Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)A:--

F: --

P: --

Brazil Retail Sales MoM (Nov)

Brazil Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Jan)

U.S. NY Fed Manufacturing Prices Received Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Jan)

U.S. NY Fed Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Jan)

U.S. NY Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. Export Price Index YoY (Nov)

U.S. Export Price Index YoY (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Jan)

U.S. NY Fed Manufacturing Index (Jan)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Export Price Index MoM (Nov)

U.S. Export Price Index MoM (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Nov)

Canada Manufacturing Unfilled Orders MoM (Nov)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Nov)

Canada Manufacturing New Orders MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Nov)

Canada Wholesale Inventory YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Nov)

Canada Manufacturing Inventory MoM (Nov)A:--

F: --

P: --

Canada Wholesale Sales YoY (Nov)

Canada Wholesale Sales YoY (Nov)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Nov)

Canada Wholesale Inventory MoM (Nov)A:--

F: --

P: --

U.S. Import Price Index YoY (Nov)

U.S. Import Price Index YoY (Nov)A:--

F: --

U.S. Import Price Index MoM (Nov)

U.S. Import Price Index MoM (Nov)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

Canada Wholesale Sales MoM (SA) (Nov)

Canada Wholesale Sales MoM (SA) (Nov)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)A:--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)A:--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)A:--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)A:--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)A:--

F: --

P: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)--

F: --

P: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)--

F: --

P: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)--

F: --

P: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Saudi Arabia is finalizing an agreement on a new military coalition with Somalia and Egypt, part of its bid to curtail the United Arab Emirates' regional influence.

The French government is drafting a new version of its 2026 budget after a contentious parliamentary debate collapsed, forcing officials to seek a way to pass the fiscal plan without a direct vote.

Budget Minister Amelie de Montchalin confirmed that the changes would effectively create a new text, which the government intends to enact using constitutional tools to circumvent the deadlocked legislature.

"We are putting new proposals on the table and the prime minister will ask political parties what they think and how to advance," she stated Friday on France 2 television. "We don't want nonsense, we want transparency for all French people."

The move comes after Prime Minister Sebastien Lecornu's office declared on Thursday that a successful budget vote in the National Assembly had become impossible. The office blamed obstruction from far-left and far-right parties in the hung parliament, where no single group commands a majority.

To pass a budget under these circumstances, the government has several options outside of a standard vote. These include invoking the controversial Article 49.3 of the constitution, which allows legislation to be passed without a vote, or using a separate decree system.

The choice of mechanism has created a new political dilemma. Prime Minister Lecornu had previously vowed not to use Article 49.3 to force the budget through, a significant concession aimed at placating opposition lawmakers who had ousted his two predecessors, Michel Barnier and Francois Bayrou.

However, the alternative path is now facing stiff resistance from a key political group. The Socialist Party, whose support is crucial for the government's survival, has come out strongly against the use of the untested decree route.

Socialist lawmaker Philippe Brun described the potential use of decrees in stark terms on France Info radio Tuesday. "It would be extremely grave," he warned. "It would be a kind of creeping coup d'état."

This opposition is notable because the government survived no-confidence votes last year after using Article 49.3 for the previous budget, largely because the Socialists abstained.

According to Montchalin, the new budget proposals will reflect negotiations held with political parties in recent weeks, including the Socialists. She outlined several key areas that will be addressed in the updated text:

• Local Government: New measures for local and regional authorities.

• Taxation: Adjustments and tweaks to the tax code.

• Youth Support: Plans to provide additional support for young people.

Vietnam has officially broken ground on its first semiconductor manufacturing plant in Hanoi, a landmark project designed to anchor the nation's ambitions as a high-tech economic power. The facility is being developed by Viettel, a military-run technology giant, and is positioned as a core piece of national infrastructure for chip research, design, testing, and production.

According to Viettel, while Vietnam participates in five of the six main stages of semiconductor production, it has historically lacked capability in the most complex and crucial step: fabrication. The new plant aims to close this gap, creating a complete, end-to-end semiconductor production process within the country's borders.

Once operational, the factory is expected to serve a wide range of industries, including aerospace, telecommunications, automotive manufacturing, and medical equipment. It will also support the development of internet-connected devices and automation technologies.

Viettel has set a clear timeline for the project's development. Lt. Gen. Tao Duc Thang, the company's chairman and CEO, stated that trial production is slated to begin by the end of 2027. The subsequent three-year period will be dedicated to perfecting the manufacturing process, optimizing efficiency, and ensuring the facility meets stringent global chip industry standards.

The plant is situated on a 27-hectare site, providing ample room for future expansion as Vietnam's semiconductor sector grows.

This project is a cornerstone of Vietnam's broader strategy to prioritize semiconductors and artificial intelligence. The government has been actively rolling out incentives—including tax breaks, visa perks, and housing benefits—to attract international experts and drive investment in these high-tech fields.

These efforts are directly linked to ambitious national goals. Vietnam is targeting at least 10% economic growth in 2026 and aims to achieve developed-country status by 2045. Investing in advanced technology is seen as the primary vehicle for reaching these targets.

Building a Complete Chip Ecosystem

The government's vision extends beyond a single factory. Last week, the country launched the National Center for Semiconductor Chip Prototyping Support to foster a complete ecosystem from design to commercialization.

Speaking at the groundbreaking ceremony, Prime Minister Pham Minh Chinh outlined specific goals for 2030:

• At least 100 chip design companies operating in Vietnam.

• One national chip manufacturing plant.

• Approximately 10 assembly, packaging, and testing facilities.

• Annual revenue from the chip industry reaching $25 billion.

Vietnam is working to elevate its manufacturing base, which is currently concentrated in low- and mid-skilled labor. The country, already one of Samsung's largest global production hubs, exported $132 billion in hardware products in 2024. The move into chip fabrication represents a strategic shift toward becoming an advanced technology production center. U.S. chip designer Marvell has noted that the global boom in AI demand presents a significant opportunity for Vietnam to achieve its tech ambitions.

Currently, Vietnam hosts over 170 foreign investment projects in the semiconductor sector with a combined capital of nearly $11.6 billion. These projects are primarily focused on chip design, packaging, and testing. Government data shows there are approximately 60 design companies, eight packaging and testing projects, and more than 20 firms supplying materials and equipment in the country today.

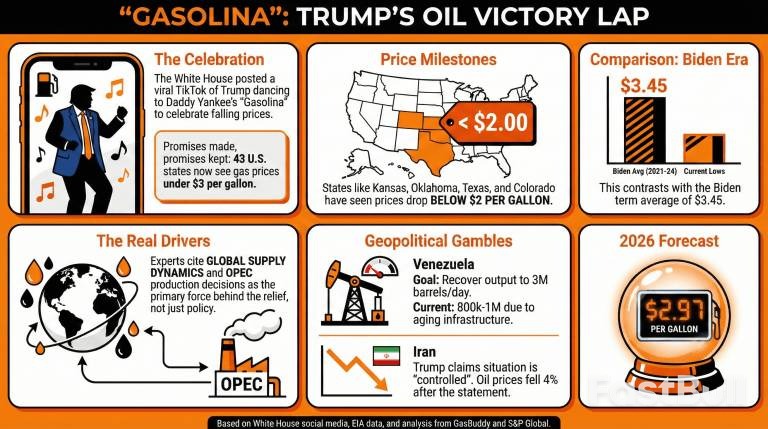

The Trump administration is celebrating a key economic goal: bringing down oil and gas prices for American consumers. To mark the occasion, the official White House TikTok account released a video of Donald Trump dancing to Daddy Yankee's 2004 hit "Gasolina."

Under the banner "promises made, promises kept," the video highlights that gasoline prices have now fallen below $3 per gallon in 43 U.S. states. The White House also claims that prices in some states—including Kansas, Oklahoma, Texas, and Colorado—have dropped to $2 or even lower.

This development stands in contrast to the average gas price during the Biden administration, which the U.S. Energy Information Administration (EIA) calculated at $3.45 per gallon from January 2021 to December 2024.

While the administration has made falling gas prices a priority, experts point to broader market dynamics as the primary cause.

Patrick De Haan, head of petroleum analysis at Gasbuddy, told CNN that "global supply dynamics—particularly OPEC's production decisions—have been the primary force behind the relief drivers are seeing at the pump."

A combination of high-level oil production in the United States and a steady supply from OPEC nations has been instrumental in keeping prices low. However, the Trump administration's foreign policy moves regarding Venezuela and Iran could also play a significant role in maintaining high production levels, potentially offsetting future OPEC cuts.

Two key international situations could further influence the global oil supply and, consequently, prices at the pump.

Venezuela's Uncertain Oil Recovery

The potential return of Venezuelan oil to the U.S. market is a point of debate among analysts. Some argue it would not make a significant difference, while others believe any new supply could have an outsized impact.

"Prices are set on the margin, and small imbalances in volume can lead to large shifts in prices," said Rick Joswick, Head of Near-Term Oil Analytics at S&P Global Energy.

However, this depends on Venezuela's ability to rapidly increase its oil output to over 3 million barrels per day. This is a formidable challenge, as current production is only between 800,000 and 1 million barrels per day, hampered by aging infrastructure and power shortages. Even with a proposed $100 billion investment from private companies, analysts believe it would take years for production to fully recover.

The Impact of Stability in Iran

Another critical factor is the stabilization of Iran. Washington is actively working to de-escalate tensions in the region. Despite prediction markets anticipating a U.S. strike on Iran, President Trump recently stated that the situation in Tehran was under control and the regime would not execute more protesters.

Following these remarks, Brent crude prices fell over 4%, demonstrating the market's sensitivity to potential disruptions in Iranian production. Jim Reid of Deutsche Bank noted that Iran, which produces over 4% of the world's oil and has a well-maintained infrastructure, is a major market mover. He assessed that a conflict there would have "the potential for wider spillovers in the oil market."

Even without major changes in Venezuela or Iran, the downward trend in gas prices is expected to continue. De Haan forecasts that the average price per gallon will reach $2.97 in 2026.

He attributes this outlook to several factors, including "the unwinding of post-pandemic market distortions, expanding global refining capacity, and more stable supply chains." With these key elements working in its favor, the Trump administration may have more positive news on gas prices to share in the coming year.

Canada and China have brokered a significant agreement to de-escalate their trade dispute, with Beijing set to slash tariffs on Canadian rapeseed and Ottawa lowering barriers for Chinese electric vehicles. The move signals a major thaw in relations after a period of high tariffs disrupted agricultural trade flows.

The deal was announced by Canadian Prime Minister Mark Carney during a visit to China, following months of negotiations aimed at mending economic ties.

The core of the agreement involves reciprocal tariff reductions on key goods:

• China's Concessions: Beijing will lower its tariffs on Canadian rapeseed products to 15% by March 1. It will also suspend duties on other agricultural imports, including canola meal and lobsters.

• Canada's Concessions: Ottawa will permit 49,000 Chinese electric vehicles to enter its market at a tariff rate of approximately 6%, a dramatic reduction from the current 100% rate.

Tensions flared in 2024 when Canada imposed tariffs on Chinese EVs, steel, and aluminum. Beijing swiftly retaliated early last year, imposing 100% duties on Canadian rapeseed oil and meal.

Following this, Beijing launched an anti-dumping investigation into Canadian rapeseed, known as canola, which resulted in initial duties of nearly 76% on the oilseed. A final decision on these levies has been extended until March 9.

The punitive duties effectively closed the Chinese market to Canadian canola products, halting a trade relationship valued at C$4.9 billion ($3.5 billion) in 2024.

This new agreement to suspend tariffs is poised to reopen this crucial market, offering much-needed relief to Canadian growers and exporters who have been struggling with ample supplies and few alternative destinations for their products.

Prime Minister Carney has been actively working to rebuild Canada's relationship with Beijing. This effort is part of a broader strategy to diversify trade and reduce the country's economic reliance on the United States, particularly after the Trump administration imposed its own sweeping tariffs.

Carney has indicated opportunities to expand agriculture and energy trade with China. However, it remains uncertain if Ottawa is prepared to fully ease tariffs on Chinese EVs—a key demand from Beijing but a sensitive issue for Canada's domestic auto and steel industries.

Russia’s critical oil and gas revenues fell to a five-year low in 2025, a significant blow to the nation's finances as it continues to fund its war in Ukraine. The state budget collected 8.48 trillion rubles ($108 billion) from energy taxes last year, a 24% decline from 2024 and the lowest annual intake since the beginning of the decade, according to Finance Ministry data.

This revenue shortfall creates a major challenge for the Kremlin. As one of the world's top oil and gas producers, Russia depends heavily on these taxes to fund state operations. The decline was driven by a mix of lower global oil prices, a stronger ruble, and energy sanctions. With military spending rising well beyond initial plans, the government is now under increased fiscal pressure.

To cover the budget gap, Moscow has drawn down more than half of its National Wellbeing Fund—an emergency reserve—and has resorted to expensive borrowing that will weigh on the economy for years.

Oil revenues, the larger component of the energy income, dropped by over 22% year-on-year to 7.13 trillion rubles, the lowest level recorded since 2023. This was the result of two primary factors: falling crude prices and a less favorable exchange rate.

Weaker Prices and Sanction-Driven Discounts

Concerns over a global crude oversupply and specific Western sanctions targeting Russian barrels weakened the flow of cash to state coffers. The average price of Urals, Russia’s main export blend, was calculated at $57.65 a barrel for tax purposes in 2025, marking a 15% decrease from the previous year.

The discount for Urals crude compared to the Brent international benchmark widened significantly after November, when the US sanctioned major producers Rosneft PJSC and Lukoil PJSC. This discount reached approximately $27 a barrel at the point of export, as buyers demanded steeper price cuts to continue purchasing Russian oil.

The Strong Ruble Problem

A stronger domestic currency also eroded the value of Russia's oil sales. The ruble traded at an average of 85.67 per U.S. dollar in 2025, about 6.4% stronger than in 2024. This combination of lower Urals prices and a stronger ruble meant that for every barrel produced and sold, the Russian budget received fewer rubles.

Russia’s tax revenues from the natural gas industry experienced an even sharper decline, falling over 30% to 1.35 trillion rubles. This represents the lowest level since the pandemic year of 2020.

The primary cause was the near-total loss of the European market, which Russia once dominated. Since the start of the war in Ukraine, Russia has systematically lost its most valuable clients in the region.

The situation worsened in January 2025 when the gas transit agreement through Ukraine expired, cutting off a key export route to Europe and leaving state-owned Gazprom PJSC with fewer options. While Russia has increased its natural gas exports to China, these sales are not yet large enough to fully compensate for the lost European business.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up