Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. House Oversight Committee Chairman Comer Is Considering Subpoenaing Bill Gates In Connection With The Epstein Case

Offshore Yuan Hit A New High Since May 2023. On Wednesday (February 4th), At The Close Of New York Trading (05:59 Beijing Time On Thursday), The Offshore Yuan (CNH) Was Quoted At 6.9412 Against The US Dollar, Down 61 Points From Tuesday's New York Close, Trading Within A Range Of 6.9290-6.9434 During The Day. On The Daily Chart, The Offshore Yuan Approached The Highs Of 6.9168 On May 10th, 2023, 6.8963 On May 4th Of That Year, And 6.6975 At 09:27

Alphabet Executives: We Expect To See A Foreign Exchange Tailwind To Consolidated Revenues In Q1 2026

The Philadelphia Gold And Silver Index Closed Down 0.23% At 397.53 Points. The NYSE Arca Gold Miners Index Rose 0.55% To 2830.82 Points. The Materials Index Closed Up 0.57%, While The Metals And Mining Index Closed Down 1.61%

Eric Beinstein, A U.S. Credit Strategist At JPMorgan Chase, Has Left The Company After 40 Years Of Service

Gold Tested The Psychological Level Of $5,000 For The Second Consecutive Day. On Wednesday (February 4th), Spot Gold Rose 0.32% To $4,962.73 Per Ounce In Late New York Trading. It Reached A Daily High Of $5,091.60 At 16:01 Beijing Time, Before Giving Back Its Gains And Hitting A Daily Low Of $4,853.67 At 00:48. Comex Gold Futures Rose 0.98% To $4,984.20 Per Ounce

Fed Governor Bowman: Freezing Bank Capital Levels Allows Fed To Correct Any 'Deficiencies' In Stress Test Models

US Federal Reserve Votes To Maintain Large Bank Stress Capital Buffers Until 2027 As It Considers Stress Test Changes

Toronto Stock Index .GSPTSE Unofficially Closes Up 175.53 Points, Or 0.54 Percent, At 32564.13

The Nasdaq Golden Dragon China Index Closed Up 1.9% Initially. Among Popular Chinese Concept Stocks, Yilong Energy Rebounded 64%, Jinko Solar Rose 8%, Yum China Rose 4.6%, Zai Lab Rose 3.7%, Canadian Solar Rose 3.3%, Li Auto Rose 2.2%, NetEase Fell 5.3%, 21Vianet Fell 5.6%, And WeRide Fell 6.3%

On Wednesday (February 4), The Bloomberg Electric Vehicle Price Return Index Rose 0.65% To 3533.63 Points In Late Trading. The Index Rose Throughout The Day, Exhibiting A "V"-shaped Pattern, Fluctuating At High Levels Between 2:00 PM And Midnight Beijing Time, Reaching A High Of 3561.87 Points In Early Trading. Among Its Components, BMW Closed Up 3.88%, Ola Electric Mobility Ltd. Rose 3.6%, STMicroelectronics Closed Up 3.6%, Porsche P911 Rose 3.5%, Li Auto H Shares Closed Up 3.43%, And Zhejiang Leapmotor H Shares Closed Up 2.88%, Ranking Sixth. Chilean Chemical And Mining Company Sqm Fell 5.3%, Mp Materials Fell 6.2%, WeRide Fell 7.2%, And Solid Power Fell 9.5%

The Yen Fell More Than 0.7%, Nearing 157 Yen. In Late New York Trading On Wednesday (February 4), The Dollar Rose 0.74% Against The Yen To 156.91 Yen, Trading Between 155.70 And 156.94 Yen During The Day, Continuing Its Upward Trend. The Euro Rose 0.64% Against The Yen To 185.26 Yen, Fluctuating At High Levels Since 10:00 AM Beijing Time; The Pound Rose 0.42% Against The Yen To 214.229 Yen, Giving Back About Half Of Its Gains Since 10:00 PM

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)A:--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)A:--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)A:--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)A:--

F: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)A:--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)A:--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)A:--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)A:--

F: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)--

F: --

P: --

Australia Exports MoM (SA) (Dec)

Australia Exports MoM (SA) (Dec)--

F: --

P: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction Yield--

F: --

P: --

Indonesia Annual GDP Growth

Indonesia Annual GDP Growth--

F: --

P: --

Indonesia GDP YoY (Q4)

Indonesia GDP YoY (Q4)--

F: --

P: --

France Industrial Output MoM (SA) (Dec)

France Industrial Output MoM (SA) (Dec)--

F: --

P: --

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. Yield--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)--

F: --

P: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)--

F: --

P: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest Rate--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending Rate--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit Rate--

F: --

P: --

Euro Zone ECB Main Refinancing Rate

Euro Zone ECB Main Refinancing Rate--

F: --

P: --

ECB Monetary Policy Statement

ECB Monetary Policy Statement U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

ECB Press Conference

ECB Press Conference

No matching data

View All

No data

This, the vice president said, would create the conditions for more investment by private mining companies to extract these varied minerals, which are often called the building blocks of the modern economy.

President Donald Trump has made it clear that any nominee to lead the Federal Reserve must be committed to lowering interest rates, stating he would have rejected potential candidate Kevin Warsh otherwise.

"If he came in and said, 'I want to raise it,' he would not have gotten the job, no," Trump said in an interview with NBC News on Wednesday.

Trump expressed confidence that the Fed would ultimately lower rates, arguing that "we're way high in interest" at a time when "we're a rich country again."

When asked if Warsh, a former Fed governor, understood the administration's desire for a lower benchmark rate, the president affirmed, "I think he does, but I think he wants to anyway."

These remarks are expected to become a focal point during any future confirmation process, where the political independence of the Federal Reserve will be a central theme of debate.

The nomination already faces political roadblocks. Republican Senator Thom Tillis, a member of the Banking Committee, has vowed to block Trump's nominees to the central bank. His opposition will continue until the Justice Department concludes an investigation into a renovation at the institution.

Current Fed Chair Jerome Powell has characterized the probe as a thinly veiled attack on the central bank's authority to set monetary policy without political interference. While Trump administration officials deny this, the president has maintained a public pressure campaign on Powell for months to ease policy.

Kevin Warsh, who previously served as a Federal Reserve governor, historically held a reputation as an inflation hawk. However, his recent commentary has shifted, showing more support for the idea of lower interest rates.

President Donald Trump has indicated a new willingness to allow China and India to invest in Venezuela's troubled oil industry. However, this apparent openness is paired with a strict new licensing framework from the U.S. Treasury Department, ensuring that Washington will maintain tight control over any renewed oil trade.

Speaking to reporters on January 31, Trump said China is "welcome to come in and we'll make a great deal on oil." He also confirmed that the U.S. is coordinating with India on a plan for it to purchase Venezuelan crude as an alternative to Iranian oil, stating the basic "concept" is already in place.

These remarks coincide with new U.S. regulations that define exactly who can participate in Venezuela's oil sector, how payments are processed, and where legal disputes will be settled. Together, the comments and rules signal a cautious reopening of Venezuelan oil, channeled through a system the United States can closely monitor and enforce.

The U.S. Treasury's Office of Foreign Assets Control (OFAC) recently issued General License 46, which authorizes specific activities related to Venezuelan oil. The license permits established U.S. entities to engage in lifting, shipping, buying, selling, storing, and refining oil originating from Venezuela.

But this authorization comes with significant constraints designed to assert U.S. jurisdiction:

• Legal Framework: All contracts under the license must be governed by U.S. law.

• Dispute Resolution: Any legal disputes must be adjudicated in U.S. courts.

• Payment Channels: Payments to sanctioned parties are prohibited. Instead, funds must be directed into U.S.-designated "Foreign Government Deposit Funds," where their use is restricted.

• Country Exclusions: The license explicitly forbids transactions involving Russia, Iran, North Korea, or Cuba.

The rules also place specific limits on Chinese entities. The license bars transactions involving U.S. or Venezuelan-based companies that are owned, controlled by, or in a joint venture with individuals or firms based in the People's Republic of China.

To support this framework, a White House executive order on January 9 established the Foreign Government Deposit Funds. This system ensures that Venezuela-related oil revenues moving through designated accounts are held in U.S. custody. The structure is intended to prevent funds from reaching blocked actors and gives Washington significant leverage over how Venezuela's oil money is handled.

India was previously a major buyer of Venezuelan oil, importing an average of 300,000 barrels per day in 2019 before U.S. sanctions tightened in 2020. Trump's comments suggest a strategic realignment is underway.

On January 2, Trump announced a new trade agreement with India that includes immediate tariff reductions. He also stated that India has agreed to halt its purchases of Russian oil, a move aimed at pressuring Moscow financially. Since Western sanctions were imposed, India and China have been top buyers of discounted Russian crude, which helps fund Russia's war in Ukraine.

Trump noted that India is interested in buying "much more" Venezuelan oil. This interest aligns with recent changes in Venezuela's hydrocarbons law, which aims to attract foreign investment by loosening state control. For India, Venezuelan crude offers an alternative supply that is compliant with U.S. foreign policy, even if it requires accepting American oversight.

China's involvement in Venezuela is far more complex and carries higher financial stakes. Over the past two decades, Beijing became a primary financial backer for Caracas, extending an estimated $60 billion in "loans-for-oil" agreements since 2007, according to a Columbia University analysis.

A large portion of Venezuela's oil exports has gone directly toward repaying this massive debt. By 2023, data from the U.S. Energy Information Administration (EIA) showed that about 68% of Venezuelan oil exports were directed to China.

If the U.S. successfully channels Venezuela's oil trade through its new framework, China could face significant financial losses. The Columbia analysis estimates that Beijing stands to lose between $10 billion and $12 billion on its outstanding loans. When asked on January 31 if China would ever recover its loans to Venezuela, Trump simply replied, "I don't know."

Even with a clearer legal path forward, a rapid recovery of Venezuela's oil output is unlikely. The nation sits on an estimated 303 billion barrels of proven oil reserves—among the world's largest. However, much of this is heavy or extra-heavy crude that requires costly specialized processing and blending.

Decades of mismanagement, sanctions, infrastructure decay, and a brain drain of skilled workers have devastated the industry. After producing around 3.5 million barrels per day in the late 1990s, output had fallen to an estimated 1.1 million barrels per day by late 2025.

Recent U.S. import data from the EIA shows flows from Venezuela remain minimal, ranging from 72,000 to 120,000 barrels per day in January 2026. While an increase from virtually zero, these volumes are negligible in the global market.

Wall Street analysts are forecasting modest growth. In a January 8 report, JPMorgan Chase estimated that production could climb to between 1.3 million and 1.4 million barrels per day within two years under a new administration. Goldman Sachs analysts projected in a January 5 interview that if output reaches 2 million barrels per day, global oil prices could fall by about $4 per barrel, benefiting U.S. consumers but creating deflationary pressure for other oil-producing nations.

President Donald Trump expressed strong confidence on Wednesday that the Federal Reserve will lower its benchmark interest rates, signaling his clear expectations for the central bank's monetary policy.

In an interview with NBC News, Trump stated there was "not much" doubt in his mind that the Fed would move to cut rates. His comments underscore his long-standing preference for a more accommodative monetary stance to fuel economic activity.

The president also tied his preference for monetary easing directly to his selection for the Federal Reserve's leadership. Discussing his nominee, Kevin Warsh, Trump suggested that an alignment on interest rate policy was a core requirement for the job.

When asked if Warsh understood the president's desire for lower rates, Trump replied, "I think he does, but I think he wants to anyway."

Trump made it explicit that any candidate advocating for rate hikes would be disqualified from consideration. "I mean, if he came in and said, 'I want to raise them' ... he would not have gotten the job. No," the president affirmed.

A criminal investigation launched by the Trump administration into Federal Reserve Chair Jerome Powell has stalled the confirmation of his successor, creating a high-stakes standoff in Washington. The probe now threatens to derail President Donald Trump's pick to lead the central bank, former Fed Governor Kevin Warsh.

The conflict escalated after Powell disclosed that the Department of Justice had served the Fed with subpoenas. The investigation centers on statements Powell made to the Senate Banking Committee in June regarding renovations at the Fed's building, which the White House had publicly criticized for overspending.

Powell has framed the probe as an intimidation tactic in the administration's broader push for the Fed to cut interest rates. The move drew sharp criticism from Democrats and, more significantly, from Republican Senator Thom Tillis of the Senate Banking Committee. Tillis labeled the investigation as political interference and pledged to block any Fed nominee as long as it continues.

This opposition is critical. Fed nominations must clear the Senate Banking Committee with a majority vote. With Tillis refusing to support a nominee and Democrats united against the proceedings, any nomination like Warsh's would face a deadlock in the committee, preventing it from reaching the full Senate for a final vote.

Breaking weeks of tension, Republican Senator Tim Scott, who chairs the Senate Banking Committee, has directly pushed back against the investigation. On Wednesday, Scott stated he does not believe Jerome Powell broke the law during his congressional testimony last summer.

In an interview with Fox Business Network, Scott clarified that it was he who had questioned Powell about the building renovations. "I do not believe that he committed a crime during the hearing," Scott said.

He offered a blunt assessment of Powell's performance but distinguished it from criminal wrongdoing. Scott said he would tell any prosecutor that he found Powell "to be inept at doing his job, but ineptness or being incompetent is not a criminal act."

Scott expressed optimism about resolving the impasse, stating he has had "productive conversations" with Tillis and believes a solution can be found to move Warsh's nomination forward with unified Republican support on the committee.

Despite Scott's confidence, Senator Tillis has shown no signs of backing down. Speaking on CNBC, he described the DOJ probe as a "vindictive" act. He argued it appeared to be "an attempt to try and force somebody out of the Fed Board because you disagree with their policies."

Tillis's firm stance has effectively frozen any progress on confirming Warsh, who is generally popular among Republicans and shares Trump's view that interest rates should be lower.

The ongoing probe has introduced another layer of complexity: the possibility that Powell may choose to remain at the Fed even after his term as chair ends in May. While most Fed chairs depart the central bank entirely, Powell's term as a Fed governor does not expire until 2028, and he has not confirmed his plans.

Tillis highlighted this "perverse consequence," suggesting Powell might stay on principle. "I know how I would react to this: I'd be there for the remaining two years because I don't want to reward bad behavior," he said.

If Powell stays, it would deny Trump an open seat on the Fed Board to fill with another advocate for rate cuts. It would also create a unique dynamic where an influential former chair remains at the policy-setting table, potentially complicating the leadership of his successor.

The situation has revealed a split among Senate Banking Committee Republicans on how to handle the stalemate. Senator Kevin Cramer described Tillis's opposition to Warsh's nomination as a "not a winning strategy" and expressed his hope that Powell would "exit gracefully."

However, even Cramer voiced his belief that the Fed chair does not belong in court. "I don't think that he belongs in a federal courtroom or a federal penitentiary," he stated, signaling a broader Republican unease with the criminal probe itself, even if they disagree on the best political response.

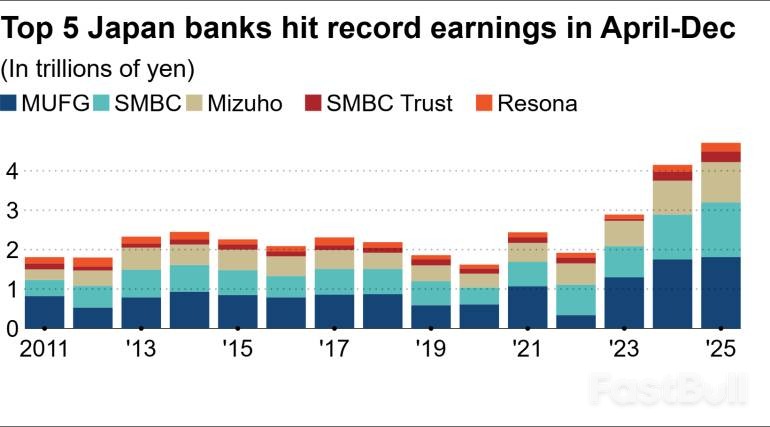

Japan’s three largest commercial banks are on track for a third consecutive year of record-breaking full-year profits, driven by a surge in lending income from higher domestic interest rates.

Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Financial Group (SMFG), and Mizuho Financial Group collectively generated a record 4.22 trillion yen ($26.9 billion) in net profit for the April-December 2025 period, a 13% increase from the previous year. All three have maintained their earnings forecasts for the full fiscal year.

The banking giants are projected to achieve a total net profit of 4.73 trillion yen for the year ending in March. This would represent 9% of the total net profit from all companies listed on the Tokyo Stock Exchange's Prime market, an increase of 1.6 percentage points from the prior year.

MUFG reported a 4% year-on-year rise in its consolidated net profit to 1.81 trillion yen for the nine-month period, marking its third straight record for that timeframe. The bank cited higher interest rates boosting deposit and loan revenue, growing fee income, and strong performance from its U.S. partner Morgan Stanley.

SMFG and Mizuho also delivered record profits. When including Sumitomo Mitsui Trust Group and Resona Holdings, Japan's five largest banks saw their combined net profits climb 14% to 4.71 trillion yen, setting a new high for the third year in a row.

The primary catalyst for this performance has been the Bank of Japan's interest rate hikes. The BOJ's most recent move in December 2025 raised the policy rate by 25 basis points to 0.75%. This series of rate increases, which began with the end of the negative interest rate policy in March 2024, is expected to boost the megabanks' combined net interest income by an estimated 700 billion yen for the full year ending March 2026.

Higher market rates have successfully widened the banks' interest spreads—the difference between what they charge for loans and what they pay on deposits. For the April-December 2025 period, the average interest spread at the megabanks reached 1.04 percentage points, the highest level in 11 years. As a result, their combined net interest income from lending and other sources grew 17% to a new high of 3.81 trillion yen.

Robust demand for capital from the corporate sector provided another significant tailwind. As of the end of December 2025, the total loan balance across the three megabanks had increased by 3% from the previous year. This growth was driven by strong demand for financing related to mergers and acquisitions as well as real estate projects.

This activity also translated into higher fee income. Combined profits from fees and commissions, including loan origination and M&A advisory services, rose 9% year-on-year to a record 1.6 trillion yen.

While rising interest rates are beneficial for lending profits, they create headwinds for bond portfolios by decreasing their market value. By the end of December, the megabanks held a combined 748.6 billion yen in unrealized losses on their domestic bond holdings, a 33% increase over just three months.

However, the impact on earnings is expected to be limited. The banks proactively managed this risk by shortening the maturities of their securities. Furthermore, their unrealized gains on stock holdings provided a substantial cushion, rising 11% in three months to approximately 8 trillion yen. Overall, their combined securities portfolios held unrealized gains of around 8.5 trillion yen.

Looking ahead, the banks face several challenges. Although the non-performing loan ratio remains low across all three institutions, a key focus will be the impact of a higher interest burden on borrowers.

Attracting enough deposits to fund lending growth is another critical task. The combined domestic deposit balance for the three banks grew by only 0.6% year-on-year as of December 2025. Corporate clients are increasingly moving funds into financial products with higher yields. In response, banks are expected to enhance their efforts to attract both retail and corporate deposits by improving digital services and raising interest rates on fixed-term accounts.

Despite these potential hurdles, all three megabanks have maintained their full-year earnings forecasts for the year ending March 2026. Having already achieved roughly 90% of their profit targets by December, they appear confident but have factored in allowances for potential market uncertainty and geopolitical risks.

Donald Trump's return to the presidency came with a familiar promise: to finally curb China's economic ascent. Yet his first year in office has produced the opposite outcome, handing Chinese President Xi Jinping a series of strategic advantages. The global landscape is now more receptive to Chinese exports, more inclined to hedge against Washington's volatility, and increasingly skeptical of America's reliability as an ally.

President Trump's unpredictable and often combative diplomatic style has given President Xi more room to maneuver on the world stage. Instead of falling in line with Washington, key US allies and so-called middle powers are hedging their bets.

Leaders from Canada to Europe, though frustrated by a flood of Chinese goods, have stopped short of erecting significant new trade barriers. According to Bloomberg Executive Editor Dan Ten Kate, they are actively courting Beijing as a form of insurance against Trump's erratic tariff threats and aggressive military posture. In a twist of irony, Ten Kate notes that economic tools originally designed to counter Chinese coercion are now more likely to be directed at the United States itself.

Despite Trump's intentions, Beijing has not been forced to alter its state-driven, export-heavy economic model. In fact, China's reliance on foreign demand has only grown stronger. The country posted a record trade surplus last year, with exports rising to their highest share of the economy since the global financial crisis.

While nations from Ottawa to Paris express frustration over the influx of Chinese products—from electric vehicles to industrial equipment—this has not translated into meaningful action. Washington's inconsistent foreign policy has left other countries hesitant to join a united front against China, allowing Beijing to continue its economic strategy without major opposition.

However, China's current strategic advantage has clear limits. Richard McGregor, a Senior Fellow at the Lowy Institute, points out that Beijing is in no position to replace the United States as the world's primary market for finished goods.

President Xi's ambitions are constrained by significant internal challenges, including:

• Ongoing territorial disputes

• A rapidly aging population

• An economic structure geared toward self-reliance rather than consumption

For now, Beijing's primary objective is simple: achieve stability in its relationship with Trump. With high-level summits planned and Washington's restrictions on trade and technology under review, China's immediate goal is to keep the US president engaged. This strategy is designed to buy crucial time to manage domestic issues while securing more breathing room on the international stage.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up