Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

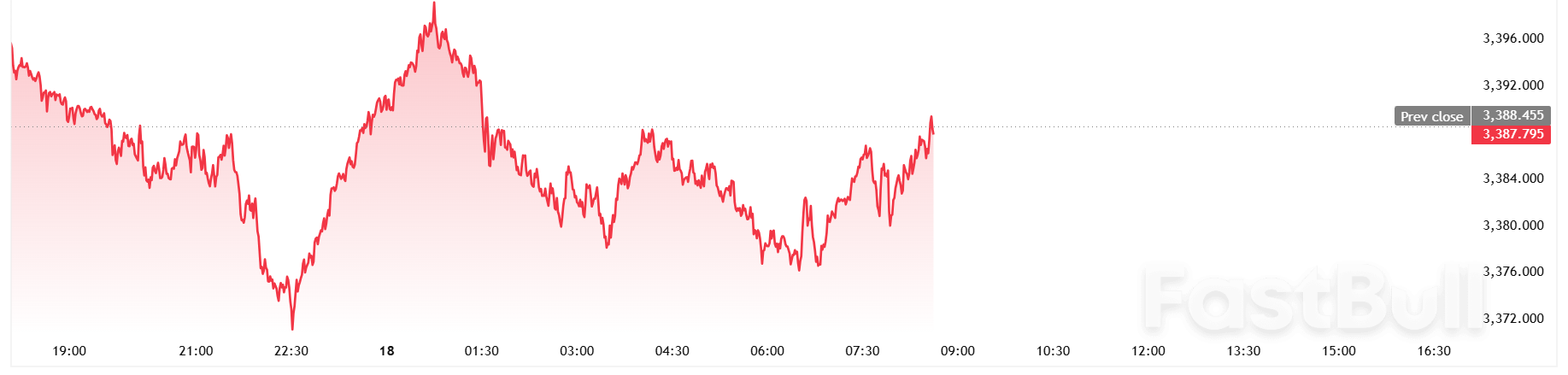

Wall Street indexes posted modest gains and oil prices dipped on Wednesday as investors weighed the impacts of a Middle East conflict and a U.S. rate decision on a global economy already grappling with uncertainty stemming from U.S. economic policy.Brent crude oil prices initially extended their recent rise as the Israel-Iran air war entered its sixth day, feeding concerns over global oil supply, before falling 1.52% to $75.31 per barrel after U.S. President Donald Trump said Iran wanted to negotiate.

Wall Street indexes posted modest gains and oil prices dipped on Wednesday as investors weighed the impacts of a Middle East conflict and a U.S. rate decision on a global economy already grappling with uncertainty stemming from U.S. economic policy.

Brent crude oil prices initially extended their recent rise as the Israel-Iran air war entered its sixth day, feeding concerns over global oil supply, before falling 1.52% to $75.31 per barrel after U.S. President Donald Trump said Iran wanted to negotiate.

Stock buyers made cautious inroads in early trading on Wall Street, giving a 0.50% push to both the Dow Jones Industrial Average and the S&P 500 (.SPX), and a 0.56% boost to the Nasdaq Composite (.IXIC).

While geopolitics were the biggest immediate concern, other lingering doubts included a squabble over President Trump's tax bill, said Chris Maxey, Managing Director and Chief Market Strategist at New York-based Wealthspire.

"Uncertainty began at the start of the year, and it felt like it just kept growing ... It's uncertain about what's coming next with respect to the (U.S.) tax package, what's going to happen with the Federal Reserve, what's going to happen in the Middle East," he said.

"People are trying to digest all of this information without a huge amount of clarity," Maxey added.

Trump declined to answer questions on whether the U.S. was planning to strike Iran or its nuclear facilities, saying: "Nobody knows what I am going to do."

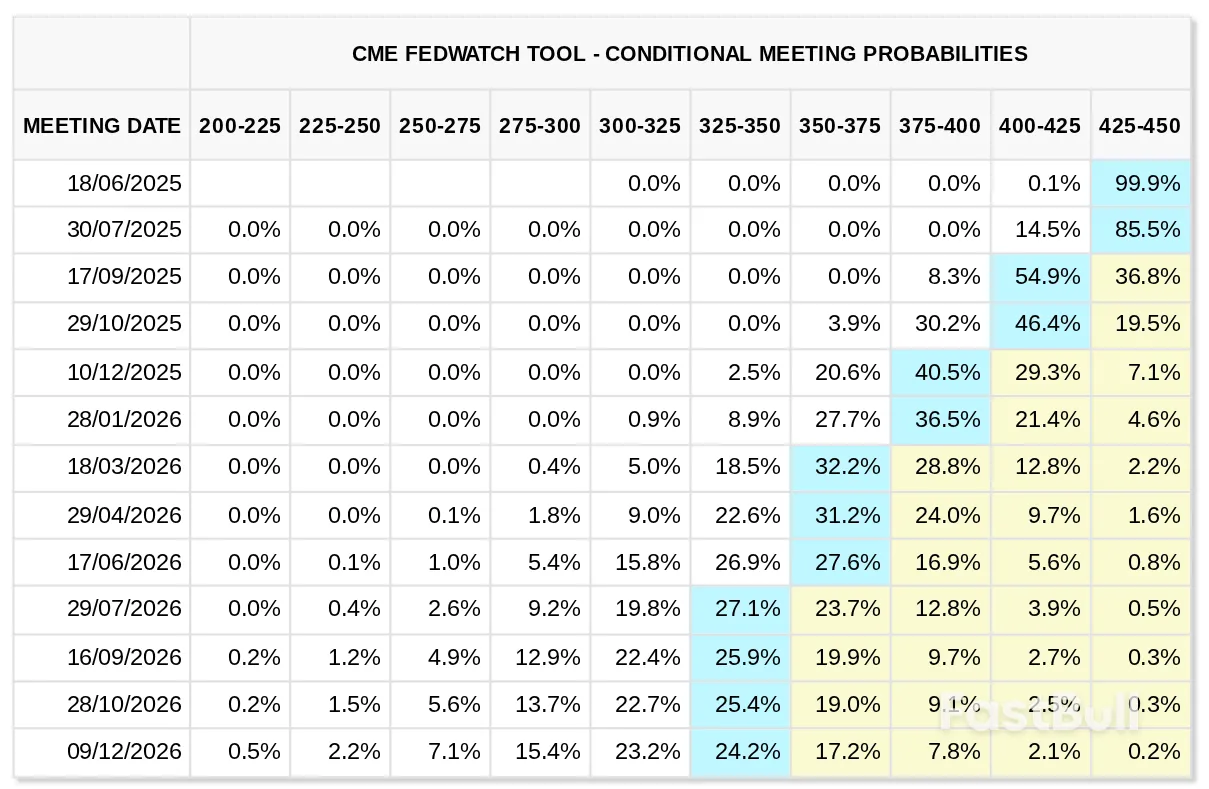

The Fed is expected to keep its main funds rate steady on Wednesday in the 4.25%-4.50% range it has held since December. It is expected to issue projections, known as a dot plot, that signal it will not move decisively for months to come.

Signs of fragility in the U.S. economy make for a challenging backdrop.

U.S. retail sales fell by a larger-than-expected 0.9% in May, data showed on Tuesday, the biggest drop in four months, while labour market indicators are showing weakness.

"Markets are going to be closely watching the Fed's quarterly dot plot for clues on how and when the central bank will resume its cutting cycle," Insight Investment co-head of global rates Harvey Bradley said.

"As tensions in the Middle East have the potential to threaten the inflation picture further, it cannot be ruled out that projections adjust to reflect just one rate cut this year,” he added.

U.S. Treasury yields fell again on Wednesday, continuing a slide on Tuesday prompted by investors calculating that geopolitical risks abroad were greater than the chances the U.S. debt pile becomes unmanageable.

The benchmark 10-year note was last yielding 2.6 basis points less, at 4.365%, from 4.391% late on Tuesday.

The two-year yield, which is more sensitive to changes in expectations for Fed interest rates, fell 1.1 basis points to 3.939%, from 3.95% late on Tuesday.

Fed target rate probabilities (screenshot). Source: CME Group FedWatch Tool

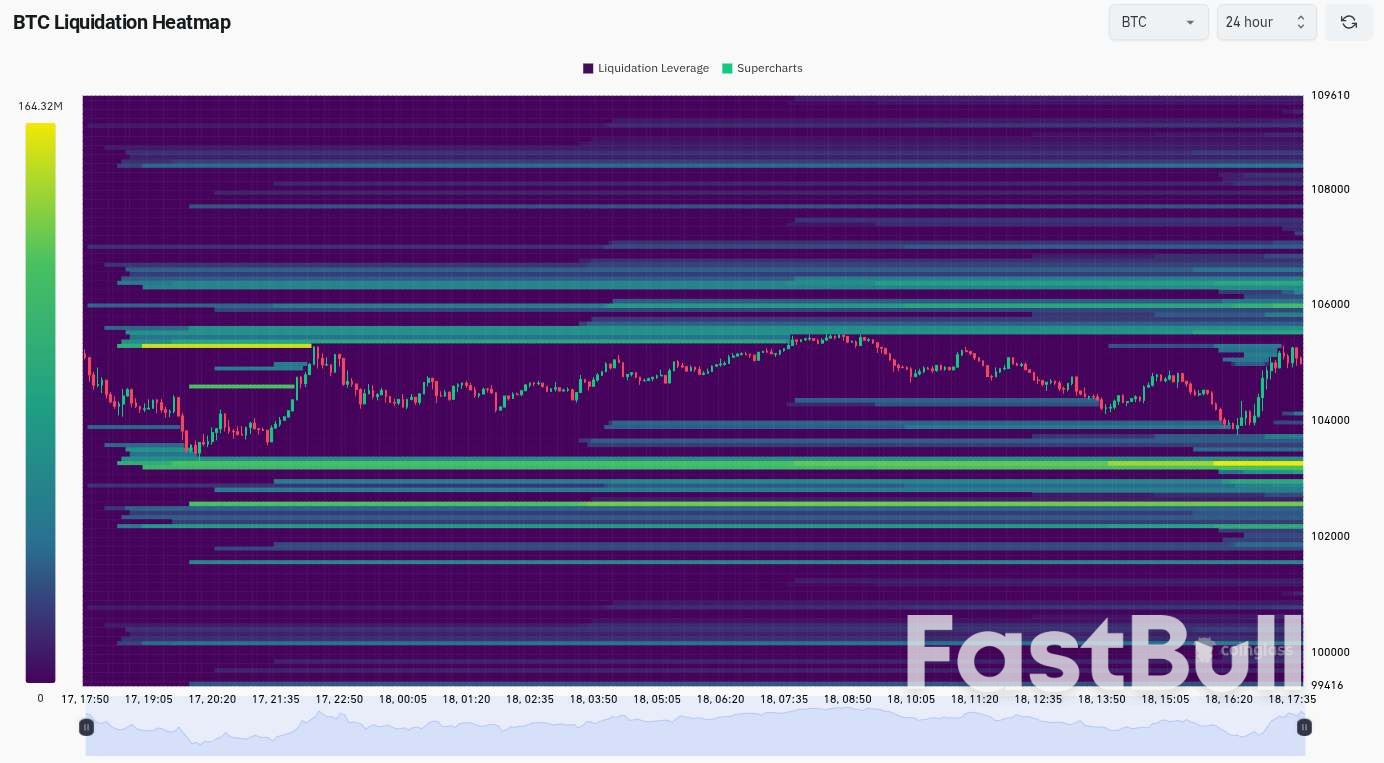

Fed target rate probabilities (screenshot). Source: CME Group FedWatch Tool BTC liquidation heatmap (screenshot). Source: CoinGlass

BTC liquidation heatmap (screenshot). Source: CoinGlass

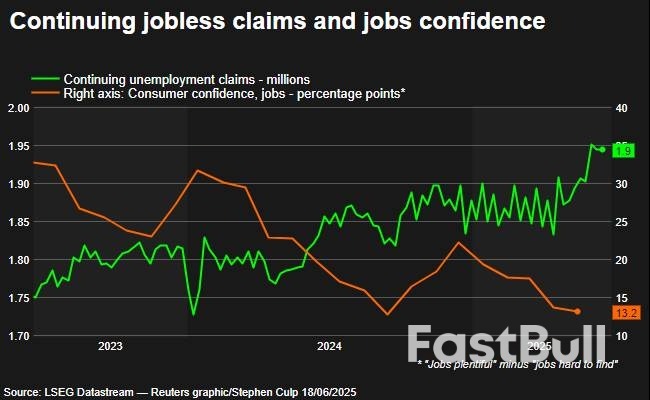

The number of Americans filing new applications for unemployment benefits fell last week, but stayed at levels consistent with a further loss of labor market momentum in June and softening economic activity.

The report from the Labor Department on Wednesday showed widespread layoffs in the prior week, which had boosted claims to an eight-month high. Though some technical factors accounted for the elevation in claims, layoffs have risen this year, with economists saying President Donald Trump's broad tariffs had created a challenging economic environment for businesses.

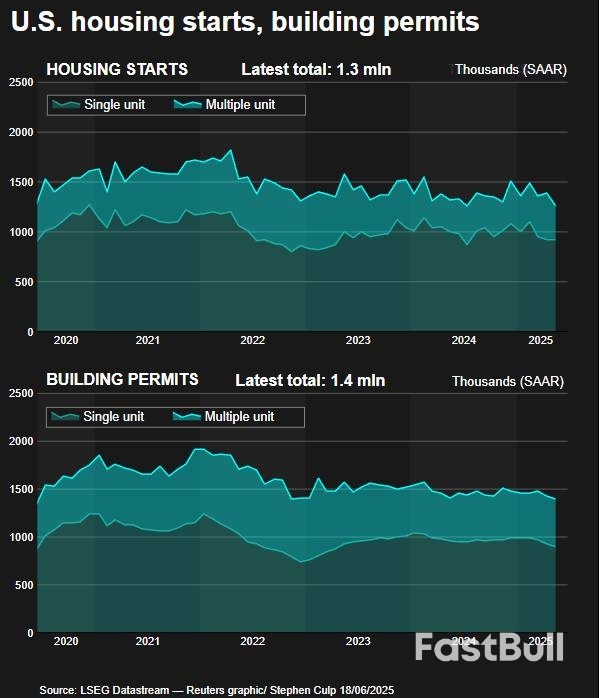

Those challenges were also evident in other data showing permits for future construction of single-family housing dropped to a two-year low in May as builders grappled with higher costs from duties on materials, including lumber, steel and aluminum.

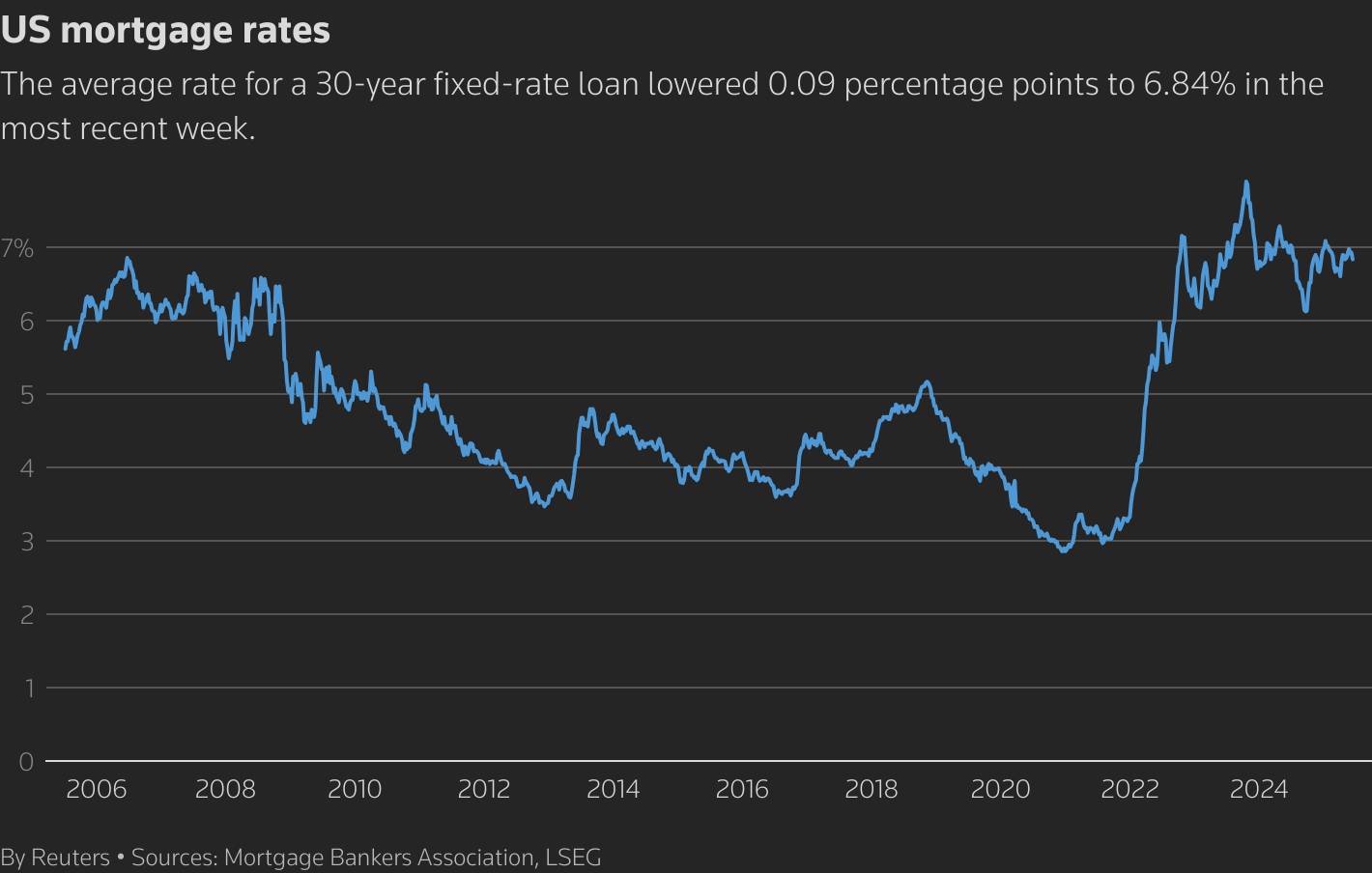

Higher borrowing costs as the Federal Reserve responded to the heightened economic uncertainty from tariffs by pausing its interest rate cutting cycle have weighed on demand for homes, resulting in excess inventory of unsold houses on the market.

Fed officials at the end of a two-day policy meeting later on Wednesday were expected to leave the U.S. central bank's benchmark overnight interest rate in the 4.25%-4.50% range, where it has been since December, as it also monitored the economic fallout from the conflict between Israel and Iran.

"Even though claims remain low by historical standards, we can no longer deny that there is some upward movement toward levels that would support our assessment of an economy slowing into a contraction," said Carl Weinberg, chief economist at High Frequency Economics. "It is time, now, to say that."

Initial claims for state unemployment benefits dropped 5,000 to a seasonally adjusted 245,000 for the week ended June 14, the Labor Department said. Data for the prior week was revised to show 2,000 more applications received than previously reported, lifting claims for that week to the highest since October.

Economists polled by Reuters had forecast 245,000 claims for the latest week. The report was released a day early because of the Juneteenth National Independence Day holiday on Thursday.

Layoffs were reported in the prior week across several states in the transportation and warehousing, accommodation and food services, healthcare and social assistance, agriculture, construction and manufacturing industries as well as in wholesale, retail trade, administrative, professional, arts, entertainment, and recreation industries.

Claims rose in Minnesota in the prior week as non-teaching staff filed for benefits at the start of summer school holidays. Filings in the state increased further last week. There were also rises in applications in Pennsylvania and Oregon.

The claims data covered the period during which the government surveyed businesses for the nonfarm payrolls component of June's employment report. Claims increased between the May and June survey weeks.

Historically low layoffs have accounted for much of the labor market stability, with the hiring side of the equation tepid amid hesitancy by employers to increase headcount because of the unsettled economic environment. Nonfarm payrolls increased by 139,000 jobs in May, compared with a 193,000 gain a year ago.

Data next week on the number of people receiving benefits after an initial week of aid, a proxy for hiring, could shed more light on the state of the labor market in June.

The so-called continuing claims dropped 6,000 to a still-high seasonally adjusted 1.945 million during the week ending June 7. Recently laid-off workers are struggling to find work.

The dollar fell against a basket of currencies. U.S. Treasury yields eased.

A separate report from the Commerce Department's Census Bureau showed permits for future construction of single-family housing dropped 2.7% to a seasonally adjusted annual rate of 898,000 units in May, the lowest level since April 2023.

Higher borrowing costs have sidelined potential buyers, boosting the supply of new single-family homes on the market to levels last seen in late 2007. That has left builders with little incentive to break ground on new housing projects.

A National Association of Home Builders survey on Tuesday showed sentiment among single-family homebuilders plummeted to a 2-1/2-year low in June. The NAHB reported an increase in the share of builders cutting prices to lure buyers and reduce inventory. It forecast a drop in single-family starts this year.

Permits for the volatile multi-family housing segment, buildings with five units or more, rose 1.4% to a rate of 444,000 units in May. Overall building permits decreased 2.0% to a rate of 1.393 million units, the lowest level since June 2020.

Single-family housing starts, which account for the bulk of homebuilding, gained 0.4% to 924,000 units last month. Starts for multi-family housing units slumped 30.4% to a rate of 316,000 units. Overall housing starts plunged 9.8% to a rate of 1.256 million units, the lowest level in five years.

Residential investment, which includes homebuilding, contracted slightly in the first quarter after rebounding in 2024 following steep declines in the prior two years caused by a surge in mortgage rates.

"We appear on course for a substantial decline in real activity in the current quarter and perhaps further weakness in the summer," said Stephen Stanley, chief U.S. economist at Santander U.S. Capital Markets.

Following multiple rounds of Iranian missile barrages that have proven far more effective than many "experts" anticipated, the Israeli Defense Forces are already running low on defensive Arrow interceptor missiles, making Israel all the more desperate for the United States to join the war Prime Minister Benjamin Netanyahu's government initiated on Friday the 13th. Meanwhile, as Iran's retaliation continues, reports of war-fatigue among Israel's population are already emerging.

Interceptor missiles in the sky over Tel Aviv during an early-Wednesday Iranian barrage (Leo Correa via Associated Press)

Interceptor missiles in the sky over Tel Aviv during an early-Wednesday Iranian barrage (Leo Correa via Associated Press)Against that backdrop, President Trump has been dialing up the intensity of his rhetoric as he pushes Iran to capitulate to demands that it cease all uranium enrichment -- a demand that Iran has long ruled out as a violation of its sovereignty, while insisting its nuclear program isn't focused on creating a weapon. The US intelligence community assessed that to be true in March. "UNCONDITIONAL SURRENDER!" exclaimed Trump in a terse Tuesday social media post. Trump, who spoke with Netanyahu by phone on Tuesday, is considering options that include a US strike on Iran, the Wall Street Journal reports. As his deliberations continue -- while some members of Congress are backing a resolution that would bar a US attack without congressional authorization -- the Pentagon continues shifting a variety of assets toward the region. The DOD insists they're for defensive use, which includes shielding Israel from the consequences of starting a war with Iran.

According to an individual briefed on US and Israeli intelligence, Israel is on pace to run out of defensive missiles in 10 to 12 days. “They will need to select what they want to intercept,” that person told the Washington Post. “The system is already overwhelmed.” Arrow interceptors are manufactured by Israel Aerospace Industries. The United States has been pushing other missile defense assets into Israel over the last week, but the Wall Street Journal reports that practice is already raising concerns about the effect on US military readiness.

Israel is running low on Arrow interceptor missiles fired from mobile launchers like this one (AP Photo: Eitan Hess-Ashkenazi)

Israel is running low on Arrow interceptor missiles fired from mobile launchers like this one (AP Photo: Eitan Hess-Ashkenazi)“Neither the U.S. nor the Israelis can continue to sit and intercept missiles all day,” Tom Karako of the Center for Strategic and International Studies (CSIS) told the Journal. “The Israelis and their friends need to move with all deliberate haste to do whatever needs to be done, because we cannot afford to sit and play catch.” (CSIS is funded in part by the US government and major weapons manufacturers.) According to Israeli financial newspaper The Marker, the ongoing missile defense is costing Israel about $285 million a night, though ZeroHedge readers will reasonably brace for the day that American taxpayers are presented with the bill.

Even ahead of running out of interceptors, Israel is struggling to consistently defend its citizens and assets from Iran's arsenal, and especially its cutting-edge hypersonic missiles. Videos of the missiles repeatedly hammering Israel have been making jaws drop around the world and across social media since Iran began retaliating for Israel's unprovoked launch of a war on Iran.

Iran's Islamic Revolution Guards Corps (IRGC) said that strikes over Tuesday night used "a new advanced missile." According to state media, the first-generation Fattah hypersonic ballistic missile has a two-stage solid-fuel system, a 1,400-kilometer range, a top speed of Mach 13-15, and a maximum time-to-target of just 336 seconds. Claiming it repeatedly and easily penetrated Israel's defenses, the IRGC boasted that “tonight’s missile strike demonstrated that we have achieved total control over the skies of the occupied territories."

Of course, there's also the question of how long Iran's inventory of offensive missiles can last -- but it's far from clear how much of the arsenal remains after accounting for missiles already launched and others destroyed by Israeli strikes. Iran's pace of strikes has reportedly eased over the past two nights. “Iran has to make a very, very difficult calculation, because they have a limited amount of missiles, and considering the rate of fire, they cannot replenish in real time,” said International Institute for Strategic Studies analyst Fabian Hinz told the Post. Working to accelerate the math to Iran's detriment, Israel said it struck missile factories on Tuesday, along with a centrifuge production center.

As Israel runs low on defensive missiles, the Israeli population is already running low on the psychological wherewithal to carry on in the face of a level of bombardment the country hasn't seen in a generation. Dozens have been killed and several hundred wounded, alongside startling destruction of government buildings, apartment towers and power plants. In a quote that echoes the desperation of Palestinian and other populations on the receiving end of IDF destruction, Israeli nurse and mother Ella Keren told the Post, “The fact that you don’t know if the missiles are about to fall on you, that we are now living with this feeling of helplessness, it’s insane.” Weary of the nightly blasts and hours spent in bomb shelters, some Israelis are opting to leave Tel Aviv to seek refuge in the relatively safer suburbs and countryside.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up