Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

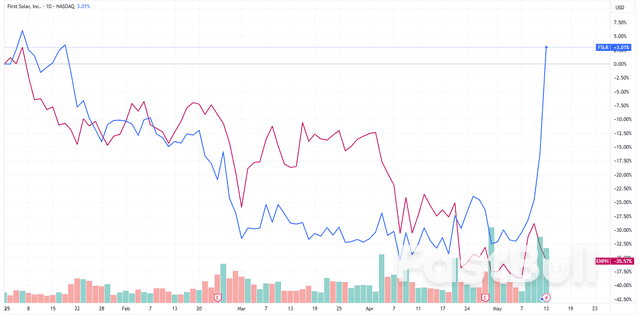

Tech stocks lifted U.S. markets as inflation eased, with Nvidia and First Solar gaining. UnitedHealth plunged on rising costs, while Honda and Enphase dropped on tariff and demand concerns.

India officially told the World Trade Organization (WTO) that it plans to increase tariffs on goods made in the United States as a direct response to the Trump administration’s decision to impose high duties on steel and aluminum.

This is India’s first trade retaliation against the U.S. during Donald Trump’s second term as president, even though both countries are still working to finalize a broader trade agreement that they hope to finalize in the coming months.

India submitted a detailed notification to WTO on Monday explaining how the U.S government’s decision to impose high duties on steel and aluminum has hurt the country’s trade. As a result, it plans to raise tariffs on various goods imported from the United States.

Furthermore, India argued that the U.S. tariffs break global trade rules and that their excuse of “national security” to introduce these duties was more of “safeguard measures” or emergency trade restrictions countries can respond to under WTO regulations.

The U.S. announced in March that the tariffs would add a 25% duty on all steel imports and similar levies on aluminum as part of President Trump’s efforts to change how the country trades with the world and improve national security.

India has responded, claiming that the tariffs have affected $7.6 billion worth of its exports and will force U.S. importers to pay an extra $1.91 billion in duties on Indian goods, which makes the products more expensive but less competitive in the American market.

India will raise tariffs on a similar amount of U.S. goods to make the total cost of duties equal on both sides as a countermeasure in line with WTO regulations that allow a country to suspend its trade promises when another nation’s actions cause unfair damage.

India avoided reacting strongly to Trump’s trade actions during most of his second term. New Delhi did not respond immediately, even after the U.S slapped heavy tariffs on Indian steel and aluminum exports earlier this year. Instead, it hoped that cooperation and diplomacy would lead to better results for both sides and, therefore, continued the talks to finalize a bilateral trade agreement.

In addition, India lowered import duties on American goods like Harley-Davidson motorcycles and bourbon whiskey to help both countries move closer to a trade deal and because President Trump has personally criticized the country over these goods.

The country didn’t stop there; it also overhauled its tariff system by cutting import duties on over 8,500 industrial products to reduce barriers and express its willingness to cooperate.

However, the recent filing shows that India isn’t willing to wait for diplomacy alone to solve its trade issues and is now ready to stand up for its economic interests by taking strong steps within the rules of WTO.

India’s decision to file a WTO notification while still in trade talks with the U.S. could make the negotiations difficult, and experts warn that this action might cast a shadow over the final stages of the deal.

New Delhi previously offered to reduce two-thirds of its tariff gap with the U.S. to help close the distance between the two sides. Still, Washington took a tougher stance and recently threatened to slap a 26% torrid on Indian exports, which could escalate the tensions further if talks fall apart.

President Trump also made comments that linked the trade between the U.S and India to Kashmir ceasefire negotiations between India and Pakistan, which made matters even more politically sensitive.

“If you stop it, we’re doing trade. If you don’t stop it, we’re not going to do any trade.” Trump said.

However, government sources who spoke anonymously claimed that trade negotiations had nothing to do with political or military matters and that India never used it as a bargaining chip in discussions with the U.S.

This tension comes as India imposed a temporary 12% import duty on steel from countries like China to prevent a flood of cheap metal from hurting local producers as a way to protect its domestic industries while also using global trade regulations to assert itself intentionally.

Canadian Prime Minister Mark Carney unveiled Tuesday a new cabinet weeks following his election victory, leaning on newcomers and key officials working on U.S.-Canada relations to rebuild a weakened economy exposed by President Trump's tariff policy.

Carney is keeping François-Philippe Champagne as Finance Minister. Champagne faces two big immediate tasks: host his Group of Seven peers next week in Banff, Alberta in a three-day gathering likely to be dominated by trade; and present a budget plan, likely next month, to outline spending and tax-cut plans as promised during the spring election campaign.

The majority of the 28-member cabinet are either newly elected or are serving in cabinet for the first time, as Carney tries to further distance his administration from the previous government of former prime minister Justin Trudeau. Carney, a former central banker, won the election on April 28, arguing he has the economic acumen and policymaking mettle to lead Canada in this period of economic turmoil.

The new cabinet "is built to deliver the change Canadians want and deserve," Carney said. "Everyone is expected and empowered to show leadership - to bring new ideas, a clear focus, and decisive action to their work."

Before taking over as Liberal Party leader, he said the Trudeau government didn't pay sufficient attention to the economy, and acknowledged it was in a feeble state prior to Trump unveiling tariffs of up to 25% of key Canadian imports, such as automobiles, steel and aluminum.

Among the notable moves is shifting Anita Anand as Canada's Foreign Minister. Melanie Joly, formerly the foreign minister and part of Carney's inner circle on dealing with the Trump White House, moves to the industry portfolio, while Dominic LeBlanc retains responsibility for trade between the U.S. and Canada. LeBlanc and Joly traveled to the White House last week with Carney to speak with Trump.

Carney has also appointed a former Goldman Sachs executive, Tim Hodgson, to be Canada's Energy Minister. Carney has promised to accelerate the construction of certain energy projects, like a cross-country pipeline connecting the west to the east. The oil-rich province of Alberta has warned it could hold a referendum next year on separating from Canada due to frustration over the federal environmental policy.

Hodgson once advised Carney — also part of the Goldman Sachs alumni — when Carney served as Bank of Canada governor.

BRUSSELS (May 13): The easing of trade tensions between the United States and China is a step in the right direction and helps reduce European fears of being flooded with Chinese goods redirected from the US market, European Economic Commissioner Valdis Dombrovskis said.

Speaking to reporters after a meeting of European Union finance ministers on Tuesday, Dombrovskis noted, however, that the reduction of tariffs after weekend talks in Switzerland was for 90 days and the tariff rates that remained were still high.

"Obviously this easing of trade tensions between the US and China is heading in the right direction but it is worth noting that the 30% tariffs which the US would continue to apply to Chinese goods, also in this 90-day period, is still quite a high tariff level and correspondingly trade distortive," he said.

"But of course it may ease somewhat the trade diversion concerns we had," Dombrovskis told a news conference.

The president of the European Commission, Ursula von der Leyen, urged China on April 8 to ensure that goods that could no longer enter the US because of prohibitively high tariffs were not redirected to the EU.

On Monday, Washington also announced that the US would cut the "de minimis" tariff for low-value items imported from China, further de-escalating a potentially damaging trade war between the world's two largest economies.

The USDCAD extended higher yesterday and again earlier today, but both rallies have stalled just ahead of a key resistance confluence. The area of interest includes:

● The 200-day moving average, currently near 1.40111

● The swing area resistance between 1.4009 and 1.4027

● Today’s high stopped at 1.40157 before rotating back lower

This zone has now rejected buyers on two separate occasions, reinforcing its role as a critical barrier that bulls must break to extend the upside bias. A clean move above 1.4027 would open the door toward the 38.2% retracement of the move down from the March high at 1.40525, with other key resistance around the 50% and swing area between 1.4146–1.41836.

On the downside, the initial support now comes in near 1.3978, where the 200-bar moving average on the 4-hour chart lines up with the old swing high from April 15. Holding above that level keeps the rebound and short term bullish bias intact. A move below it, however, could trigger a deeper correction down to 1.389172 1.3904 swing area.

● Resistance: 1.4009–1.4027 (200-day MA + swing), 1.40525 (38.2% retracement), 1.4146 to 1.41836 (50% and swing area)

● Support: 1.3978 (4H 200-bar MA/old high from April 15), 1.38917 – 1.3904 (swing area)

● Bias: Neutral to bullish above 1.3978; stronger bullish bias only above 1.4027 and then the 38.2% retracement at 1.40525

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up