Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

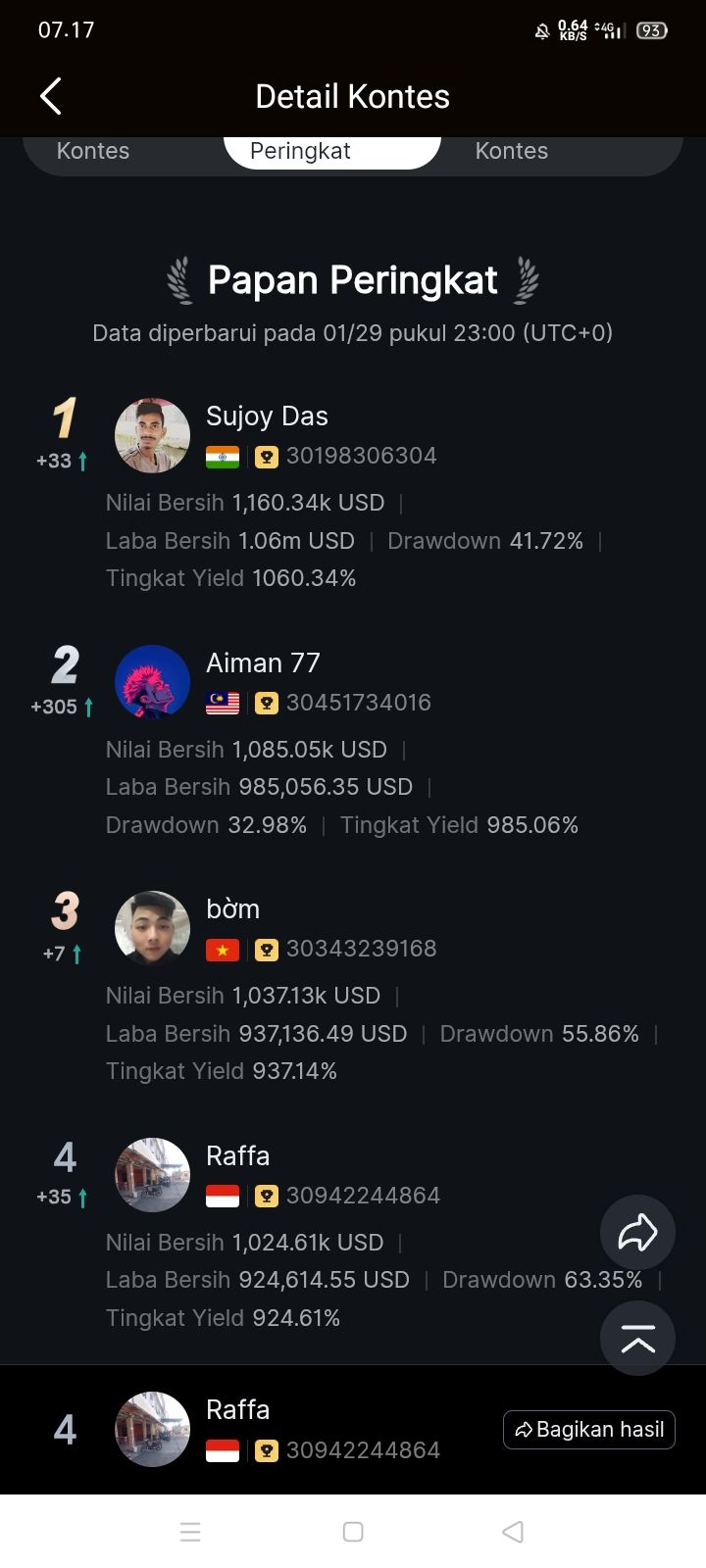

Signal Accounts for Members

All Signal Accounts

All Contests

China Central Bank Injects 477.5 Billion Yuan Via 7-Day Reverse Repos At 1.40% Versus Prior 1.40%

Spot Gold Fell Sharply, Dropping Nearly $50 In The Short Term To A Low Of $5,325.33 Per Ounce, Down 0.80% On The Day

Taiwan Overnight Interbank Rate Opens At 0.805 Percent (Versus 0.805 Percent At Previous Session Open)

Trump: 'Very Dangerous' For UK To Get Into Business With China, More Dangerous For Canada To Get Into Business With China

U.S. Exports (Nov)

U.S. Exports (Nov)A:--

F: --

P: --

Canada Imports (SA) (Nov)

Canada Imports (SA) (Nov)A:--

F: --

Canada Exports (SA) (Nov)

Canada Exports (SA) (Nov)A:--

F: --

U.S. Factory Orders MoM (Excl. Defense) (Nov)

U.S. Factory Orders MoM (Excl. Defense) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Nov)

U.S. Factory Orders MoM (Nov)A:--

F: --

U.S. Wholesale Sales MoM (SA) (Nov)

U.S. Wholesale Sales MoM (SA) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Transport) (Nov)

U.S. Factory Orders MoM (Excl. Transport) (Nov)A:--

F: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

South Korea Industrial Output MoM (SA) (Dec)

South Korea Industrial Output MoM (SA) (Dec)A:--

F: --

P: --

South Korea Services Output MoM (Dec)

South Korea Services Output MoM (Dec)A:--

F: --

P: --

South Korea Retail Sales MoM (Dec)

South Korea Retail Sales MoM (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Unemployment Rate (Dec)

Japan Unemployment Rate (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Jan)

Japan Tokyo CPI YoY (Jan)A:--

F: --

P: --

Japan Jobs to Applicants Ratio (Dec)

Japan Jobs to Applicants Ratio (Dec)A:--

F: --

P: --

Japan Tokyo CPI MoM (Jan)

Japan Tokyo CPI MoM (Jan)A:--

F: --

P: --

Japan Tokyo Core CPI YoY (Jan)

Japan Tokyo Core CPI YoY (Jan)A:--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)A:--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)A:--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)A:--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)A:--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)A:--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)A:--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)A:--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)--

F: --

P: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)--

F: --

P: --

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)--

F: --

P: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)--

F: --

P: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)--

F: --

P: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Saudi Arabia eyes a rare crude discount for Asia, signaling perceived oversupply despite US outages and Mideast tensions.

Saudi Arabia may be preparing to cut the official selling price of its flagship Arab Light crude for Asian customers for March delivery, according to trading sources. If implemented, the move would mark the first time since 2020 that Arab Light has traded at a discount to the key Middle Eastern benchmark.

For the past three months, Saudi Arabia has consistently lowered its official selling prices, though Arab Light has maintained a premium over the Oman-Dubai benchmark.

This potential cut could shift the price to a discount of between $0.20 and $0.55 per barrel below that benchmark. For comparison, February deliveries of Arab Light were priced at a $0.30 premium.

Saudi Arabia, which typically announces its pricing around the fifth of each month without public comment, acts as a trendsetter for other major Middle Eastern producers. Its decisions influence the pricing of approximately 9 million barrels per day of oil exported from the Arab Gulf region.

The expected price adjustment reflects a widespread view that the oil market is well-supplied, with supply potentially outpacing demand. However, recent events challenge this outlook.

Supply-Side Pressures

Recent production outages in the United States, estimated at up to 2 million barrels per day, have driven international benchmarks higher. This suggests the market may be tighter than previously thought.

Geopolitical Risks

Adding to market uncertainty are escalating supply risks in the Middle East. Tensions have risen after President Trump warned Iran that "time was running out" to agree on a nuclear deal. Trump stated the U.S. is moving a "massive Armada" to the region.

In response, Iran's Foreign Minister declared that the country's military was ready, "with their fingers on the trigger," to "immediately and powerfully respond" to any attack.

High-level diplomatic talks between the United States, Denmark, and Greenland are "back on track," according to Denmark's foreign minister, signaling a potential easing of tensions over the Arctic island's future.

Speaking in Brussels, Danish Foreign Minister Lars Lokke Rasmussen described a recent meeting in Washington as "very constructive." The talks were organized to address the diplomatic fallout from U.S. President Donald Trump's repeated interest in acquiring Greenland, a vast and sparsely populated autonomous Danish territory.

"The meeting went well," Rasmussen told reporters. "Very constructive atmosphere and tone and new meetings are planned."

Rasmussen noted that while the issues are far from resolved, the dialogue has returned to a more stable footing. "Things were escalating but now we are back on track," he said, adding, "I am slightly more optimistic today than a week ago."

This sentiment was echoed by U.S. Secretary of State Marco Rubio, who assured lawmakers that discussions about Greenland's future would proceed in a "very professional, straightforward way."

"We're in a good place right now," Rubio stated. "I think we have in place a process that is going to bring us to a good outcome for everybody. The president's interest in Greenland has been clear, it's a national security interest."

The Washington talks follow a period of escalating rhetoric from President Trump. At the World Economic Forum in Davos, Trump had recently stepped back from imposing tariffs on European nations that opposed his efforts. He also ruled out using force to take control of the territory for the first time.

Shortly after, Trump claimed on Truth Social to have a "framework of a future deal" concerning Greenland and later told CNBC he had "the concept" of one.

The U.S. president's interest is not new. In 2019, he stated his administration was interested in purchasing Greenland, framing it as essential for U.S. national security. This interest was reportedly renewed after a military operation on January 3 to capture Venezuelan President Nicolás Maduro.

The renewed American focus has caused significant alarm in both Greenland and Denmark. In response, the leaders of both have recently visited Germany and France to rally support from European allies.

"What we are dealing with as a government is trying to push back from outside and handle our people who are afraid and scared," Greenland's Prime Minister Jens-Frederik Nielsen said at an event in Paris.

The situation has prompted stark warnings from Danish leadership. Prime Minister Mette Frederiksen declared that "the world order as we know it is now over."

Public sentiment on the island remains clear. Opinion polls show that an overwhelming majority of Greenlanders oppose U.S. control, while most support full independence from Denmark.

German Chancellor Friedrich Merz is drawing a clear line against Donald Trump, signaling that Europe will not yield to intimidation while still aiming to preserve the transatlantic alliance. In a recent speech to the Bundestag, Merz directly addressed Trump's policies, defending European interests and outlining a path toward greater sovereignty.

The Chancellor criticized the U.S. leader for disparaging the role of NATO troops in Afghanistan, stating he would not allow Germany's mission—which cost around 60 lives—"to be disparaged and denigrated."

Merz highlighted the European Union's recent unified resistance to Trump's tariff threats over Greenland as proof of the bloc's "unity and determination." He delivered a pointed message that Europe is prepared to defend itself "if necessary."

This firm stance reflects a broader policy adjustment by Merz's conservative government and its Social Democrat partners. As the geopolitical landscape shifts, they are recalibrating Germany's approach to trade, defense, and economic competitiveness to navigate a world where traditional alliances are being tested.

The return of Donald Trump to the presidency has forced European governments to envision a future where they can no longer fully rely on their partnership with the United States.

Despite these "irritations," Merz reaffirmed his commitment to the NATO military alliance. He emphasized that the trust built within NATO over seven decades remains the strongest guarantee of peace and security for members on both sides of the Atlantic.

While upholding existing alliances, Merz is also marketing Germany and the EU as an alternative partner for nations looking to diversify their relationships beyond the U.S. and China.

"We should not underestimate how attractive this European model can be for new partners and new alliances," Merz argued. "We are, after all, a viable alternative to imperialism and autocracy on the world stage."

This strategic pivot is detailed in a new policy paper from Merz's coalition, which identifies a "paradigm shift" in global affairs. The document warns of a world where major powers act without regard for others and economic shocks are increasingly common.

"To survive in this new world order... Germany, and indeed Europe as a whole, must become stronger," the paper states.

The coalition outlined several reforms already underway to boost the nation's resilience and economic strength:

• Massive investment in infrastructure and the military

• Tax relief measures for businesses

• Reductions in energy costs

• Accelerated planning and approval processes

The paper concludes that while these steps are significant, international threats demand an even faster pace of reform to increase both resilience and sovereignty.

Concluding his address, Merz expressed confidence that Europe has yet to realize its full potential. He argued that the immense pressure from multiple global challenges could be the catalyst for unlocking that strength.

"In this European Union, and in our country, there is so much potential that we can make something good out of this difficult situation in the world," he told lawmakers. "Perhaps we even need that pressure."

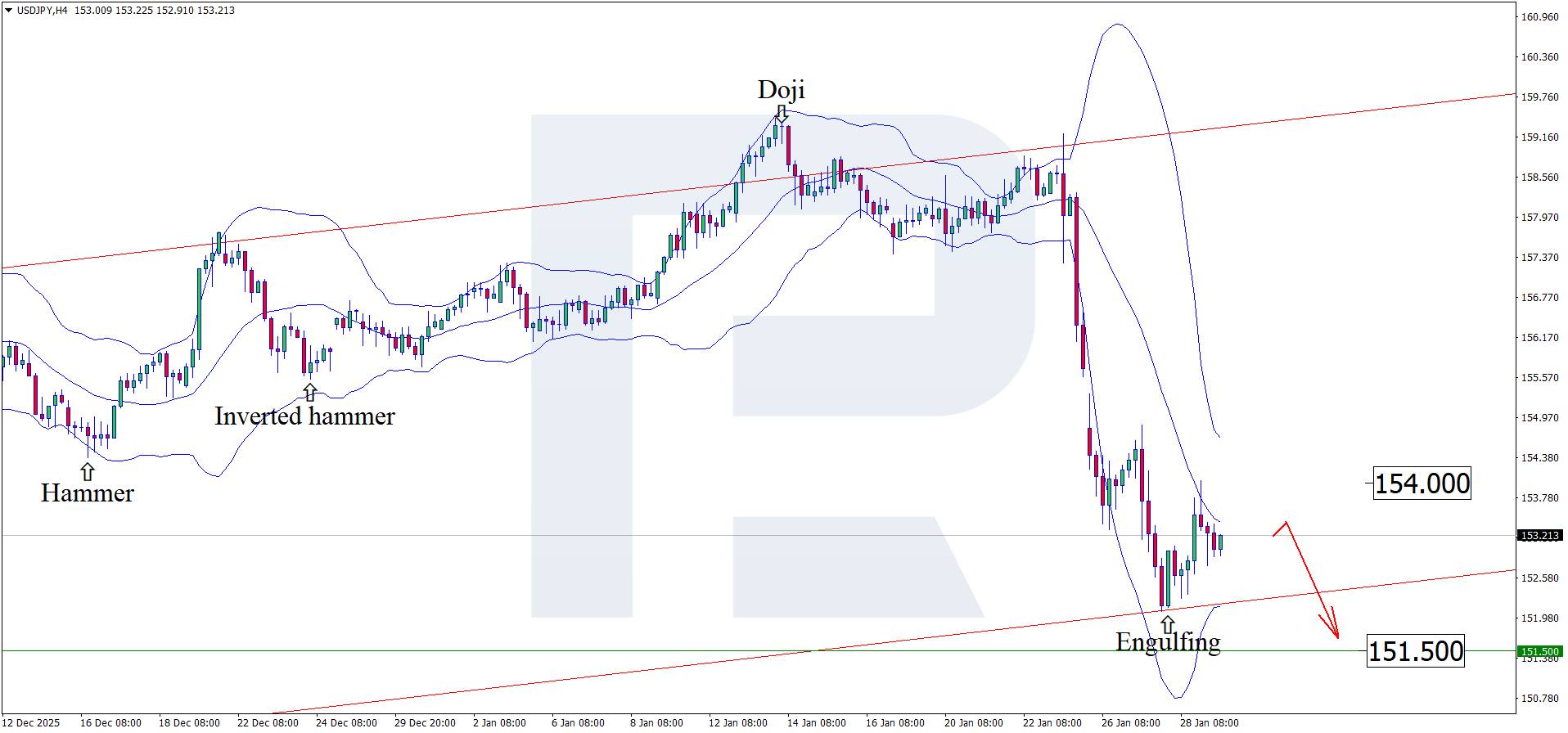

A combination of fundamental factors from the US and Japan continues to increase USDJPY volatility, with quotes testing the 152.90 level.

The forecast for 29 January 2026 appears optimistic for the JPY. After a sharp decline, the USDJPY pair is completing a corrective wave and may continue to fall. Currently, quotes are trading near the 152.90 level.

The US Federal Reserve's interest rate decision did not cause market turbulence, as the forecast was confirmed and the rate remained unchanged at 3.75%. For the USD, this became another trigger for weakening against major global currencies.

Yesterday, the Bank of Japan released its monetary policy meeting minutes.

Key takeaways from the minutes:

Overall, economic indicators are working in favour of the yen. However, the possibility of a currency intervention in the near term should not be ruled out, as such actions are usually carried out when market participants expect them the least.

On the H4 chart, the USDJPY pair has formed an Engulfing reversal pattern near the lower Bollinger Band and is currently trading around the 153.20 level. At this stage, the price may continue an upward wave following the pattern's signal, with the upside target at 154.00.

At the same time, the USDJPY forecast also considers an alternative scenario, with quotes falling to the 151.50 level without testing the resistance level.

Main scenario (Sell Stop)

A consolidation below the 152.45 level will create conditions for opening short positions. This scenario would open the way towards the target level of 151.00. The risk-to-reward ratio exceeds 1:3. Potential profit upon reaching the target is 145 pips, while possible losses are limited to 45 pips.

Alternative scenario (Buy Stop)

The bearish scenario will be cancelled if the price moves above the 154.00 resistance level and consolidates above it. This scenario would indicate a transition to a growth phase.

Risks to the bearish USDJPY scenario are associated with a possible recovery of the US dollar in case expectations of a more hawkish Fed policy strengthen. An additional factor could be a reduction in intervention rhetoric and a more cautious stance by the BoJ, which would weaken support for the Japanese yen.

The yen continues to strengthen against the USD following the release of the US interest rate decision. USDJPY technical analysis suggests a correction towards the 154.00 level before a further decline.

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair's movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold's recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Yesterday, financial markets were closely watching statements from central banks regarding interest rates, including the Federal Reserve and the Bank of Canada. According to Forex Factory:

→ The Federal Reserve kept the Federal Funds Rate at 3.75% by a majority vote. "The economy has once again surprised us with its strength," Powell said at the press conference. The Fed Chair also added that "our policy is in a good place".

→ The Bank of Canada left the Overnight Rate unchanged at 2.25%. In its official statement, significant attention was paid to the impact of uncertainty surrounding the trade agreement between Canada, the United States and Mexico (CUSMA).

Although there were no surprises and the central banks' decisions matched analysts' forecasts, the reaction of the USD/CAD pair was quite dynamic. After a spike in volatility, the exchange rate fell below the 2025 low. Moreover, on higher-timeframe charts, a bearish break of support is visible, with that support running through the lows of 2023–2025.

On 19 January, when analysing the USD/CAD chart, we:

→ highlighted important signs of bullish weakness on the chart;

→ suggested that bears might seize the initiative and attempt a break of the local ascending channel (shown in blue).

Indeed, a bearish breakout occurred, after which the price formed a trajectory resembling an accelerating plunge (approximately −2.7% over 10 days). At the same time, there are grounds to assess the market within the context of a long-term downtrend (shown in red).

In this context, we see that the price is near the lower boundary of the channel, which may act as support and slow the decline. However, even if bulls attempt to form a rebound, they are likely to face significant difficulties, because:

→ the price fell aggressively from the median to the lower boundary and broke the December low with virtually no local recoveries;

→ the area around the 1.3650 level appears to be a key resistance zone.

Thus, the USD/CAD exchange rate reflects the broader January trend, in which the US dollar is under considerable pressure due to geopolitical and other factors. Notably, even Powell's comment about the "strength of the economy" failed to support the dollar. This suggests that the market may currently be driven not by past successes of the US economy, but by concerns about future uncertainty.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up