Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

South Korea's former president Yoon Suk Yeol allegedly sought to prompt a military confrontation with North Korea to create grounds for declaring martial law a year ago, but the plan collapsed when Pyongyang failed to respond, a special counsel said.

South Korea's former president Yoon Suk Yeol allegedly sought to prompt a military confrontation with North Korea to create grounds for declaring martial law a year ago, but the plan collapsed when Pyongyang failed to respond, a special counsel said.

"They attempted to create a pretext for declaring martial law by carrying out abnormal military operations designed to provoke a North Korean armed response, but the effort failed because North Korea did not react militarily," Special Counsel Cho Euk-suk told reporters on Monday, wrapping up a six-month investigation into the botched martial law attempt.

The probe team believes Yoon and his officials sent drones into North Korea in October 2024 in an attempt to trigger a military response from the North. The North Korean military put its border units on full alert after reports of the drones flying above its capital, though at that time South Korea denied it had flown unmanned aircraft over the heavily fortified border.

The special prosecutor said Yoon, who was impeached over his martial law attempt, sought to monopolize power by seizing legislative and judicial authority through mobilizing the military.

Yoon, now jailed and facing an insurrection trial, has denied wrongdoing and defended his move as a desperate bid to counter what he claimed were North Korea sympathizers trying to paralyze his administration. Yoon's fall paved the way for the election of Lee Jae Myung as the new president in June. Lee's administration has sought to improve ties with North Korea in a departure from Yoon's hard-line approach.

In total, 24 people — including the former president, sitting lawmakers and past cabinet members — have been indicted over their alleged involvement in the former leader's political gamble, the special prosecutor said.

Britain will start regulating cryptoassets from October 2027, the finance ministry said on Monday, rules it hopes will give the industry certainty while keeping out "dodgy actors".

The new law - the government will introduce legislation into parliament later on Monday - will extend existing financial regulation to companies involved in crypto, aligning Britain with the U.S. rather than the European Union, which has built rules tailored to the industry.

A draft bill giving effect to regulation has undergone only minor changes since it was published earlier this year, a ministry spokesperson said.

Globally, interest in cryptoassets has surged since U.S. President Donald Trump came to power promising to embrace the industry, although the price of the largest cryptocurrency, bitcoin , has fallen sharply in recent months after hitting a record high.

The U.S. is pursuing what is perceived by the industry to be a more crypto-friendly approach than Britain, while the European Union's Markets in Cryptoassets rules took effect in 2024.

Britain has said it would collaborate with the U.S. on the best approach to digital assets through a "transatlantic taskforce".

Finance minister Rachel Reeves said the rules would provide "clear rules of the road", strengthen consumer protections and keep "dodgy actors" out of the market.

Natalie Lewis, a partner at Travers Smith, told Reuters she hoped the changes in the final legislation would be "more than minor" as there were "quite a few technical legal problems with the original draft".

Britain's regulatory regime for cryptocurrencies is taking shape, with the Financial Conduct Authority planning bespoke rules for trading and market abuse, custody and issuance, and the Bank of England last month unveiling its proposals for regulating stablecoins - a type of cryptocurrency - that are used for everyday payments.

At the same time, regulators continue to warn about the risks, including that investors in cryptocurrencies should be prepared to lose all of their money.

Both the BoE and the FCA have promised to finalise their rules by end-2026.

Daniel Slutzkin, head of UK at crypto exchange Gemini, said firms had "long awaited regulatory clarity" and could now start preparing to meet the new requirements.

Confidence among Japan's large manufacturers rose to the highest level in four years, reinforcing market expectations for the Bank of Japan to raise interest rates this week.

The business sentiment index advanced to 15 this month from 14 in September, the BOJ's quarterly Tankan business survey showed Monday. The result matched the median economist forecast in a Bloomberg poll.

The gauge for large non-manufacturers held at 34, remaining near the strongest level since the early 1990s. A positive reading means more firms view conditions as "favorable" than "unfavorable."

The Tankan, one of the most closely scrutinized data sets released by the BOJ, suggests Japan's businesses have so far avoided significant fallout from US tariffs — a source of uncertainty the central bank has highlighted for months. The results strengthen the case for Governor Kazuo Ueda's board to raise rates on Friday, which would mark the first increase since January.

The data showed confidence improved among oil and coal product makers, offering the BOJ an early read on how firms are responding to lower US tariffs after reductions took effect in mid-September. Roughly 70% of companies had submitted responses to the previous survey days before that change.

A still-weak yen continues to aid exporters while increasing running costs for service sector firms, which employ most of Japan's workforce. Companies expected the yen at 147.06 against the dollar for this fiscal year in Friday's data, weaker than the 145.68 they predicted in Septermber.

Ueda repeatedly cited uncertainty over US tariffs and the initial momentum of wage negotiations as factors that would be critical for authorities considering the next rate hike.

While uncertainties around US levies have somewhat receded, Japan's ties with China have deteriorated after Prime Minister Sanae Takaichi's remarks on Taiwan last month. That's raised concerns over potentially new economic spillovers including a sharp drop in the number of Chinese tourists.

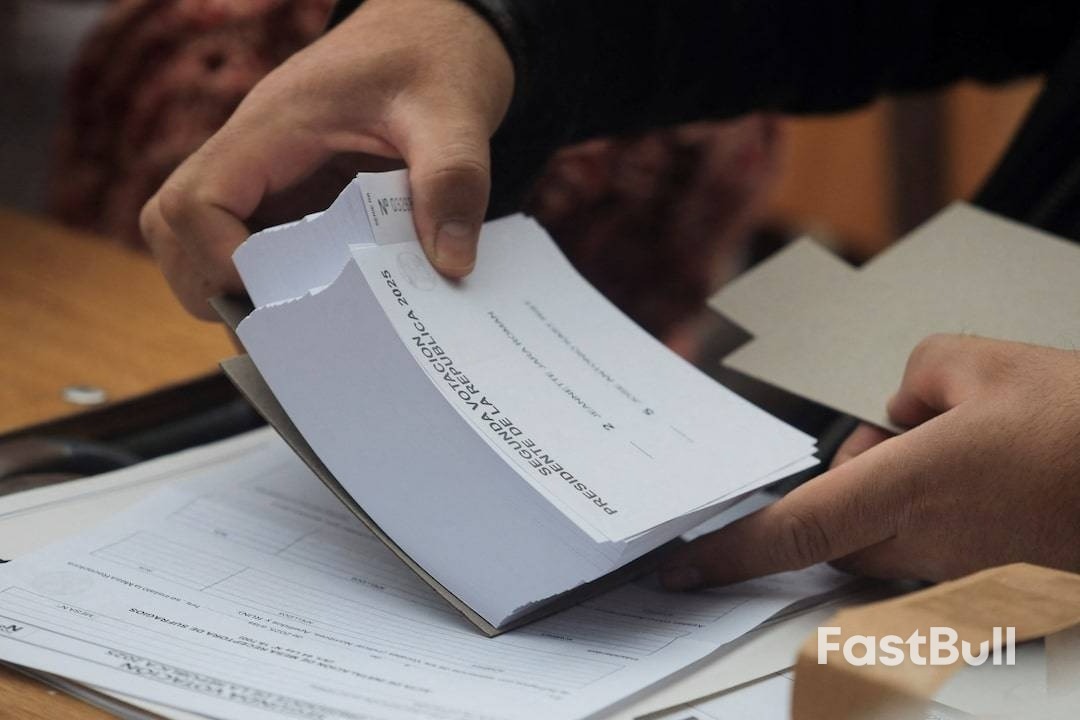

Jose Antonio Kast won Chile's presidential election on Sunday, leveraging voter fears over rising crime and migration to steer the country in its sharpest rightward shift since the end of the military dictatorship in 1990.

Kast secured a commanding 58% of the vote in a runoff with leftist candidate Jeannette Jara, who won 42% and swiftly conceded.

Throughout his decades-long political career, Kast has been a consistent right-wing hardliner. He has proposed building border walls, deploying the military to high-crime areas, and deporting all migrants in the country illegally.

His victory marks the latest win for the resurgent right in Latin America. He joins Ecuador's Daniel Noboa, El Salvador's Nayib Bukele, and Argentina's Javier Milei. In October, the election of centrist Rodrigo Paz ended almost two decades of socialist rule in Bolivia.

The campaign was Kast's third run at the presidency and second runoff, after losing to leftist President Gabriel Boric in 2021. Once seen by many Chileans as too extreme, he has attracted voters increasingly worried about crime and immigration.

His definitive win, even in parts of Chile that traditionally vote for leftist candidates, was also likely driven by voter rejection of Jara, who as a member of the Communist Party was seen by many as too extreme, said Claudia Heiss, a political scientist at the University of Chile.

Kast supporters arrived at the president-elect's campaign headquarters in Santiago on Sunday evening, waving Chile flags. Some wore red caps emblazoned "Make Chile Great Again."

Ignacio Segovia, a 23-year-old engineering student, was among them.

"I grew up in a peaceful Chile where you could go out in the street, you had no worry, you went out and you never had problems or fear," he said. "Now you can't go out peacefully."

While Chile remains one of the safest countries in Latin America, violent crime has spiked in recent years as organized crime groups have taken root, capitalizing on the country's porous northern desert borders with coca-producing neighbors Peru and Bolivia, major international marine ports, and surge of migrants susceptible to human and sex trafficking.

The vast majority of migrants in Chile illegally have arrived from Venezuela in recent years, government data shows.

Kast's proposals include creating a police force inspired by U.S. Immigration and Customs Enforcement to rapidly detain and expel migrants in the country illegally.

He has also touted massive cuts in public spending.

Chile is the world's largest copper producer and a major producer of lithium, and expectations of less regulation and market-friendly policies have already buoyed the local stock market, peso and equity benchmark.

However, Kast's more radical proposals are likely to face pushback from a divided Congress. While right-wing parties won seats in both legislative houses in a November general election, most of those gains came from more traditional parties. The Senate is evenly split between left and right-wing parties, while the swing vote in the lower legislative body belongs to the populist People's Party.

He will have to satisfy a wide electoral base, said Guillermo Holzmann, a political analyst and professor at the University of Valparaiso.

"It is clear that not everyone who voted for Kast is from his party. That is, much of his vote is borrowed," he said.

That fact may stay Kast's hand on policies like abortion. He has previously been outspoken against abortion and the morning-after pill, but rarely spoke about it during the recent campaign. Changing the country's abortion laws would require the support of more than half of the Congress - and polls suggest most Chileans support existing rights.

A more dovish rate cut than anticipated by the U.S. Federal Reserve has created an interesting setup for fixed income markets next year. The focus on its independence adds another dimension.

As expected, the Federal Reserve cut interest rates last week for the third consecutive time this year, lowering the policy rate by a quarter point to the 3.5 – 3.75% range, the lowest level in three years.

Mounting concerns over a weakening U.S. labor market, outweighing sticky inflation, persuaded the Fed to cut again, with risk markets overall reading a more dovish tone than expected from the meeting, broadly supporting equity indices and helping push front-end Treasury yields lower.

Importantly, Fed Chair Jerome Powell suggested the Fed had now done enough to bolster the threat to employment while leaving rates high enough to continue weighing on price pressures, a framing that could otherwise be read as the Fed is comfortable pausing at this level and waiting to see how the economy performs.

While the majority of the 12 voting Federal Open Market Committee (FOMC) members voted for the cut, three dissented Fed governor Stephen Miran, who called for a half-point reduction, and Chicago Fed's Austan Goolsbee and Kansas City Fed's Jeffrey Schmid, who both backed a hold.

Dissent was expected, and even though the numbers were lower than some estimates, it still marked the biggest dispersion among FOMC members since 2019.

So long as there is tension between the balance of risks across the Fed's dual mandate, we expect the divergence in opinion among members on future policy direction will continue.

Interestingly, the FOMC created some optionality on future decisions, stating that in "considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks."

That assessment will come into play this week as a series of important delayed macro data is released—including the October and November payrolls and unemployment rate for November—potentially giving some indication as to which way the Fed may lean going into next year.

Chair Powell posited that the current level of short-term rates is now "within a broad range of estimates of its neutral value" and argued that any further rate cuts from here would need to come from a combination of materially weaker labor market with a higher unemployment rate.

Whether, and to what extent, we see that, our current baseline expectation is that the FOMC does deliver another quarter-point reduction in the first quarter of 2026, with more cuts potentially through the year should downward pressure be applied by a new dovish FOMC chair.

Powell steps down in May, with Kevin Hassett, President Trump's economic adviser and known dove, seen as the favorite to succeed him although other candidates, including former Fed governor Kevin Warsh, Fed governors Christopher Waller and Michelle Bowman, and BlackRock's Rick Rieder, are also on the shortlist being vetted by Treasury Secretary Scott Bessent. An announcement is expected early in the new year, an event that will likely have read-through across the rates market.

Post the Fed meeting, front-end Treasury yields have followed policy rates lower—a move partly supported by the central bank announcing it would immediately start buying short-dated Treasury bills to help manage market liquidity—yet long-end yields across 10- and 30-year Treasuries have broadly risen.

Higher expected growth rates combined with increasing concerns about fiscal overreach and debt sustainability are among the main factors driving long-end yields higher. Such factors are, therefore, priced in, which in our view suggests the worst may be over for long interest rates, a call we highlighted in our fixed income theme for Solving 2026. Indeed, we would argue that improving carry profiles in longer maturities on the back of lower policy rates should provide support to the long end of yield curves.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up