Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)A:--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)A:--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

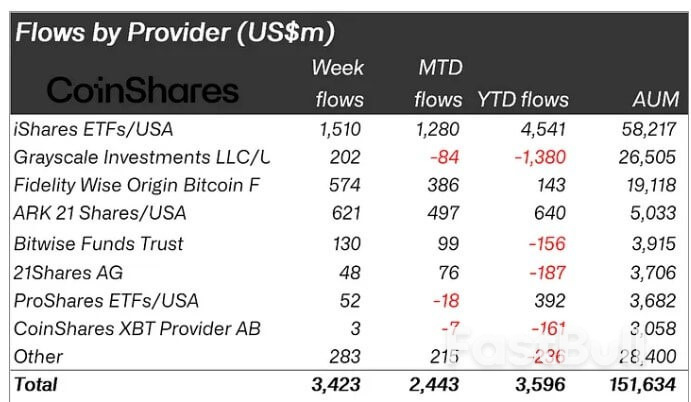

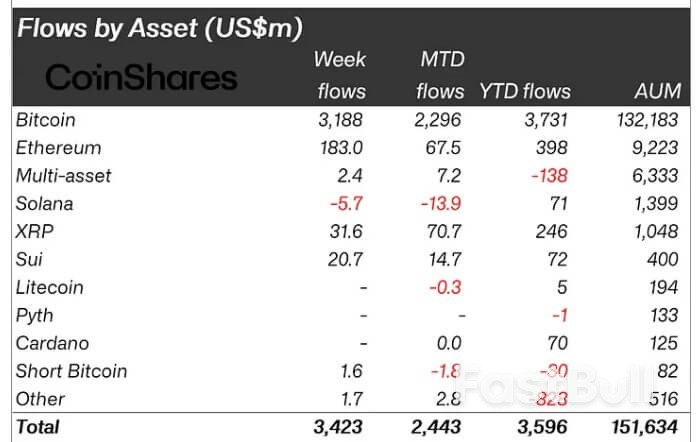

Bitcoin funds saw record $3.2 billion inflows last week, signaling rising demand for crypto as a safe haven amid dollar weakness and economic fears, while Ethereum and other altcoins also attracted investments.

Wall Street stocks showed little conviction on Monday and gold eased as market participants watched for signs of progress in tariff negotiations at the top of an eventful week of corporate earnings and economic data.

Weakness in the tech sectorheld the Nasdaq back, but gold lost ground and benchmark U.S. Treasury yields oscillated.

"The news has evened out," Thomas Martin, Senior Portfolio Manager at GLOBALT in Atlanta. "There's not really any news today that’s market-moving."

U.S. Treasury Secretary Scott Bessent on Monday said many of the top U.S. trading partners have made "very good" tariff proposals, adding that China's recent moves to exempt certain U.S. goods from its retaliatory tariffs showed a willingness to de-escalate trade tensions between the world's two largest economies.

"We just keep on trying to dial into what the trade negotiations are going to be like," Martin added. "And it's this combination of public statements versus what's really going on behind the scenes."

Despite hopes for progress, economists polled by Reuters say the risk of global recession is high as a result of Trump's tariffs; the same group of economists expected the world economy to grow at a healthy clip a mere three months ago.

First quarter earnings season heats up this week, with Meta Platforms, Microsoft, Appleand Amazon.comamong the high-profile results on the docket.

While Monday was quiet with respect to U.S. economic data, the week is back-end loaded with closely watched indicators such as Personal Consumption Expenditures (PCE), the Institute for Supply Management's purchasing managers' index (PMI), an advance take on U.S. GDP and the April employment report.

The Dow Jones Industrial Averagerose 146.72 points, or 0.40%, to 40,275.27, the S&P 500rose 6.25 points, or 0.11%, to 5,531.38 and the Nasdaq Compositefell 15.79 points, or 0.09%, to 17,367.15.

European shares gained ground on trade negotiation optimism.

MSCI's gauge of stocks across the globeEURONEXT:IACWIrose 3.46 points, or 0.42%, to 828.20.

The pan-European STOXX 600index rose 0.74%, while Europe's broad FTSEurofirst 300 indexrose 14.58 points, or 0.71%.

Emerging market stocksCBOE:EFSrose 6.24 points, or 0.57%, to 1,103.34. MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) closed higher by 0.58%, to 573.95, while Japan's Nikkeirose 134.25 points, or 0.38%, to 35,839.99.

The yield on benchmark U.S. 10-year notesfell 2.1 basis points to 4.245%, from 4.266% late on Friday. The 30-year bond (US30YT=RR) yield fell 2.8 basis points to 4.7099% from 4.738% late on Friday.

The 2-year note (US2YT=RR) yield, which typically moves in step with interest rate expectations for the Federal Reserve, fell 2.6 basis points to 3.736%, from 3.762% late on Friday.

The dollar edged lower as investors awaited further trade talks progress and girded themselves for an eventful week.

The dollar index, which measures the greenback against a basket of currencies including the yen and the euro, fell 0.59% to 99.16, with the euroup 0.33% at $1.1398.

Against the Japanese yen, the dollar weakened 0.68% to 142.69.

Sterlingstrengthened 0.76% to $1.3415. The Mexican pesoweakened 0.09% versus the dollar at 19.555.

The Canadian dollarstrengthened 0.21% versus the greenback to C$1.38 per dollar. Canadians are going to the polls on Monday after an election campaign in which U.S. President Donald Trump's tariffs and musings about annexing Canada became the central issue.

Crude oil softened as investors weighed a potential supply increase from OPEC+ amid ongoing trade uncertainties.

U.S. crudefell 0.94% to $62.43 a barrel and Brentfell to $66.17 per barrel, down 1.05% on the day.

Gold prices advanced in opposition to the easing greenback.

Spot goldrose 0.27% to $3,327.19 an ounce. U.S. gold futures (GCc1) rose 0.06% to $3,284.50 an ounce.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up