Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[US Publicly Traded Company Srx Health Solutions Allocates $18 Million To Purchase Btc And Eth] January 28Th, According To Globenewswire, The US-Listed Company Srx Health Solutions Has Invested $18 Million To Purchase Btc And Eth. In Addition To Investing In Bitcoin And Ethereum, It Will Also Deploy Excess Liquidity Into Commodities Such As Securities, Gold, And Silver

India Prime Minister Modi: India Poised To Become A Major Producer And Exporter Of Green Aviation Fuel In Next Few Years

[Trump Warns: Next Attack On Iran Will Be More Serious] US President Donald Trump Warned That A Massive Fleet, Even Larger Than The One Previously Sent To Venezuela, Is Rapidly Heading Towards Iran. Trump Stated That Iran Must Never Possess Nuclear Weapons And Threatened That The Next Attack On Iran Would Be Far More Serious. He Also Expressed Hope That Iran Would "sit At The Negotiating Table" As Soon As Possible, Emphasizing That "Iran's Time Is Running Out."

[Blackrock Deposits 1,156.87 Btc To Coinbase, Worth Around $104 Million] January 28, According To Onchain Lens Monitoring, Blackrock Deposited 1,156.87 Btc To Coinbase, Worth Approximately $104 Million. As Well As 19,644 Eth, Worth Approximately $59.23 Million

[Report Shows Nearly 60% Of Surveyed US Companies Plan To Increase Investment In China] The China Council For The Promotion Of International Trade (CCPIT) Released The "2026 China Business Environment Survey Report" On The 28th, Compiled By The American Chamber Of Commerce In China. The Report Shows That Nearly 60% Of Surveyed US Companies Plan To Increase Their Investment In China. According To The Recently Released Report, Over Half Of The Surveyed US Companies Operating In China Expect To Achieve Profitability Or Significant Profitability By 2025, And Over 70% Of The Surveyed Companies Are Not Currently Considering Transferring Production Or Procurement Outside Of China. Wang Wenshuai, Spokesperson For The CCPIT, Stated At A Regular Press Conference Held That Day That This Reflects, From One Perspective, That China Will Undoubtedly Remain A Fertile Ground For Foreign Investment And Business Development For A Long Time To Come

Paris-Denmark Prime Minister: I Think There Are Som Lessons Learned For Europe In The Last Weeks

Deutsche Bank: We Are Cooperating Fully With Prosecutor's Office. We Cannot Comment Further On This Matter

US President Trump: The Next Attack On Iran Will Be Worse Than The Attack On Its Nuclear Facilities

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. YieldA:--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)A:--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

Euro Zone Consumer Confidence Index Final (Jan)

Euro Zone Consumer Confidence Index Final (Jan)--

F: --

Euro Zone Selling Price Expectations (Jan)

Euro Zone Selling Price Expectations (Jan)--

F: --

P: --

Euro Zone Industrial Climate Index (Jan)

Euro Zone Industrial Climate Index (Jan)--

F: --

P: --

Euro Zone Services Sentiment Index (Jan)

Euro Zone Services Sentiment Index (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Despite an expedited hearing, the Supreme Court has yet to rule on Trump’s tariffs case nearly three months after arguments, with the delay appearing typical rather than political. The justices are likely navigating complex legal and constitutional questions, with a decision expected later in the term.

Global uncertainty is kicking off 2026 with a rally in safe-haven assets. As gold and silver hit new records, the Swiss franc has soared to its highest levels in over a decade, creating a major headache for policymakers in Switzerland.

The franc's rally against the U.S. dollar has been relentless. After strengthening 12.7% against the greenback in 2025, it has already gained another 3.5% this year. On Tuesday, it briefly touched an 11-year high and continued to trade near those levels on Wednesday.

This strength is fueled by a cocktail of global risks, including unpredictable U.S. trade policy, questions surrounding the Federal Reserve's independence, and the threat of American military action in Greenland, Latin America, and the Middle East.

While investors flock to the franc for safety, the Swiss National Bank (SNB) sees the appreciation as a threat.

"Further escalation, geopolitically, means more uncertainty," SNB Chairman Martin Schlegel told CNBC at the World Economic Forum in Davos. "It's not good for the Swiss franc or for Switzerland, because the Swiss franc is a safe haven. Whenever there is uncertainty in the world, the Swiss franc appreciates, and this makes monetary policy more complicated for Swiss National Bank."

Unlike other major economies, Switzerland is fighting sluggish price growth. With inflation at just 0.1%, a stronger currency adds disinflationary pressure by making imports cheaper and squeezing the country's vital export sector.

The problem is compounded by the unique nature of the Swiss economy. Key exports like pharmaceuticals, precision manufacturing, and high-value services have relatively stable demand regardless of price.

"The Swiss franc remains strong in part because demand for many Swiss exports is relatively price-inelastic," explained Giuliano Bianchi, Co-Founder of the Quantitas Institute at EHL Hospitality Business School.

This dynamic weakens the natural economic mechanism where a stronger currency would typically curb foreign demand and stabilize the exchange rate. Bianchi added that this "complicates the SNB's task, as a strong franc lowers imported inflation and squeezes exporters' margins, weighing on wages and investment at a time when inflation is already subdued."

With its key policy rate already at 0%, Switzerland is on the verge of disinflation and a potential return to negative interest rates. The SNB only ended a seven-year experiment with negative rates in 2022, a policy deeply unpopular with savers and banks whose profit margins it erodes.

Despite the reluctance, Schlegel confirmed that the option remains on the table. "The bar to go negative is higher than normal, [but] if we need to go negative, we will go negative," he stated.

Another primary tool for the SNB has been direct intervention in the foreign exchange market—selling francs to buy foreign currencies. However, deploying this strategy now carries significant political risks.

The Shadow of U.S. Tariffs

Just months ago, Switzerland negotiated a deal to reduce punishing 39% U.S. tariffs to 15%. The Trump administration had imposed these "reciprocal tariffs" last year, partly in response to what it called "currency manipulation."

The political climate remains tense. In June, the White House placed Switzerland on a "Monitoring List" of trading partners whose currency practices require "close attention."

President Trump's unpredictable approach was highlighted last week in Davos when he said tariffs were raised from 31% to 39% simply because the then-Swiss president, Karin Keller-Sutter, "just rubbed me the wrong way." This has left Switzerland wary of attracting further ire from the White House.

Experts believe the franc's fundamental strengths will likely keep it elevated regardless of the SNB's actions.

"From a long-term perspective, the Swiss Franc is the strongest currency on earth, and this year it is likely to remain relatively resilient," said Lloyd Harris, head of fixed income at Premier Miton Investors. He pointed to several supporting factors:

• The high price of gold

• Switzerland's safe-haven status

• A persistent current account surplus

"The SNB may intervene if there's excessive strength, but over the medium term we don't really see a change to the Swiss Franc outperforming the USD," Harris added.

Claudio Sfreddo, a doctor of economics and adjunct professor at EHL Hospitality Business School, noted that history shows safe-haven inflows can overwhelm policy moves like interest rate cuts. "Greater political sensitivity around FX interventions further constrains the SNB's room for maneuver, sharpening the trade-off between price stability and growth," he said.

Despite the constraints, Schlegel was firm in his resolve. He insisted the SNB will do what is necessary to fulfill its mandate, even if it means risking renewed anger from Washington.

"We are ready to intervene in the FX market if necessary," he said.

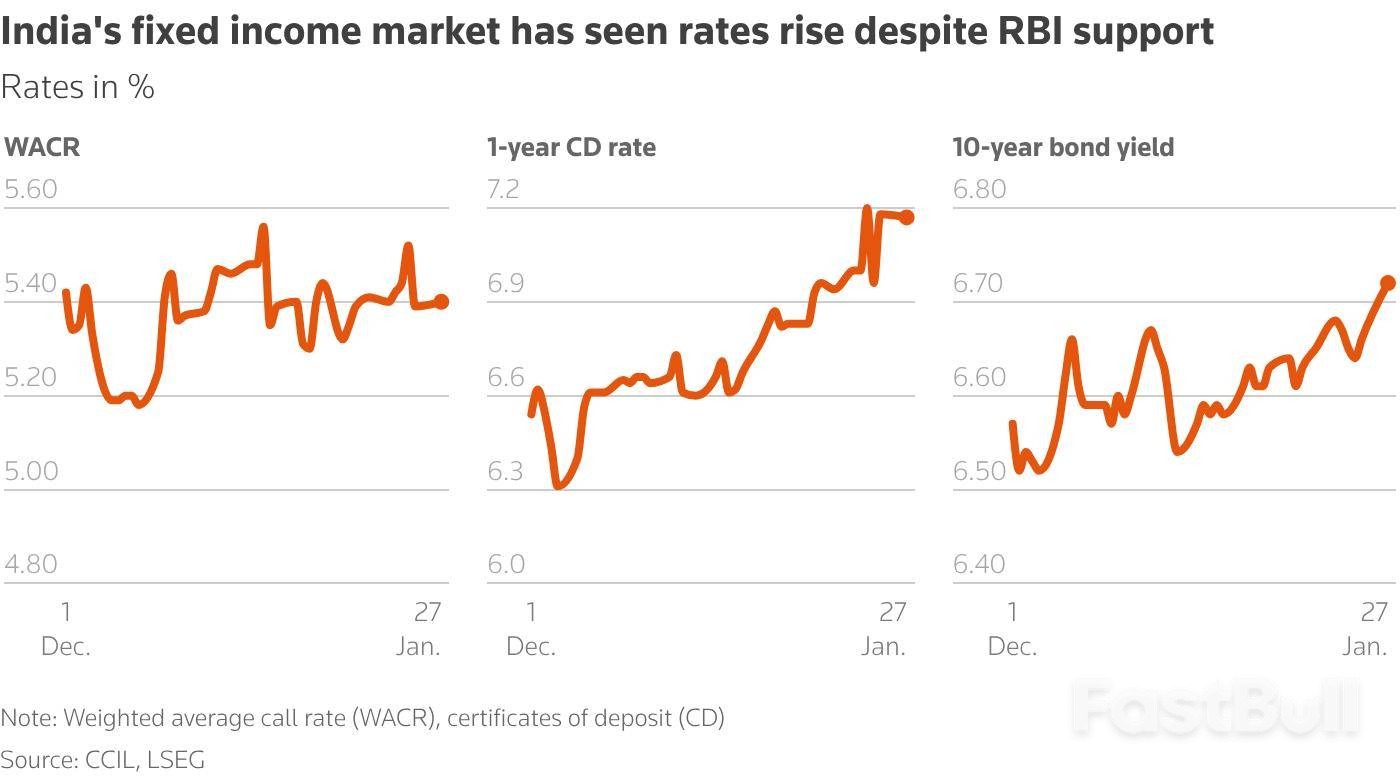

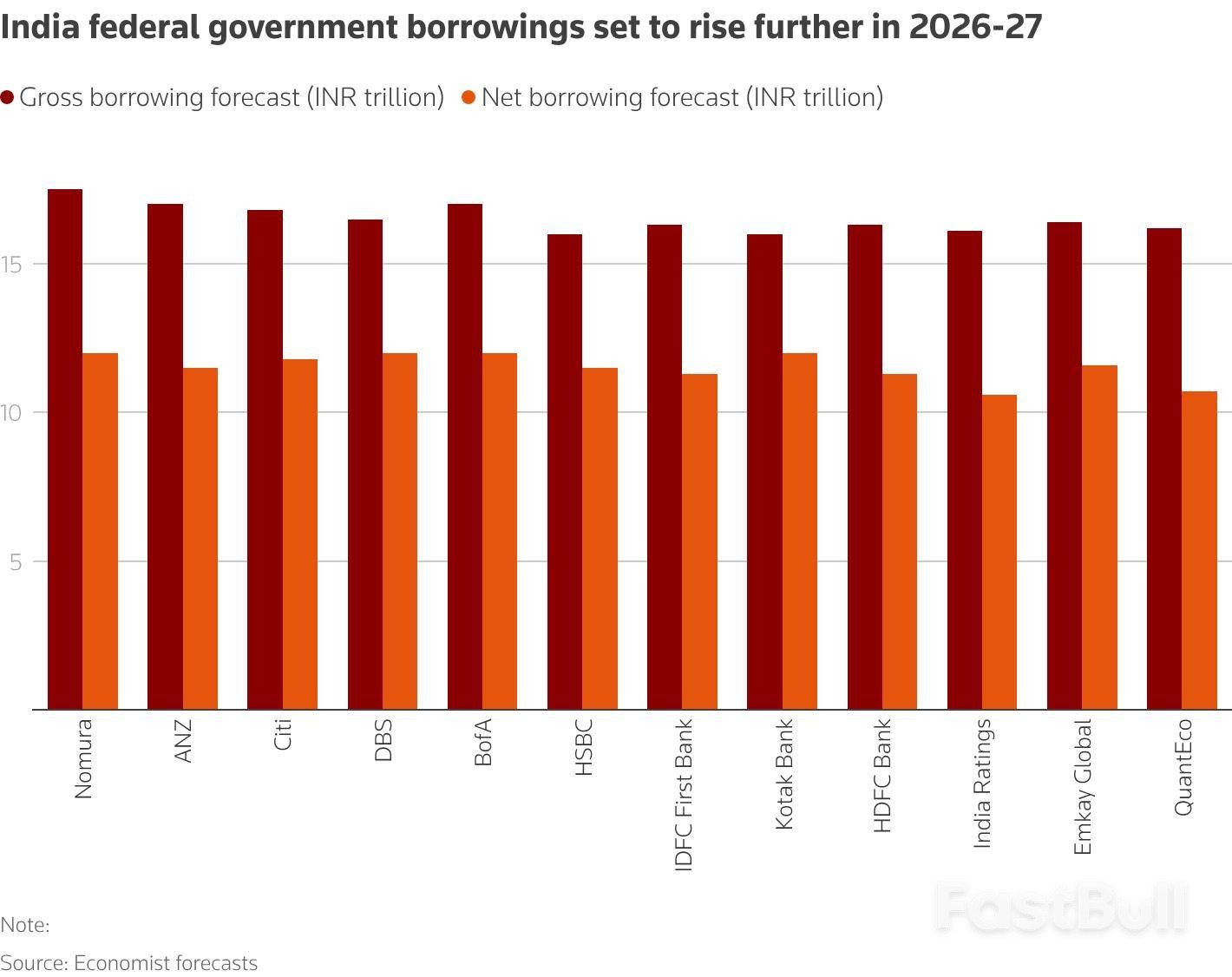

India's fixed-income market is flashing warning signs as yields surge across the board. Investors are bracing for an estimated 30 trillion rupee ($327 billion) flood of government bonds in the next fiscal year, a record supply that threatens to overwhelm demand and complicates the Reserve Bank of India's efforts to manage a weakening rupee.

This borrowing estimate from 20 economists, which covers both federal and state governments, represents an annual increase of over 10%. While the federal government will unveil its debt plan in the budget on Sunday, the market is already reacting to the immense supply pressure on the horizon.

Despite unprecedented liquidity injections by the Reserve Bank of India (RBI) through bond purchases and currency swaps, market rates have climbed higher, signaling deep-seated concerns among investors.

The stress is clearly visible in key market indicators. India's benchmark 10-year bond yield has jumped by a quarter of a percentage point since December, hitting an 11-month high of 6.72%.

Other segments are also feeling the heat. Overnight money market rates have consistently traded above the RBI's key policy rate of 5.25%. Meanwhile, the rate for one-year bank borrowing via certificates of deposit has soared by 65 basis points in just two months to approximately 7.20%.

A core part of the problem is weakening demand from the market's biggest players. According to bank treasurers and economists, appetite for government debt is flagging due to several factors:

• Weak Deposit Growth: Banks, the largest buyers of government bonds, are seeing deposit growth lag behind the net increase in bond supply. Vivek Kumar, an economist at QuantEco Research, notes, "This means the incentive of banks to buy more bonds is lower."

• Liquidity Scarcity: The RBI's interventions in the foreign exchange market have drained cash from the system.

• Accounting Changes: Shifts in how banks account for their trading books have also dampened demand.

• Slowing Institutional Purchases: Insurers and pension funds have also scaled back their bond purchases.

"There are some structural problems in the market," said A. Prasanna, chief economist at ICICI Securities Primary Dealership, who pointed out that banks are shifting from government bonds to higher-yielding state debt.

The result is a widening term premium—the extra return investors demand for the risk of holding longer-term debt—which has reached its highest level in three years.

The market's anxiety persists even after the RBI infused 9.56 trillion rupees of liquidity this financial year, including a record 5.7 trillion rupees in bond buying.

Traders say the central bank is caught in a policy conflict. It is trying to support the bond market with one hand while defending the rupee with the other.

"On one hand, the RBI is infusing money through OMOs and FX swaps, but on the other hand, there is large-scale intervention in the foreign exchange market that is draining cash conditions," explained the treasury head at a private bank.

To prop up the rupee, which has hit record lows amid foreign outflows, the RBI has been selling U.S. dollars. This action effectively pulls rupees out of the financial system, counteracting its efforts to inject liquidity.

Parijat Agrawal, head of fixed income at Union Asset Management, summarized the challenging environment. "We believe pressure on the rupee, sustained pressure on durable liquidity, higher credit-to-deposit ratios, higher issuance of state bonds and expectations of record borrowing have soured sentiment."

Short-term Eurozone bond yields fell on Wednesday after European Central Bank officials signaled that the euro's recent appreciation could suppress inflation and influence the future path of interest rates.

As a net energy importer, the Eurozone benefits from a stronger currency, which lowers the cost of energy and other imported goods. This dynamic can directly contribute to pushing inflation down.

Policymakers are taking notice. Austrian central bank governor Martin Kocher told the Financial Times that while the euro's gains have been "modest" so far and don't require an immediate response, a sharper appreciation could lower inflation projections enough to warrant considering rate cuts.

Echoing this sentiment, French policymaker Francois Villeroy de Galhau confirmed that the ECB is closely monitoring the currency and its potential to drive inflation lower.

Following these comments, traders increased their bets on a rate cut by the summer. Futures markets now imply a 22% probability of a rate cut by July, up from about 15% on Tuesday.

This shift in expectations directly impacted bond markets. Germany's 2-year bond yield, which is highly sensitive to ECB rate policy, dropped 2.5 basis points to 2.078%, its lowest level in a week.

Rene Albrecht, an analyst at DZ Bank, noted that he already expects Eurozone inflation to fall below 2% in the first two quarters of this year as high energy prices from last year drop out of the annual calculation.

"If you add another layer of deflationary impulses from the exchange rate, we can make a case that the ECB might cut once or twice," Albrecht said. He added, however, that this would depend on the euro strengthening even further.

The euro has gained significantly against the dollar recently, climbing above $1.20 on Tuesday after U.S. President Donald Trump commented that the dollar's value was "great." The euro was last trading at $1.1977. The U.S. dollar index, which tracks the greenback against six major currencies, fell to its lowest point since early 2022.

In the 10-year bond market, Germany's benchmark yield fell 2 basis points to 2.852%. France's 10-year yield also dropped by 2 basis points.

The spread between German and French 10-year yields tightened to 55.15 basis points, its narrowest level since French President Emmanuel Macron's call for a snap election in June 2024. The spread has been narrowing sharply in the last two weeks after the French government announced it would use constitutional powers to pass its 2026 budget.

"The story has run its course now and it won't tighten that much anymore," said DZ Bank's Albrecht. "Our view is that the spread should stick to a range between 55 and 65 basis points for the foreseeable future, since they don't get their deficit down and it's almost certain they won't in 2027."

Looking ahead, investors are awaiting the Federal Reserve's rate decision later on Wednesday. The consensus among analysts is that the U.S. central bank will hold the Fed funds rate steady, following a cut in December to a range of 3.5%-3.75%. Currently, markets are fully pricing in the next Fed rate cut for July, with nearly two quarter-point reductions anticipated by the end of the year.

Former U.S. President Donald Trump has outlined a dramatic shift in monetary policy, vowing to replace Federal Reserve Chairman Jerome Powell and pursue rapid interest rate cuts once Powell's term concludes. Speaking in Iowa, Trump's comments have sparked debate over the future of the Fed's leadership and its impact on the economy.

Market participants are now closely watching for a potential Fed Chair nomination, even as they prepare for an upcoming Federal Open Market Committee (FOMC) meeting.

Trump heavily criticized the Federal Reserve's current strategy, arguing that interest rates have been kept too high for too long. He advocates for a significant reduction in borrowing costs to energize key economic sectors like housing and investment. His remarks suggest he may accelerate the process of appointing a new Fed Chair to implement this vision.

Furthermore, Trump expressed no concern over a weakening U.S. dollar, suggesting it would create a more favorable environment for American exports. This perspective comes as the dollar index has recently fallen to levels around 96. His assertive stance points toward a future policy focused on loosening financial conditions.

While Trump's long-term plans create a new narrative, the market's immediate focus is on the next FOMC meeting. Current expectations are for the Fed to hold interest rates steady. According to CME FedWatch data, there is a 97% probability that the policy rate will remain in its current range of 3.5% to 3.75%, largely due to recent data showing cooling inflation.

However, the Fed remains cautious, citing ongoing risks from trade disputes and geopolitical instability.

Speculation is already growing about who might succeed Jerome Powell. Several names have emerged as potential candidates, including:

• Rick Rieder: A prominent figure from BlackRock.

• Kevin Warsh: A former Fed Governor.

• Kevin Hassett: A White House adviser.

• Chris Waller: A current Fed Governor.

Rick Rieder is reportedly the betting favorite, with 48% support. His proposed strategy is said to align closely with Trump's goal of monetary easing. Crypto analyst Anthony Pompliano noted, "Rick Rieder's proposed strategy could be a game-changer for the Federal Reserve's future direction."

The uncertainty surrounding future Fed policy has already sent ripples through financial markets. In response to the potential for lower rates and a weaker dollar, gold prices surged to a new record high above $5,200.

In contrast, the cryptocurrency market saw increased volatility, with Bitcoin’s price dropping to around $88,000. As the financial world digests Trump's comments, the focus will remain on the Fed's upcoming decisions and the potential for a fundamental reshaping of U.S. monetary policy.

The arrest of Zhang Youxia, China's highest-ranking general, has sent a political earthquake through the Chinese Communist Party. Alongside fellow senior general Liu Zhenli, Zhang stands accused of "grave violations of discipline and the law"—a common euphemism for corruption.

This isn't just another takedown. Zhang is the most powerful figure purged during Xi Jinping's rule and, until recently, was considered one of the president's closest and most trusted allies.

Xi appointed Zhang as the first-ranking vice chairman of the Central Military Commission (CMC) in 2022, making him the top operational commander of the armed forces, second only to Xi himself. Their connection was deeply personal; their fathers were comrades, and they had known each other since childhood.

While Xi has removed numerous generals in his long-running anti-corruption campaign, this move is different. The purge has shrunk the normally seven-member CMC leadership to just two: Xi and Zhang Shengmin, a political commissar who has led previous investigations.

The speed of the event was also unprecedented. Typically, months pass between an official's disappearance and a public announcement of charges. Yet, Zhang and Liu were absent from a senior officials' meeting on a Tuesday and publicly denounced just four days later. This rapid timeline suggests an urgent effort to preempt any potential unrest within the military.

The reasons for such a drastic move remain opaque, sparking widespread speculation. However, several popular theories seem unlikely.

• Armed Standoff: Rumors of a dramatic armed confrontation during the arrests are almost certainly false. Such stories are a common feature of the overseas Chinese rumor mill but rarely have a basis in reality.

• Doctrinal Disagreement: A simple policy dispute over military training or preparedness would not warrant such a high-profile purge. Xi could have easily pushed Zhang into retirement, especially since he had already granted him an exception to serve past the official retirement age.

• Passing Nuclear Secrets: A report that Zhang passed nuclear secrets to the United States also appears weak. This is likely a misunderstanding based on secondhand reports or flimsy evidence, such as discussions of nuclear policy in official meetings with American counterparts.

The most plausible explanation points to the fallout from an investigation Xi launched into the People's Liberation Army (PLA) following Russia's 2022 invasion of Ukraine. The inquiry into PLA readiness uncovered two alarming problems: rampant corruption within the PLA Rocket Force and a systemic culture of graft tied to military promotions.

The findings reportedly shocked Xi, who believed his purges in the mid-2010s had already cleaned up the military. This was not merely an issue of discipline but of national security. Between 2007 and 2012, the CIA was discovered to have paid the "promotion fees" for its Chinese assets, effectively bribing their way up the PLA hierarchy.

Official editorials on this latest purge reinforce this theory, stressing the themes of entrenched corruption and the absolute necessity of party control over the army.

As disciplinary investigations ensnared one general after another, it's possible that the remaining leaders felt their positions becoming untenable. Some analysts suspect a desperate Zhang and Liu may have started asserting their own authority or even contemplated a move against Xi. This would have confirmed Xi's worst fears, convincing him that swift action was necessary for his own political survival and the PLA's future.

More purges are likely to follow, which does not bode well for China's military capabilities. Historically, purges leave armies ill-prepared for war.

While Zhang was not a military mastermind, he was a competent administrator and one of the very few PLA members with direct combat experience, having served as a commander in China's 1979 invasion of Vietnam. His removal is a tangible loss of experience.

The greater damage, however, is to the military's internal culture. Under Xi, state institutions have seen the mediocre and incompetent rise, while the talented and assertive have been sidelined or have left for the private sector. Anti-corruption drives accelerate this trend. In a system where nearly everyone is implicated in some way, the only defense is to attack others for disloyalty.

There is a silver lining to this internal turmoil: it makes Chinese military adventurism, including a potential invasion of Taiwan, less likely in the near term. Before Xi can trust the PLA to execute such a complex operation, he needs to be confident that its personnel and corruption-induced logistical nightmares have been resolved.

While a weakened officer corps may produce more yes-men, there is little to suggest Xi has succumbed to the kind of delusional nationalism that drove Vladimir Putin to invade Ukraine. Xi's rhetoric on "unstoppable reunification" with Taiwan has remained largely consistent with the positions of his predecessors for decades.

For Xi himself, purging men he personally appointed damages his credibility but simultaneously demonstrates his absolute power. In the long run, however, his legacy is already burdened. Many Chinese view him as a failed leader due to the disastrous zero-COVID policies, the collapse of the real estate sector, economic stagnation, and rising social discontent.

By breaking the unwritten rule against targeting those in his innermost circle, Xi has fostered even greater instability within the party's institutions. This may inadvertently create the conditions for a future coup.

However, the pervasive fear, mutual distrust, and sophisticated electronic surveillance that define modern China make the coordination required for such a move extraordinarily difficult. Any serious challenge to Xi's rule would likely only be possible if he appeared visibly weak, perhaps due to a severe illness.

For now, he remains China's sole strongman.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up