Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

South Korea’s trade deal with the U.S. under President Trump, which sets tariffs at 15% in exchange for $350 billion in investment commitments, has eased immediate market concerns...

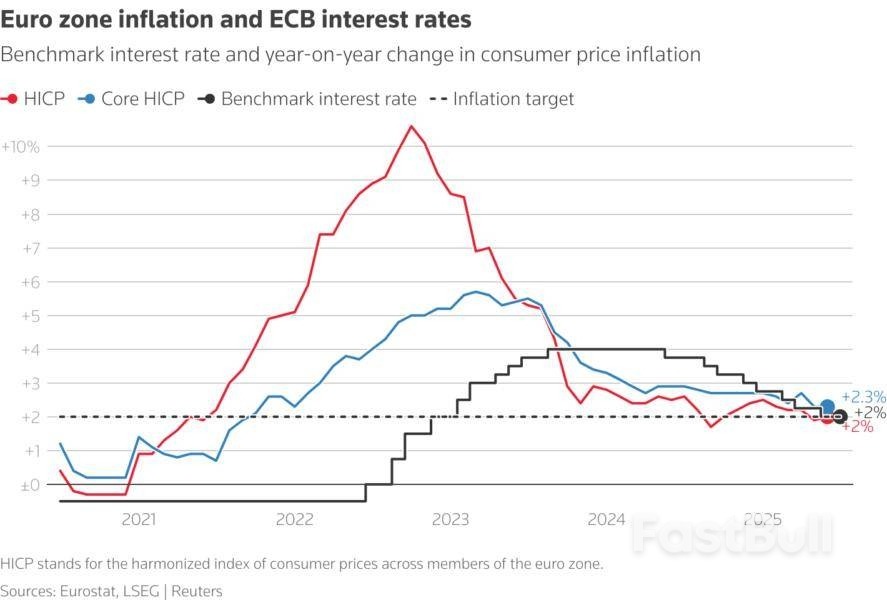

Inflation in some of the euro zone's biggest economies was at or just above expectations this month, indicating that price growth in the broader currency bloc remained near the European Central Bank's 2% target.Euro zone inflation eased back to 2% this summer after years of overshooting and the central bank now sees it hovering near this level, even as a few policymakers now fear that risks have shifted to undershooting.

Inflation in Italy eased to 1.7% in July from 1.8% in June, coming above expectations for 1.6% while price growth in France was unchanged at 0.9%, above expectations for 0.8%, official figures showed on Thursday.The data, combined with an anticipated jump in Spanish inflation to 2.7% from 2.3%, suggests a modest upside risk in the euro zone figure, which is due on Friday and is seen by economists at 1.9% after a 2.0% reading in June.

Such a small miss is unlikely to concern the ECB, however, after it made clear it considered inflation defeated and was not in any hurry to move rates again after halving them to 2% in the year to June.The ECB is also keen to hold out until it gains more clarity on how the evolution of a global trade conflict will impact prices.Tariffs, imposed by President Donald Trump on U.S. imports, are expected to weigh on prices for now since they slow global trade and economic growth, but a major realignment is corporate value chains could actually raise price pressures further out.

For now, the ECB sees inflation dipping under 2% in the coming months and projects an 18-month period of undershooting before price growth returns back to 2% in 2027.This muted inflation picture and relatively resilient growth are why financial investors think the ECB is close to done cutting rates. Markets see less than a 50% chance of another rate cut this year and they have started to price in a hike towards the end of 2026.

Friday's euro zone inflation reading is also going to be influenced by Germany but figures from various German states showed only modest changes compared to the previous month.Euro zone inflation is expected by policymakers to remain near 2% as still quick price growth in services will be offset by energy and goods prices.The stronger euro and muted wage growth are also exerting some downward pressure on prices, enough to counter upward pressure from increased government spending on things like defence or infrastructure.

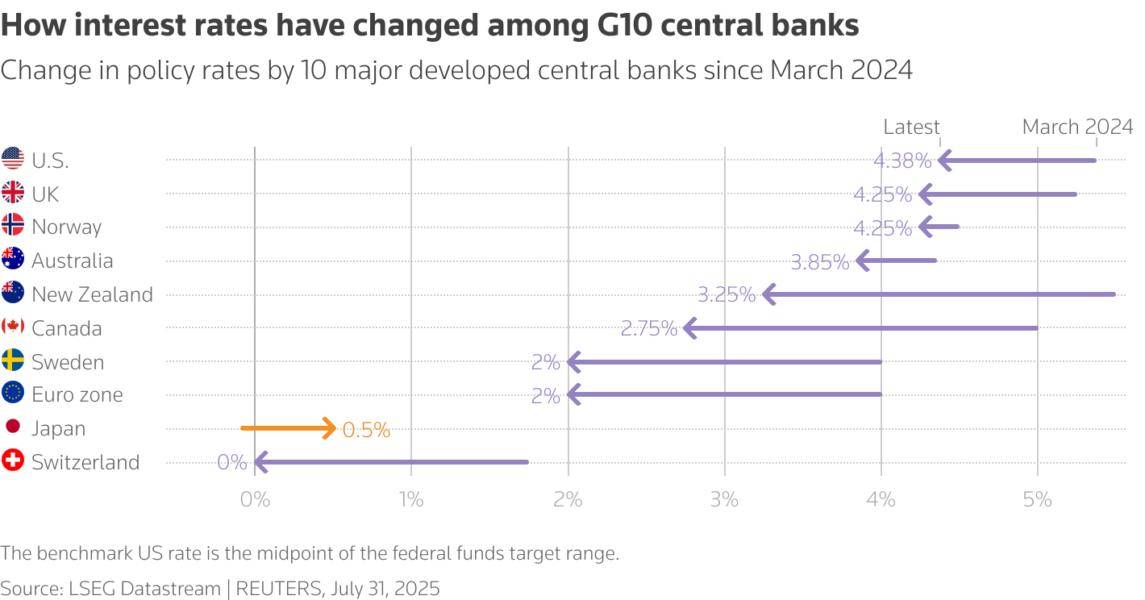

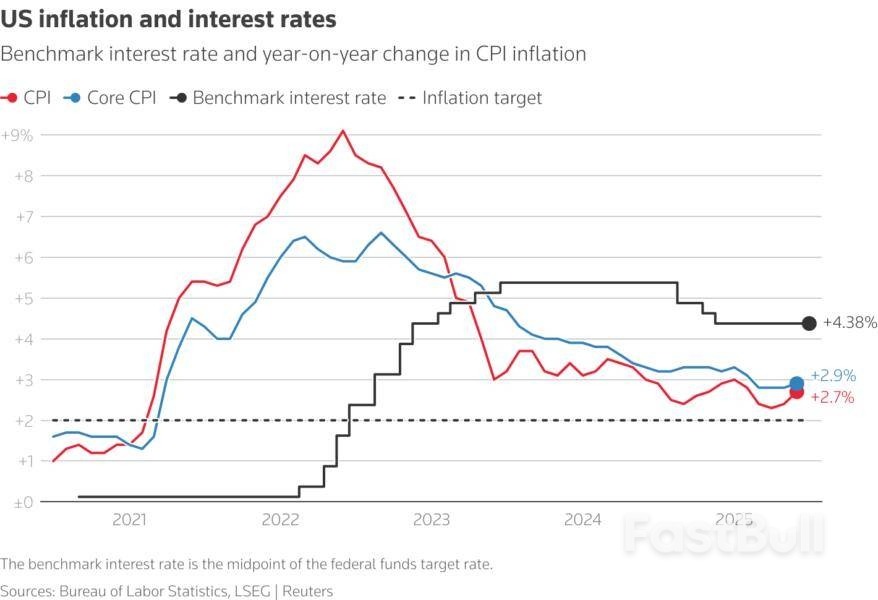

The pace of global rate cuts is slowing as the European Central Bank nears the end of its easing cycle, the U.S. Federal Reserve stays cautious about tariff-driven inflation and investors watch to see whether Britain speeds up from here.

The Fed struck a hawkish tone on Wednesday alongside holding rates steady, an approach that lifted the dollar and assuaged fears that President Donald Trump's intense pressure on chair Jerome Powell has eroded central bank independence.

Here's where 10 big central banks stand:

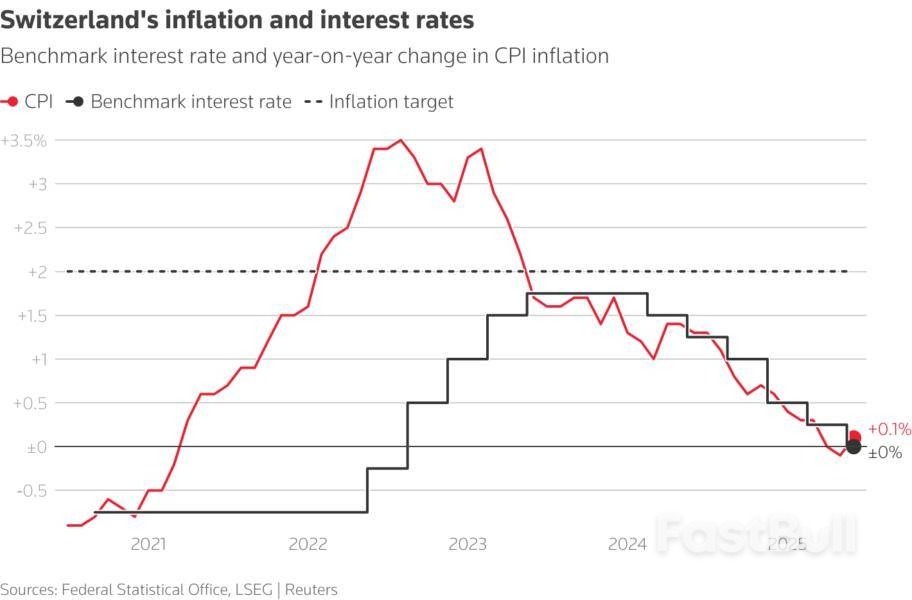

1/ SWITZERLAND

Bets that the Swiss National Bank will use negative interest rates to tackle the seemingly unstoppable rise of the safe haven franchave faded after it kept benchmark borrowing costs on hold at 0% in June.

Traders regard another pause in September as near certain and speculate that the SNB has started intervening to weaken the franc.

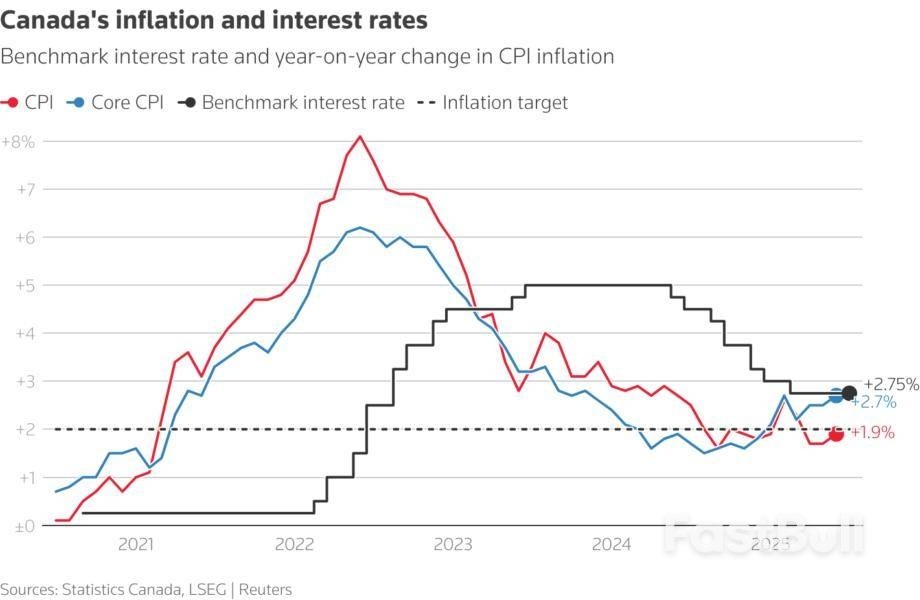

2/ CANADA

The Bank of Canada held its key policy rate at 2.75% for the third straight meeting on Wednesday, citing lower risks of a severe and escalating global trade war.

But it declined to give detailed economic forecasts, citing uncertainty aroundU.S. trade policy, and said that if the economy weakened further it could cut rates again.

The BoC has eased rates by 225 basis points since June 2024, and markets see a reasonable chance of one more cut by year end.

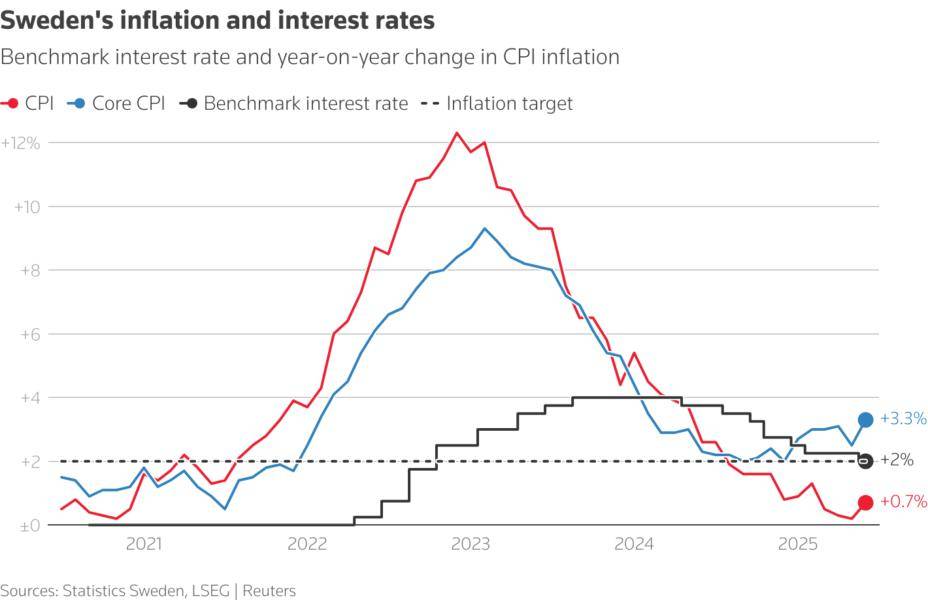

3/ SWEDEN

Ahead of Sweden's disappointing second quarter GDP data on Tuesday, the Riksbank cut its key rate to 2% last month and said policy could be eased again this year if inflation remains tame and growth remains weak.

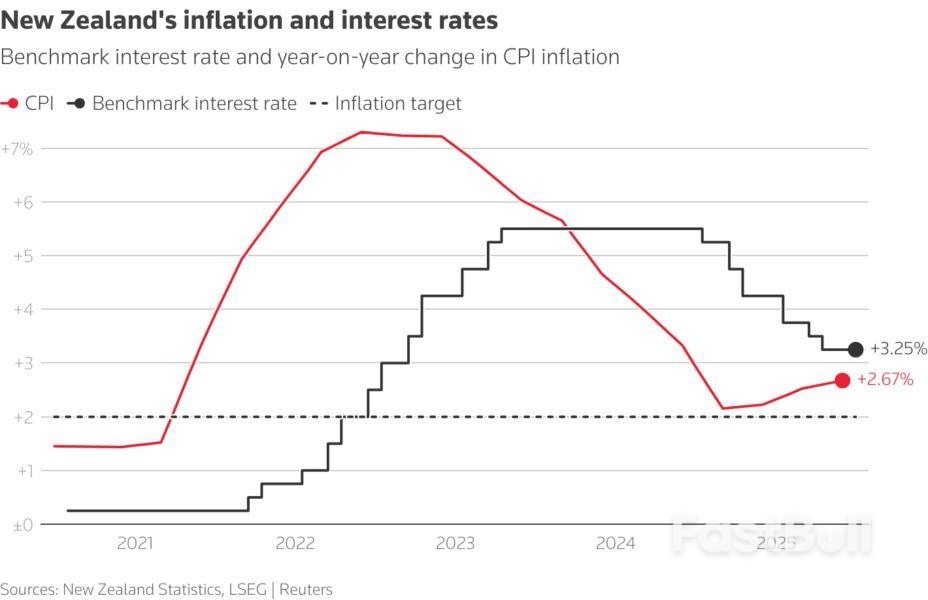

4/ NEW ZEALAND

The Reserve Bank of New Zealand, which has cut rates by 225 bps already this cycle, held borrowing costs steady earlier this month but said it expected to loosen monetary policy if price pressures continued to ease as expected.

5/ EURO ZONE

The European Central Bank held steady last week after cutting eight times in a year, and many analysts expect it is finished with easing this cycle.

The EU-U.S. trade deal took worst-case tariff scenarios off the table, and, alongside the ECB's relatively upbeat assessment of the economic outlook, allayed fears that inflation would fall significantly below its 2% target.

The ECB's main policy rate is currently at 2%, down from 4% a year ago, though markets see some chance of one more cut.

6/ UNITED STATES

The Federal Reserve stayed on pause on Wednesday and traders responded to Chair Jerome Powell's comments by cutting bets that borrowing costs would begin to fall in September, putting $18 billion worth of bets on dollar weakness in danger.

That could stoke the ire of President Donald Trump who has demanded immediate and steep rate relief.

Powell said the Fed is focused on controlling inflation - not on government borrowing or home mortgage costs that Trump wants lowered.

He added that the risk of rising price pressures from the administration's trade and other policies remains too high for the Fed to begin loosening its "modestly restrictive" grip on the economy until more information is collected.

The Fed has been on hold all this year, and markets see less than a 50% chance of a rate cut in September.

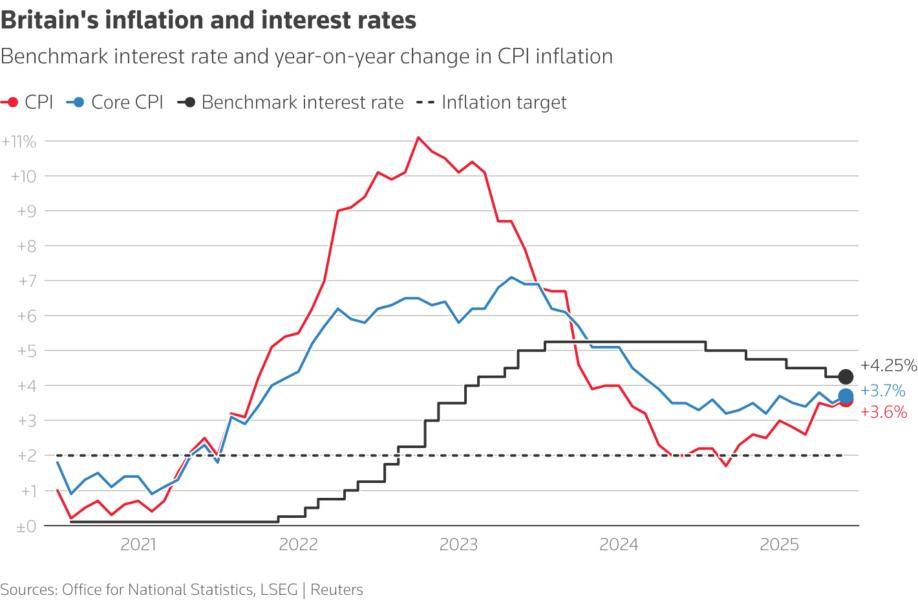

7/ BRITAIN

The Bank of England meets on Aug 7.

Markets expect a 25-bps rate cut even after data this month showed a surprise jump in inflation and a less-dramatic-than-feared cooling in the labour market.

Sticky inflation means the BoE has been more cautious than most with easing. Markets price two, 25-bp rate cuts by year-end - including an August move.

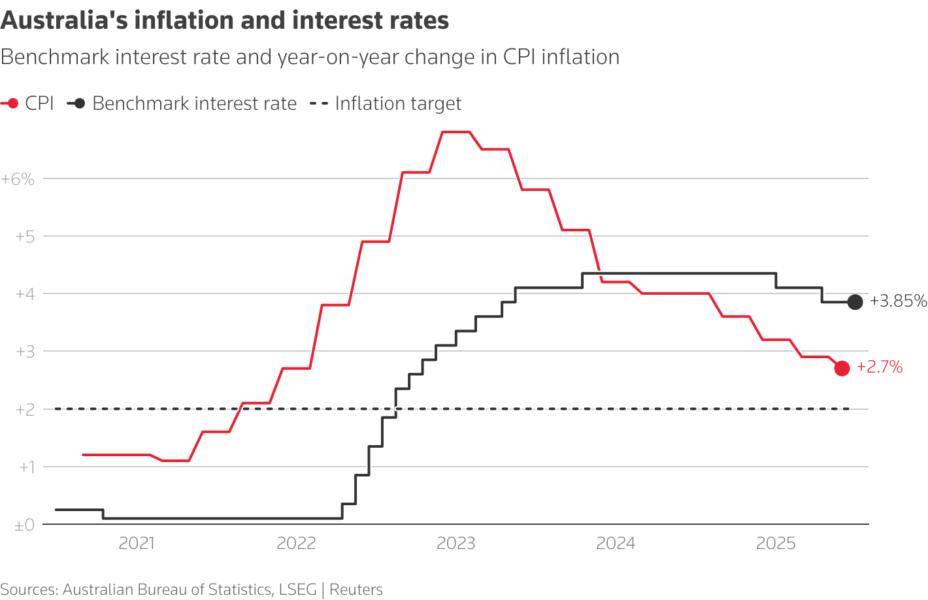

8/ AUSTRALIA

The Reserve Bank of Australia is cautious too and surprised markets earlier this month by holding rates steady at 3.85%, as it awaited confirmation that inflation is continuing to slow.

Wednesday data showing Australian consumer prices grew at the slowest pace in over four years in the June quarter should help, and markets are near certain the RBA will cut its 3.85% cash rate by 25 bps next month, and continue easing to 3.10% by year end.

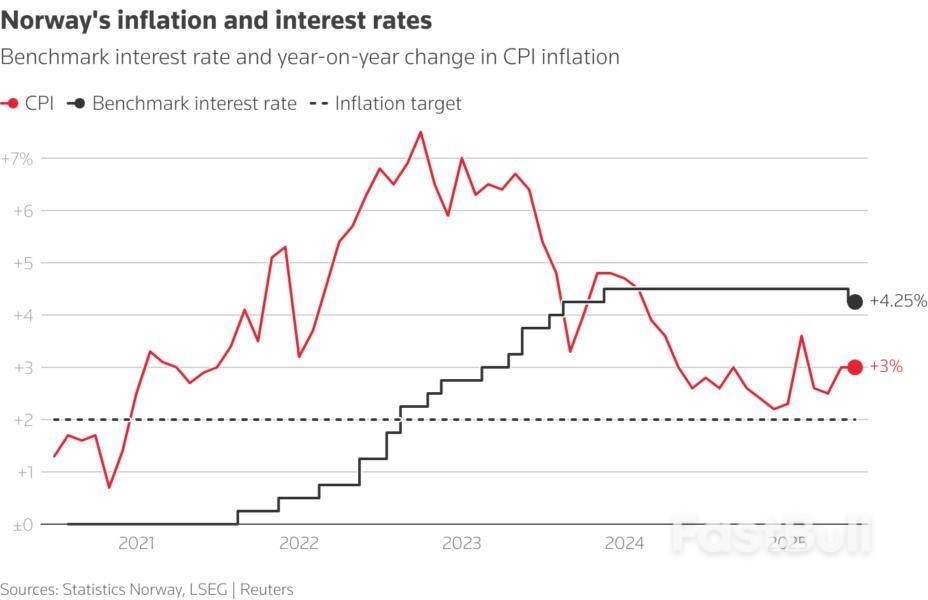

9/ NORWAY

Norway's central bank cut rates by 25 bps to 4.25% last month, its first reduction since 2020 but with only one more fully priced for 2025.

The Norges Bank has been the most cautious among developed market central banks, and data this month showing core inflation at 3.1% reinforced this stance.

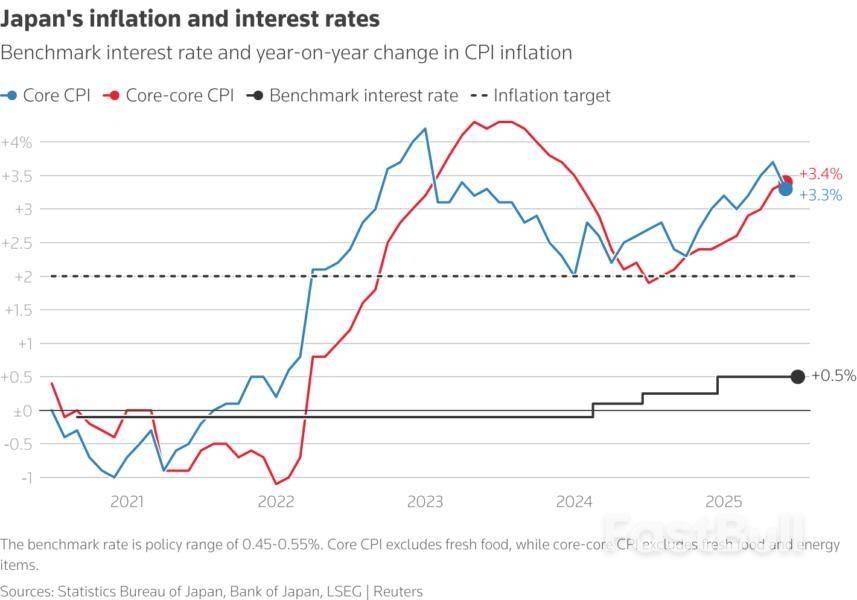

10/ JAPAN

The Bank of Japan, the sole major central bank in hiking mode, kept interest rates steady at 0.5% on Thursday, but revised up its inflation forecasts and offered a less gloomy outlook on the economy than three months ago.

Those changes maintained confidence about the BOJ resuming hikes this year.

It is remarkable. Despite all the economic sluggishness and uncertainty in recent years, the eurozone labour market has remained as strong as ever. With unemployment at 6.2%, the domestic economy continues to be supported by historically low unemployment and income stability for Europeans.

As we have previously argued, the strong eurozone job market has been mainly driven by job growth in the south, whereas northern eurozone economies have seen unemployment run up modestly in recent years. In May, the broad pattern was no different as unemployment decreased in Spain, Italy and Portugal, while the rate remained stable in Germany, France, Belgium and the Netherlands. Austria and Finland experienced increases.

The eurozone economy is facing huge uncertainty now, but business surveys about activity and hiring actually don’t look that bad. This makes it likely that unemployment will continue to trend around the current all-time lows. Low unemployment dampens the impact of economic uncertainty on domestic demand, which contributes to our view of continued economic growth in the coming quarters.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up