Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Brazilian state-run oil firm Petrobrashas lowered its dividend forecast and cut expected investments by almost 2% in a new five-year business plan announced Thursday, as it grapples with lower crude prices.

Brazilian state-run oil firm Petrobrashas lowered its dividend forecast and cut expected investments by almost 2% in a new five-year business plan announced Thursday, as it grapples with lower crude prices.

Petrobras expects to dole out between $45 billion and $50 billion during the 2026-2030 period in ordinary dividends, a filing showed. In its previous five-year plan to 2029, released last year, the firm had expected to give shareholders up to $55 billion.

There was no mention of extraordinary dividends in the new plan, while the previous one estimated up to $10 billion could be disbursed during the 2025-2029 period.

The cut in investments to $109 billion comes as Petrobras faces lower Brent oil prices, that it now expects to hover around $63 a barrel for next year, below the $77 estimate it had set for 2026 in the previous plan.

This marks the first drop in investments of the state-run firm under President Luiz Inacio Lula da Silva's current administration.

The last time investment was cut was the 2021-2025 plan, under former President Jair Bolsonaro's administration, when Petrobras was undergoing a series of divestments.

Reuters reported on Wednesday, citing sources, that Petrobras' expected investments were set to drop to around $109 billion in the new plan.

Since taking office, Lula has pushed the oil firm to invest more in order to boost the country's economy. Next year, the leftist leader is set to seek a fourth, non-consecutive term as president.

Despite lowering investments overall, Petrobras raised investments in exploration and production activities by about $1 billion to $78 billion for the period, while keeping refining, transportation and marketing investments at around $20 billion.

Petrobras also said it expects to reach peak oil production within the period of 2.7 million barrels per day (bpd) in 2028.

Peak total production within the plan's timeframe would be 3.4 million barrels of oil and gas equivalent per day (boed) in 2028 and 2029, based on annual projections with a margin of variation of plus or minus 4%.

The India rupee is poised to open weaker on Friday, with the imbalance between robust importer hedging and hesitant exporter flows making it vulnerable to a lifetime low and dependent on central bank support.

The 1-month non-deliverable forward indicated the rupeewill open in the 89.40-89.42 range versus the U.S. dollar, having settled at 89.3050 on Thursday, and within striking distance of last week's all-time low of 89.49.

The Reserve Bank of India stepped in heavily at the beginning of the week in a bid to break the cycle of weakness that threatened to deepen after last week's breakdown.

Its intervention briefly lifted the rupee back through the 89 handle, offering a short-lived reprieve. The relief, however, faded with persistent dollar demand from importers, hesitant exporter hedging and lacklustre portfolio flows eroding much of the RBI-spurred recovery.

The fact that the rupee is back under pressure despite the RBI's support is noteworthy considering the softness in the dollar.

The dollar indexis headed for its worst week in four months on mounting confidence that the Federal Reserve will deliver a third straight rate cut next month, a tailwind that would normally offer rupee some respite.

Fed funds futures now imply an 86% chance of a 25-basis point rate cut on December 10, up from about 40% just a week ago, according to the CME's FedWatch tool.

"You don't get this kind of this slow relentless push higher (on dollar/rupee) unless corporate flows are skewed and there is nothing to offset it," a currency trader at a private sector bank said.

For speculators, there's no macro trigger to chase USD/INR higher, he added.

Mexico's Attorney General Alejandro Gertz Manero resigned under pressure from President Claudia Sheinbaum, who had grown increasingly frustrated over his handling of high-profile investigations.

The Senate approved his resignation Thursday afternoon and announced that the next attorney general will be selected through an open contest allowing up to 10 candidates to compete for the job. People familiar with the matter said Ernestina Godoy, who served as Mexico City's prosecutor when Sheinbaum was mayor, has the president's support.

The president's office didn't immediately reply to a request for comment.

Sheinbaum's dissatisfaction with Gertz Manero deepened as her team considered his office responsible for leaking sensitive information related to a widening fuel-smuggling scandal known in Mexico as "huachicol fiscal," the people familiar added, requesting anonymity because they're not authorized to speak publicly.

The last straw was how the Attorney General's Office handled a probe into one of the owners of Mexico's Miss Universe franchise, Raul Rocha Cantu, who is facing allegations of smuggling fuels and weapons into the country as part of the "huachico fiscal" scheme.

Details of the investigation leaked to the press revealed Rocha Cantu's ties with state oil company Pemex and the father of the current Miss Universe winner, raising questions about the fairness of the competition.

Sheinbaum was displeased by media reports that the attorney general had offered criminal immunity to Rocha Cantu during the investigation, the people familiar said. She was particularly upset about the probe's impact on Miss Universe, a cherished event in Mexico, according to one of the people.

Speaking to reporters on Wednesday morning, the president said the investigation into Rocha Cantu's dealings should not overshadow the beauty queen's win.

"That's separate from the young woman who won the contest," Sheinbaum said. "They want to lump it together, but it's different. They want to take away her merit."

In his letter to the Senate, Gertz Manero justified his resignation by saying Sheinbaum offered him the position of ambassador to a "friendly country," without specifying which one.

The 86-year-old lawyer became Mexico's attorney general in 2019 after the position was revamped the previous year. He had three years left in his mandate. A former Mexico City prosecutor, federal security minister and congressman, he was appointed by former President Andres Manuel Lopez Obrador — a move questioned by some within the ruling party given his roles in previous administrations and his age.

Gertz Manero's replacement marks the second major change in Sheinbaum's one-year-old administration after she appointed Edgar Amador as finance minister in March.

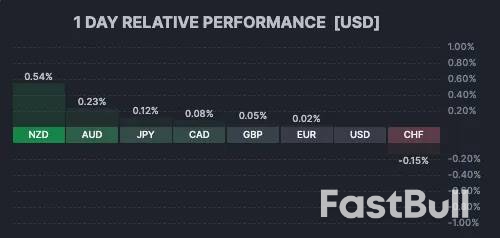

While US Markets are away for the Thanksgiving holiday, leaving the broader session fairly calm, the FX markets remain open and active, with all eyes turning to the Kiwi Dollar (NZD), posting yet another strong session.

The Antipodean currency has faced its share of struggles this year, weighed down by a slowing New Zealand economy that proved more sensitive than its neighbor Australia to the slowdown in global trade post-tariffs—a weakness that was starkly evident in a terrible Q2 GDP growth rate of -0.9%.

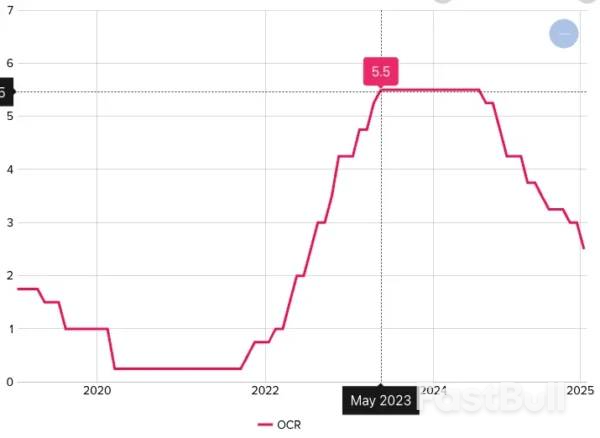

However, after 325 basis points of cuts, the data has started to come back in a flash. New Zealand Retail Sales just posted a strong beat of 1.9% versus the 0.5% expected, a sign of strong recovery that follows stronger inflation prints and improving Manufacturing PMIs.

Adding to the shift in sentiment, RBNZ Governor Christian Hawkesby mentioned that a future rate cut faces "significant hurdles."

This wording sufficed the market to assume that the 2.25% rate is the lower bound for the Kiwi rate, with markets now pricing rates to stay put throughout 2026.

This fundamental pivot is a clear sign of renewed strength for the NZD, which is up 2.65% against the US Dollar since last Friday.

Let's look at the major Kiwi pair, NZD/USD, to spot where that takes the action looking forward.

Daily Chart

Since July 1st and the comeback of the US Dollar, the NZD/USD has been in a one-way descent, exacerbated by diverging policies between the Fed and the RBNZ.

Taking the pair all the way down to a retest of the Liberation Day troughs in a Monthly Downward Channel, the action is now marking a first clear rebound in months.

Propulsed by changing fundamentals and bullish daily divergences, the ongoing action is strong and will face hurdles at the 50-Day Moving Average (0.57268) and Channel highs.

Still, when looking at how strong the current candles are, these hurdles could be breached soon. For confirmation, look at a session close above the 50-MA.

The ongoing rally is also facing a few hurdles on the intraday timeframe:

Overbought RSI levels within the Pivot Zone (0.5720 to 0.5750) could trigger some small mean-reversion.

A retest of the 4H-MA 200 (0.5690) could see higher probability for the action to continue its path higher.

NZD/USD Technical Levels to keep on your charts:

Resistance levels (NZDUSD)

Support levels

Looking even closer, the action is strongly following the 20-Hour MA at 0.57140;

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up