Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

UK economy leads G7 and stocks outperform, but locals stay pessimistic, selling shares while foreigners buy. Strong earnings, falling trade deficit, and IPOs signal recovery.

U.S. tech stocks seem to have found a level following two days of sharp pullbacks, but the Treasury market was unnerved by the latest Federal Reserve drama just as everyone awaits the central bank’s annual Wyoming jamboree.

U.S. stock futures ended in the red again on Wednesday, driven by a whole host of AI and tech sector jitters ahead of Nvidia's big earnings release next week. But stock futures seemed to find a foothold ahead of today's bell, with attention turning back to the Fed following President Trump's demand for the resignation of another Fed board member - Lisa Cook - over allegations of mortgage fraud that she insists she will contest.

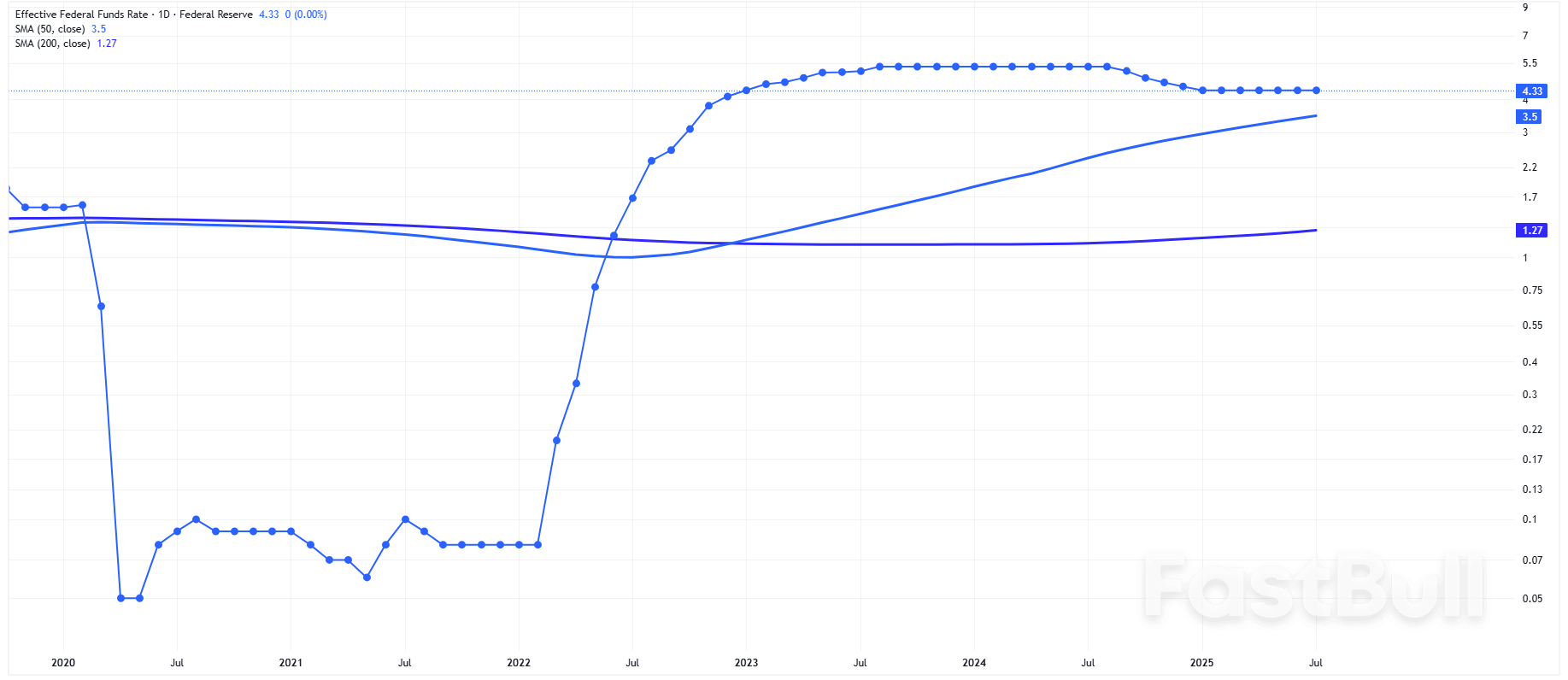

* If Cook were forced out, Trump would then likely secure a majority of his appointees on the seven-person Fed board by next summer. If Chair Jerome Powell, who gives his keynote Jackson Hole speech on Friday, steps down as a board member when his chairmanship ends in May, then a majority of deep rate cut advocates could well emerge on the Fed's policymaking committee with the support of just one regional Fed boss.

* Despite the board machinations, minutes from the Fed's last meeting showed two policymakers - Christopher Waller and Michelle Bowman - were alone in voting for a rate cut and it recounted how "almost all" favored holding the policy rate steady last month. Fed futures pricing for September's meeting slipped back to show less than an 80% chance of a rate cut and Treasury yields nudged higher, with a mixed review of the latest 20-year bond auction. The dollar was steady but gold firmed after the Cook story, giving up some of that today.

* The big economic releases around the world today were early August business surveys, which came in above forecast in Europe and Japan - propping the euro, sterling and yen even though stocks in all three areas fell back. U.S. equivalent surveys are due later, with the Philadelphia Fed's August survey also released alongside closely watched jobless claims updates and existing home sales data for July. Walmart tops the earnings diary in a busy week for big retailers.

In today's column, I look at the extraordinary moves by the Trump administration to propose taking stakes in big chipmaking firms, which would radically shift U.S. industrial policy and raise questions about what might next be seen as "strategic"., opens new tab

* Financial markets are taking in a collective breath ahead of Jerome Powell's eighth and final keynote Jackson Hole speech as Federal Reserve Chair. If the moves following his last seven are any guide, writes ROI columnist Jamie McGeever, investors should buckle up for a bumpy ride.

* China is considering allowing the usage of yuan-backed stablecoins for the first time to boost wider adoption of its currency globally, sources familiar with the matter said, in a major reversal of its stance towards digital assets.

* Indian companies have seen the steepest earnings downgrades in Asia, with analysts slashing forecasts as steep U.S. tariffs heighten risks to growth even if proposed domestic tax cuts help cushion the impact.

* Chinese artificial intelligence startup DeepSeek on Thursday released DeepSeek-V3.1, an upgraded model with hybrid inference structure, faster thinking speed and stronger agent capability, the company said in a statement published on WeChat.

* U.S. power generation capacity is evolving at the fastest pace in decades, as utilities scramble to ensure that supplies keep up with rapidly growing electricity demand. ROI columnist Gavin Maguire lays out current expectations for the U.S. power generation mix through the next 10 years.

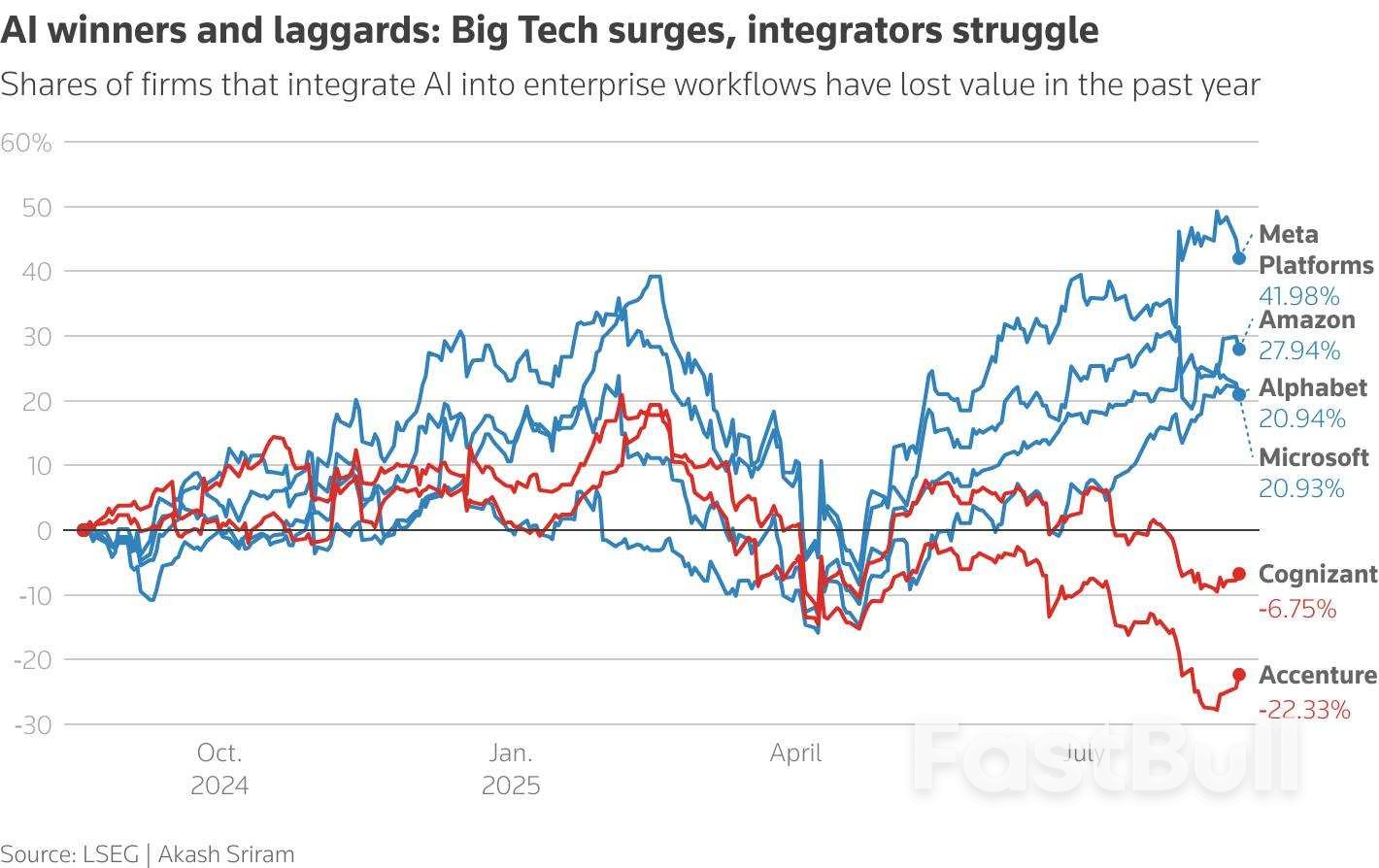

AI winners and laggards: Big Tech surges, integrators struggle - Shares of firms that integrate AI into enterprise workflows have lost value in the past year

The week's latest tech shakeout, with heavy losses for high flyers such as Nvidia and Palantir, comes as the sector's price-to-earnings ratio recently reached about 30 times expected earnings for the next 12 months, its highest level in a year, and tech's share of overall S&P 500 market value is close to its highest since 2000.

Seeds of doubt over such heady valuations were sown over the past week by a study from researchers at the Massachusetts Institute of Technology that found that 95% of organizations are getting no return on AI investments, and comments by OpenAI CEO Sam Altman that investors may be getting overexcited about AI and some bubbles would emerge and pop.

* Philadelphia Federal Reserve's August business survey (8:30 AM EDT), U.S. weekly jobless claims (8:30 AM EDT), S&P Global flash U.S. business surveys for August (9:45 AM EDT) U.S. July existing home sales (10:00 AM EDT); Canada July producer prices (8:30 AM EDT); Euro zone August consumer confidence (10:00 AM EDT)

* Fed's annual Jackson Hole symposium gets underway; Atlanta Fed President Raphael Bostic speaks

* U.S. corporate earnings: Walmart, Ross Stores, Workday, Intuit

* U.S. Treasury sells $8 billion of 30-year inflation protected securities

Effective Fed Funds Rate

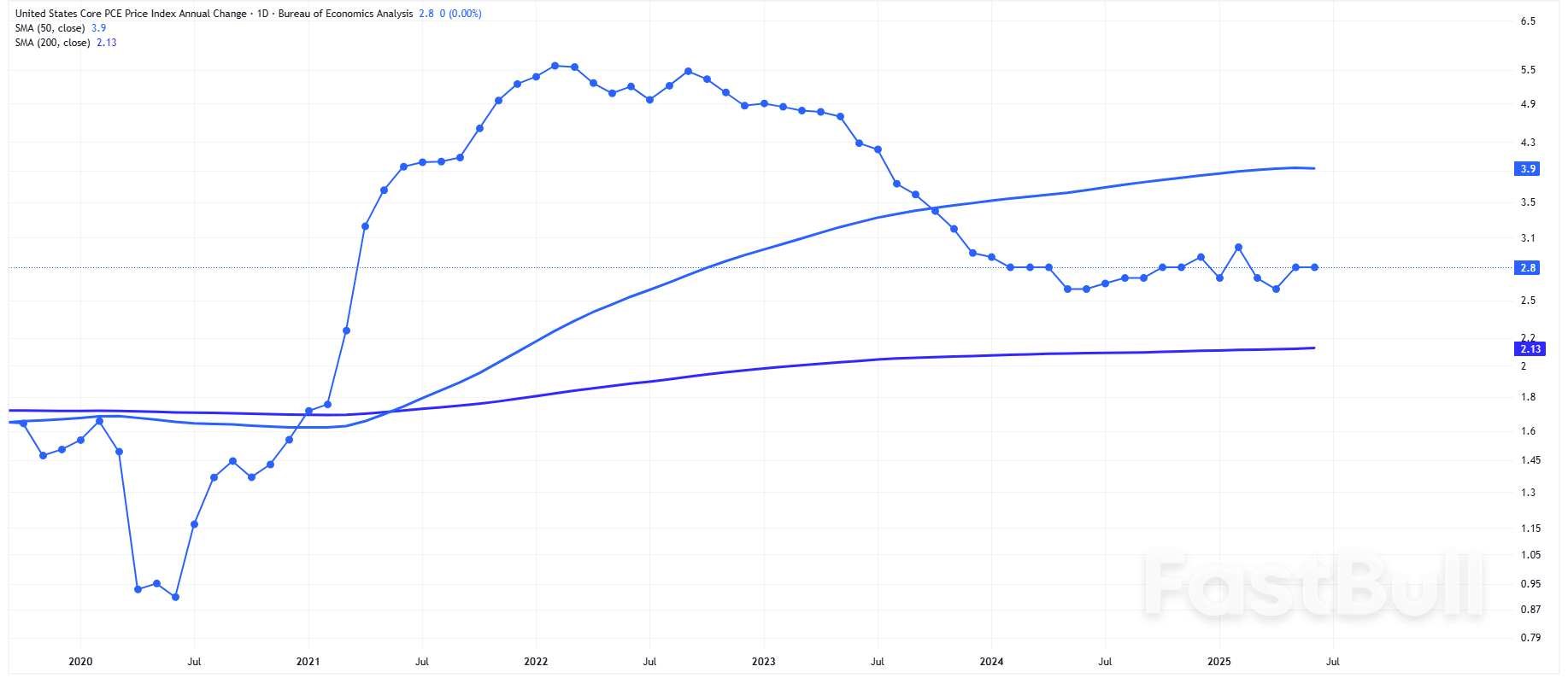

Effective Fed Funds Rate US Core PCE Annual Change

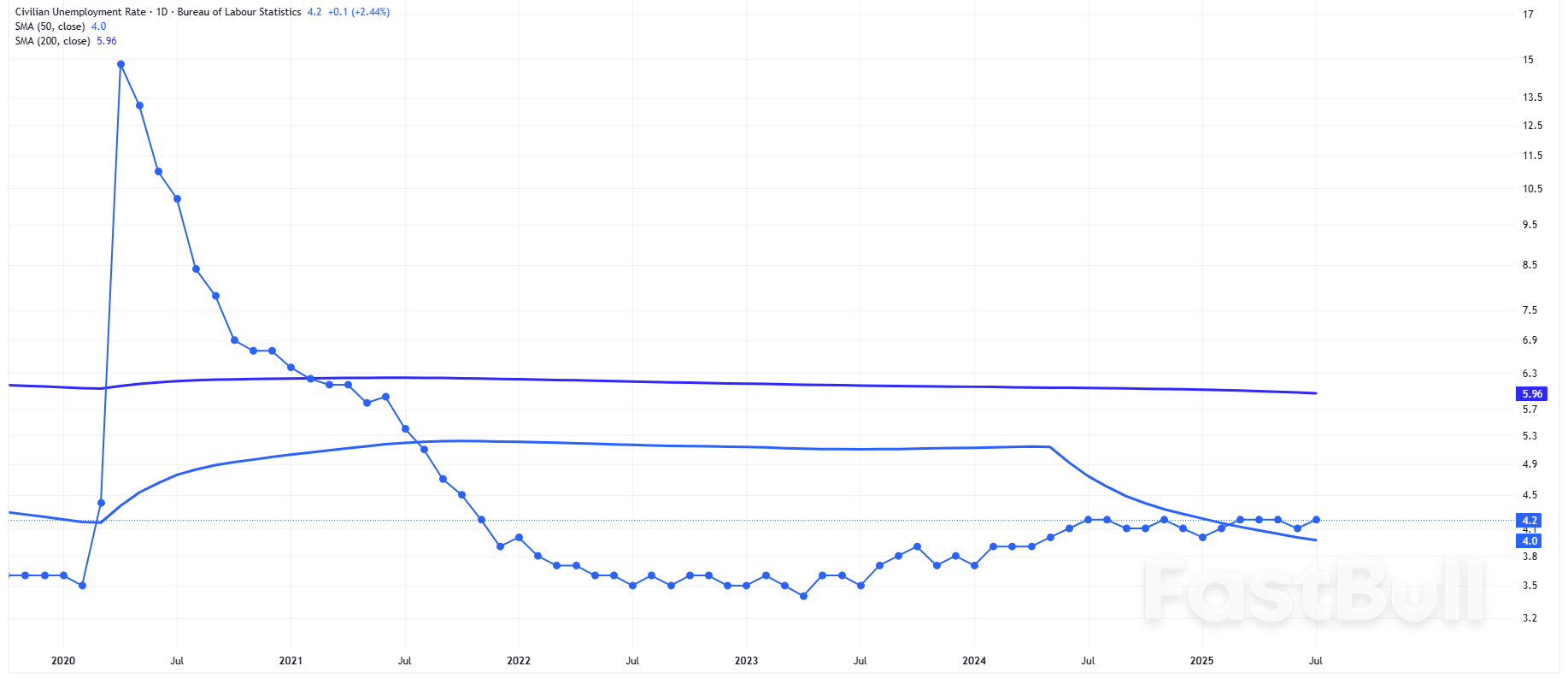

US Core PCE Annual Change July 2025 Unemployment Rate

July 2025 Unemployment Rate Daily E-mini Nasdaq 100 Index Futures

Daily E-mini Nasdaq 100 Index Futures(Aug 21): The euro area’s private sector grew at the quickest pace in 15 months as manufacturing exited a three-year downturn despite a deal locking in higher levies for exports to the US.

The Composite Purchasing Managers’ Index compiled by S&P Global rose to 51.1 in August from 50.9 in July, further above the 50 threshold separating expansion from contraction. Analysts had predicted a reading of 50.6.

While services weakened a little, in line with estimates, manufacturing saw a jump to 50.5, bucking expectations for a slight slowdown and recording its first expansion since June 2022. Germany’s factory sector also neared the end of a three-year slump.

“Things are getting better,” Cyrus de la Rubia, an economist at Hamburg Commercial Bank, said Thursday in a statement. “Despite headwinds like US tariffs and general uncertainty, businesses across the eurozone seem to be coping reasonably well.”

The euro was steady against the dollar at US$1.1654 after erasing small losses earlier, while euro area bonds held declines with the German 10-year yield two basis points higher at 2.73%.

The data provide more evidence of Europe’s resilience to obstacles ranging from trade to wars, and will support those European Central Bank officials who say there’s no rush into lowering interest rates further.

President Christine Lagarde said Wednesday that the 15% US levy on most goods from the European Union, which kicked in this month, is a touch above the level the ECB assumed in its June projections but “well below” a more severe scenario it had also mapped out.

Even so, the pact with President Donald Trump’s administration looks like it will crimp business in the months ahead, according to de la Rubia, who highlighted a second straight decline in foreign orders for eurozone manufacturers.

“US trade policy is leaving its mark,” he said. “Germany had been holding up well, possibly due to pre-emptive purchases from the US, but now it’s also seeing a drop in orders. France has climbed out of the deep hole of falling foreign demand over the last months, but incoming orders are still on the decline.”

Germany’s economy will probably stagnate in the third quarter after a slight contraction in the second, the Bundesbank said Thursday in its monthly report. While the US trade deal eased uncertainty, it remains high given unanswered questions and the “volatile US economic policy,” it said, without excluding a small gain in output over 2025 as a whole.

“The PMI survey suggests economic activity is picking up. The pace of expansion will, however, likely remain muted in the near term as weak external demand and high uncertainty act as a drag. With the economy far from crashing, we think the ECB will leave interest rates unchanged until December,” said Bloomberg Economics.

The eurozone’s 20-nation economy unexpectedly eked out growth of 0.1% between April and June, though this was significantly lower than the 0.6% expansion in the previous three months, which was driven by tariff-related front-loading. Inflation is hovering around the ECB’s 2% target.

Officials in Frankfurt are widely expected to leave the key deposit rate at 2% when they reconvene after their summer break in September, extending a pause that began last month following a yearlong campaign of cuts.

PMIs are closely watched by markets as they arrive early in the month and are good at revealing trends and turning points in an economy. A measure of breadth of changes in output rather than depth, business surveys can sometimes be difficult to map directly to quarterly GDP.

A PMI reading from the UK came in far ahead of expectations, at 53, while the US composite number, due later Thursday, is also estimated to have remained well over 50.

Israeli media is reporting that around 60,000 Israeli reservists are set to receive call-up orders on Wednesday as the Israel Defense Forces (IDF) gear up for a major assault on Gaza City.A report in Times of Israel notes that reservists will have up to two weeks before going to their duty stations, but not all will be directly involved in the Gaza City offensive, as some are needed replace Israeli forces currently stationed in other parts of Gaza.

Anadolu Agency

Anadolu AgencyThe controversial Netanyahu-ordered expanded offensive which aims to achieve total control of Gaza City is expected to displace over a million Palestinian civilians.The IDF is prepared to use artillery to forcibly remove them, and a ramped-up air campaign has already been underway. Arab media sources, including Al Jazeera, have said that areas with a lot of tent shelters for refugees have at times been directly struck.

Israel's military has issued evacuation orders, and is framing this as simply a mass transfer, while the Palestinian side along with international human rights monitors have decried an ethnic cleansing and land grab in progress.Reports in Israeli media have further described that after capturing the city, the IDF plans to spend over a year systematically demolishing it, which is precisely what previously happened in Beit Hanoun, Beit Lahia, and Jabalia.

The ostensible justification is for removal of "Hamas infrastructure" - but critics have said it is ultimately to pave the way for Jewish settlement of the Gaza Strip.The question remains, where will these Gazans go? Israel has been seeking to pressure some regional and even north African countries to take them in.To be expected, these conversations have gone nowhere especially as regional Arab states have already historically absorbed hundreds of thousands. For example, the majority of the population of Jordan actually has Palestinian roots.

The Trump administration has meanwhile appeared to greenlight the takeover plans, in a break from Europe - which has grown much more critical of Israeli policy and loud over the last months.Some EU states like Denmark are even mulling sanctions on Israel, and several major US allies are set to recognize the state of Palestine at the upcoming UN General Assembly meeting in September.

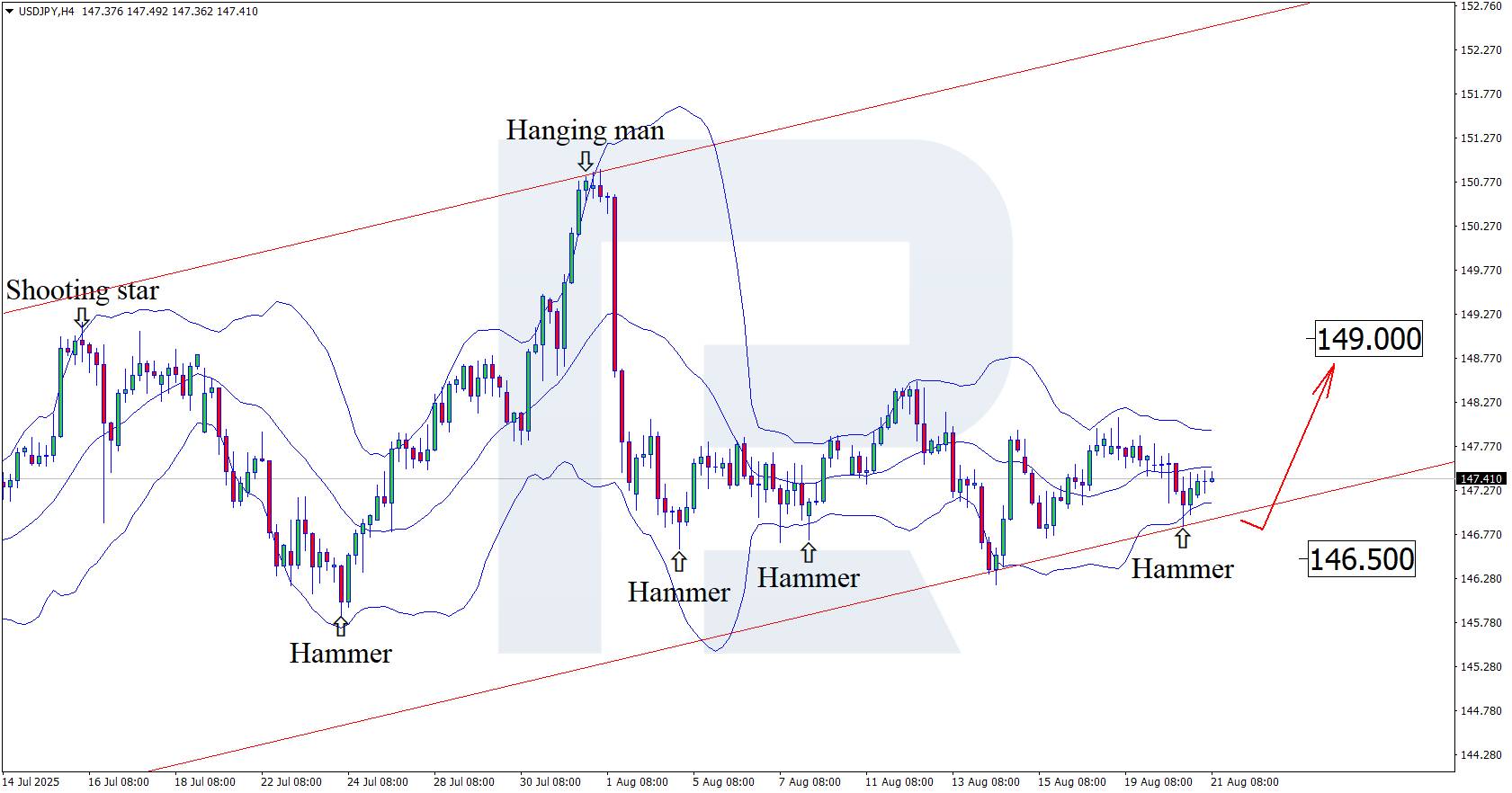

With Japan’s PMI declining and the US PMI remaining uncertain, the USDJPY rate may reach 149.00.

Fundamental analysis for 21 August 2025 shows the USDJPY pair holding steady, trading sideways near 147.40.

Japan’s services PMI covers a wide range of industries, including transport and communications, financial intermediation, business and household services, IT, hospitality and restaurants.

The USDJPY forecast for today does not appear optimistic for the yen, with the PMI down to 52.7 from the previous reading. Although the figure remains above the 50.0 threshold, which indicates expansion, the yen continues to lose ground against the US dollar.

In the US, the services PMI is forecast to ease slightly from 49.8 to 49.7. While such a move may not be critical, it is important to note that forecasts can diverge significantly from actual results, which could either strengthen or weaken the USD.

Having tested the lower Bollinger Band, the USDJPY pair formed a Hammer reversal pattern near 147.40 on the H4 chart. At this stage, the pair may continue its upward trajectory in line with the pattern’s signal. The USDJPY rate remains within an ascending channel, which supports the case for growth towards resistance near 149.00.

At the same time, the USDJPY forecast also considers an alternative scenario where the price dips to 146.50 before resuming its upward movement.

Fundamental data currently favours the USD, while USDJPY technical analysis points to growth towards 149.00.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up