Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Powell’s hawkish tone dimmed hopes for a September rate cut, but stellar earnings from Microsoft and Meta lifted markets. Tariff tensions rise globally, while AI momentum drives Big Tech-led optimism.

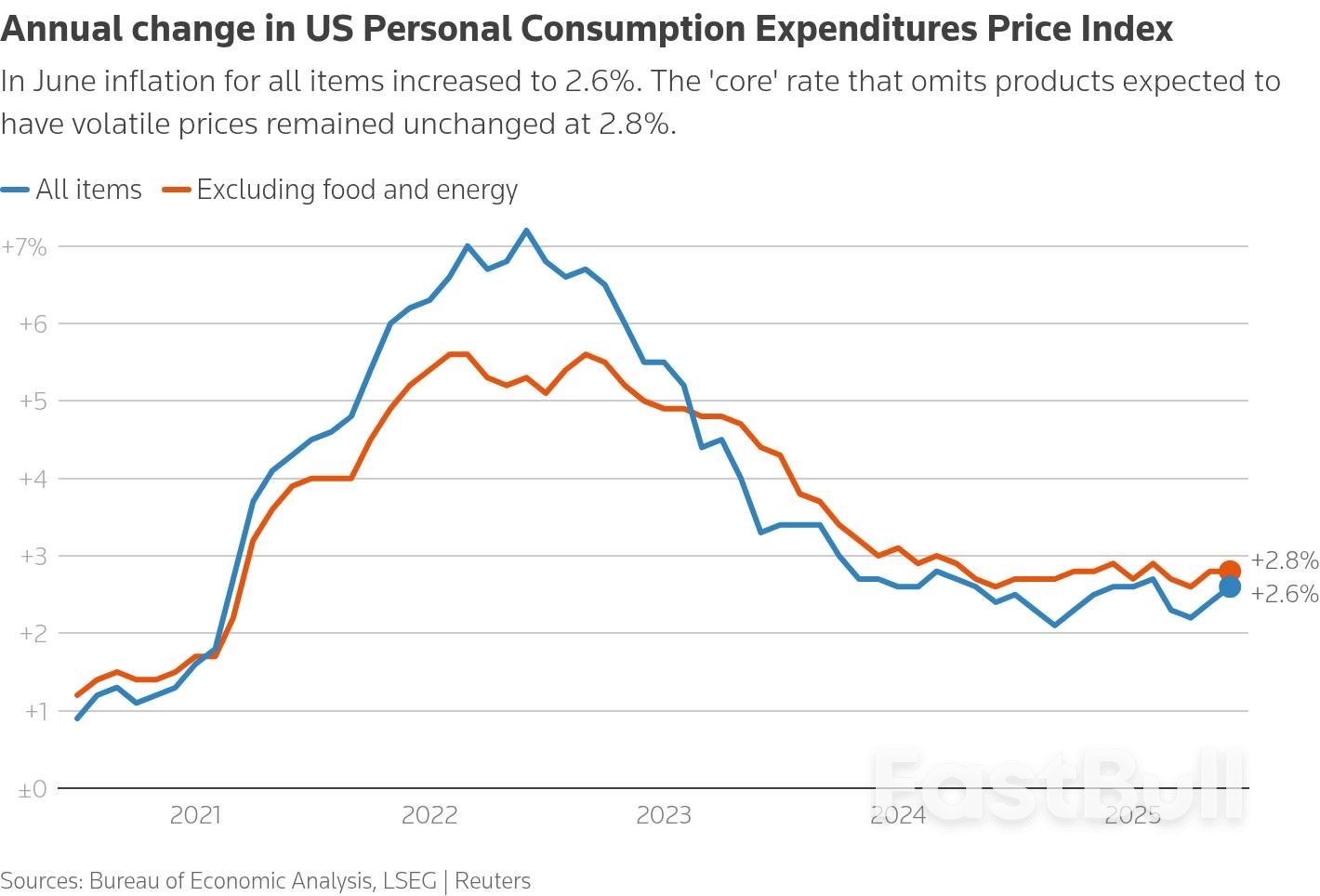

U.S. inflation increased in June as tariffs boosted prices for imported goods like household furniture and recreation products, supporting views that price pressures would pick up in the second half of the year and delay the Federal Reserve from resuming cutting interest rates until at least October.

The report from the Commerce Department on Thursday showed goods prices last month posting their biggest gain since January, with also solid rises in the costs of clothing and footwear. The U.S. central bank on Wednesday left its benchmark interest rate in the 4.25%-4.50% range and Fed Chair Jerome Powell's comments after the decision undercut confidence the central bank would resume policy easing in September as had been widely anticipated by financial markets and some economists.

"The Fed is unlikely to welcome the inflation dynamics currently taking hold," said Olu Sonola, head of U.S. economic research, Fitch Ratings. "Rather than converging toward target, inflation is now clearly diverging from it. This trajectory is likely to complicate current expectations for a rate cut in September or October."

The personal consumption expenditures (PCE) price index rose 0.3% last month after an upwardly revised 0.2% gain in May, the Commerce Department's Bureau of Economic Analysis said. Economists polled by Reuters had forecast the PCE price index climbing 0.3% following a previously reported 0.1% rise in May.

Prices for furnishings and durable household equipment jumped 1.3%, the biggest gain since March 2022, after increasing 0.6% in May. Recreational goods and vehicles prices shot up 0.9%, the most since February 2024, after being unchanged in May. Prices for clothing and footwear rose 0.4%.

Outside the tariff-sensitive goods, prices for gasoline and other energy products rebounded 0.9% after falling for four consecutive months. Services prices rose 0.2% for a fourth straight month, restrained by cheaper airline fares and steady prices for dining out and hotel stays.

In the 12 months through June, the PCE price index advanced 2.6% after increasing 2.4% in May.

The data was included in the advance gross domestic product report for the second quarter published on Wednesday, which showed inflation cooling, though remaining above the Fed's 2% target. Economists said businesses were still selling inventory accumulated before President Donald Trump's sweeping import duties came into effect.

They expected a broad increase in goods prices in the second half. Procter & Gamble (PG.N), opens new tab said this week it would raise prices on some products in the U.S. to offset tariff costs.

The Fed tracks the PCE price measures for monetary policy.

Excluding the volatile food and energy components, the PCE price index increased 0.3% last month after rising 0.2% in May. In addition to higher goods prices, the so-called core PCE inflation was lifted by rising costs for healthcare as well as financial services and insurance.

In the 12 months through June, core inflation advanced 2.8% after rising by the same margin in May.

Stocks on Wall Street were mixed. The dollar was steady against a basket of currencies. U.S. Treasury yields fell.

A line chart titled "Annual change in US Personal Consumption Expenditures Price Index" that compares two key inflation metrics over the past five years.

The BEA also reported that consumer spending, which accounts for more than two-thirds of economic activity, rose 0.3% in June after being unchanged in May. The data was also included in the advance GDP report, which showed consumer spending growing at a 1.4% annualized rate last quarter after almost stalling in the first quarter.

In the second quarter, economic growth rebounded at a 3.0% rate, boosted by a sharp reduction in the trade deficit because of fewer imports relative to the record surge in the January-March quarter. The economy contracted at a 0.5% pace in the first three months of the year.

Spending is being supported by a stable labor market, with other data from the Labor Department showing initial claims for state unemployment benefits rose 1,000 to a seasonally adjusted 218,000 for the week ended July 26.

But a reluctance by employers to increase headcount amid uncertainty over where tariff levels will eventually settle is making it harder for those who lose their jobs to find new opportunities, which could hamper future spending.

The number of people receiving benefits after an initial week of aid, a proxy for hiring, was unchanged at a lofty seasonally adjusted 1.946 million during the week ending July 19, the claims report showed.

The government's closely watched employment report on Friday is expected to show the unemployment rate rising to 4.2% in July from 4.1% in June, according to a Reuters survey of economists.

Economists expect pressure from tariffs and a slowing labor market will put a brake on consumer spending in the third quarter. Slow growth is likely already in the works as inflation-adjusted consumer spending edged up 0.1% in June after declining 0.2% in May.

Precautionary saving could also curb spending. The saving rate was unchanged at 4.5% in June.

Though a third report from the Labor Department showed wage growth picking up in the second quarter, inflation-adjusted annual gains moderated to 0.9% from 1.1% in the 12 months through March.

The BEA report showed inflation cutting into income for households after accounting for taxes, which was flat in June.

Signs of financial strain are also emerging among higher-income households, who have largely been driving spending. Lower- and middle-income families have been disproportionately affected by tariff-related price increases, higher borrowing costs and slowing economic activity.

"While consumer spending has thus held up — supported by solid income gains — it now faces mounting headwinds from a cooling labor market and renewed inflationary pressures," said Gregory Daco, chief economist at EY-Parthenon.

NZDUSD Daily Chart, July 31, 2025

NZDUSD Daily Chart, July 31, 2025 NZDUSD 4H Chart, July 31, 2025

NZDUSD 4H Chart, July 31, 2025 NZDUSD 1H Chart, July 31, 2025

NZDUSD 1H Chart, July 31, 2025President Trump announced in a Truth Social 网站 that he is extending trade talks with Mexico for another 90 days. Yahoo Finance Washington Correspondent.

President Trump announcing on Truth Social he is extending Mexico's current tariff rates for 90 days to allow more time for trade negotiations with the country. That announcement coming after Trump threatened last month to increase Mexico's country-based duty to 30% starting August 1st. The president's decision coming shortly after he said he would not extend his Friday deadline. Joining us now, Washington correspondent Ben Werschkull. Ben, we were just talking about the countries that have been left out in the cold so to speak. Mexico was one of them, but it seems like they're getting a little more time, but the time that they're getting comes still with these high tariffs attached.

For sure. Yeah. So this is, this is the 90 day pause that Trump announced just a few minutes ago, and it'll, it'll keeps the rates at 25%. So it's not a 5% increase to, to 30%. I do think it's significant that Trump talked about this call as very successful. He had a lot of kind words for Mexican president Claudia Sheinbaum, um, as, as they met this morning to, to kind of work out these deals considering how, how many, how many issues they have to work out over the next 90 days on the border and these other things. Um, other things Trump announced today in this post will be that the 25% headline rate will continue, the 25% auto rate will continue. That's, that's a big one in focus. And then as with all the other deals, the 50% tariffs on steel, aluminum and copper, which is also coming tomorrow, will, will, will stay in place. So those, those rates will stay now. Um, Trump also announced that Mexico has agreed to terminate its non-tariff trade barriers without providing any additional details there. the President Sheinbaum did already respond to confirm this call and to confirm the 90 day pause. What she says she's focused on for the next 90 days is building a long-term deal with President Trump on all these other more complex trade issues.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up