Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Russia's liquefied natural gas (LNG) exports fell by 3% in the first five months of 2025, with shipments to Europe plunging by 12%, reflecting mounting Western sanctions. The EU's ban on LNG transshipment and the U.S. sanctions targeting Arctic LNG 2 have disrupted Russian energy strategies...

WADonald Trump's administration asked the U.S. Supreme Court on Friday to permit it to proceed with dismantling the Department of Education, a move that would leave school policy in the United States almost entirely in the hands of states and local boards.

The Justice Department asked the court to halt Boston-based U.S. District Judge Myong Joun's May 22 ruling that ordered the administration reinstate employees terminated in a mass layoff and end further actions to shutter the department.

The department, created by a U.S. law passed by Congress in 1979, oversees about 100,000 public and 34,000 private schools in the United States, though more than 85% of public school funding comes from state and local governments.

It provides federal grants for needy schools and programs, including money to pay teachers of children with special needs, fund arts programs and replace outdated infrastructure. It also oversees the $1.6 trillion in student loans held by tens of millions of Americans who cannot afford to pay for college outright.

Trump's move to dismantle the department is part of the Republican president's campaign to downsize and reshape the federal government. Closing the department long has been a goal of many U.S. conservatives.

Attorneys general from 20 states and the District of Columbia, as well as school districts and unions representing teachers, sued to block the Trump administration's efforts to gut the department. The states argued that the massive job cuts will render the agency unable to perform core functions authorized by statute, including in the civil rights arena, effectively usurping Congress's authority in violation of the U.S. Constitution.

Trump on March 20 signed an executive order intended to effectively shut down the department, making good on a longstanding campaign promise to conservatives to move education policy almost completely to states and local boards. At a White House ceremony surrounded by children and educators, Trump called the order a first step "to eliminate" the department.

Secretary of Education Linda McMahon announced plans on March 11 to carry out a mass termination of employees. Those layoffs would leave the department with 2,183 workers, down from 4,133 when Trump took office in January. The department said in a press release those terminations were part of its "final mission."

Trump on March 21 announced plans to transfer the department's student loan portfolio to the Small Business Administration and its special education, nutrition and related services to the U.S. Department of Health and Human Services, which also is facing deep job cuts.

Joun in his ruling ordered the administration to reinstate the laid off workers and halt implementation of Trump's directive to transfer student loans and special needs programs to other federal agencies.

The judge rejected the argument put forth by Justice Department lawyers that the mass terminations were aimed at making the department more efficient while fulfilling its mission. In fact, Joun ruled, the job cuts were an effort to shut down the department without the necessary approval of Congress.

"This court cannot be asked to cover its eyes while the department's employees are continuously fired and units are transferred out until the department becomes a shell of itself," the judge wrote.

White House spokesperson Harrison Fields called the judge's ruling "misguided."

The Boston-based 1st U.S. Circuit Court of Appeals on June 4 rejected the Trump administration's request to pause the injunction issued by Joun.

Bond yields were up some 5 basis points globally whilst the euro made a slight reversal after having pushed for a near high of 1.15 as the ECB concluded its press conference. From a ‘low’ inspired by 50% tariffs on US steel and aluminium imports going ‘live’ earlier this week and growing concerns about the US economy and the labor market, sentiment in financial markets briefly swung back to a ‘high’ as President Donald Trump said he had a “very good phone call” with Chinese President Xi Jinping. Gains in equity markets were modest but still good enough for S&P500 to extend its rally to 20% from its 8 April low. That is, before the falling-out between Trump and Musk reached a boiling point on social media. Enough is being written about that right now, so we’ll leave you at it.

After the call with Xi, Trump said that both leaders have agreed to further talks and that there “should no longer be any questions respectively the complexity of Rare Earth products”. That’s up for various interpretations, but it suggests China has offered to speed up its process of lifting its export restrictions. Still, the Chinese readout of the call, unsurprisingly, was more nuanced and said that Xi had urged Trump to remove “negative” measures that have affected trade between the countries in recent months. The upshot, from the market’s perspective is that both sides are, at least, talking and that holds the prospect of further progress in removing some (still very high) tariffs. But, just for balance, Commerce Secretary Lutnick yesterday called for increased enforcement of US export controls on technology, warning that China was “only attacking great American companies.” If President Xi was referring to those export controls with “negative measures”, the market’s positive assessment may be, well, too high.

That further talks with the US can lead to a ‘deal’ (as Keir Starmer can confirm), a stalemate (see EU-US) or a major escalation, as Zelensky can attest, is on any global leader’s mind. Nikkei Asia reports that US negotiators Bessent, Lutnick and Greer keep Japan guessing. “At one point the three cabinet officials put the talks with the Japanese side on hold an began debating right in front of them”, a source tells the Nikkei. In that sense, German Chancellor Merz came away nicely after a 40-minute meeting in the Oval Office, as he let Trump do most of the talking. Little concrete came from that meeting, though Trump acknowledged the ramp-up in German defense spending.

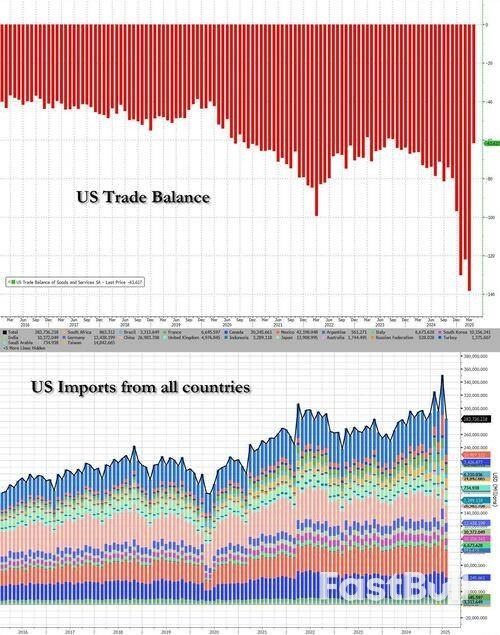

Trade data are going from lows to highs as well, which in some cases makes the Covid-episode data look pale. As the Commerce Department confirmed, the US trade deficit for April shrunk by the most on record, to $61.6bn from $138.3bn in March, driven by the largest-ever decline in imports.

Frontloading in the run-up the tariffs clearly was massive and then collapsed. This also suggests that after its big negative contribution to US GDP growth in Q1 it will be a significant positive factor in Q2. Inventory effects will likely attenuate some of its effect. Bloomberg noted that a drop in imports of pharmaceuticals from Ireland was responsible for an almost $20bn swing in the deficit. The opposite (statistical) effect is thus going to be seen in Europe in Q2. Ireland yesterday reported a significant upward revision in Q1 GDP (which now points to a revision in Eurozone GDP growth to around +0.6% q/q (!) from 0.3% previously). But this will obviously turn to a significant drag in Q2 as those US trade numbers for April just signaled.

Staying in Europe, the ECB seemingly presented itself as an anchor of stability in these times of highs and lows. Lagarde’s new mantra is now “well positioned”, which could be viewed in our opinion as code language for “we’re done cutting, unless…”. This becomes even clearer when you compare it to the previous mantra Lagarde introduced in March when she called ECB policy “meaningfully less restrictive”. We had expected little to no guidance from yesterday’s policy meeting, but these new words – despite lower oil prices and a stronger euro – lead us to maintain our view that we have reached the terminal rate.

However, the ECB leaves ample room to respond if things do not work out the way they envisage. Indeed, it lowered its inflation forecast significantly with core inflation positioned around 2% for the coming years. Moreover, its new scenario analyses unveiled a dovish reaction function to a potential escalation of trade tensions. Should this happen, and paused tariffs were to be reinstated, the ECB’s economists estimate that this could lower GDP growth through 2027 by about 1% cumulatively. And, interestingly, they conclude that inflation would be somewhat lower as well: in such a scenario inflation would average 1.8% in 2027, and that includes the assumption that the EU retaliates. By contrast, our own econometric analysis indicates that European tariffs on the US would be (mildly) inflationary instead.

Lagarde did say that their modelling exercise assumed that higher tariffs could lead to lower demand for euro area exports and to countries with overcapacity rerouting their exports to the euro area thereby putting more downward pressure on inflation. However, she acknowledged that the ECB’s analysis did not include any inflationary impact from a disruption of supply chains. Although this effect, admittedly, is surrounded by even more uncertainty, we did take this into account in our own scenario analysis (which explains why we still have inflation somewhat above the ECB’s target even in 2026). And one only need to take a quick glance at container freight rates (benchmark composite by WCI up by a staggering 175% compared to last month) to understand why be believe the ECB the ECB could be under-estimating the potential highs.

Time will tell, of course. But one thing that the ECB may be right about, is the (initial) downward pressure on imported goods prices due to a diversion of trade. The European Commission yesterday published its first assessment from its trade diversion monitoring tool that was launched in April. The early warning system tracks shipments and prices of goods at a high level of detail. In the short-run lower prices may benefit European importers and thereby consumers, but if those prices are the result of overcapacity in other parts of the world (such as China) this could also undermine European producers. The South China Morning Post reported that “in the month to May 25, imports of light-emitting diodes surged 156 per cent, while their price fell 65 per cent. Shipments of industrial robots shot up by 315 per cent, paired with a 35 per cent price decline. And imports of some bars and rods made from steel alloy soared by over 1,000 per cent as their price plunged 86 per cent.”

Whilst such figures can be extremely volatile due to their level of detail, seasonal patterns etc. and make no distinction between the origin of the content, a heatmap by the Commission shows that China was a significant contributor to these changes. The FT writes that the surge in steel imports, driven by trade diversion, is setting off alarm bells in the steel sector. Forecasting the next steps by the European Commission is a rather speculative affair, but we’d not be surprised if this leads to some form of action. This year the Commission has already launched more than 10 cases against China and/or Chinese producers (based on our count of news articles on the EU’s trade defense website).

China has granted temporary export licenses to rare-earth suppliers of the top three U.S. automakers, two sources familiar with the matter said, as supply chain disruptions begin to surface from Beijing's export curbs on those materials.

At least some of the licenses are valid for six months, the two sources said, declining to be named because the information is not public. It was not immediately clear what quantity or items are covered by the approval or whether the move signals China is preparing to ease the rare-earths licensing process, which industry groups say is cumbersome and has created a supply bottleneck.

China's decision in April to restrict exports of a wide range of rare earths and related magnets has tripped up the supply chains central to automakers, aerospace manufacturers, semiconductor companies and military contractors around the world.

China's dominance of the critical mineral industry, key to the green energy transition, is increasingly viewed as a key point of leverage for Beijing in its trade war with U.S. President Donald Trump. China produces around 90% of the world's rare earths, and auto industry representatives have warned of increasing threats to production due to their dependency on it for those parts.

Suppliers of three big U.S. automakers, General Motors,, Ford and Jeep-maker Stellantis got clearance for some rare earth export licenses on Monday, one of the two sources said.

GM and Ford each declined to comment. Stellantis said it is working with suppliers "to ensure an efficient licensing process" and that so far the company has been able to "address immediate production concerns without major disruptions."

China's Ministry of Commerce did not immediately respond to a faxed request for comment.

China's critical-mineral export controls have become a focus on Trump's criticism of Beijing, which he says has violated the truce reached last month to roll back tariffs and trade restrictions.

On Thursday, Trump and Chinese President Xi Jinping had a lengthy phone call to iron out trade differences. Trump said in social-media post that "there should no longer be any questions respecting the complexity of Rare Earth products." Both sides said teams will meet again soon.

U.S. auto companies are already feeling the impact of the restrictions. Ford shut down production of its Explorer SUV at its Chicago plant for a week in May because of a rare-earth shortage, the company said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up