Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Silver fell 1.5%, breaking a key trendline as strong U.S. data and Fed hawkishness boost the dollar. Technicals suggest downside toward $34.60, though short-term rebound is possible from oversold conditions.

The number of Americans filing new applications for unemployment benefits increased marginally last week, suggesting that the labour market remained stable, though it is taking longer for laid-off workers to find new opportunities.

Initial claims for state unemployment benefits rose 1,000 to a seasonally adjusted 218,000 for the week ended July 26, the Labor Department said on Thursday. Economists polled by Reuters had forecast 224,000 claims for the latest week.

The labour market has slowed, with economists saying uncertainty over where President Donald Trump's tariff levels will eventually settle has left businesses wary of adding headcount. But labour supply has also declined amid the White House's immigration crackdown.

The Federal Reserve on Wednesday left its benchmark interest rate in the 4.25%-4.50% range, resisting pressure from President Donald Trump to lower borrowing costs. Fed chair Jerome Powell told reporters the labour market was in balance. But he added because that was partly due to both demand and supply declining, "we do see downside risk in the labour market."

The central bank cut rates three times in 2024, with the last move coming in December. Most economists expect it to resume policy easing in September.

Employers' hesitancy to increase hiring means there are fewer jobs for those being laid off. Government data on Tuesday showed there were 1.06 job openings for every unemployed person in June compared to 1.33 in January.

The number of people receiving benefits after an initial week of aid, a proxy for hiring, were unchanged at a seasonally adjusted 1.946 million during the week ending July 19, the claims report showed.

The claims data has no bearing on July's employment report, due on Friday as it falls outside the survey period. Non-farm payrolls likely increased by 110,000 jobs last month after rising 147,000 in June, a Reuters survey of economists showed.

The unemployment rate is forecast to rise to 4.2% from 4.1% in June.

U.S. inflation increased in June as tariffs boosted prices for imported goods like household furniture and recreation products, supporting views that price pressures would pick up in the second half of the year and delay the Federal Reserve from resuming cutting interest rates until at least October.

The report from the Commerce Department on Thursday showed goods prices last month posting their biggest gain since January, with also solid rises in the costs of clothing and footwear. The U.S. central bank on Wednesday left its benchmark interest rate in the 4.25%-4.50% range and Fed Chair Jerome Powell's comments after the decision undercut confidence the central bank would resume policy easing in September as had been widely anticipated by financial markets and some economists."The Fed is unlikely to welcome the inflation dynamics currently taking hold. Rather than converging toward target, inflation is now clearly diverging from it," said Olu Sonola, head of U.S. economic research, Fitch Ratings. "This trajectory is likely to complicate current expectations for a rate cut in September or October."

The personal consumption expenditures (PCE) price index rose 0.3% last month after an upwardly revised 0.2% gain in May, the Commerce Department's Bureau of Economic Analysis said. Economists polled by Reuters had forecast the PCE price index climbing 0.3% following a previously reported 0.1% rise in May.

Prices for furnishings and durable household equipment jumped 1.3%, the biggest gain since March 2022, after increasing 0.6% in May. Recreational goods and vehicles prices shot up 0.9%, the most since February 2024, after being unchanged in May. Prices for clothing and footwear rose 0.4%.

Outside the tariff-sensitive goods, prices for gasoline and other energy products rebounded 0.9% after falling for four consecutive months. Services prices rose 0.2% for a fourth straight month. In the 12 months through June, the PCE price index advanced 2.6% after increasing 2.4% in May.

The data was included in the advance gross domestic product report for the second quarter published on Wednesday, which showed inflation cooling, though remaining above the Fed's 2% target. Economists said businesses were still selling inventory accumulated before President Donald Trump's sweeping import duties came into effect.

They expected a broad increase in goods prices in the second half. Procter & Gamble (PG.N), opens new tab said this week it would raise prices on some products in the U.S. to offset tariff costs.

The U.S. central bank tracks the PCE price measures for monetary policy. Excluding the volatile food and energy components, the PCE price index increased 0.3% last month after rising 0.2% in May. In addition to higher goods prices, the so-called core PCE inflation was lifted by rising costs for healthcare as well as financial services and insurance.

In the 12 months through June, core inflation advanced 2.8% after rising by the same margin in May.

U.S. stocks opened higher. The dollar was trading higher against a basket of currencies. U.S. Treasury yields fell.

The BEA also reported that consumer spending, which accounts for more than two-thirds of economic activity, rose 0.3% in June after being unchanged in May. The data was also included in the advance GDP report, which showed consumer spending growing at a 1.4% annualized rate after almost stalling in the first quarter.

In the second quarter, economic growth rebounded at a 3.0% rate, boosted by a sharp reduction in the trade deficit because of fewer imports relative to the record surge in the January-March quarter. The economy contracted at a 0.5% pace in the first three months of the year.

Consumer spending remains supported by a stable labor market, with other data from the Labor Department showing initial claims for state unemployment benefits rose 1,000 to a seasonally adjusted 218,000 for the week ended July 26.

But a reluctance by employers to increase headcount amid uncertainty over where tariff levels will eventually settle is making it harder for those who lose their jobs to find new opportunities, which could hamper future spending.

The number of people receiving benefits after an initial week of aid, a proxy for hiring, was unchanged at a lofty seasonally adjusted 1.946 million during the week ending July 19, the claims report showed.

The government's closely watched employment report on Friday is expected to show the unemployment rate rising to 4.2% in July from 4.1% in June, according to a Reuters survey of economists.

Economists expect the combination of pressure from tariffs and a slowing labor market will put a brake on consumer spending in the third quarter. Slow growth is likely already in the works as inflation-adjusted consumer spending edged up 0.1% in June after declining 0.2% in May. Precautionary saving could also curb spending. The saving rate was unchanged at 4.5% in June, while personal income re

"The June numbers and revisions to previous data set the economy up for fairly weak consumer spending in the third quarter," said Oren Klachkin, financial markets economist at Nationwide. "With wage growth staying contained, we expect the consumer will continue to look for discounts through the rest of the year."Reporting by Lucia Mutikani, Editing by Chizu Nomiyama and Andrea Ricci

President Donald Trump said the U.S. would charge a 15% tariff on imports from South Korea, one of a number of such measures announced in the run-up to his August 1 deadline to impose such levies.He also signed an executive order imposing a 40% tariff on Brazilian exports, bringing the country's total tariff amount to 50%, but with a number of notable exemptions.He has also threatened to impose a 25% tariff on goods imported from India starting on August 1.

Following are key developments:

SOUTH KOREA:

Trump said the U.S. will charge a 15% tariff on imports from South Korea, including autos, as part of a trade deal.He also said South Korea would accept American products, including autos and agriculture into its markets and impose no import duties on them.The U.S. agreed that South Korean firms would not be put at a disadvantage compared with other countries over upcoming tariffs on chips and pharmaceutical products, while retaining 50% tariffs on steel and aluminium.

INVESTMENTS:

Trump said South Korea would invest $350 billion in the United States in projects "owned and controlled by the United States" and selected by Trump.South Korea said $150 billion has been earmarked for shipbuilding cooperation, while investments in chips, batteries, biotechnology and nuclear energy cooperation accounted for the remaining $200 billion.Trump said South Korea would purchase $100 billion worth of liquefied natural gas or other energy products, which the Asian country said would mean a slight shift in energy imports from the Middle East in the next four years.

BRAZIL:

Trump slapped a 50% tariff on most Brazilian goods to fight what he has called a "witch hunt" against former President Jair Bolsonaro, but softened the blow by excluding sectors such as aircraft, energy and orange juice from heavier levies.The new tariffs are due to take effect on August 6 in the case of Brazil.General exemptions also apply to donations intended to relieve human suffering such as food, clothing, medicine, as well as publications, films, music and artworks.

INDIA:

Trump said on Wednesday the United States is still negotiating with India on trade after announcing earlier in the day the U.S. would impose a 25% tariff on goods imported from the country starting on Friday.India has resisted U.S. demands to open its agricultural and dairy markets, saying such moves would hurt millions of poor farmers. New Delhi has historically excluded agriculture from free trade pacts to protect domestic livelihoods.According to a White House fact sheet, India imposes an average MFN (Most Favoured Nation) tariff of 39% on imported farm goods, compared to 5% in the U.S., with some duties as high as 50%.

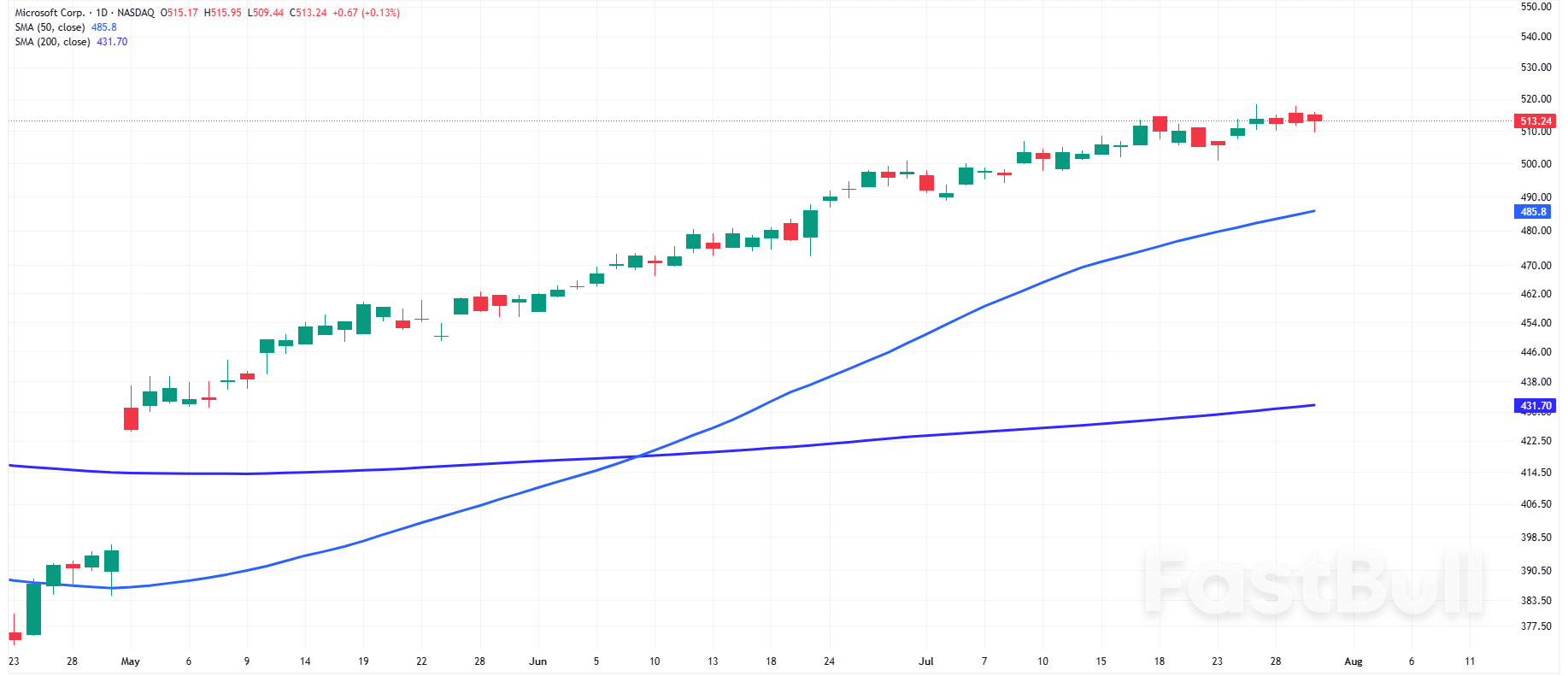

Daily Microsoft Corp.msftMM

Daily Microsoft Corp.msftMM

President Donald Trump said he extended Mexico’s current tariff rates for 90 days to allow more time for trade negotiations with the US’ southern neighbor.

“We have agreed to extend, for a 90 Day period, the exact same Deal as we had for the last short period of time, namely, that Mexico will continue to pay a 25% Fentanyl Tariff, 25% Tariff on Cars, and 50% Tariff on Steel, Aluminum, and Copper,” Trump said Thursday in a social media post.

Trump threatened last month to increase Mexico’s country-based duty to 30% starting Aug. 1. The president’s decision comes shortly after he said he would not extend his Friday deadline.

“Additionally, Mexico has agreed to immediately terminate its Non Tariff Trade Barriers, of which there were many. We will be talking to Mexico over the next 90 Days with the goal of signing a Trade Deal somewhere within the 90 Day period of time, or longer,” the president added.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up