Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Silver’s recent pullback is seen as a buying opportunity, with rising industrial demand, structural supply deficits, a weaker dollar, and new strategic-resource status all supporting a potential next major rally phase.

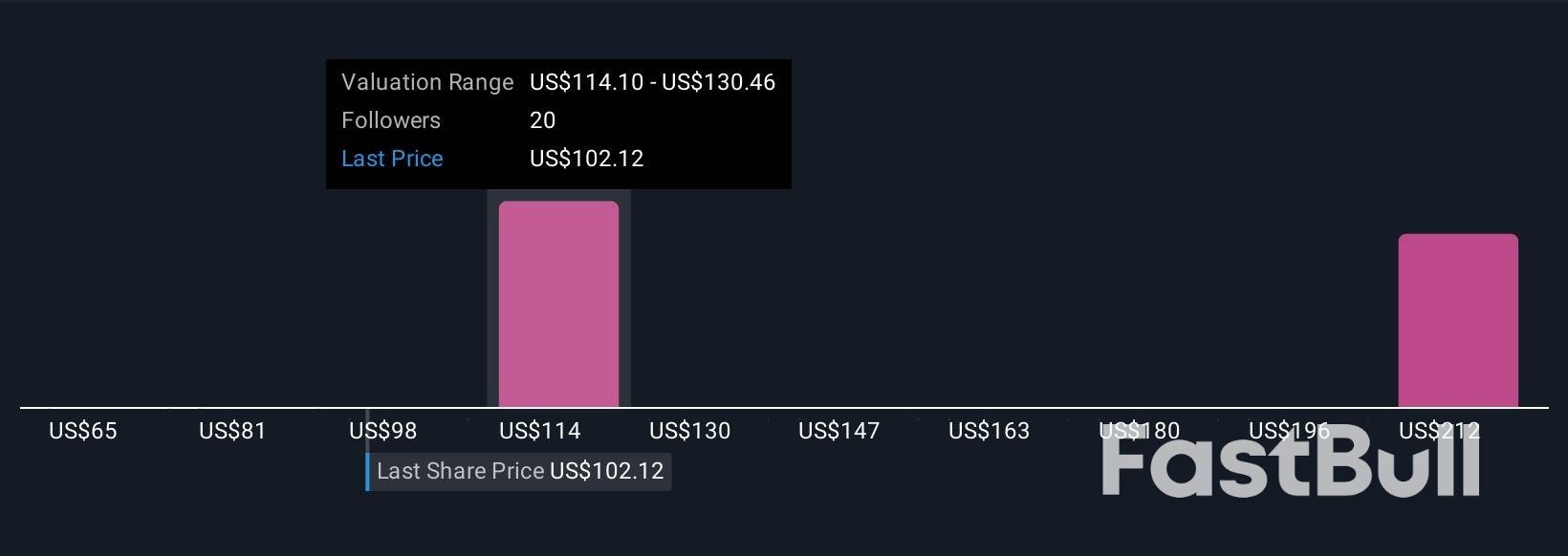

East West Bancorp's consensus analyst price target edged down marginally from $125.40 to $125.20, reflecting evolving views on the company's outlook. The modest adjustment comes as analysts weigh the impact of continued strong fundamentals against ongoing challenges in the sector. Stay tuned to discover how investors and observers can stay ahead as the narrative around East West Bancorp evolves.

Stay updated as the Fair Value for East West Bancorp shifts by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on East West Bancorp.

Analyst sentiment for East West Bancorp has generally leaned positive in recent weeks, with several firms raising their price targets following solid quarterly results and improved bank guidance. However, not all views are uniformly bullish, and some firms remain cautious or maintain a more neutral outlook, citing broader sector risks and valuation considerations.

Bullish Takeaways:

BofA raised its price target to $133 from $128 after what it described as "another beat and raise quarter." This reflects increased confidence in earnings growth and forward guidance.

Citi lifted its price targets twice, most recently to $137 from $124. Analysts cited strong deposit growth and higher net interest income, and emphasized improved management execution and outlook transparency.

Cantor Fitzgerald initiated coverage with an Overweight rating and a $124 price target. The firm noted a "constructive view" on the macro backdrop that could support continued upside and robust loan growth across US banks.

Morgan Stanley hiked its price target to $126 from $111, seeing a steepening yield curve and lower short-term rates as an ideal backdrop for midcap banks like East West Bancorp. The firm also upgraded the industry view to Attractive.

Bearish Takeaways:

Despite positive results and upward price target revisions, both Truist and Piper Sandler maintained neutral or Hold ratings. They suggested that upside may already be reflected in the current share price and that near-term risks persist.

Truist, while raising its target to $116 from $112, continues to flag sector challenges including skewed investor preference toward larger banks and limited catalysts for near-term outperformance.

Piper Sandler increased its target to $104 from $100 but keeps a Neutral rating, noting that revised guidance is broadly in line with previous expectations and that the outlook for further estimate increases remains muted.

Do your thoughts align with the Bull or Bear Analysts? Perhaps you think there's more to the story. Head to the Simply Wall St Community to discover more perspectives or begin writing your own Narrative!

BofA raised its price target for East West Bancorp to $133 from $128 after the company posted another strong quarter and delivered higher forecasts for earnings per share through 2026.

Truist increased its price target to $116 from $112, citing greater confidence in East West Bancorp's higher net interest income, increased fee revenues, lower expenses, and expanded share buybacks after the third quarter report.

East West Bancorp completed the repurchase of 258,000 shares for $25 million in the third quarter of 2025, bringing the total to 7.37% of outstanding shares repurchased since 2020.

East West Bank announced a new partnership with Worldpay to expand payment solutions and enhance transaction capabilities for commercial and business customers in-store and online.

Consensus Analyst Price Target edged down marginally from $125.40 to $125.20.

Discount Rate increased slightly from 6.78% to 6.96%.

Revenue Growth projection declined modestly from 10.22% to 10.15%.

Net Profit Margin expanded a touch from 44.17% to 44.30%.

Future P/E ratio inched up from 13.45x to 13.48x.

Narratives offer a smarter way to invest by telling the story behind a company's numbers and forecasts. On Simply Wall St, any investor can craft or follow a Narrative, an easy-to-read, constantly updated summary that connects East West Bancorp's business story, financial projections, and current fair value. This helps you compare fair value to the latest market price and decide when to buy or sell. Narratives adapt quickly as news or results come in, giving you a living, actionable insight on the Community page.

Discover why following the original East West Bancorp Narrative keeps you ahead of market moves:

See how rising net interest income and digital banking partnerships are driving resilience and growth.

Understand the risks of heavy commercial real estate exposure and rapid sector change in banking technology.

Track updated forecasts and analyst assumptions for revenue, profit margins, and fair value, refreshed as new data arrives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Americans expect inflation to moderate in the near term while expressing concerns about the job market and their personal finances, according to a Federal Reserve Bank of New York report released Friday.

The bank's Survey of Consumer Expectations for October showed households anticipate inflation to reach 3.2% a year from now, down from September's 3.4% expectation. Three and five-year inflation expectations remained unchanged at 3% for both time horizons.

Despite the improved inflation outlook, respondents showed increased concern about employment conditions. They predicted a higher unemployment rate in the coming year compared to the previous month's survey and anticipated greater difficulty finding work if they became unemployed, though they expressed less worry about losing their current jobs than in September.

The heightened concern about future employment was particularly pronounced among respondents under age 60 and those with some college education.

The survey also revealed growing pessimism about both current and future financial situations. However, Americans reported that credit is now easier to obtain and expected it to become even more accessible in the future.

Expectations for future earnings and income were mixed in October. Households anticipated declines in gasoline and food prices, while the expected year-ahead increase in medical costs reached its highest level since February 2023.

The survey was conducted throughout October amid the government shutdown and growing concerns about job market conditions. Last week, the Fed reduced its interest rate target by a quarter percentage point to the 3.75%-4.00% range, aiming to support employment while maintaining downward pressure on inflation, which remains above the Fed's 2% target.

Fed officials have indicated that the relative stability of longer-term inflation expectations gives them confidence that inflation will eventually return to target, as these expectations significantly influence current price pressures.

Gold (GC=F) futures sat near $4,000 per ounce on Friday, remaining steady after last month's sharp sell-off but raising questions over where the precious metal is headed next.

Gold is still on pace for its best year since 1979, driven by central bank purchasing and increased inflows into exchange-traded funds (ETFs), bar and coin purchases. But the yellow metal is off roughly 9% from its all-time high north of $4,350 last month.

Analysts at Macquarie Group said Thursday they believe gold prices have likely peaked, noting that other central banks began cutting rates ahead of the Federal Reserve, which has remained noncommittal about another move in December. Rate cuts typically boost the metal's appeal over yield-bearing assets.

"With global growth beginning to rebound, central bank easing cycles near an end, real interest rates still relatively high and tensions between the US and China easing (at least for now), we suspect the near-term peak is in, with prices likely to fall over the coming year." chief economist Ric Deverell wrote on Thursday.

"However, the decline will likely be slower than seen after previous peaks, with prices remaining well above the end-2023 level through the current US Presidential term," he added. Gold was sitting near $2,000 per troy ounce almost two years ago.

The analysts noted if geopolitical tensions re-escalate or concerns about the size of the US government return, gold may rally further.

Gold saw its biggest daily drop in more than a decade in October, bringing a stunning rally to a sudden stop. It still ended the month with a roughly 5% gain.

A World Gold Council report released earlier this week said that a stronger dollar fueled gold's seesaw from its recent all time high.

"With no long-term momentum 'sell' signals seen thus far, our view is that an October decline will likely provide a healthy and much needed breather in the core long-term uptrend," the report said.

Even if a peak is reached, some Wall Street analysts still expect gold to rise from current levels from end of year.

"Despite the recent pullback in gold to around USD 4,000 an ounce from a peak above USD 4,300/oz, our target remains USD 4,200/oz for the next 12 months; a rise in political and financial market risks could lead gold to our upside target of USD 4,700/oz," UBS analysts said in note on Thursday.

Meanwhile Goldman Sachs analysts predicted last month that gold will reach $4,900 per troy ounce by the end of next year.

"While a correction in speculative upside call options structures likely contributed to the selloff, we believe sticky, structural buying will continue further, and still see upside risk to our $4,900 end-2026 forecast from growing interest in gold as a strategic portfolio diversifier," said Goldman Sachs analysts in October.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up