Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Powell’s final Jackson Hole speech may hint at September cuts, but focus is on dropping average inflation targeting, defending Fed independence, and shaping a lasting policy framework.

For American farmers travelling through the Heartland scouting corn and soybean fields, it feels like 2019 all over again.President Donald Trump is back in power, a trade war with top soybean buyer China is raging, and growers are coping with prices that are near the lowest levels in years. Huge crops ahead are only going to make matters worse.It’s a familiar picture for the more than 40 growers, analysts and journalists taking part in the annual Pro Farmer Crop Tour that started on Monday and will cross seven states before ending in Minnesota on Thursday. In 2019, they were facing exactly the same conditions.

Back then, tensions were so high that a staffer from the US Department of Agriculture (USDA) was threatened, forcing the agency to pull their people out of the tour as a precaution. Things are much calmer this year, but anxiety is slowly building up — after all, the US has yet to sell a single cargo of soybeans to China from the harvest that starts next month.“I just wish they’d start buying again,” said Bill Timblin, a Nebraska farmer on the tour. He hopes the Chinese market isn’t gone for good.

American farmers, a key voting bloc for Trump, are growing increasingly worried as harvest approaches. In a letter to the president this week, Caleb Ragland, who heads the American Soybean Association, warned growers are near a “trade and financial precipice” and cannot survive a prolonged trade war with China.“Soybean farmers are under extreme financial stress,” he said, urging the administration to reach a deal with China to remove duties. “Prices continue to drop and at the same time our farmers are paying significantly more for inputs and equipment.”

A gauge of grain prices tracked by Bloomberg fell earlier this month to the lowest since the pandemic in 2020.The USDA is already forecasting a record corn crop for the season starting in September. While the soy harvest will be smaller than last year as farmers planted less, yields are on track to hit a record.Partial results from the crop tour indicate bigger corn crops than last year in all states but Illinois. Indiana is currently the only state where soybean counts were lower than in 2024. Scouts crossed Ohio, South Dakota, Indiana, Nebraska, Illinois, Iowa and Minnesota. The combined result is expected on Friday.

In typical years, China buys on average 14% of its estimated soybean purchases before the US begins gathering its crop on Sept 1, according to an analysis by the American Soybean Association provided to the administration. The impact is being felt from Chicago to the Pacific Northwest, which is home to several export elevators dedicated to shipping American crops to Asia.

Steve Swanhorst, a South Dakota farmer on the tour, said he isn’t surprised. Trump was transparent about his plans on a variety of issues including tariffs and immigration, he said in an interview.“We had to know it was going to get rough,” he said. “You’ve got to give Trump some credit because he isn’t scared to get out of the box.”Chip Flory, who has taken part in all but one tour since 1988 and is now one of the hosts, is still positive.

“China has the need for soybeans,” he said. “There is going to come a time when they have to book beans.”Thousands of miles away from the crop tour, in Washington DC, the head of the US Soybean Export Council (USSEC) echoed that idea.“We are optimistic that some sort of a trade deal will be made soon,” Jim Sutter, USSEC’s chief executive officer, said in an interview at an event hosted by the group. “We don’t know exactly how soon.”

Luke Lindberg, the USDA’s undersecretary for trade and foreign agricultural affairs, said the government has created “very real” opportunities to get American products into new markets and that sales to destinations other than China are growing as a result.“The combines are firing up, and we need to get that soy crop sold around the world, we’re very aware of that,” he said at the USSEC event. “There are deals on the horizon that will make a significant impact for the American farmer.”

Still, concerns about China’s absence from the market at a time when growers are expected to harvest big crops are generating anxiety beyond the crop tour.

At the Iowa State Fair last week, Aaron Lehman, president of the centrist Iowa Farmers Union, said trade is top of mind after the US lost foreign markets during Trump’s first trade war with China. The Asian nation turned to South America for supplies instead.“Last time we went through this we lost lots of customers overseas and they have not come back to us,” said Lehman, who grows corn, soybeans and hay in Polk County. “We know there are things we need to do to get to fair trade for farmers, but we are not getting any closer to that with this approach.”

Wall Street's main indexes were set to open higher on Friday following a recent string of losses as investors awaited Federal Reserve Chair Jerome Powell's speech at the Jackson Hole Symposium for insights into the interest-rate path.

At the Wyoming research conference last year, Powell had promised to lower rates and support the job market when the unemployment rate started to rise, while in 2022, he underscored the central bank's inflation-fighting rigor.

Powell's address, expected at 10 a.m. ET, could prove pivotal in shaping the rate-cut expectations for September.

Michael Matousek, head trader at U.S. Global Investors, said Powell was going to "take the cautious approach".

"The tariffs are really starting to kick in, so he's still going to put some caution out there and state that he wants to look at data, see how things happen, because you didn't have the tariff effect kick in until early in the summer," Matousek said.

Markets had initially ramped up the bets following a weak payrolls report at the start of August and after consumer price data showed limited upward pressure from tariffs.

Traders now see a 69.5% chance of a 25-basis-point rate cut next month, down from an 85.4% chance a week ago, according to the CME FedWatch Tool.

Other Fed officials speaking on Thursday appeared to be less keen on the idea of a rate reduction next month.

Earnings reports from big-box retailers including Walmartearlier this week offered a mixed picture as investors sought fresh signals on the broader health of the American consumer amid ongoing tariff pressures.

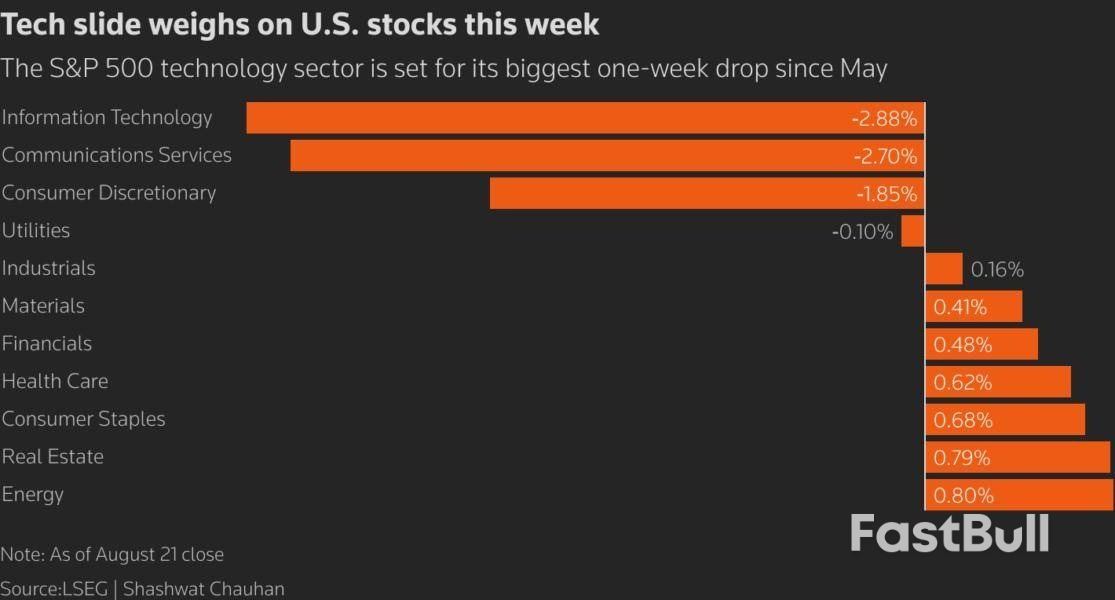

Against this backdrop, all three main U.S. stock indexes are set for weekly losses, with the S&P 500and the Nasdaqon pace for their worst weekly showing of the month.

The S&P 500 took its string of losses to a fifth straight day on Thursday. A broad-based selloff in heavyweight technology stocks has kept U.S. equities pressured this week.

Information technologywas the week's worst hit sub-sector, while energyand real estatewere on track for mild weekly gains.

Meanwhile, UBS Global Wealth Management lifted its year-end target for the S&P 500 to 6,600 points from 6,200.

At 08:12 a.m. ET, Dow E-minis (YMcv1) rose 132 points, or 0.29%, S&P 500 E-minisgained 12.50 points, or 0.20%, and Nasdaq 100 E-minisadded 32.75 points, or 0.14%.

Among top movers, Nvidiaslipped 1.3% in premarket trading after reports the chipmaker had asked Foxconnto suspend work on the H20 AI chip, the most advanced product the company is permitted to sell to China.

Google-parent Alphabetgained 1.3% after reports the company has struck a six-year cloud computing deal with Meta Platformsworth more than $10 billion. Meta shares last rose 0.2%.

Intuitdropped 6.3% after the TurboTax-maker forecast first-quarter revenue growth below analysts' estimates due to sluggish performance at its Mailchimp marketing platform.

Workdayshed 4.4% after the human resources software provider provided an in-line outlook for the current quarter.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up