Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

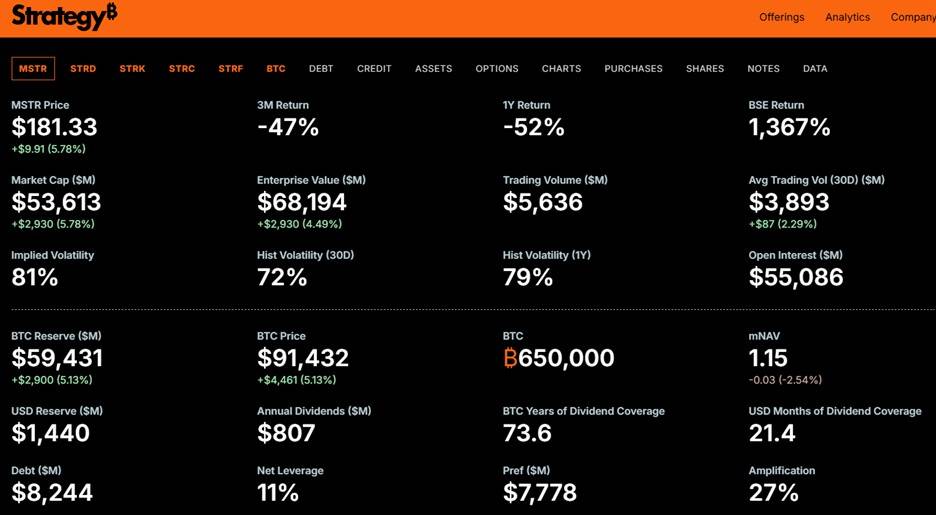

The irony is that Strategy is relying on fiat to fund the $807m per year in interest and dividend payments across its debt and preferred-share tranches.

The irony is that Strategy is relying on fiat to fund the $807m per year in interest and dividend payments across its debt and preferred-share tranches. Meeting these obligations is essential if Saylor is to keep the good ship MSTR afloat and keep the holders of the $17bn in preferred stock and convertible notes satisfied.

To achieve this in 2026 (and beyond), Strategy will need either to continue issuing new shares or sell part of its 650,000 BTC holdings on the balance sheet.Given the choice, Saylor has made it clear he will never willingly sell Bitcoin - but in 2026 that decision may well be taken out of his hands. Ultimately, Mr Market could decide it for him.

On Monday, Schiff incorrectly claimed that MSTR had sold BTC on-market to fund upcoming interest payments. This misstep didn't help his argument, even if his broader critique of MicroStrategy's increasingly complex capital structure still resonates.

MicroStrategy subsequently disclosed a US$1.44bn reserve fund to cover senior-debt obligations - providing around 21 months of dividend and coupon cover. This may offer short-term support to the MSTR share price. But the short sellers are circling, with short interest is now around 41%, a level that adds fuel to both upside squeezes and downside volatility.

Until recently, traders were focused on market net asset value (mNAV) - now around 1.15, meaning MSTR trades at a small premium to the total BTC value on its balance sheet. It has even traded at a slight discount, which historically would be extremely bearish for MicroStrategy.

With the company's capital structure changing - and $17bn of senior claims above the equity — the market has pivoted to TEV mNAV (Total Enterprise Value / Bitcoin Value).This metric captures:

TEV mNAV remains well above 1.0, suggesting Saylor still has options to raise capital and maintain the company's leveraged Bitcoin strategy.

As long as MSTRs TEV mNAV ratio stays comfortably above 1, Saylor can be reasonably confident that investors will support further equity issuance, enabling MicroStrategy to continue using leverage to accumulate more BTC.

However, with $17bn above the equity, if BTC were to fall significantly below $74,436 (MicroStrategy's average BTC purchase price) and traders increased its concerns for its future solvency, the deep subordination would radically increase the risk premium for MSTR common equity stockholders – a factor which could catalyze the selling.

This is why, when Bitcoin rises, MSTR often sees a much larger percentage gain, with the move amplified by heavy short interest. It's exactly why traders view MSTR as a leveraged, high-beta play on Bitcoin, not simply a proxy for BTC.

Conversely, when Bitcoin trades lower, MSTR almost always suffers a larger percentage decline, reflecting its leveraged capital structure. In 2026, should we continue to see strong drawdown, the big debate will focus on the possibility that MSTR and many other crypto treasury entities could be forced to deleverage and sell down part of their crypto holdings.

MicroStrategy owns around 3% of all BTC in circulation - a meaningful share, though not dominant. But Saylor is unquestionably the most prominent spokesperson for institutional Bitcoin adoption, making his financing decisions and interest-payment strategy highly relevant for BTC markets in 2026–27.

If BTC collapses and MicroStrategy is forced to sell part of its holdings, Peter Schiff will be the first to celebrate — loudly. In that scenario, MSTR could even start leading Bitcoin's price action on down days, particularly when cross-asset volatility rises.

This developing standoff between Saylor's leveraged Bitcoin empire and Schiff's warnings of structural fragility will make for fascinating market theatre — and a source of exceptional trading opportunities in 2026.

Who do you think ultimately wins this battle - Saylor or Schiff?

Senior Ukrainian negotiator Rustem Umerov will hold talks in Brussels on Wednesday with European leaders' national security advisers and then visit the United States, Ukrainian President Volodymyr Zelenskiy said.

He was speaking after U.S. President Donald Trump's special envoy, Steve Witkoff, and son-in-law Jared Kushner met Russian President Vladimir Putin on Tuesday for talks. The Kremlin said on Wednesday no compromise had been reached on a possible peace deal to end the war in Ukraine.

"Ukrainian representatives will brief their colleagues in Europe on what is known following yesterday's contacts by the American side in Moscow, and they will also discuss the European component of the necessary security architecture," Zelenskiy said on Telegram.

After visiting Brussels, Umerov and Andrii Hnatov, Chief of the General Staff of the Armed Forces of Ukraine, will begin preparations for a meeting with Trump envoys in the U.S., he added.

"This is our ongoing coordination with partners, and we ensure that the negotiation process is fully active," Zelenskiy said.

A leaked set of 28 U.S. draft peace proposals, opens new tab emerged last week, alarming Ukrainian and European officials who said it bowed to Moscow's main demands on NATO, Russian control of a fifth of Ukraine and restrictions on Ukraine's army.

European powers then came up with a counter-proposal, and at talks in Geneva, the United States and Ukraine said they had created an "updated and refined peace framework" to end the war. Details of those talks have not been released made public.

The U.K. now formally recognizes cryptocurrency as property following the passing of a new law this week.

The Property (Digital Assets etc) Act received Royal Assent, the final step of an act becoming law after being passed by Parliament.

The act, approved by King Charles on Tuesday, was designed to modernize property law to take account of digital assets. Previously, property fell into one of two categories: things in possession, such as physical objects, and things in action, such as a debt.

The law establishes a third category that includes digital assets such as cryptocurrencies and non-fungible tokens (NFTs).

Crypto industry associations welcomed the law, hailing it as an important step in the legal recognition of digital assets and therefore instilling greater confidence for users.

"This change provides greater clarity and protection for consumers and investors by ensuring that digital assets can be clearly owned, recovered in cases of theft or fraud, and included within insolvency and estate processes," trade association CryptoUK wrote in a post on X.

"By recognising digital assets in law, the UK is giving consumers clear ownership rights, stronger protections, and the ability to recover assets lost through theft or fraud," Gurinder Singh Josan MP, co-chair of the Crypto and Digital Assets All Party Parliamentary Group (APPG) wrote in an emailed comment.

Cryptocurrency has previously been treated as property in court, but this has been on a case-by-case basis. This act makes the recognition law.

An acute global shortage of memory chips is forcing artificial intelligence and consumer-electronics companies to fight for dwindling supplies, as prices soar for the unglamorous but essential components that allow devices to store data.

Japanese electronics stores have begun limiting how many hard-disk drives shoppers can buy. Chinese smartphone makers are warning of price increases. Tech giants including Microsoft (MSFT.O), opens new tab, Google (GOOGL.O), opens new tab and ByteDance are scrambling to secure supplies from memory-chip makers such as Micron (MU.O), opens new tab, Samsung Electronics (005930.KS), opens new tab and SK Hynix (000660.KS), opens new tab, according to three people familiar with the discussions.

The squeeze spans almost every type of memory, from flash chips used in USB drives and smartphones to advanced high-bandwidth memory (HBM) that feeds AI chips in data centers. Prices in some segments have more than doubled since February, according to market-research firm TrendForce, drawing in traders betting that the rally has further to run.

The fallout could reach beyond tech. Many economists and executives warn the protracted shortage risks slowing AI-based productivity gains and delaying hundreds of billions of dollars in digital infrastructure. It could also add inflationary pressure just as many economies are trying to tame price rises and navigate U.S. tariffs.

"The memory shortage has now graduated from a component-level concern to a macroeconomic risk," said Sanchit Vir Gogia, CEO of Greyhound Research, a technology advisory firm. The AI build-out "is colliding with a supply chain that cannot meet its physical requirements."

This Reuters examination of the spiraling supply crisis is based on interviews with almost 40 people, including 17 executives at chipmakers and distributors. It shows industry efforts to meet voracious appetite for advanced chips — driven by Nvidia (NVDA.O), opens new tab and tech giants like Google, Microsoft and Alibaba (9988.HK), opens new tab — created a dual bind: Chipmakers still can't produce enough high-end semiconductors for the AI race, yet their tilt away from traditional memory products is choking supply to smartphones, PCs and consumer electronics. Some are now hurrying to course-correct.

Details of the global scramble by tech firms and price increases described by electronics retailers and component suppliers in China and Japan are reported here for the first time.

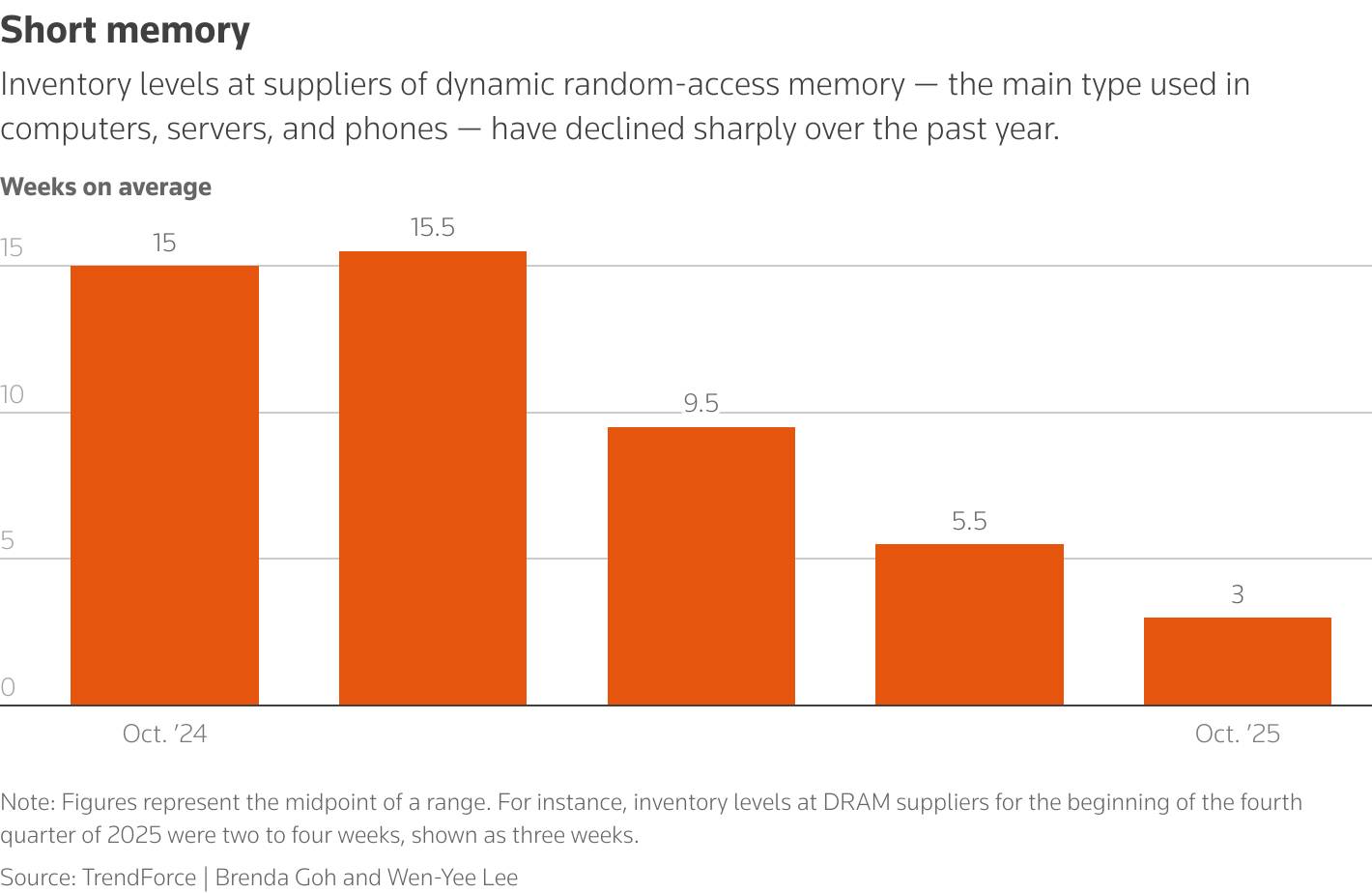

Average inventory levels at suppliers of dynamic random-access memory (DRAM) — the main type used in computers and phones — fell to two to four weeks in October from three to eight weeks in July and 13 to 17 weeks in late 2024, according to TrendForce.

Column chart shows a steep decline in average inventory levels at suppliers of DRAM since October 2024.

Column chart shows a steep decline in average inventory levels at suppliers of DRAM since October 2024.The crunch is unfolding as investors question whether the billions of dollars poured into AI infrastructure have inflated a bubble. Some analysts predict a shakeout, with only the biggest and financially strongest companies able to stomach the price increases.

One memory-chip executive told Reuters the shortage would delay future data-center projects. New capacity takes at least two years to build but memory-chip makers are wary of overbuilding for fear it could end up idle should the demand surge pass, the person said.

Samsung and SK Hynix have announced investments in new capacity but haven't detailed the production split between HBM and conventional memory.

SK Hynix has told analysts that the memory shortfall would last through late 2027, Citi said in November.

"These days, we're receiving requests for memory supplies from so many companies that we're worried about how we'll be able to handle all of them. If we fail to supply them, they could face a situation where they can't do business at all," Chey Tae-won, chairman of SK Hynix parent SK Group, said at an industry forum in Seoul last month.

OpenAI in October signed initial deals with Samsung and SK Hynix to supply chips for its Stargate project, which would require up to 900,000 wafers per month by 2029. That's about double current global monthly HBM production, Chey said.

Samsung told Reuters it is monitoring the market but wouldn't comment on pricing or customer relationships. SK Hynix said it is boosting production capacity to meet increased memory demand.

Microsoft declined to comment and ByteDance didn't address questions about the chip strain. Micron and Google didn't respond to comment requests.

After ChatGPT's release in November 2022 ignited the generative AI boom, a global rush to build AI data centers led memory makers to allocate more production to HBM, used in Nvidia's powerful AI processors.

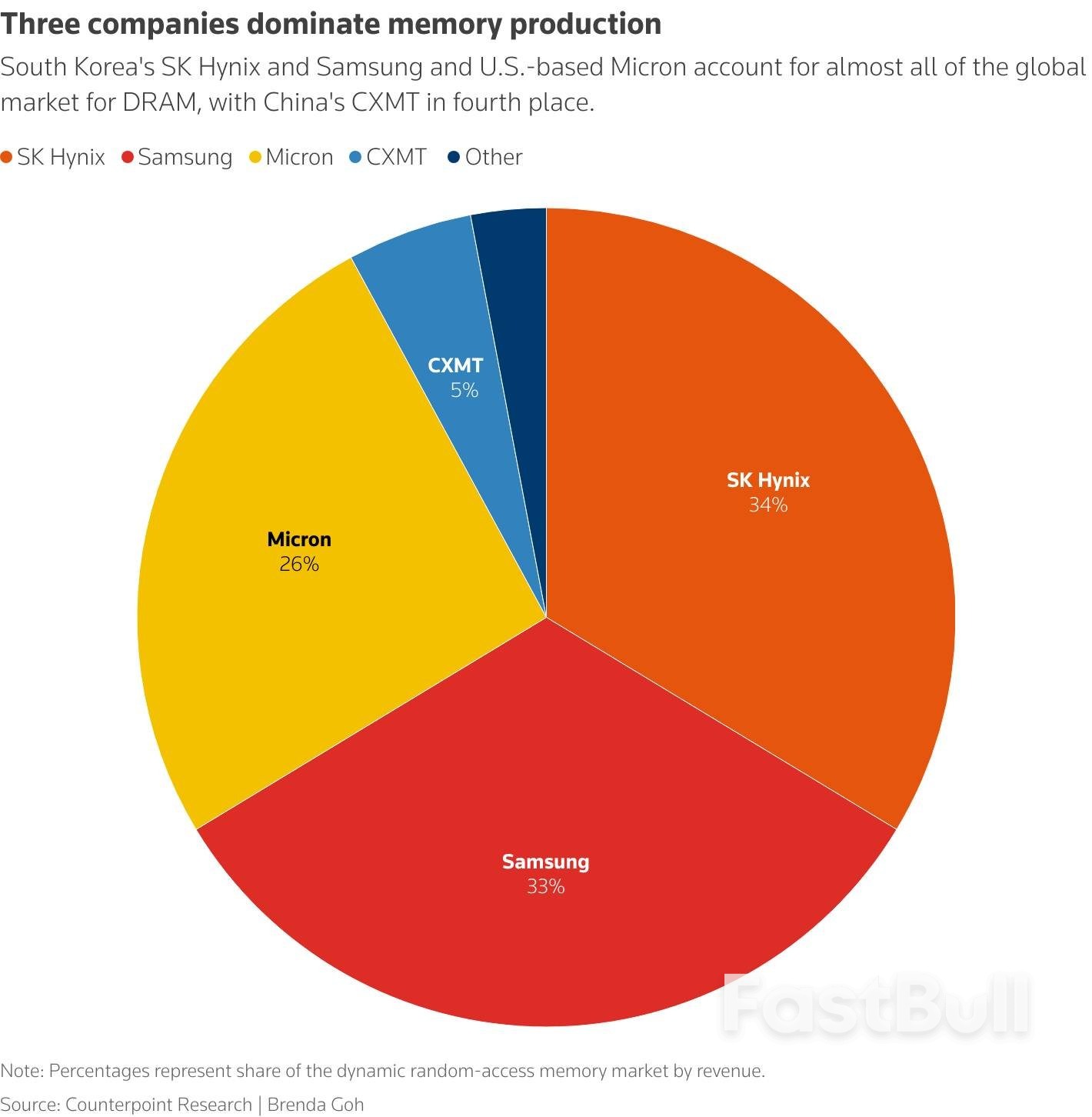

Competition from Chinese rivals making lower-end DRAM, such as ChangXin Memory Technologies, also pushed Samsung and SK Hynix to accelerate their shift to higher-margin products. The South Korean firms account for two-thirds of the DRAM market.

Samsung told customers in May 2024 that it planned to end production of one type of DDR4 chips — an older variety used in PCs and servers — this year, according to a letter seen by Reuters. (The company has since changed course and will extend production, two sources said.) In June, Micron said it had informed customers it would stop shipping DDR4 and its counterpart LPDDR4 - a type used in smartphones - in six to nine months.

Pie chart showing global chipmakers' market share by revenue.

Pie chart showing global chipmakers' market share by revenue.ChangXin followed suit in ending most DDR4 production, one source said. The firm declined to comment.

This shift, however, coincided with a replacement cycle for traditional data centers and PCs, as well as stronger-than-expected sales of smartphones, which rely on conventional chips.

In hindsight, "one could say the industry was caught off-guard," said Dan Hutcheson, senior research fellow at TechInsights.

Samsung raised prices of server memory chips by up to 60% last month, Reuters has reported. Nvidia CEO Jensen Huang, who in October announced deals and shared fried chicken with Samsung Electronics Chairman Jay Y. Lee during a trip to South Korea, acknowledged the price surge as significant but said Nvidia had secured substantial supply.

Google, Amazon, Microsoft and Meta in October asked Micron for open-ended orders, telling the company they will take as much as it can deliver, irrespective of price, according to two people briefed on the talks.

China's Alibaba, ByteDance and Tencent (0700.HK), opens new tab are also leaning on suppliers, dispatching executives to visit Samsung and SK Hynix in October and November to lobby for allocation, the two people and another source told Reuters.

"Everyone is begging for supply," one said.

The Chinese firms didn't address questions about the chip crunch. Nvidia, Meta (META.O), opens new tab, Amazon (AMZN.O), opens new tab and OpenAI didn't respond to requests for comment.

In October, SK Hynix said all its chips are sold out for 2026, while Samsung said it had secured customers for its HBM chips to be produced next year. Both firms are expanding capacity to meet AI demand, but new factories for conventional chips won't come online until 2027 or 2028.

Shares in Micron, Samsung and SK Hynix have rallied this year on chip demand. In September, Micron forecast first-quarter revenue above market estimates while Samsung in October reported its biggest quarterly profit in more than three years.

Consultancy Counterpoint Research expects prices of advanced and legacy memory to rise by 30% through the fourth quarter and possibly another 20% in early 2026.

Chinese smartphone makers Xiaomi (1810.HK), and Realme have warned they may have to raise prices.

Francis Wong, Realme India's chief marketing officer, told Reuters the steep increases in memory costs were "unprecedented since the advent of smartphones" and could force the company to lift handset prices by 20% to 30% by June.

"Some manufacturers might save costs on imaging cameras, some on processors, and some on batteries," he said. "But the cost of storage is something all manufacturers must completely absorb; there's no way to transfer it."

Xiaomi told Reuters it would offset higher memory costs by raising prices and selling more premium phones, adding that its other businesses would help cushion the impact.

In November, Taiwanese laptop maker ASUS said it had about four months of inventory, including memory components, and would adjust pricing as needed.

Winbond (2344.TW), a Taiwanese chipmaker with around 1% of the DRAM market, was among the first to announce a capacity expansion to meet demand. Shareholders approved a plan in October to sharply boost capital expenditure to $1.1 billion.

"Many customers have been coming to us saying, 'I really need your help,' and one even asked for a six-year long-term agreement," Winbond's President Pei-Ming Chen said.

TRADERS RUSH IN

In Tokyo's electronics hub of Akihabara, stores are restricting purchases of memory products to curb hoarding. A sign outside PC shop Ark says that since November 1 customers have been limited to buying a total of eight products across hard-disk drives, solid-state drives and system memory.

Clerks at five shops said shortages had pushed prices sharply higher in recent weeks. At some stores, one-third of products were sold out.

Products such as 32-gigabyte DDR5 memory – popular with gamers – were over 47,000 yen, up from around 17,000 yen in mid-October. Higher-end 128-gigabyte kits had more than doubled to around 180,000 yen.

The hikes are driving customers to the secondhand market — benefiting people like Roman Yamashita, owner of iCON in Akihabara, who said his business selling used PC parts is booming.

Eva Wu, a sales manager at component trader Polaris Mobility in Shenzhen, said prices are changing so rapidly that distributors issue broker-style quotes that expire daily – and in some cases hourly – versus monthly before the crunch.

In Beijing, a DDR4 seller said she had hoarded 20,000 units in anticipation of further increases.

Some 6,000 miles away in California, Paul Coronado said monthly sales at his company, Caramon, which sells recycled low-end memory chips pulled from decommissioned data-center servers, have surged since September. Almost all its products are now bought by Hong Kong-based intermediaries who resell them to Chinese clients, he said.

"We were doing about $500,000 a month," he said. "Now it's $800,000 to $900,000."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up