Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The European Central Bank is set to cut interest rates by 25 basis points amid slowing growth and easing inflation. Further cuts are likely, though future moves remain uncertain due to global risks.

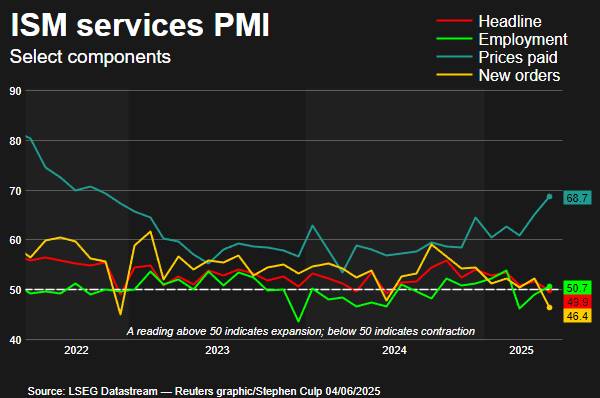

The U.S. services sector contracted for the first time in nearly a year in May while businesses paid higher prices for inputs, a reminder that the economy remains in danger of experiencing a period of very slow growth and high inflation.

The survey from the Institute for Supply Management (ISM) on Wednesday showed uncertainty was the dominant theme among businesses as they tried to navigate President Donald Trump's constantly shifting trade policy.

The whiplash from the tariffs that Trump has announced, paused, and imposed has left most businesses in limbo and struggling to plan ahead, to the detriment of the economy. The Trump administration has given U.S. trading partners until Wednesday to make their "best offers" to avoid other punishing import levies from taking effect in early July.

"Until there is clarity on the trading environment, it appears that the business sector will remain wary of putting money to work," said James Knightley, chief international economist at ING.

The ISM said its nonmanufacturing purchasing managers index (PMI) dropped to 49.9 last month, the first decline below the 50 mark and lowest reading since June 2024. It stood at 51.6 in April.

Economists polled by Reuters had forecast the services PMI would rise to 52.0 following some easing in the U.S.-China trade tensions. A PMI reading below 50 indicates contraction in the services sector, which accounts for more than two-thirds of the economy. The ISM associates a PMI reading above 48.6 over time with growth in the overall economy.

"May's PMI level is not indicative of a severe contraction, but rather uncertainty," said Steve Miller, chair of the ISM Services Business Survey Committee. "Respondents continued to report difficulty in forecasting and planning due to longer-term tariff uncertainty and frequently cited efforts to delay or minimize ordering until impacts become clearer."

The ISM on Monday reported that manufacturing contracted for a third straight month in May, with suppliers taking the longest time in nearly three years to deliver inputs amid tariffs.

Retailers, airlines and auto manufacturers are among the businesses that have either withdrawn or refrained from giving financial guidance for 2025. While economists do not expect a recession this year, stagflation is on the radar of many.

Public administration, utilities, educational services, information as well as healthcare and social assistance were among the 10 services industries reporting growth. Eight industries, including retail trade, construction, transportation and warehousing, reported contraction.

Businesses in the construction industry said "tariff variability has thrown residential construction supply chains into chaos," adding that "major heating, ventilation and air conditioning equipment manufacturers are passing on their cost increases due to higher refrigerant and steel commodity prices."

They also noted that "planning is difficult for community projects that could be scheduled for the next 22 to 30 months."

Trump on Tuesday doubled steel and aluminium duties to 50%. Businesses in the information sector said tariffs were a challenge "as it is not clear what duties apply," adding "the best plan is still to delay decisions to purchase where possible." Transportation and warehousing businesses said the import duties had "increased the cost of doing business."

The White House's unprecedented campaign to slash spending also impacted purchasing decisions by companies in the healthcare and social assistance industry. But tariffs are boosting demand for retailers as some customers pull purchases forward to avoid higher prices. Demand for data centers was driving activity for businesses in the utility industry.

Stocks on Wall Street were largely flat. The dollar eased against a basket of currencies. U.S. Treasury yields fell.

The ISM survey's new orders measure dropped to 46.4, the lowest reading in nearly 2-1/2 years, from 52.3 in April, likely as the boost from front-running related to tariffs faded. Data on Tuesday showed the new light vehicle sales rate slumped in May by the most in about five years.

Services sector customers viewed their inventory as too high in relation to business requirements, which does not bode well for activity in the near term. Backlog orders were the lowest in nearly two years.

Suppliers' delivery performance continued to worsen. This, together with lengthening delivery times at factories, points to strained supply chains that could drive inflation higher through shortages. Businesses are also seeking to pass on tariffs, which are a tax, to consumers.

That effort was corroborated by a report from the New York Federal Reserve showing the majority of businesses in its district said they had passed on at least some of the tariffs in the form of higher prices in May. Companies also flagged considerable confusion and uncertainty in navigating the duties.

The ISM survey's supplier deliveries index for the services sector rose to 52.5 from 51.3 in April. A reading above 50 indicates slower deliveries. A lengthening in suppliers' delivery times is normally associated with a strong economy. Delivery times are, however, likely getting longer because of supply-chain bottlenecks.

That situation was reinforced by a surge in the survey's measure of prices paid for services inputs to 68.7, the highest level since November 2022, from 65.1 in April. Most economists anticipate the tariff hit to inflation and employment could become evident in the so-called hard economic data by this summer.

Services sector employment picked up. The survey's measure of services employment rose to 50.7 from 49.0 in April. Some companies said "higher scrutiny is being placed on all jobs that need to be filled." The index is generally consistent with a steadily cooling labor market.

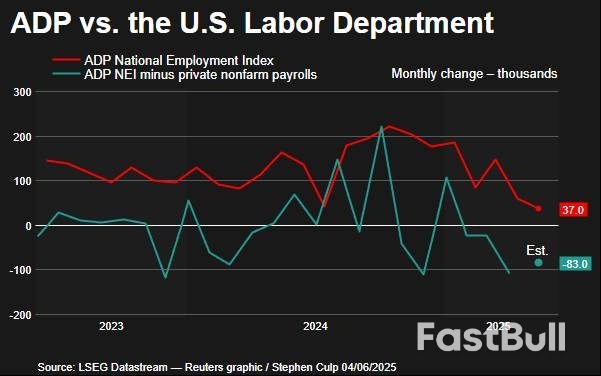

Economists shrugged off the release on Wednesday of the ADP National Employment Report, which showed private payrolls increased by only 37,000 jobs in May, the smallest gain since March 2023, after a rise of 60,000 in April. They noted ADP had a poor record predicting the government's closely watched employment report.

The government is expected to report on Friday that nonfarm payrolls increased by 130,000 jobs in May after advancing by 177,000 in April, a Reuters survey of economists showed. The unemployment rate is forecast to hold steady at 4.2%.

The United States and European Union said trade talks advanced quickly and in the right direction on Wednesday, top negotiators said, despite a stumbling block posed by new U.S. metals tariffs.

President Donald Trump's doubling of tariffs on steel and aluminium imports kicked in on Wednesday, the same day his administration sought "best offers" from trading partners to avoid other punishing import levies from taking effect in July.

The 27-nation EU's trade negotiator, Maros Sefcovic, and U.S. Trade Representative Jamieson Greer said their meeting in Paris was constructive.

"We both concluded that we are advancing in the right direction, at pace," Sefcovic told reporters. Technical talks are ongoing in Washington, he said, and high-level contacts will follow.

"What makes me optimistic is I see the progress ... the discussions are now very concrete," Sefcovic said, adding that he and Greer had agreed to restructure the focus of their talks.

Greer said the talks were advancing quickly and demonstrated "a willingness by the EU to work with us to find a concrete way forward to achieve reciprocal trade."

Trump has made charging U.S. importers tariffs on goods from foreign countries the central policy of his ongoing trade wars, which have severely disrupted global trade flows and roiled financial markets.

The Republican president has long been angered by the massive federal trade deficit, saying it was emblematic of how trading partners "take advantage" of the U.S. He sees tariffs as a tool to bring more manufacturing - and the jobs that go with that - back to the United States.

However, the non-partisan Congressional Budget Office said on Wednesday that U.S. economic output will fall as a result of Trump's new tariffs on foreign goods that were in place as of May 13.

In another sign of disruptions to global trade, concerns about the damage from China's restrictions on critical mineral exports deepened, with some European auto parts plants suspending output and German carmaker BMWwarning that its supplier network was affected by shortages of rare earths.

Separately, Trump said early on Wednesday that Chinese President Xi Jinping is tough and "extremely hard to make a deal with," exposing frictions after the White House raised expectations for a long-awaited phone call between the two leaders this week over trade issues including critical minerals.

The expected hike in the levies jolted the market for both metals this week, especially for aluminum, which has seen price premiums more than double this year.

Late on Tuesday, Trump signed an executive proclamation on a hike in the tariffs on imported steel and aluminium to 50% from the 25% rate introduced in March.

The increase came into effect at 12:01 a.m. (0401 GMT) Wednesday. It applies to all trading partners except Britain, the only country so far to strike a preliminary trade agreement with the U.S. during a 90-day pause on a wider array of Trump tariffs.

Sefcovic said he deeply regretted the doubling of the steel tariffs, stressing that the EU has the same challenge - overcapacity - as the United States on steel, and that they should work together on that.

About a quarter of all steel used in the U.S. is imported, and Census Bureau data shows the increased levies will hit the closest U.S. trading partners - Canada and Mexico - especially hard.

Canadian Prime Minister Mark Carney said intensive negotiations continued Wednesday on the new U.S. tariffs, which he considers illegal.

Canada is even more exposed to the aluminum levies as the top exporter to the U.S. by far at roughly twice the rest of the top 10 exporters' volumes combined. The U.S. gets about half of its aluminum from foreign sources.

Global forex, bond and stock markets took the latest tariffs in their stride, with many investors betting that the current levies may not last and that the president will back off from such extreme actions.

Uncertainty around U.S. trade policy has created havoc for businesses around the world.

The new tariffs will affect "everything from autos to aircraft to aluminum beer containers to cans for processed goods to machinery and equipment," said Georgetown University professor Marc Busch, a trade policy expert. "It's hard to imagine what won't be impacted in terms of manufacturing industries."

The Aluminum Association urged the Trump administration to reserve high tariffs for bad actions including China and include carve outs for partners like Canada.

"Doing so will ensure the U.S. economy has the access to the aluminum it needs to grow, while we work with the administration to increase domestic production,” said Matt Meenan, the group's vice president of external affairs.

Wednesday is also when the White House expects trading partners to propose deals that might help them avoid Trump's hefty "reciprocal" tariffs on imports across the board from taking effect in five weeks.

U.S. officials have been in talks with several countries since Trump announced a pause on those tariffs on April 9, but so far only the UK deal has materialised and even that pact is essentially a preliminary framework for more talks.

Reuters reported on Monday that Washington was asking countries to list their best proposals in such key areas as suggested tariffs and quotas for U.S. products and plans to remedy any non-tariff barriers.

In turn, the letter promises answers "within days" with an indication of what tariff rates countries can expect after the 90-day pause ends on July 8.

Daily Hewlett Packard Enterprise Company

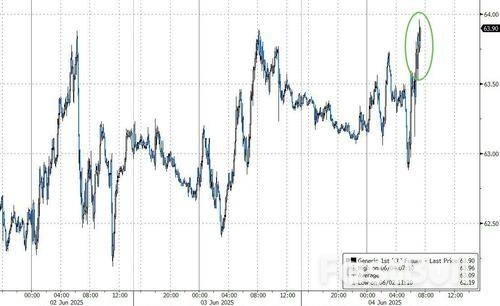

Daily Hewlett Packard Enterprise CompanyHaving surged overnight and extended gains on a big crude draw (and trade-talk progress with the Europeans), oil prices are tanking now as Bloomberg reports that, according to people familiar with the matter, Saudi Arabia wants OPEC+ to continue with accelerated oil supply hikes in the coming months as it puts greater importance on regaining lost market share.

The kingdom, which holds an increasingly dominant position within OPEC+, wants the group to add at least 411,000 barrels a day in August and potentially September, the people said, asking not to be named because the information was private.

Riyadh is keen to unwind its cuts as quickly as possible to take advantage of peak demand during the northern hemisphere summer, one person said.

The reaction was instant, slamming WTI down 2%...

We would imagine Russia will not be pleased at this outburst (or the US shale producers or the Kazakhs), but Trump might be happy with what his old friends in The Kingdom are saying (and doing).

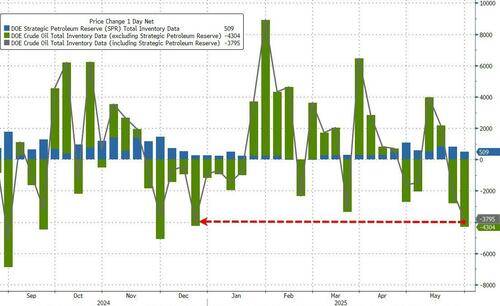

Crude prices are higher this morning on signs of progress in trade talks between the US and EU and the API report of a major drawdown in American crude inventories (despite product builds).

Geopolitical tensions continue to drive prices more aggressively as the possibility of a Putin-Zelensky meeting came and went and Iranian peace deal talks stumble.

The big question for traders is - will the official data confirm API's drawdown?

Crude -3.28mm

Cushing +952k

Gasoline +4.73mm

Distillates +761k

Crude -4.30mm

Cushing +576k

Gasoline +5.22mm

Distillates +4.23mm

The official data confirmed API's report with a large crude draw offset by big draws in products...

Even including the 509k barrel addition to the SPR, total crude stocks fell by the most since December...

The rig count continues to slide (now at its lowest since Dec 2021), and despite Trump's 'Drill, Baby, Drill' push, US crude production remains well of its highs...

WTI extended gains after the official data confirmed API's...

Oil rose at the start of the week after a decision by OPEC+ to increase production in July was in line with expectations, easing concerns over a bigger hike.

However, prices are still down about 11% this year on fears around a looming supply glut, while traders continue to monitor US trade tariffs as President Donald Trump said his Chinese counterpart is “extremely hard” to make a deal with.

Saudi Arabia led increases in OPEC oil production last month as the group began its series of accelerated supply additions, according to a Bloomberg survey.

Nevertheless, the hike fell short of the full amount the kingdom could have added under the agreements.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up