Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

U.S. President Donald Trump on Wednesday announced a 50% tariff on copper imports, claiming that the measure was aimed at boosting the domestic copper industry.

U.S. President Donald Trump on Wednesday announced a 50% tariff on copper imports, claiming that the measure was aimed at boosting the domestic copper industry.

Trump announced the tariff in a social media post, making good on his threat from earlier in the week. He also criticized his predecessor Joe Biden in the post, claiming that the Biden administration had compromised the U.S. copper industry.

“Copper is the second most used material by the Department of Defense… This 50% TARIFF will reverse the Biden Administration’s thoughtless behavior, and stupidity. America will, once again, build a DOMINANT Copper Industry,” Trump said.

The president had repeatedly threatened to tariff the red metal and boost domestic production. The U.S. domestically produces just over half the refined copper it consumes annually, with the remainder being imported.

Chile, Canada, and Peru are the biggest copper exporters to the U.S., and have all called for the Trump administration to exempt them from the planned tariffs.

China is the world’s largest copper refiner, but is also the largest consumer of the red metal.

Freeport shares rallied, while U.S. copper futures soared to record highs earlier this week after Trump’s tariff threat.

Federal Reserve officials diverged at their June meeting about how aggressively they would be willing to cut interest rates, split between concerns over tariff-fueled inflation and signs of labor market weakness and economic strength.

Minutes from the June 17-18 meeting released Wednesday showed that policymakers largely held to a wait-and-see position on future rate moves. The meeting ended with Federal Open Market Committee members voting unanimously to hold the central bank's key borrowing rate in a range between 4.25%-4.5%, where it has been since December 2024.

However, the summary also showed a growing divide over how policy should proceed from here.

"Most participants assessed that some reduction in the target range for the federal funds rate this year would likely be appropriate," the minutes stated, as officials saw tariff-induced inflation pressures as potentially "temporary and modest" while economic growth and hiring could weaken.

How far the cuts could go, though, was a matter of debate.

Opinions ranged from a "couple" officials who said the next cut could come as soon as this month to "some" who thought no cuts this year would be appropriate. Though the minutes do not mention names, Fed governors Michelle Bowman and Christopher Waller have gone on record saying they could see their way to cutting rates as soon as the July 29-30 Fed meeting if inflation stays under control.

At the same time, "several" officials said they thought the current overnight funds rate "may not be far" from a neutral level, meaning only a few cuts may be ahead. Those officials cited inflation still above the 2% goal amid a "resilient" economy.

In Fed parlance, some is more than several.

Officials at the meeting updated their projections for rate cuts, expecting two this year followed by three more over the next couple years.

The release comes with President Donald Trump ramping up pressure on Fed Chair Jerome Powell and his cohorts to cut aggressively. In public statements and on his Truth Social site, Trump has lambasted Powell, going as far to call for his resignation.

Powell has said repeatedly that he won't bow to political pressure when it comes to setting monetary policy. For the most part, he has joined the cautious approach, insisting that with a strong economy and uncertainty over inflation, the Fed is in a good position to stay on hold until it has more information.

The minutes largely reflect that position that policy is currently well-positioned to respond to changes in the data.

"Participants agreed that although uncertainty about inflation and the economic outlook had decreased, it remained appropriate to take a careful approach in adjusting monetary policy," the document stated.

Officials also noted that they "might face difficult tradeoffs if elevated inflation proved to be more persistent while the outlook for employment weakened." In that case, they said they would weigh which side was further from its goal in formulating policy.

Since the meeting, Trump has continued negotiations with key U.S. trading partners, with the tariff ground shifting on a near-daily basis. Trump initially announced tariffs on April 2, and then has altered deadlines for agreements, most recently ticking off a series of letters to foreign leaders notifying them of looming levies should they not act.

Recent data indicate that Trump's tariffs have not Fed into prices, at least on a large scale.

The consumer price index showed an increase of just 0.1% in May. While inflation gauges are still mostly above the Fed's 2% target, recent sentiment surveys show the public is growing less fearful of inflation further down the road.

"Many participants noted that the eventual effect of tariffs on inflation could be more limited if trade deals are reached soon, if firms are able to quickly adjust their supply chains, or if firms can use other margins of adjustment to reduce their exposure to the effects of tariffs," the minutes stated.

At the same time, job gains have slowed considerably, though the rate of nonfarm payrolls growth has consistent surprised economists. June showed an increase of 147,000, against the consensus forecast for 110,000, while the unemployment rate unexpectedly fell to 4.1%.

Consumer spending has slowed considerably. Personal expenditures declined 0.1% in May, while retail sales tumbled 0.9%.

U.S. President Donald Trump turned his trade ire against Brazil on Wednesday, threatening Latin America's largest economy with a punitive 50% tariff on exports to the U.S. and ordering an unfair trade practices investigation that could lead to even higher tariffs.

Trump set the Aug. 1 tariff rate -- far higher than the 10% duty imposed on Brazil on April 2 -- in a tariff letter to Brazilian President Luiz Inacio Lula da Silva, that vented anger over what he called the "Witch Hunt" trial of Lula's right-wing predecessor, Jair Bolsonaro.

Criticizing what he said were Brazil's attacks on free elections and speech and "SECRET and UNLAWFUL Censorship Orders to U.S. Social Media platforms," Trump also ordered the U.S. Trade Representative's office to open an unfair trade practices investigation into Brazil's policies under Section 301 of the Trade Act of 1974.

The probe could lead to further tariffs on Brazilian exports.

Trump's broadside against Brazil came as his administration was inching closer to a deal with its biggest trading partner bloc, the European Union.

Trump earlier on his Truth Social media platform issued Aug. 1 tariff notices to seven minor trading partners: a 20% tariff on goods from the Philippines, 30% on goods from Sri Lanka, Algeria, Iraq, and Libya, and 25% on Brunei and Moldova.

Those countries are bit players in the U.S. trade deficit, accounting for just under $15 billion in U.S. imports in 2024.

Brazil is the 15th largest U.S. trading partner, with total two-way trade of $92 billion in 2024, and a rare $7.4 billion U.S. trade surplus.

But Trump's letter to Lula contained the same language as previous form letters describing Brazil's trading relationship as "very unfair".

The latest letters add to 14 others issued earlier in the week including 25% tariffs for powerhouse U.S. suppliers South Korea and Japan, which are also to take effect August 1 barring any trade deals reached before then.

They were issued a day after Trump said he was broadening his trade war by imposing a 50% tariff on imported copper and would soon introduce long-threatened levies on semiconductors and pharmaceuticals. Trump's rapid-fire tariff moves have cast a shadow over the global economic outlook, paralyzing business decision-making.

Trump said trade talks have been going well with China and the European Union, which is the biggest bilateral trading partner of the U.S.

Trump said he would "probably" tell the EU within two days what rate it could expect for its exports to the U.S., adding that the 27-nation bloc had become much more cooperative.

"They treated us very badly until recently, and now they're treating us very nicely. It's like a different world, actually," he said.

EU trade chief Maros Sefcovic said good progress had been made on a framework trade agreement and a deal may even be possible within days.

Sefcovic told EU lawmakers he hoped that EU negotiators could finalise their work soon, with additional time now from the extension of a U.S. deadline to August 1 from July 9.

"I hope to reach a satisfactory conclusion, potentially even in the coming days," Sefcovic said.

However, Italian Economy Minister Giancarlo Giorgetti had earlier warned that talks between the two sides were "very complicated" and could continue right up to the deadline.

EU officials and auto industry sources said that U.S. and EU negotiators were discussing a range of potential measures aimed at protecting the European Union's auto industry, including tariff cuts, import quotas and credits against the value of EU automakers' U.S. exports.

Equity markets shrugged off the Republican president's latest tariff salvo on Wednesday, while the yen remained on the back foot after the levies imposed on Japan.

Following Trump's announcement of higher tariffs for imports from the 14 countries, U.S. research group Yale Budget Lab estimated consumers face an effective U.S. tariff rate of 17.6%, up from 15.8% previously and the highest in nine decades.

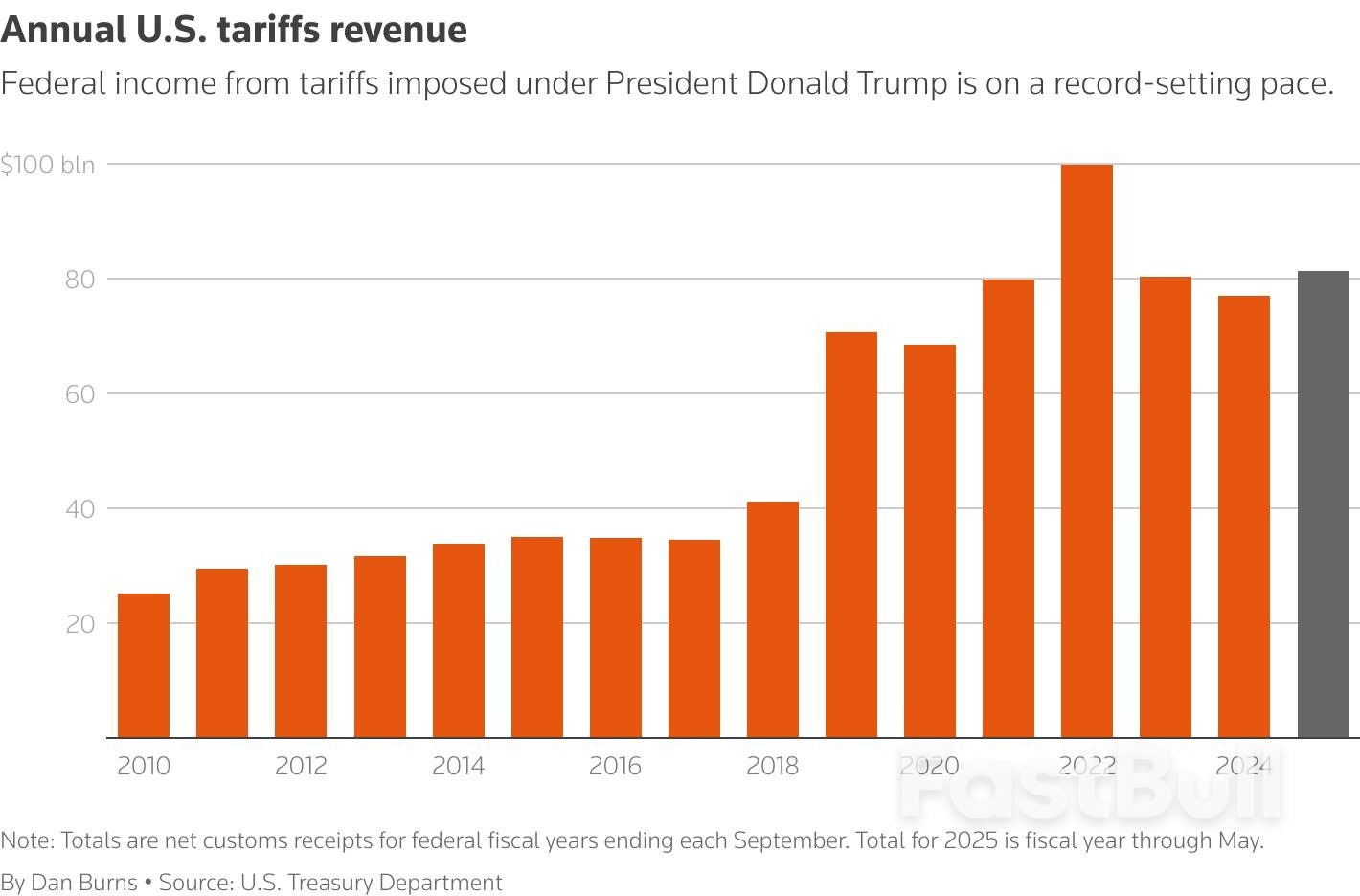

Trump's administration has been touting those tariffs as a significant revenue source. Treasury Secretary Scott Bessent said Washington has taken in about $100 billion so far and could collect $300 billion by the end of the year. The United States has taken in about $80 billion annually in tariff revenue in recent years.

The Trump administration promised "90 deals in 90 days" after he unveiled an array of country-specific duties in early April. So far, only two agreements have been reached, with Britain and Vietnam. Trump has said a deal with India was close.

Massachusetts Governor Maura Healey, a Democrat, blasted Trump for his "failed trade war".

"President Trump was elected to lower costs, and all he is doing is raising prices and hurting our businesses," she said in a statement.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up