Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Trump came out swinging early (as we detailed below) and has now followed up with an upper cut as Bloomberg reports, the Trump administration plans to broaden restrictions on China’s tech sector with new regulations to capture subsidiaries of companies under US curbs.

Trump came out swinging early (as we detailed below) and has now followed up with an upper cut as Bloomberg reports, the Trump administration plans to broaden restrictions on China’s tech sector with new regulations to capture subsidiaries of companies under US curbs.

Officials are drafting a rule that would impose US government licensing requirements on transactions with companies that are majority-owned by already-sanctioned firms, according to people familiar with the matter.

The subsidiary rule — which applies a 50% ownership threshold in relation to companies on the Entity List, Military End-User list and Specially Designated Nationals list — could be unveiled as soon as June, said the people, who asked not to be named to discuss private deliberations.

The people emphasized that the contents and timing of the rule and related sanctions are not yet finalized and could still change.

After the rule is published, the US is likely to move forward with new sanctions on major Chinese companies, the people said.

So trade policy uncertainty is about to skyrocket again

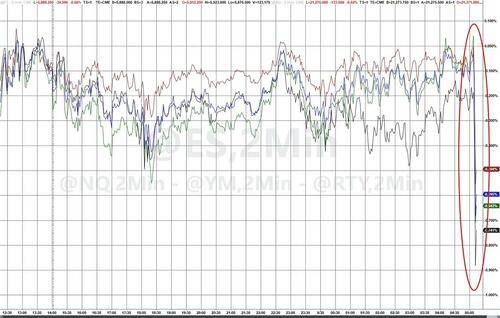

The reaction in stocks was immediate... and lower...

NVDA has erased all of its post-earnings gains

Following earlier comments by TsySec Bessent that trade talks with China had "stalled", President Trump took to social media to explain his position:

Two weeks ago China was in grave economic danger!

The very high Tariffs I set made it virtually impossible for China to TRADE into the United States marketplace which is, by far, number one in the World.

We went, in effect, COLD TURKEY with China, and it was devastating for them.

Many factories closed and there was, to put it mildly, "civil unrest."

I saw what was happening and didn’t like it, for them, not for us. I made a FAST DEAL with China in order to save them from what I thought was going to be a very bad situation, and I didn’t want to see that happen.

Because of this deal, everything quickly stabilized and China got back to business as usual.

Everybody was happy! That is the good news!!!

The bad news is that China, perhaps not surprisingly to some, HAS TOTALLY VIOLATED ITS AGREEMENT WITH US. So much for being Mr. NICE GUY!

The reaction was swift - US equity futures dumped...

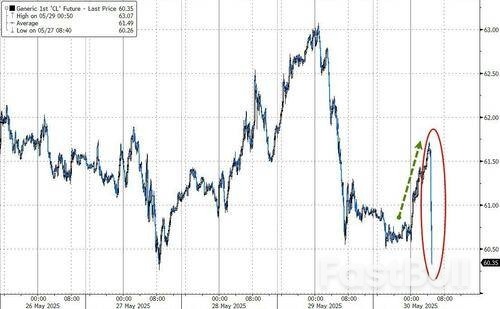

And crude crashed...

Source: Roman/X

Source: Roman/X

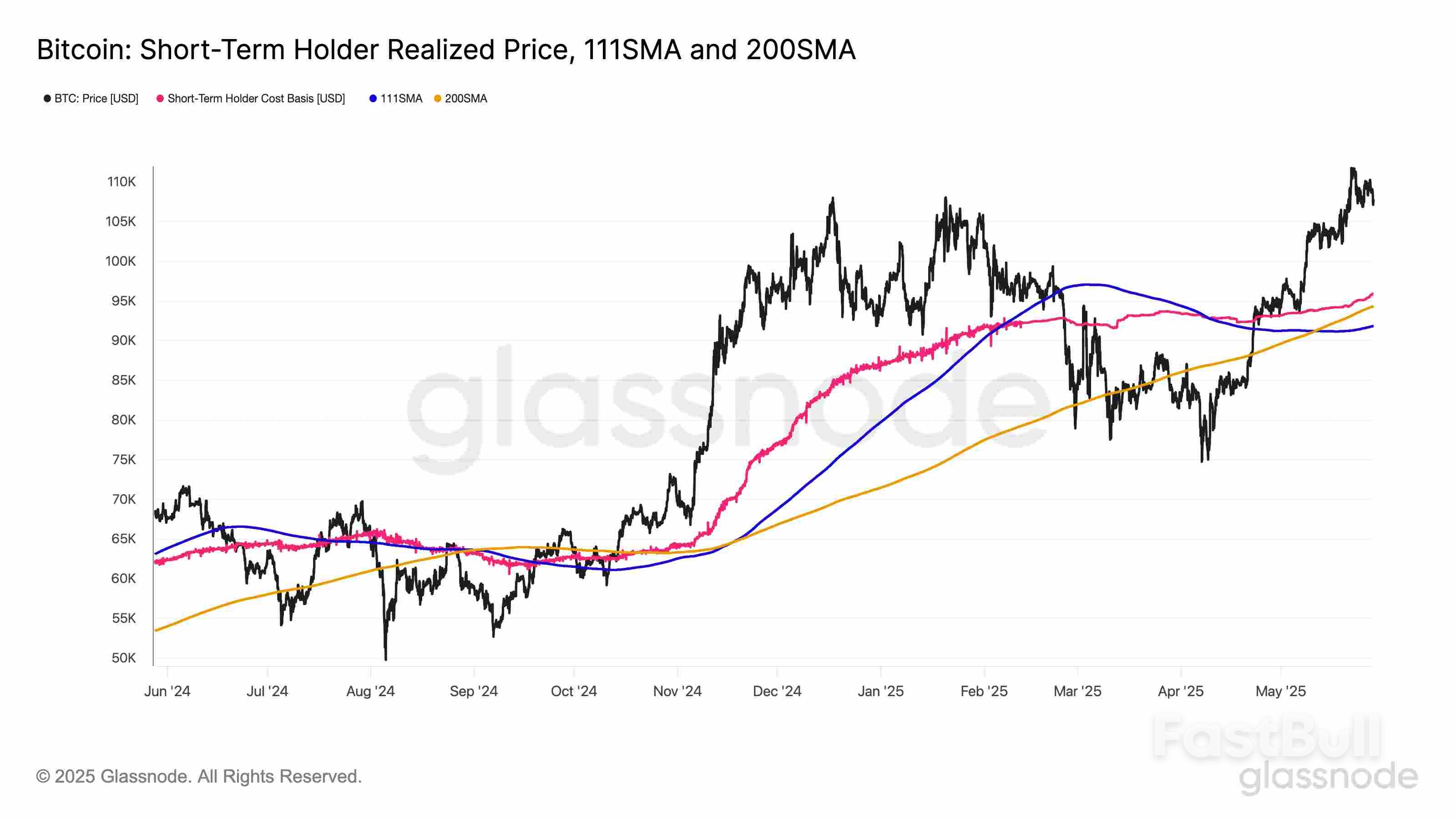

BTC/USD chart with 111-day, 200-day SMA, short-term holder cost basis. Source: Glassnode

BTC/USD chart with 111-day, 200-day SMA, short-term holder cost basis. Source: GlassnodeHOUSTON, May 30 (Reuters) - Oil prices fell on Friday and headed for a second consecutive weekly loss, as investors weigh a potentially larger OPEC+ output hike for July, and uncertainty spreads around U.S. tariff policy after the latest courtroom twist.

Brent crude futures fell by 21 cents, or 0.33%, to $63.94 a barrel by 1451 GMT. U.S. West Texas Intermediate crude fell by 34 cents, or 0.56%, to $60.60 a barrel.

The Brent July futures contract is due to expire on Friday. The more liquid August contract was trading 43 cents lower, or 0.71%, at $59.77 a barrel.

At these levels, the front-month benchmark contracts were headed for weekly losses over 1%.

Price moves dipped into negative territory after Reuters reported that OPEC+ may discuss an increase in July output larger than the 411,000 barrels per day (bpd) that the group had made for May and June.

"The oil price would probably only come under greater pressure if the oil-producing countries were to increase their production even more than in previous months or give indications that there will be similarly high production increases in the following months," Commerzbank analysts said earlier on Friday in a note, published before the news.

Senior Analyst Phil Flynn with Price Futures Group said an online post on Truth Social by U.S. President Donald Trump that seemed to threaten more changes in tariff levels for Chinese imports also put pressure on crude prices.

"Trump's Truth Social message on China failing to observe a truce on tariffs also combined with the Reuters headline to push prices down," Flynn said.

The potential OPEC+ output hike comes as the global surplus has widened to 2.2 million bpd, likely necessitating a price adjustment to prompt a supply-side response and restore balance, said JPMorgan analysts in a note, adding that they expect prices to remain within the current range before easing into the high $50s by year-end.

Trump's tariffs were expected to remain in effect after a federal appeals court temporarily reinstated them on Thursday, reversing a trade court's decision a day earlier to put an immediate block on the sweeping duties.

Oil prices were down more than 1% on Thursday.

Oil prices have lost more than 10% since Trump announced his "Liberation Day" tariffs on April 2.

Also pressuring prices, U.S. consumer spending slowed in April, according to data published on Friday.

Federal Reserve policymakers wary of cutting interest rates in the face of President Donald Trump's aggressive tariffs will likely stick to their wait-and-see stance amid fresh data Friday showing muted inflation last month and evidence of increased consumer caution.

April's 2.1% year-over year increase in the Personal Consumption Expenditure price index, down from 2.3% in March, puts inflation within a stone's throw of the Fed's 2% target.But analysts don't see that trend continuing, with businesses expected to pass on to consumers at least some of their rising costs from higher import levies. Already goods prices are firming, the report showed.

"The Fed will welcome the favorable inflation reading in this report, but they are likely to interpret it as the calm before the storm," said Olu Sonola, who heads U.S. economic research at Fitch Ratings. The central bank will continue to wait for the storm, unless consumer spending buckles and the unemployment rate rises rapidly, Sonula added.

Consumer spending growth slowed to 0.2% last month, the Commerce Department also said on Friday, and the personal saving rate jumped to 4.9% from 4.3%. Analysts saw both as signs of renewed consumer caution amid uncertainty over tariff policy that continues to change on a near-daily basis.

For the Fed, wrote III Capital Management's Karim Basta, there's "nothing to do but wait."

The Fed has kept short-term borrowing costs in the 4.25%-4.50% range since last December. Since their last meeting, in May, policymakers have repeatedly voiced concerns that tariffs could reverse progress on inflation.

"As long as inflation is printing above target and there's some uncertainty about how quickly it can come back down to 2%, well, then inflation is going to be my focus because the labor market's in solid shape," San Francisco Fed President Mary Daly told Reuters late Thursday, adding that rates need to stay moderately restrictive to keep that pressure on prices.

Dallas Fed President Lorie Logan late Thursday similarly said it could be "quite some time" before it's clear if Trump's policies pose bigger risks to employment or to inflation; for now, she said, the risks are in rough balance, leaving the Fed on hold.

Traders after the data continued to bet that by September the Fed will begin cutting rates gradually, bringing the policy rate down to 3.75%-4.0% by year's end.

The best week for the dollar in three months isn’t enough to reverse its broader declines as US trade and policy uncertainty weighs on sentiment.

A gauge of dollar strength is on track for its longest monthly losing streak in five years despite being up 0.4% so far this week. Investors were focused on a proposed US measure that would hit companies from countries deemed to have “discriminatory” tax policies.

“If the bill as presently written takes effect, it would deter foreign investment in US assets at a time when the country faces increasing reliance on foreign capital to finance its ballooning debt,” wrote Elias Haddad, a strategist at Brown Brothers Harriman & Co. in a note. “Clearly, this is not good for the dollar.”

Concern that President Donald Trump’s erratic trade policies will undermine the economy are adding to the greenback’s weakness and eroding its appeal as a traditional haven bet. A court battle is underway over the legality of Trump’s sweeping tariffs — though the US administration insists they’re here to stay.

The Bloomberg Dollar Spot Index pared earlier gains to trade up 0.1% on Friday as reports showed US consumers hitting the brakes on spending in April while goods imports plummeted by a record as companies adjusted to higher tariffs. US consumer sentiment rebounded in late May, according to the University of Michigan.

The latest data is “still insufficient for the Federal Reserve to seriously consider its cuts,” said Yusuke Miyairi, a foreign-exchange strategist at Nomura. “Choppy price action in the dollar continues, owing to the market following back-and-forth tariff headlines.”

Earlier in the week, stronger-than-expected economic data lifted the dollar amid a global bond rally. But on Thursday, the greenback weakened after weak jobs results.

Meanwhile, a gauge of emerging-market currencies is on track for its first weekly loss since mid-April as investors scale back on risk following recent gains. The South African rand slumped more than 1% against the dollar on Friday.

While currencies including the rand and Mexico’s peso have strengthened more than 4% against the greenback since Trump unveiled his comprehensive list of tariffs, traders are taking some profits amid renewed global trade noise.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up