Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Australia Labor Force Participation Rate (SA) (Nov)

Australia Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Turkey Retail Sales YoY (Oct)

Turkey Retail Sales YoY (Oct)A:--

F: --

P: --

South Africa Mining Output YoY (Oct)

South Africa Mining Output YoY (Oct)A:--

F: --

P: --

South Africa Gold Production YoY (Oct)

South Africa Gold Production YoY (Oct)A:--

F: --

P: --

Italy Quarterly Unemployment Rate (SA) (Q3)

Italy Quarterly Unemployment Rate (SA) (Q3)A:--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report Turkey 1-Week Repo Rate

Turkey 1-Week Repo RateA:--

F: --

P: --

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)A:--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Dec)

Turkey Overnight Lending Rate (O/N) (Dec)A:--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Dec)

Turkey Late Liquidity Window Rate (LON) (Dec)A:--

F: --

P: --

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)A:--

F: --

P: --

Brazil Retail Sales MoM (Oct)

Brazil Retail Sales MoM (Oct)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

U.S. Exports (Sept)

U.S. Exports (Sept)A:--

F: --

P: --

U.S. Trade Balance (Sept)

U.S. Trade Balance (Sept)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

Canada Imports (SA) (Sept)

Canada Imports (SA) (Sept)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

Canada Trade Balance (SA) (Sept)

Canada Trade Balance (SA) (Sept)A:--

F: --

Canada Exports (SA) (Sept)

Canada Exports (SA) (Sept)A:--

F: --

U.S. Wholesale Sales MoM (SA) (Sept)

U.S. Wholesale Sales MoM (SA) (Sept)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. 30-Year Bond Auction Avg. Yield

U.S. 30-Year Bond Auction Avg. YieldA:--

F: --

P: --

Argentina CPI MoM (Nov)

Argentina CPI MoM (Nov)A:--

F: --

P: --

Argentina National CPI YoY (Nov)

Argentina National CPI YoY (Nov)A:--

F: --

P: --

Argentina 12-Month CPI (Nov)

Argentina 12-Month CPI (Nov)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Industrial Output Final MoM (Oct)

Japan Industrial Output Final MoM (Oct)--

F: --

P: --

Japan Industrial Output Final YoY (Oct)

Japan Industrial Output Final YoY (Oct)--

F: --

P: --

U.K. Services Index MoM (SA) (Oct)

U.K. Services Index MoM (SA) (Oct)--

F: --

P: --

U.K. Services Index YoY (Oct)

U.K. Services Index YoY (Oct)--

F: --

P: --

Germany HICP Final YoY (Nov)

Germany HICP Final YoY (Nov)--

F: --

P: --

Germany HICP Final MoM (Nov)

Germany HICP Final MoM (Nov)--

F: --

P: --

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoM--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)--

F: --

P: --

U.K. Manufacturing Output MoM (Oct)

U.K. Manufacturing Output MoM (Oct)--

F: --

P: --

U.K. Monthly GDP 3M/3M Change (Oct)

U.K. Monthly GDP 3M/3M Change (Oct)--

F: --

P: --

Germany CPI Final MoM (Nov)

Germany CPI Final MoM (Nov)--

F: --

P: --

Germany CPI Final YoY (Nov)

Germany CPI Final YoY (Nov)--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

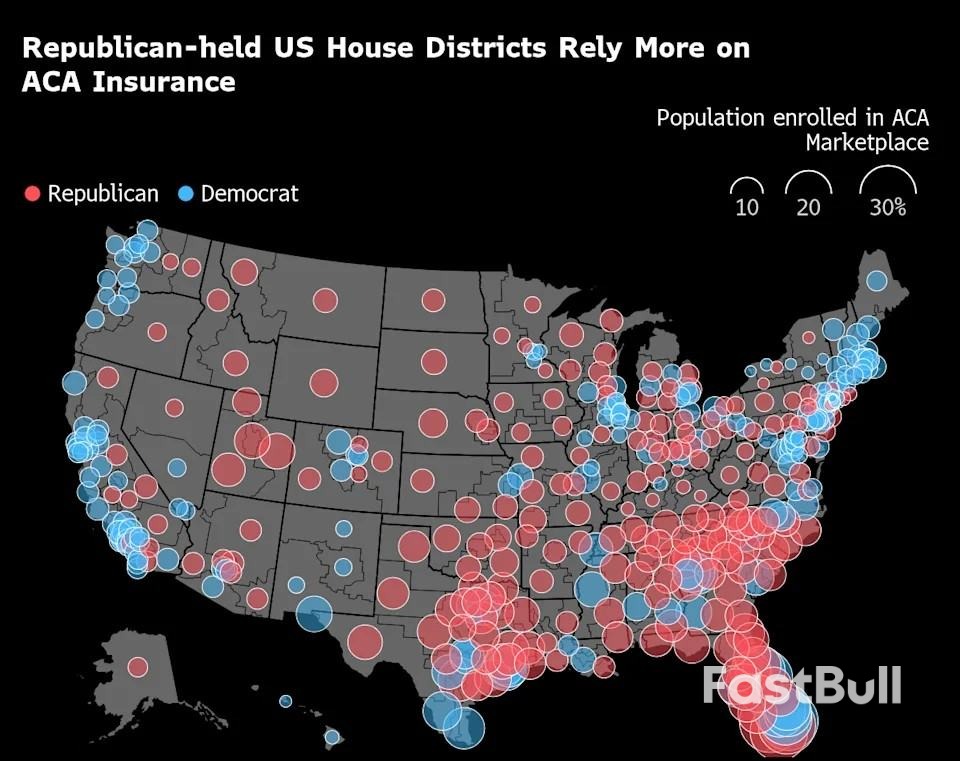

The issue has divided Republicans, pitting moderates and lawmakers from states and districts with high ACA enrollment against GOP leadership and the rest of the party.

Dec 11 (Reuters) - Gold rose on Thursday to hit its highest level in more than a month after the U.S. Federal Reserve's quarter-point rate cut pushed the dollar lower, while silver surged to a fresh record high.

Spot gold was up 1.2% at $4,275.39 per ounce, as of 11:49 a.m. ET (16:49 GMT), reaching its highest level since October 21. U.S. gold futures for February delivery gained 1.9% to $4,303.90 per ounce.

Spot silver added 3.2% to $63.77 per ounce, hovering near the session's record high of $63.93.

"Silver seems to be pulling gold up with it and it's also pulling up platinum and palladium...there's a lot of momentum behind it right now," said Marex analyst Edward Meir.

The U.S. dollar slipped to over seven-week low against a basket of rival currencies, making greenback-priced gold more affordable for overseas buyers.

"Inflation hasn't really come back down to the Fed's 2% target, so, when you're lowering rates in an inflationary environment that is still not optimum, and that's very bullish for gold," Meir added.

The Federal Reserve on Wednesday delivered its third consecutive quarter-point cut, while policymakers also signaled a likely pause in further reductions as they monitor labor market trends and inflation that "remains somewhat elevated".

Lower interest rates tend to be favorable to gold, as it is a non-yielding asset.

U.S. President Donald Trump has advocated for lower interest rates since the start of his second term in January, and his nominee for the next Federal Reserve chair is expected to maintain that stance. White House economic adviser Kevin Hassett is currently viewed as the leading candidate for the position.

Investors now await the monthly U.S. non-farm payrolls report, set to be released on December 16, for fresh cues on the Fed's policy path.

Meanwhile, India's pension regulator on Wednesday permitted investments in gold and silver ETFs for the country's pension funds.

Elsewhere, platinum gained 2.5% to $1,698.10, while palladium rose 1.3% to $1,494.88.

Defenders of Powell & Co's December rate might look to today's data to support the notion that a softening labor market warranted the move.

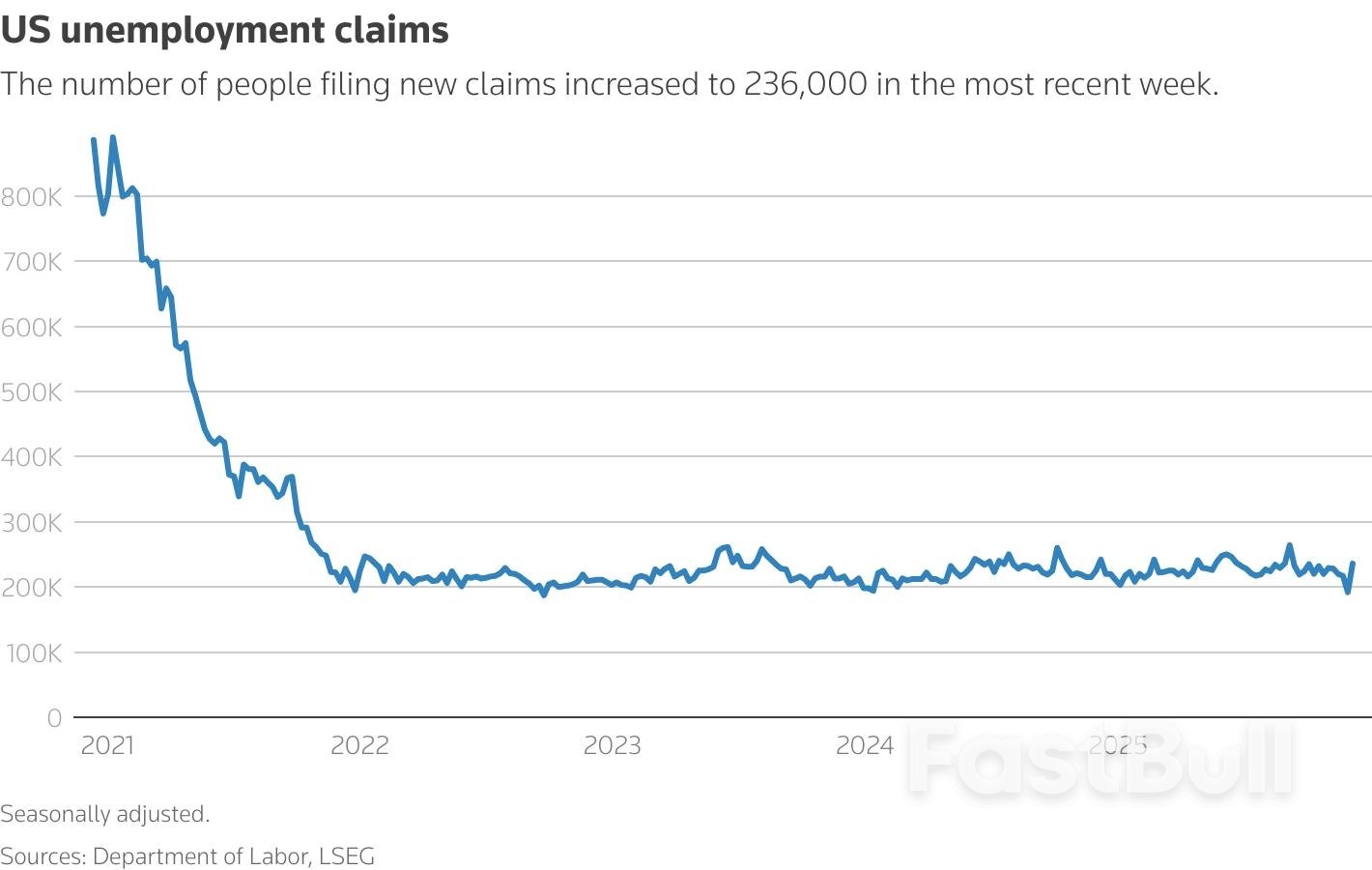

Last week, 236,000 U.S. workers joined the queue outside the unemployment office (USJOB=ECI), a 22.9% jump from the previous week and 16,000 more than analysts expected.

Ironing out weekly volatility, the four-week moving average of initial claims now has a slight upward bias, but remains comfortably within the range associated with healthy labor market churn.

At any rate, the recent spate of corporate layoff announcements is yet to have an obvious impact on the claims data.

In fact, the oversized moves in this week's claims data can be at least partially blamed on seasonality.

"Taking the past few weeks together, claims remain relatively low despite a recent uptick in layoff announcements," writes Nancy Vanden Houten, lead U.S. economist at Oxford Economics.

Surprising in the other direction, ongoing jobless claims (USJOBN=ECI), which are reported on a one-week lag, unexpectedly dropped 5.1% to 1.838 million, or 109,000 shy of consensus. While still elevated, the jumbo-size weekly plunge happens at a time of weak hiring and consumer survey data that suggests laid-off workers are finding it increasingly difficult to find a replacement gig.

It's possible that at least some of the drop can be attributed to benefits expiry, but not all of it.

"Continued claims aren't immune to seasonal volatility so we won't read anything into that decline," Houten adds.

Separately, investors were graced with trade data harkening back three months, when the government was a mere gleam in Washington's eye.

Way back in September, the trade gap (USTBAL=ECI), or the difference in the value of goods and services imported to the U.S. and those exported abroad, unexpectedly narrowed by 11.0% to $52.8 billion.

The reading is 2.3% narrower than economist predictions, notching the lowest trade deficit since June 2020.

Under the hood, exports grew by 3.0% with a boost from a weak dollar, while the ebbing effects of punishing tariff policies helped imports, which account for the lion's share of the United States' total international trade and which partially rebounded from August's 5.2% drop, edging up 0.6%.

Imports are a GDP detractor, so the shrinking trade deficit could bode well for the Commerce Department's next take on July-September GDP, if it ever arrives.

"We aren't sure we'll see consistently smaller trade deficits going forward," says Oren Klachkin, financial markets economist at Nationwide. "Looking ahead, we see the trade deficit remaining relatively wide next year."

"Firmer export growth fueled by a pickup in global demand and weaker dollar will be largely offset by stronger imports that will be a consequence of firmer US domestic demand."

The number of Americans filing new applications for unemployment benefits increased by the most in nearly 4-1/2 years last week, but the surge likely does not suggest a material weakening in labor market conditions, as the claims data are volatile around this time of year.

The larger-than-expected rise in initial weekly jobless claims reported by the Labor Department on Thursday reversed the sharp drop in the prior week, which had pushed filings to a three-year low.

Economists said adjusting the data for seasonal fluctuations is always a challenge during the start of the holiday season, and recommended focusing on the four-week moving average to get a better read of the labor market. The four-week average of claims suggested labor market conditions remained stable.

"The bulk of this week-to-week volatility is seasonal noise," said Stephen Stanley, chief U.S. economist at Santander U.S. Capital Markets. "On an underlying basis, nothing has changed, but if anything, we would have to say that initial claims are running slightly below the long-established trend, one of several data points that refutes (Federal Reserve) Chairman (Jerome) Powell's characterization of a shaky labor market."

Initial claims for state unemployment benefits jumped 44,000, the biggest increase since mid-July of 2021, to a seasonally adjusted 236,000 for the week ended December 6, the Labor Department said. Economists polled by Reuters had forecast 220,000 claims for the latest week.

Claims had dropped to a three-year low in the prior week, which was partly attributed to difficulties adjusting the data around the Thanksgiving holiday. The four-week moving average of claims, which irons out seasonal fluctuations, rose 2,000 to 216,750 last week. Economists continue to describe the labor market as being in a "no-fire, no-hire" state despite a raft of layoff announcements by large corporations, including Amazon.

"It's a little surprising that recent layoff announcements haven't translated into a shift higher in initial claims," said Nancy Vanden Houten, lead U.S. economist at Oxford Economics.

"It may be that some workers who have lost their jobs have received generous severance packages or have found other employment, although that is more difficult in the current labor market with a depressed rate of hiring."

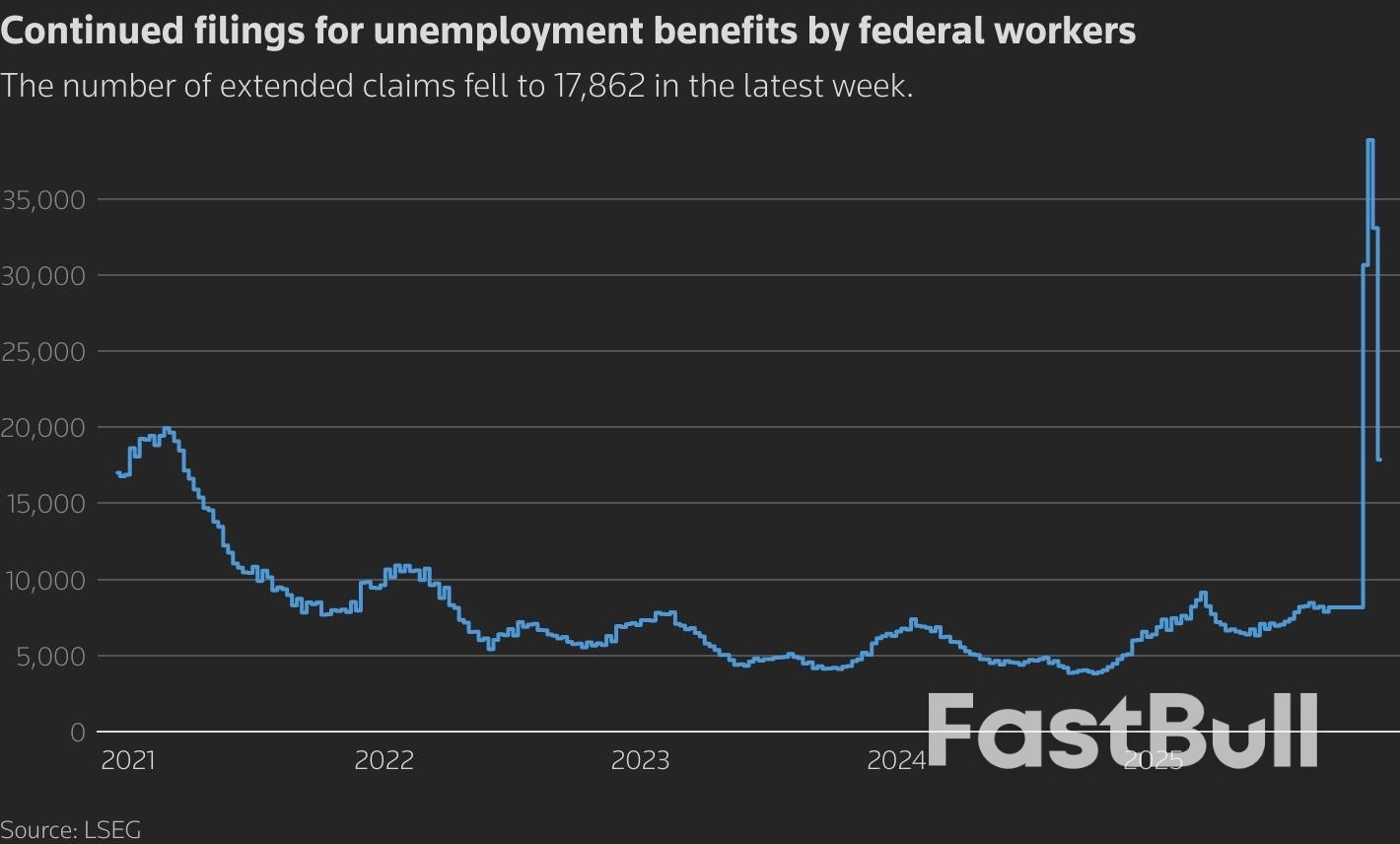

A line chart with the title 'Continued filings for unemployment benefits by federal workers'

A line chart with the title 'Continued filings for unemployment benefits by federal workers'The Fed on Wednesday cut its benchmark overnight interest rate by another 25 basis points to the 3.50%-3.75% range. The U.S. central bank has cut rates three times this year. Powell told reporters the labor market "seems to have significant downside risks," noting there was an overcounting of nonfarm payrolls, which policymakers believed was still persisting.

U.S. stocks were trading mostly lower. The dollar weakened against a basket of currencies. U.S. Treasury yields also fell.

In September, the Bureau of Labor Statistics estimated 911,000 fewer jobs were created in the 12 months through March than previously estimated, the equivalent of 76,000 fewer jobs per month. The BLS will publish the final payrolls benchmark revision in February along with January's employment report.

The employment report for November, delayed by the 43-day government shutdown, will be released next Tuesday. It will incorporate October's nonfarm payrolls data. The unemployment rate for October, however, will not be available because the shutdown prevented the collection of data for the household survey, from which the jobless rate is calculated.

The labor market has stagnated amid low supply and demand for workers, which economists blamed on reduced immigration and on import tariffs. The adoption of artificial intelligence for some job roles is also eroding demand for labor.

The number of people receiving unemployment benefits after an initial week of aid, a proxy for hiring, dropped 99,000 to a seasonally adjusted 1.838 million during the week ending November 29, the claims report showed.

Some of the decline in the so-called continuing claims could be the result of people exhausting their eligibility for benefits, limited to 26 weeks in most states. Continuing claims are consistent with a gradual rise in the unemployment rate.

A line chart with the title 'US unemployment claims'

A line chart with the title 'US unemployment claims'The unemployment rate increased to 4.4% in September from 4.3% in August. The Fed's new Summary of Economic Projections estimated the jobless rate would end this year at 4.5% and ease slightly to 4.4% in 2026, unchanged from the projections in September.

A separate report from the Commerce Department's Bureau of Economic Analysis and Census Bureau showed the trade deficit contracted 10.9% to $52.8 billion in September, the lowest level since June 2020, as goods exports soared and imports rose marginally. The smaller trade gap suggested trade likely contributed to gross domestic product in the third quarter.

Exports climbed 3.0% to $289.3 billion in September. Goods exports surged 4.9% to $187.6 billion, with shipments of consumer goods increasing to a record high. Imports rose 0.6% to $342.1 billion. Goods imports advanced 0.6% to $266.6 billion. But imports of automotive vehicles, parts and engines were the lowest since November 2022.

The goods trade deficit compressed 8.2% to $79.0 billion, the lowest level since September 2020.

The Atlanta Fed estimated GDP increased at a 3.5% annualized rate in the third quarter. The government will release its first estimate of third-quarter GDP on December 23, a delay prompted by the shutdown. The economy grew at a 3.8% pace in the April-June quarter.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up