Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Stocks wavered after a court halted Trump’s tariffs, raising hopes but also uncertainty, as the White House appealed and markets questioned the long-term impact on trade policy and the economy.

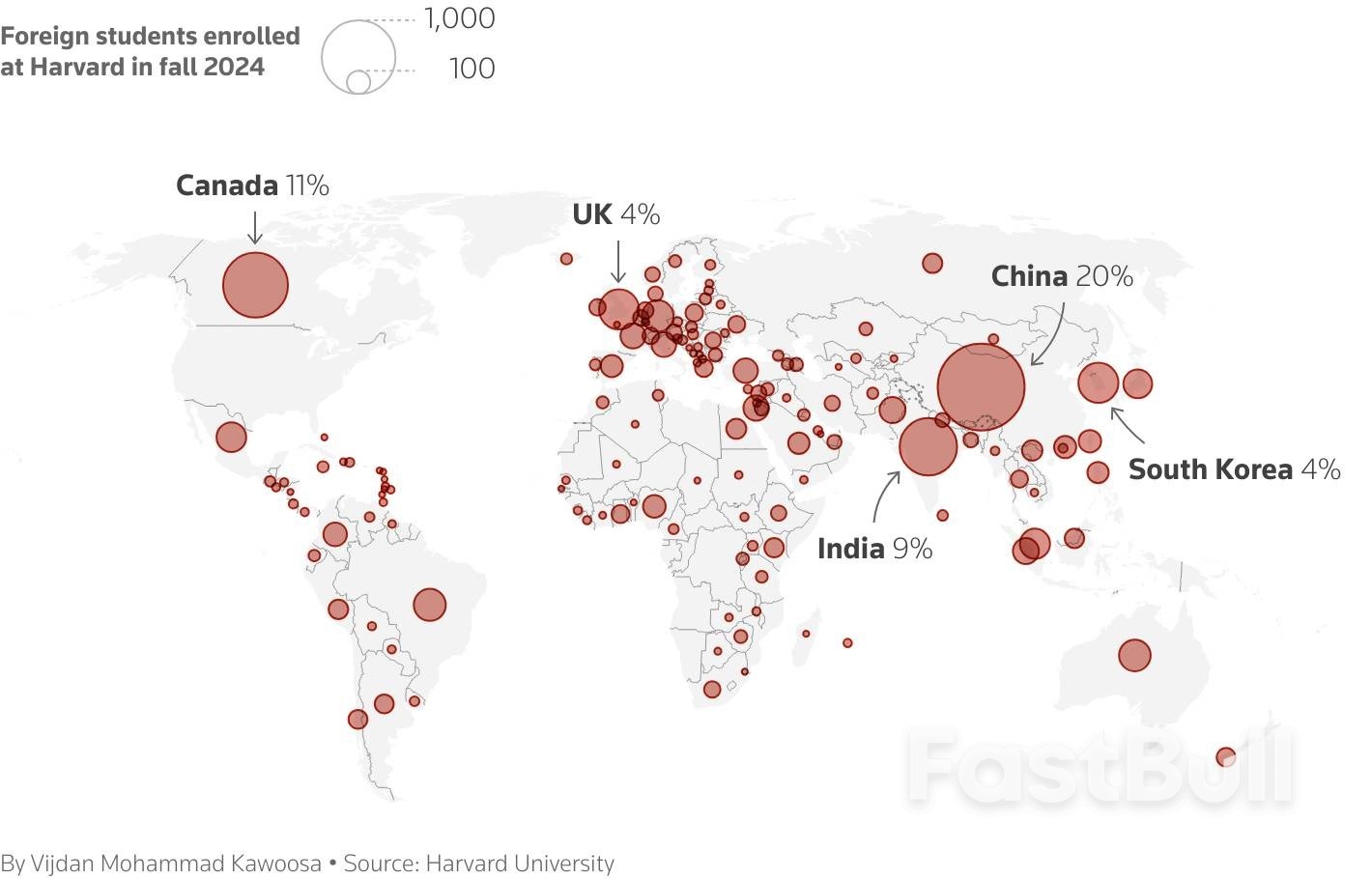

A federal judge said on Wednesday that she would issue an order that would continue to block the Trump administration from immediately revoking Harvard University's ability to enroll international students.

U.S. District Judge Allison Burroughs in Boston announced her intention to issue a broad preliminary injunction shortly after the administration revealed it plans to pursue a new, lengthier administrative process to block the students' enrollment.

The U.S. Department of Homeland Security changed course ahead of a hearing before Burroughs over whether to extend a temporary order blocking President Donald Trump's administration from revoking the Ivy League school's right to host international students.

The department in a notice, opens new tab sent to Harvard near midnight on Wednesday said it would give the school 30 days to contest its plans to revoke its certification under a federal program allowing it to enroll non-U.S. students.

The Justice Department filed a copy of the notice in court two hours before Thursday's hearing. Harvard's lawyers and the judge said at the hearing that they were still processing it and assessing its impact on the school's lawsuit.

When Burroughs asked if the notice acknowledged that procedural steps were not taken, Justice Department attorney Tiberius Davis replied that this wasn't necessarily the case. Instead, he said, the notice recognized that adopting the procedures Harvard advocated for would be better and simpler.

Davis said the notice made Harvard's arguments at this time moot. However, Burroughs, an appointee of Democratic former President Barack Obama, expressed skepticism about that, saying "Aren’t we still going to end up back here at the same place?"

Ian Gershengorn, a lawyer for Harvard, told Burroughs that an injunction protecting Harvard during the administrative process was necessary, saying the school was worried about the administration's efforts to retaliate against it.

"The First Amendment harms we are suffering are real and continuing," he said.

Burroughs said a preliminary injunction was needed to stop any immediate changes and protect international students arriving to attend Harvard.

The Cambridge, Massachusetts-based university says DHS's action is part of an "unprecedented and retaliatory attack on academic freedom at Harvard," which is pursuing a separate lawsuit challenging the administration's decision to terminate nearly $3 billion in federal research funding.

Harvard argues the Trump administration is retaliating against it for refusing to accede to its demands to control the school's governance, curriculum and the ideology of its faculty and students.

Harvard filed the lawsuit a day after Homeland Security Secretary Kristi Noem on May 22 announced she was revoking its certification with the Student and Exchange Visitor Program.

Harvard said the decision was "devastating" for the school and its student body. The university, the nation's oldest and wealthiest, enrolled nearly 6,800 international students in its current school year, about 27% of its total enrollment.

Harvard had argued that the revocation not only violated its free speech and due process rights under the U.S. Constitution but also failed to comply with DHS regulations. The regulations require it to receive 30 days to challenge the agency's allegations and an opportunity to pursue an administrative appeal.

In announcing the initial decision to revoke Harvard's certification, Noem, without providing evidence, accused the university of "fostering violence, antisemitism, and coordinating with the Chinese Communist Party."

In a letter that day, she accused the school of refusing to comply with wide-ranging requests for information on its student visa holders, including about any activity they engaged in that was illegal or violent or that would subject them to discipline.

The department's move would prevent Harvard from enrolling new international students and require existing ones to transfer to other schools or lose their legal status. Trump on Wednesday said that Harvard should have a 15% cap on the number of non-U.S. students it admits.

Reporting by Nate Raymond in Boston; Additional reporting by Jonathan Stempel in New York; Editing by Alexia Garamfalvi and Lisa Shumaker

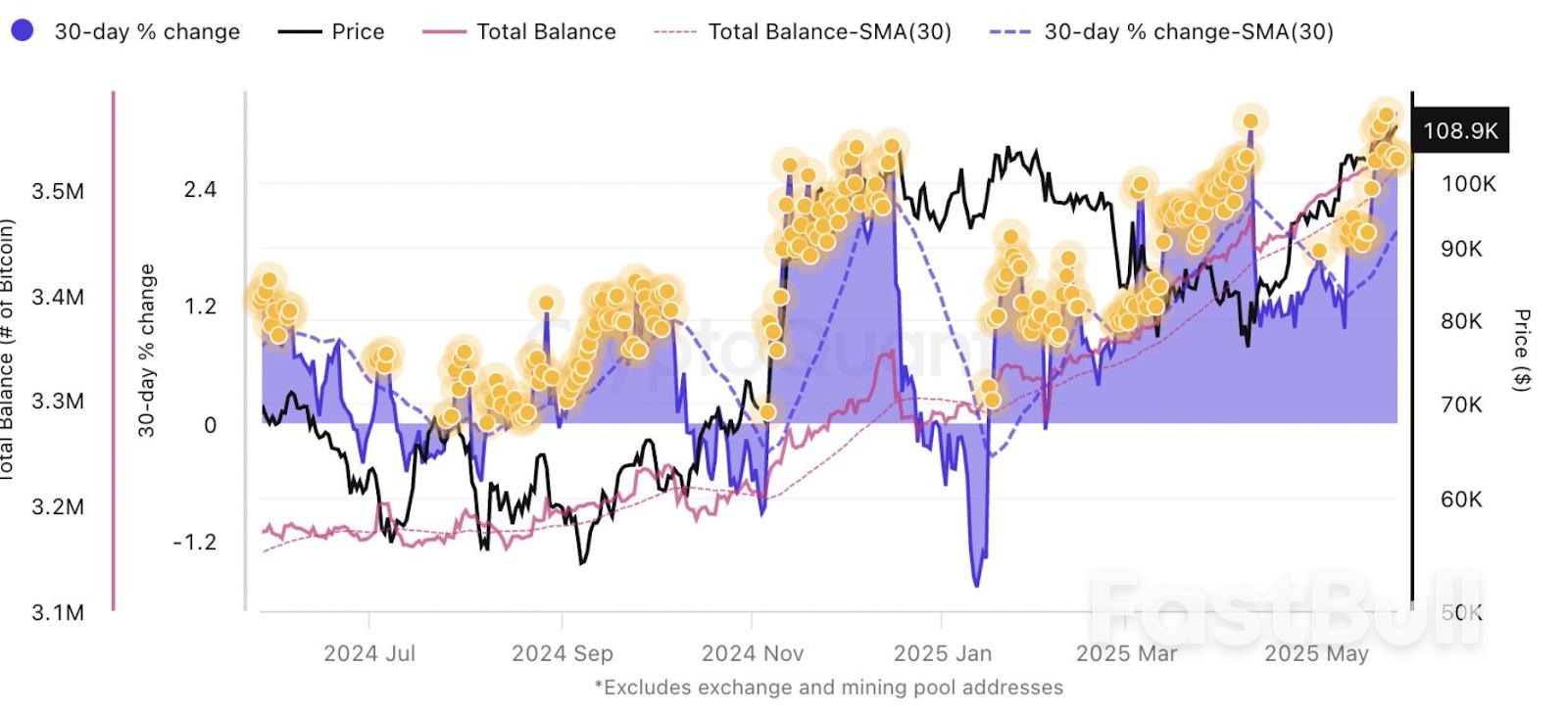

Bitcoin: Total whale holdings and monthly change (%). Source: CryptoQuant

Bitcoin: Total whale holdings and monthly change (%). Source: CryptoQuant Number of coins held and number of wallets 100-1K BTC addresses. Source: Santiment

Number of coins held and number of wallets 100-1K BTC addresses. Source: Santiment

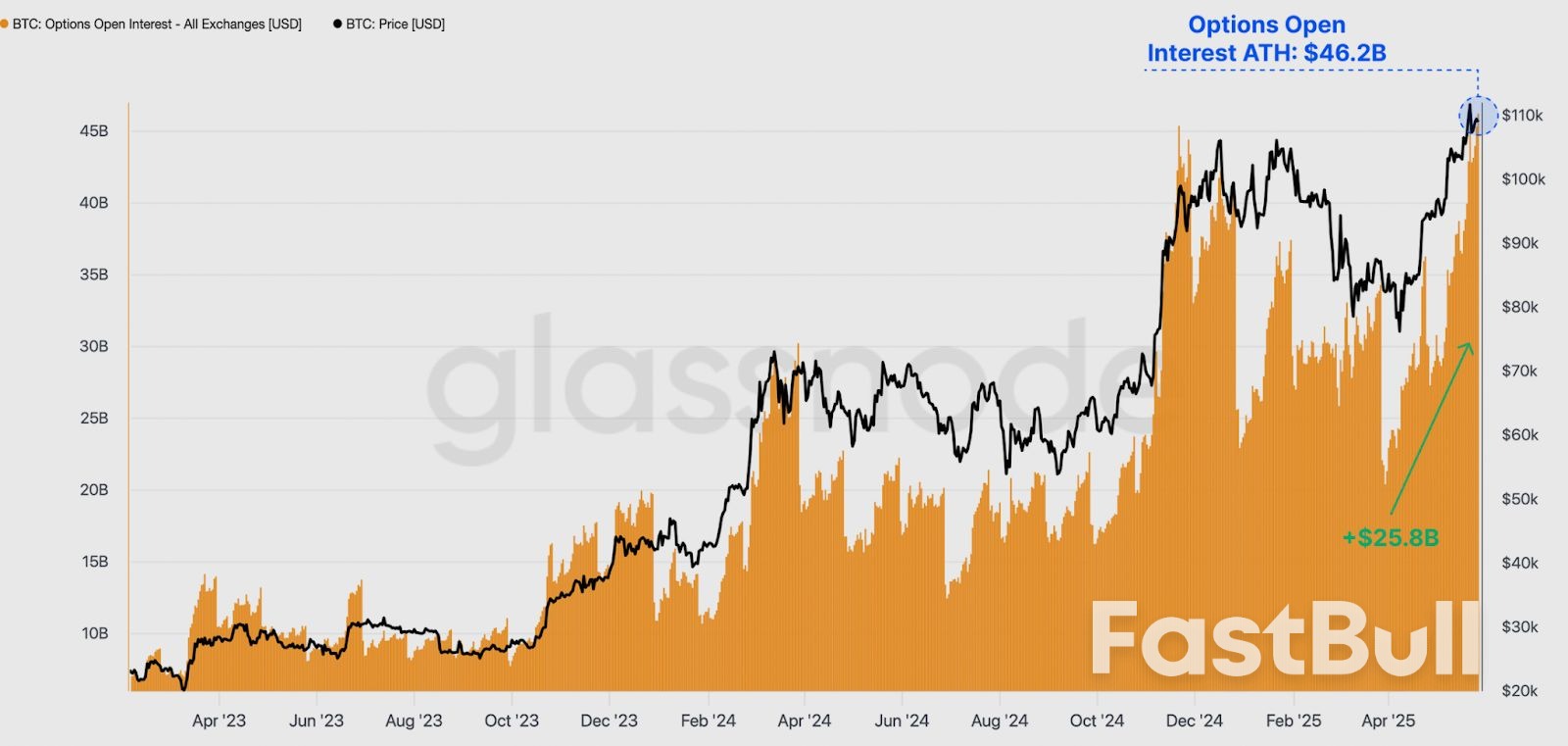

Bitcoin options OI across all exchanges. Source: Glassnode

Bitcoin options OI across all exchanges. Source: Glassnode

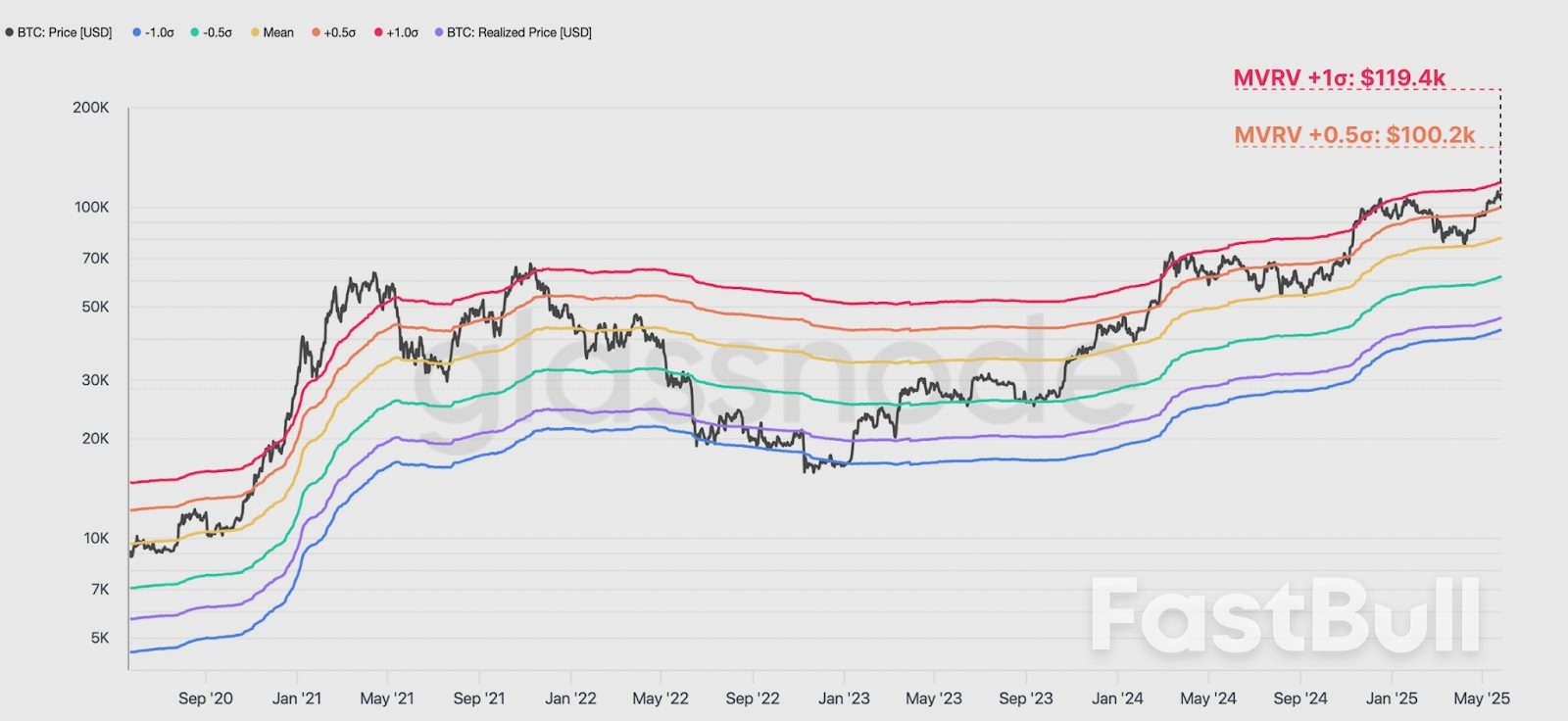

Bitcoin: MVRV extreme deviation pricing bands. Source: Glassnode

Bitcoin: MVRV extreme deviation pricing bands. Source: GlassnodeSenior Trump administration officials on Thursday downplayed the impact of a U.S. trade court ruling that blocked the most sweeping of President Donald Trump's tariffs, expressing confidence it would be overturned on appeal and insisting there are other legal avenues to employ in the interim.

Financial markets, which have whipsawed wildly in response to every twist and turn in Trump's chaotic trade war, reacted with cautious optimism on Thursday, a day after the U.S. Court of International Trade ruled that Trump overstepped his authority in imposing punitive tariffs on virtually every country in the world.

The Trump administration immediately asked an appeals court to stay the ruling and allow the tariff regime to remain in place. Trump has put tariffs at the center of his effort to extract concessions from U.S. trading partners, including traditional allies such as the European Union.

White House economic adviser Kevin Hassett expressed confidence that the ruling would ultimately be reversed in an interview with Fox Business on Thursday. He also said it would not get in the way of signing new trade deals.

"If there are little hiccups here or there because of decisions that activist judges make, then it shouldn't just concern you at all, and it's certainly not going to affect the negotiations," Hassett said.

White House trade adviser Peter Navarro, a staunch proponent of higher tariffs, told Bloomberg TV that the Trump administration could rely on other laws to implement import taxes if the court's decision remains in place.

Trump had invoked the International Emergency Economic Powers Act (IEEPA), a law intended to address threats during national emergencies, to impose tariffs on almost every U.S. trading partner, raising fears of a global recession. The president temporarily suspended many of the tariffs until early July after markets swooned in response.

The court found that the emergency powers law does not grant Trump the unilateral power to order such sweeping tariffs. Some sector-specific tariffs, such as those Trump has imposed on steel, aluminum and automobiles, were imposed under separate authorities on national security grounds and were unaffected by the ruling.

Canadian Prime Minister Jay Carney welcomed the decision, saying it was "consistent with Canada's longstanding position" that Trump's tariffs were unlawful.

Other U.S. trading partners offered careful responses. The British government said the ruling was a domestic matter for the U.S. administration and noted it was "only the first stage of legal proceedings."

Both Germany and the European Commission said they could not comment on the decision.

Several analysts said it was preliminary to conclude this closes the door entirely on Trump's sweeping tariffs, with legal paths other than IEEPA likely at his disposal.

"We suspect the administration will lean on other legal authorities to maintain tariff levels around current levels," Bernard Yaros, lead U.S. economist at Oxford Economics, wrote in a note to clients on Thursday.

After prompting an initial surge in stocks in Asia, the ruling stimulated more muted reactions in Europe, where indexes were largely flat, and in the U.S., where gains were modest. The S&P 500 was up about 0.5%, having given back about half of its initial rise at the opening bell.

An early rally in the dollar also fizzled and the greenback was about 0.4% lower against a basket of major trading partner currencies. Bond yields also slipped.

Following a market revolt after his major tariff announcement on April 2, Trump paused most import duties for 90 days and said he would hammer out bilateral deals with trade partners.

But apart from a pact with Britain this month, agreements remain elusive, and the court's suspension of the tariffs may dissuade countries like Japan from rushing into deals, analysts said.

"Assuming that an appeal does not succeed in the next few days, the main win is time to prepare, and also a cap on the breadth of tariffs – which can't exceed 15% for the time being," George Lagarias, chief economist at Forvis Mazars international advisers, said.

Trump's trade war has shaken makers of everything from luxury handbags and sneakers to household appliances and cars as the price of raw materials has risen, supply chains have been disrupted and company strategies redrafted.

The number of Americans filing new applications for jobless benefits increased more than expected last week and the unemployment rate appeared to have picked up in May, suggesting layoffs were rising as tariffs cloud the economic outlook.

The report from the Labor Department on Thursday showed a surge in applications in Michigan last week, the nation's motor vehicle assembly hub. The number of people collecting unemployment checks in mid-May was the largest in 3-1/2 years. The outlook for the economy is dimming with other data showing a sharp decline in corporate profits in the first quarter.

A U.S. trade court on Wednesday blocked most of Trump's tariffs from going into effect in a sweeping ruling that the president overstepped his authority. Economists said the ruling, while it offered some relief, had added another layer of uncertainty over the economy.

"This is a sign that cracks are starting to form in the economy and that the outlook is deteriorating," said Christopher Rupkey, chief economist at FWDBONDS. "There is nothing great about today's jobless claims data and the jump in layoffs may be a harbinger of worse things to come."

Initial claims for state unemployment benefits rose 14,000 to a seasonally adjusted 240,000 for the week ended May 24, the Labor Department said. Economists polled by Reuters had forecast 230,000 claims for the latest week.

Unadjusted claims increased 10,742 to 212,506 last week, lifted by a 3,329 jump in filings in Michigan. There were also notable increases in applications in Nebraska and California.

Despite the rise in claims, worker hoarding by employers following difficulties finding labor during and after the COVID-19 pandemic continues to underpin the jobs market.

Nonetheless, there has been an uptick in layoffs because of economic uncertainty asTrump's aggressive trade policy makes it challenging for businesses to plan ahead.

A report from the Bank of America Institute noted a sharp rise in higher-income households receiving unemployment benefits between February and April compared to the same period last year. Its analysis of Bank of America deposit accounts also showed notable rises among lower-income as well as middle-income households in April from the same period a year ago.

Economists expect claims in June to break above their 205,000-243,000 range for this year, mostly driven by difficulties adjusting the data for seasonal fluctuations, following a similar pattern in recent years.

Minutes of the Federal Reserve's May 6-7 policy meeting published on Wednesday showed while policymakers continued to view labor market conditions as broadly in balance, they "assessed that there was a risk that the labor market would weaken in coming months."

They noted that there was "considerable uncertainty" over the job market's outlook, adding "outcomes would depend importantly on the evolution of trade policy as well as other government policies."

The U.S. central bank has kept its benchmark overnight interest rate in the 4.25%-4.50% range since December as officials struggle to estimate the impact of Trump's tariffs, which have raised the prospect of higher inflation and slower economic growth this year.

U.S. stocks opened higher. The dollar eased against a basket of currencies after a brief rally. U.S. Treasury yields fell.

The number of people receiving benefits after an initial week of aid, a proxy for hiring, increased 26,000 to a seasonally adjusted 1.919 million during the week ending May 17, the claims report showed. The elevated so-called continuing claims reflect companies' hesitance to increase headcount because of the economic uncertainty.

Continuing claims covered the period during which the government surveyed households for May's unemployment rate. They increased between the April and May survey periods, suggesting an uptick in the unemployment rate this month. The jobless rate was at 4.2% in April.

Many people who have lost their jobs are experiencing long spells of unemployment. The median duration of unemployment jumped to 10.4 weeks in April from 9.8 weeks in March.

With profits under pressure, there is probably little incentive for businesses to boost hiring. Mass layoffs are, however, unlikely with a Conference Board survey of chief executive officers released on Thursday showing most captains of business anticipated no change in the size of their workforce over the next year even as about 83% said they expected a recession in the next 12-18 months.

Profits from current production with inventory valuation and capital consumption adjustments dropped $118.1 billion in the first quarter, the Commerce Department's Bureau of Economic Analysis (BEA) said in a separate report. Profits surged $204.7 billion in the October-December quarter.

Companies ranging from airlines and retailers to motor vehicle manufacturers have either withdrawn or refrained from giving financial guidance for 2025, citing the uncertainty caused by the on-again and off-again nature of some duties.

Businesses front-loaded imports and households engaged in pre-emptive buying of goods last quarter to avoid higher costs, making it difficult to get a clear picture of the economy.

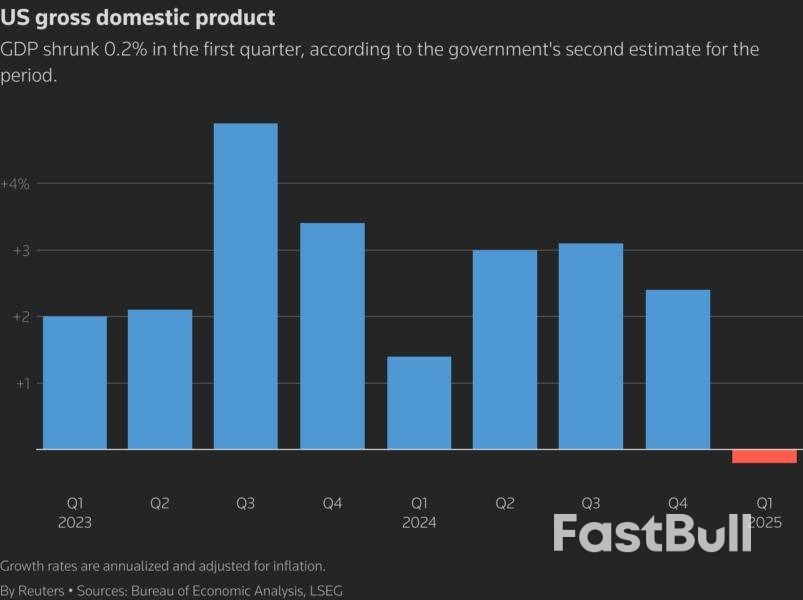

The deluge of imports sent gross domestic product declining at a 0.2% annualized rate in the January-March quarter, the BEA said in its second estimate of GDP. The economy was initially estimated to have contracted at a 0.3% pace. It grew at a 2.4% rate in the fourth quarter.

Other alternative measures of growth, gross domestic income and gross domestic output also showed the economy contracting at a 0.2% pace in the first quarter.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up