Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The US Dollar Index (DXY) is consolidating around 98.00 amid low summer volumes and market indecision. Traders await clarity from geopolitical talks and inflation outlook. Key levels: resistance at 98.50–100.50, support at 97.94–97.15.

Dollar Index Daily Chart, August 19, 2025

Dollar Index Daily Chart, August 19, 2025

The dollar fell on Wednesday after U.S. President Donald Trump called on Federal Reserve Governor Lisa Cook to resign, as investors also waited on a speech by Fed Chair Jerome Powell on Friday for clues on interest rate policy.

Trump cited a call by the head of the U.S. Federal Housing Finance Agency urging the Department of Justice to probe Cook over alleged mortgage fraud. Spokespeople for Cook and the Fed did not immediately respond to requests for comment.

“The market has voted with its pocketbook that it doesn't like when the president interferes with the Federal Reserve,” said Marc Chandler, chief market strategist at Bannockburn Global Forex in New York.

Trump has been critical of Powell for being to slow to cut rates, and traders expect he will replace the Fed Chair with a more dovish appointment when his term ends in May.

But Powell may stay on the board of governors, which would limit how many appointments Trump may make and could crimp plans to form a more dovish composition of policymakers.

“This is just a thinly veiled attempt to get control of the Federal Reserve, because if Powell doesn't step down as Governor when his chair ends, Trump's only appointment is the Kugler seat that he gave to Miran temporarily,” Chandler said.

Trump earlier this month said he would nominate Council of Economic Advisers Chairman Stephen Miran to serve out the final few months of a vacant Fed seat after Fed Governor Adriana Kugler unexpectedly resigned.

The dollar index, which measures the greenback against a basket of currencies including the yen and the euro, was last down 0.16% on the day at 98.16, with the euroup 0.15% at $1.1664.

The Japanese yenstrengthened 0.21% against the greenback to 147.37 per dollar.

Traders are focused this week on whether Powell will push back against market expectations for a rate cut at the Fed’s September 16-17 meeting when he speaks at the U.S. central bank’s Jackson Hole meeting on Friday, following a weak jobs report for July.

Powell has said he is reluctant to cut rates on expectations that Trump’s tariff policies will increase inflation this summer.

Consumer price inflation data for July showed limited impact from tariffs but hotter than expected producer price inflation has tempered expectations for how many cuts are likely this year.

Fed funds futures traders are currently pricing in 85% odds of a cut next month, and 54 basis points of cuts by year-end.

Later on Wednesday, the Fed will issue the minutes of its July 29–30 meeting, when it held rates steady, although they may offer limited insight as the meeting came before the weak jobs numbers.

The New Zealand dollardropped 1.04% to $0.5831, a four month low, after the country’s central bank cut its policy rate by 25 basis points to a three-year low of 3.00% and flagged further reductions in coming months as policymakers warned of domestic and global headwinds to growth.

The Swedish crownstrengthened 0.1% to 9.59 after Sweden's central bank held its key interest rate at 2.00% as expected.

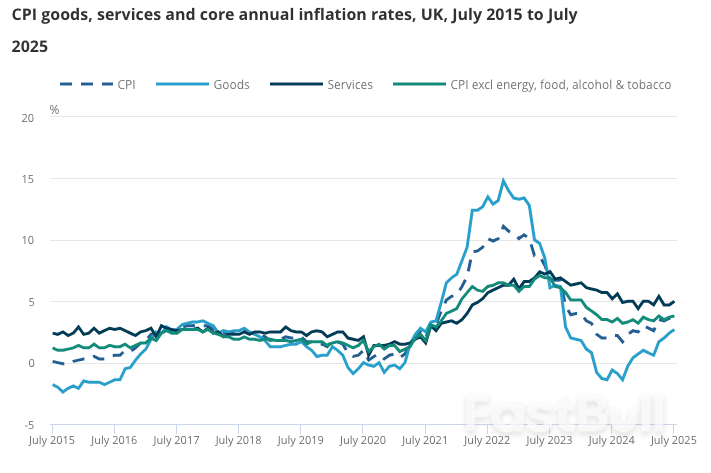

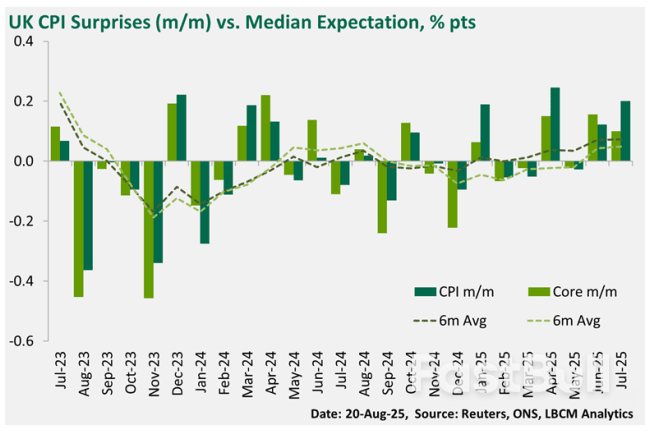

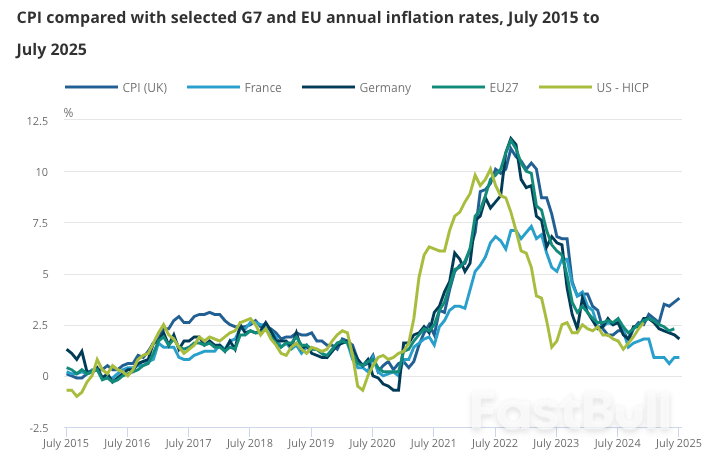

Sterling weakened 0.07% to $1.3481 after British inflation hit its highest in 18 months in July, but was not seen as swaying Bank of England policy.

"The BoE is more concerned about food inflation, which hasn't changed much in today's release," ING's head of research Chris Turner said.

In cryptocurrencies, bitcoinfell 0.22% to $113,324.

Key points:

Chinese refineries have purchased 15 cargoes of Russian oil for October and November delivery as Indian demand for Moscow's exports falls away, two analysts and one trader said on Tuesday.India has emerged as the leading buyer of Russian seaborne oil, which has sold at a discount since some Western nations shunned purchases and imposed restrictions on Russian exports over Moscow's 2022invasion of Ukraine.Indian state refiners paused Russian oil purchases last month, however, as those discounts narrowed. And U.S. PresidentDonald Trumpis also threatening to punish countries for buying Russian crude.

China had secured 15 Russian Urals cargoes for October–November delivery by the end of last week, said Richard Jones, a Singapore-based crude analyst at Energy Aspects.

Kpler senior analyst Xu Muyu wrote in an August 14 report that China has likely purchased about 13 cargoes of Urals and Varandey crude for October delivery, along with at least two Urals cargoes for November.The additional Russian Urals supply could curb Chinese refiners' appetite for Middle Eastern crude, which is $2 to $3 per barrel more expensive, Xu said.This, in turn, could add further pressure to the Dubai market which is already losing momentum as seasonal demand fades while competition from arbitrage supply intensifies, she added.

A trade source agreed with Kpler's estimate, adding that the cargoes were booked mostly at the beginning of this month by Chinese state-owned and independent refineries.China, the world's top oil importer and largest Russian oil buyer, primarily buys ESPO crude exported from the Russian Far East port of Kozmino due to its proximity. Its year-to-date imports of Urals crude stood at 50,000 barrels per day, Kpler data showed.

Urals and Varandey crude are typically shipped to India, Kpler data showed.

Indian state-refiners have backed out Russian crude imports by approximately 600,000 to 700,000 bpd, according to Energy Aspects' Jones."We do not expect China to absorb all of the additional Russian volumes, as Urals is not a baseload grade for Chinese majors," he said, referring to Chinese state refineries which are not designed to solely process the Russian grade.Chinese refiners will also be wary about the possibility of U.S. secondary sanctions if Trump's push for a Ukraine peace deal breaks down, he added.

Trump said on Friday he did not immediately need to consider retaliatory tariffs on countries such as China for buying Russian oil but might have to "in two or three weeks".

Last month's decision by the U.S. Federal Reserve to hold interest rates unchanged prompted dissents from two top central bankers who wanted to lower rates to guard against further weakening of the job market, and a readout of that two-day gathering on Wednesday could show whether their concerns had started to resonate with other policymakers, perhaps reinforcing expectations that borrowing-cost reductions could begin next month.

Not even 48 hours after the conclusion of the July 29-30 Federal Open Market Committee meeting, data from the Labor Department appeared to validate the concerns of Fed Vice Chair for Supervision Michelle Bowman and Governor Christopher Waller when it showed far fewer jobs than expected were created in July, the unemployment rate ticked up and the labor force participation rate slid to its lowest since late 2022. More unsettling, though, was an historic downward revision for estimates of employment in the previous two months.

That revision erased more than a quarter of a million jobs thought to have been created in May and June and put a hefty dent in the prevailing narrative of a still-strong-job market. The event was so angering to President Donald Trump that he fired the head of the Bureau of Labor Statistics.

Data since then, however, has provided some fodder for the camp more concerned that Trump's aggressive tariff regime risks rekindling inflation to hold their ground against moving quickly to lower rates. The annual rate of underlying consumer inflation accelerated more than expected in July and was followed by an unexpectedly large jump in prices at the producer level.

"The minutes to the Jul Federal Open Market Committee will give a more nuanced sense of the split on the committee between the majority that voted to leave rates on hold and the dovish bloc led by dissenting Governors Miki Bowman and Christopher Waller," analysts at Oxford Economics wrote ahead of the minutes release, set for 2 p.m. ET (1800 GMT) on Wednesday. "However, the minutes are more stale than usual since they predate the revised payroll figures, which prompted a rapid repricing of the probability of a September rate cut."

Heading into the release of the minutes, CME's FedWatch tool assigns an 85% probability of a quarter-point reduction in the Fed's policy rate from the current range of 4.25%-to-4.50%, where it has remained since December.

Another reason the minutes may feel stale on arrival is they come just two days before a highly anticipated speech from Fed Chair Jerome Powell at the annual economic symposium near Jackson Hole, Wyoming, hosted by the Federal Reserve Bank of Kansas City.

Powell's keynote speech on Friday morning - set to be his last Jackson Hole address as Fed chair with his term expiring next May - could show whether Powell has joined ranks with those sensing the time has come for steps to shield the job market from further weakening or if he remains in league with those more wary of inflation in light of its moves away from the central bank's 2% target.

The lack of Fed rate reductions since Trump returned to the White House has agitated the Republican president, and he regularly lashes out at Powell for not engineering rate cuts. Trump is already in the process of screening possible successors to Powell and after the unexpected resignation earlier this month of one of the seven Board of Governors members, he has a chance to put his imprint on the Fed soon. He has nominated Council of Economic Advisers Chair Stephen Miran to fill the seat vacated by Adriana Kugler, a term that expires at the end of January. It is unclear whether Miran will win Senate confirmation before the Fed's September 16-17 meeting.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up