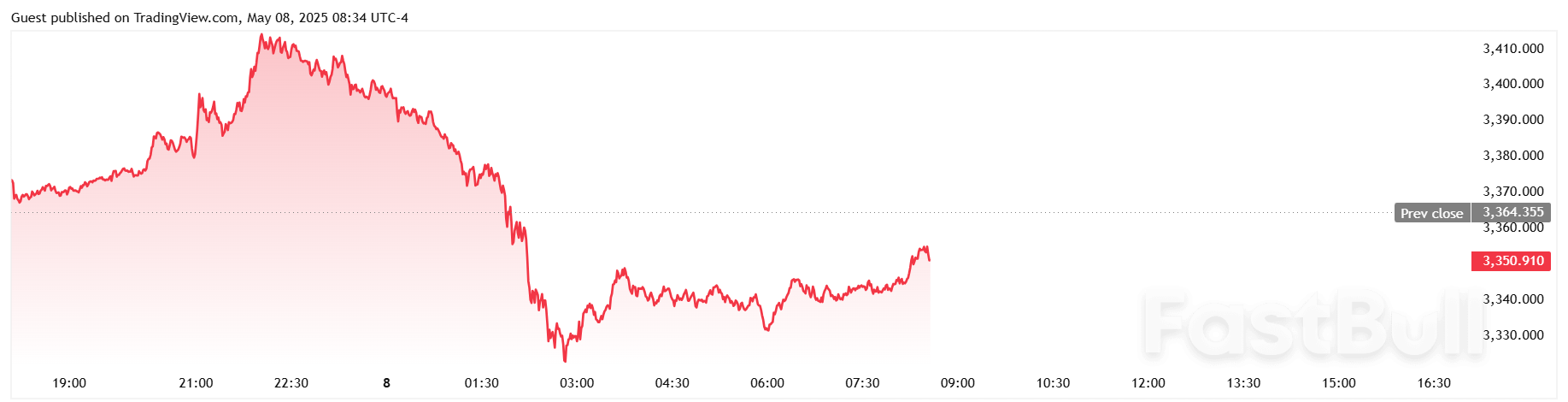

US President Donald Trump announced what he called a "breakthrough" trade deal with the United Kingdom on Thursday.

"The agreement with the United Kingdom is a full and comprehensive one that will cement the relationship between the United States and the United Kingdom for many years to come," Trump said on his Truth social media platform.

"Because of our long time history and allegiance together, it is a great honor to have the United Kingdom as our FIRST announcement."

UK Prime Minister Kier Starmer also hinted at a forthcoming announcement earlier on Thursday.

"Talks with the US have been ongoing and you'll hear more from me about that later today," Starmer told a press conference in London. "But make no mistake, I will always act in our national interest, for workers, businesses and families, to deliver security and renewal for our country."

A British official suggested that the UK was considering lowering its own tariffs on US cars as well as cutting digital sales tax affecting US tech companies, Reuters reported.

Since taking office early this year, the Trump administration has been actively expanding the US tariff policies.

In April, Trump announced broad tariffs on US trading partners, however, most of the tariffs announced were later reversed or paused to allow for trade negotiations. However, the 145% levy on Chinese imports still stands.

The US president has repeatedly said that multiple countries are eager to finalize deals with the US.

Investors will be watching to see if Trump can deescalate the trade war he triggered and which in turn sparked chaos in stock markets around the world.

Officials from the US and China are meeting in Switzerland on Saturday to find a resolution to the trade war between the world's two largest economies.

Meanwhile, since leaving the European Union, the UK has sought to expand global trade ties. But Brexit also brought some light relief, with Trump's announced tariffs on the UK only reaching 10%, half of the 20% announced against the EU.

Nevertheless, a trade deal with the US is seen as key by Starmer's government.

"The United States is an indispensable ally for both our economic and national security," a Downing Street spokesperson said. "Talks on a deal between our countries have been continuing at pace and the Prime Minister will update later today."

Britain earlier this week struck a free trade agreement with India — the biggest trade deal since Brexit.

On Tuesday, a UK official announced good progress amid talks with Washington on lowering tariffs on steel and autos. Discussions are also ongoing regarding Trump's recent announcement of 100% tariff on all movies produced outside the US.

Daily Light Crude Oil Futures

Daily Light Crude Oil Futures

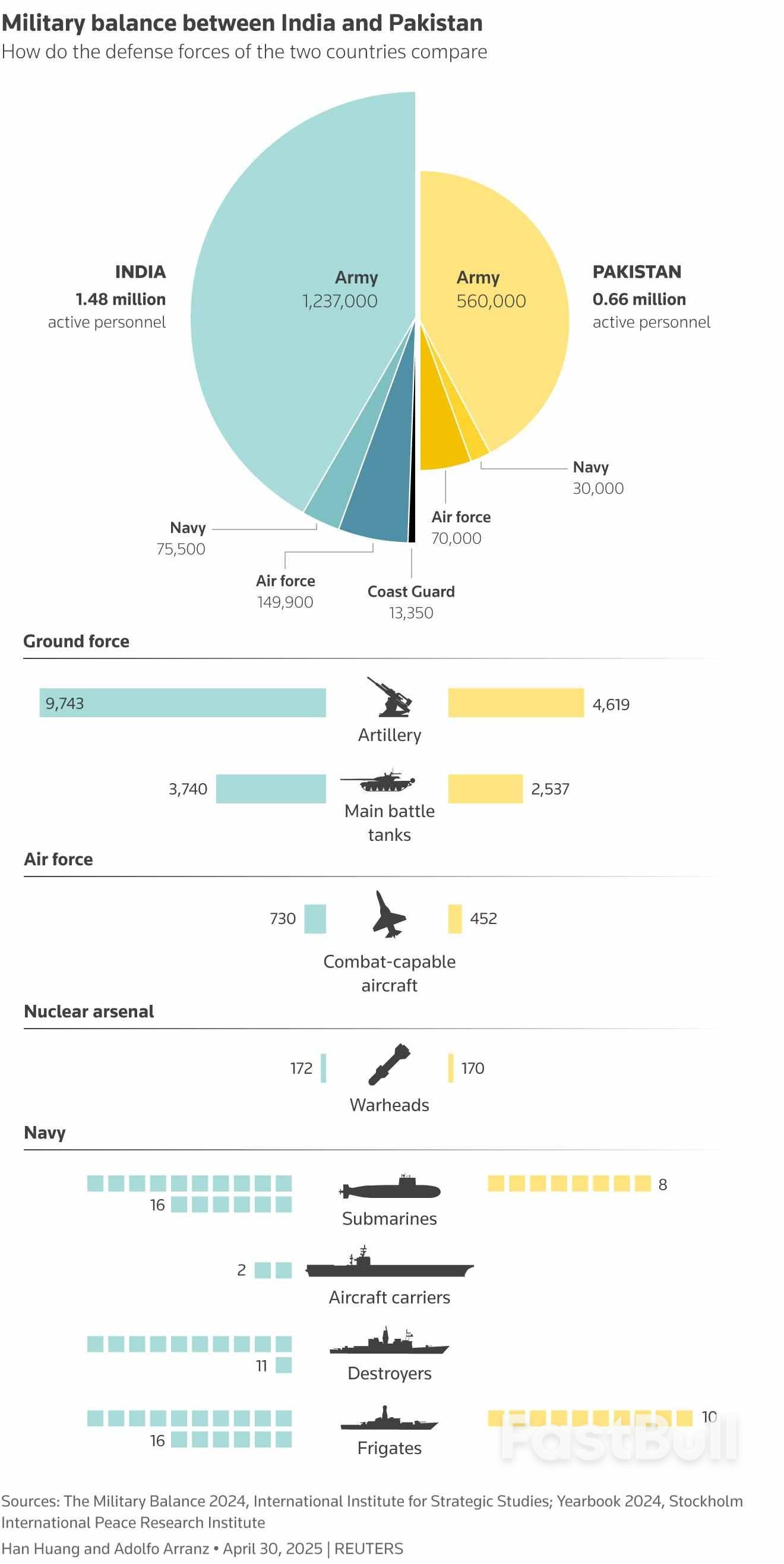

Pakistan and India accused each other of launching drone attacks on Thursday, and Islamabad’s Defence Minister said further retaliation was “increasingly certain”, on the second day of major clashes between the nuclear-armed neighbours.

Pakistan said it shot down 25 drones from India, while India said it air defences had stopped Pakistani drone and missile attacks on military targets, dashing hopes they would soon bow to pressure to end their worst confrontation in more than two decades.

World powers from the U.S. to Russia and China have called for calm in one of the world's most dangerous, and most populated, nuclear flashpoint regions. The U.S. Consulate General in Pakistan's Lahore ordered staff to shelter in place.

Thursday's reported exchanges came a day after India said it hit nine "terrorist infrastructure" sites in Pakistan in retaliation for what it says was a deadly Islamabad-backed attack in Indian Kashmir on April 22.

Pakistan says it was not involved and denied that any the sites hit by India were militant bases. It said it shot down five Indian aircraft on Wednesday, a report the Indian embassy in Beijing dismissed as "misinformation".

Pakistani retaliation "is increasingly becoming certain now," Pakistan's Defence Minister, Khawaja Muhammad Asif, told Reuters. "I will still refrain from saying it is 100%. But the situation has become very difficult. We have to respond."

The relationship between India and Pakistan has been fraught with tension since they gained independence from colonial Britain in 1947. The countries have fought three wars, two of them over Kashmir, and clashed many times.

The countries that both claim Kashmir in full and rule over parts of it separately acquired nuclear weapons in the 1990s.

Trading was halted on Pakistan's benchmark share index (.KSE), opens new tab after the index slumped 6.3% on news of the drone attacks. Pakistan's international bonds extended their losses with the 2036 bond down 2.4 cents to bid at 72.4 cents.

Indian equities, rupee and bonds fell sharply in late afternoon trading after the Indian defence ministry statement, with the stock market benchmark Nifty 50 (.NSEI), opens new tab settling 0.58% lower in the most volatile trading session in a month.

Pakistan shot down 25 Israeli-made drones from India at multiple locations, including the two largest cities of Karachi and Lahore, and their debris is being collected, Pakistan military spokesperson Ahmed Sharif Chaudhry said.

One drone was also shot down over the garrison city of Rawalpindi, home to the Pakistan army's heavily fortified headquarters, he added.

One drone hit a military target near Lahore and four personnel of the Pakistan army were injured in this attack, Chaudhry said.

"Indian drones continue to be sent into Pakistan airspace...(India) will continue to pay dearly for this naked aggression," he said.

The Indian defence ministry said Pakistan attempted to engage a number of military targets in northern and western India from Wednesday night into Thursday morning and they were "neutralised" by Indian air defence systems.

In response, Indian forces targeted air defence radars and systems at a number of locations in Pakistan on Thursday, the ministry said. The "Indian response has been in the same domain with the same intensity as Pakistan," it added.

The Indian ministry accused Pakistan of increasing the intensity of its firing across the ceasefire line, the de facto border, in Kashmir. Sixteen people, including five children and three women, were killed on the Indian side, the statement said.

Pakistan says at least 31 of its civilians were killed and about 50 wounded in Wednesday's strikes and in cross-border shelling across the frontier in Kashmir that followed, while India says 13 of its civilians died and 59 were wounded.

On Thursday, Indian government ministers told a meeting of political parties in New Delhi that the strikes on Pakistan had killed more than 100 militants and that the count was still ongoing, government sources said.

Pakistan's Information Minister Attaullah Tarar told parliament that Pakistani forces had killed 40-50 Indian soldiers on the de-facto border in Kashmir and "blown" Indian military installations.

Reuters could not independently verify claims of both countries.

Blackout drills were conducted in India's border regions on Wednesday night.

Local media reported panic buying in some cities in the Indian state of Punjab which shares a border with Pakistan, as people hoarded essentials fearing a Pakistani retaliation to the Indian strikes.

Indian Foreign Minister Subrahmanyam Jaishankar said New Delhi did not intend to escalate the situation. "However, if there are military attacks on us, there should be no doubt that it will be met with a very, very firm response," he said at a India-Iran Joint Commission Meeting.

His Pakistani counterpart, Ishaq Dar, told Reuters that there have been contacts between the offices of the national security advisers of the two countries and the hotline between their heads of military operations was also working. He did not give more details.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up