Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Oil steadied after two-day drop as investors weighed signs of glut and the fallout from western sanctions on Russian producers.

Oil steadied after two-day drop as investors weighed signs of glut and the fallout from western sanctions on Russian producers.

West Texas Intermediate traded near $61, while Brent closed below $66 on Monday. The amount of oil being shipped across the world's oceans hit a fresh record, a sign supplies are continuing to mount. In addition, OPEC+ may agree to add more production at a meeting this weekend.

US sanctions against Russia's biggest oil companies — which lifted crude last week — were also in focus. Washington has floated a six-month deadline for Berlin to sort out the ownership limbo affecting the German assets of Rosneft PJSC. Meanwhile, officials familiar with the matter said the administration's plan is to make Russia's trade costlier and riskier, but without spiking prices.

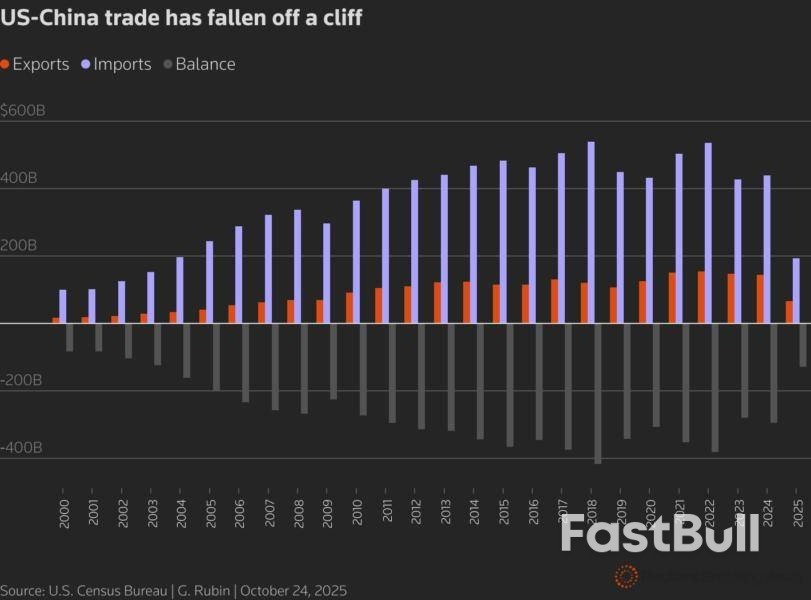

Oil is headed for a third straight monthly loss as concerns about a surplus weigh on prices, with OPEC+ and rival drillers both stepping up output. Traders are also tracking progress toward a US-China trade deal, with President Donald Trump and his Chinese counterpart Xi Jinping due to meet at a summit on Thursday after negotiators cleared the way for an agreement.

With the regime shifts in Europe and the US cornering so much of the conversation about the global economic landscape, the structural shift in Japan has largely gone unnoticed beyond its own region.However, this is a story worth paying attention to. After decades of deflation and weak growth, Japan is finally seeing an acceleration in nominal growth. Inflation has broadened, wages are rising, and both companies and households are shedding their deflationary mindsets. Fiscal stimulus, easy monetary policy, and shifting demographics support these trends, which, taken together, point to a more durable nominal growth regime.

For equity investors, the implications of this are significant — and encouraging. In this piece, I explore how investors should think about Japanese equities and detail the investment implications.

Nominal GDP growth has been accelerating in Japan since 2022, reversing decades of stagnation. This upturn has come about thanks to a rare alignment of four dynamics:

This reflation story suggests an auspicious narrative for Japan's corporate earnings landscape and long-term debt sustainability.

The reflation story, which could underpin a multiyear rerating of Japanese equities, has driven nominal GDP growth higher. This is important not only for bond markets, but also for equity investors for two key reasons:

The combination of fiscal support and loose monetary policy supports domestic cyclicals. Two sectors that stand out in this area are banks (which have strong earnings momentum and stand to benefit from further interest-rate hikes) and services (which are likely to benefit from those behavioral shifts away from savings I mentioned earlier).

Outside of domestic cyclicals, I believe the companies most dedicated to improving disclosure and governance and eliminating excess cash levels could generate significant alpha for equity investors. Active managers with deep research capabilities and boots on the ground may be better positioned than their passive counterparts to identify the companies that are both:

The bottom line is, the reflation story in Japan and the nominal GDP growth it encourages appear to bode well for Japanese equity markets, and investors may want to take note.

British retailers cut their prices in October, led by the biggest drop for food in almost five years, industry figures showed, offering a bit of relief to households before Halloween as well as the Bank of England and the government.

Overall shop prices fell by 0.3% from September, the first month-on-month drop since March, the British Retail Consortium said on Tuesday.

A monthly 0.4% drop in food prices was the biggest such fall since December 2020, the BRC said.

Compared with October last year, overall shop prices were 1.0% higher after a 1.4% rise in September, the first time that the annual pace of increases has slowed since June.

Annual food price inflation was also cooler at 3.7% compared with October last year, down from 4.2% in September, although fresh food prices continued to accelerate.

The BoE is watching food prices closely as it believes they have a big role in shaping public inflation expectations. Last week, official data showed Britain's headline inflation rate held at 3.8%, the highest since early 2024 but below forecasts of an increase to 4.0%.

BRC Chief Executive Helen Dickinson highlighted fierce competition amongst retailers, widespread discounting and an easing of global sugar prices which helped to bring down prices of chocolate and confectionary ahead of Halloween.

Some retailers started promotions for electrical goods and beauty products before the Black Friday sales that typically fall in November, Dickinson said.

She called on finance minister Rachel Reeves not to increase the cost burden on the sector in her budget on November 26.

"Adding further taxes on retail businesses would inevitably keep inflation higher for longer," Dickinson said.

Reeves has said she will use her budget to bring down the cost of living.

The United States and China appear to have hammered out the framework of a trade deal in advance of Presidents Donald Trump and Xi Jinping's meeting this week, removing the threat of an imminent collapse in trade between the world's two largest economies. World markets have welcomed the news, but, far from a game changer, this just looks like déjà vu.

"OUR DEAL WITH CHINA IS DONE, SUBJECT TO FINAL APPROVAL WITH PRESIDENT XI AND ME," Trump wrote on Truth Social on June 11, adding: "RELATIONSHIP IS EXCELLENT!"

As it turned out, the deal was not done, and the relationship was not excellent.

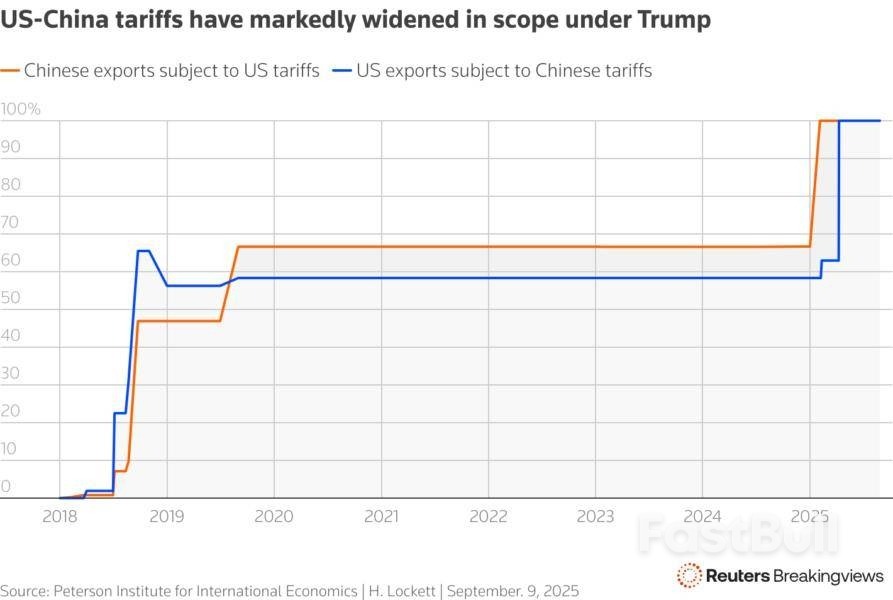

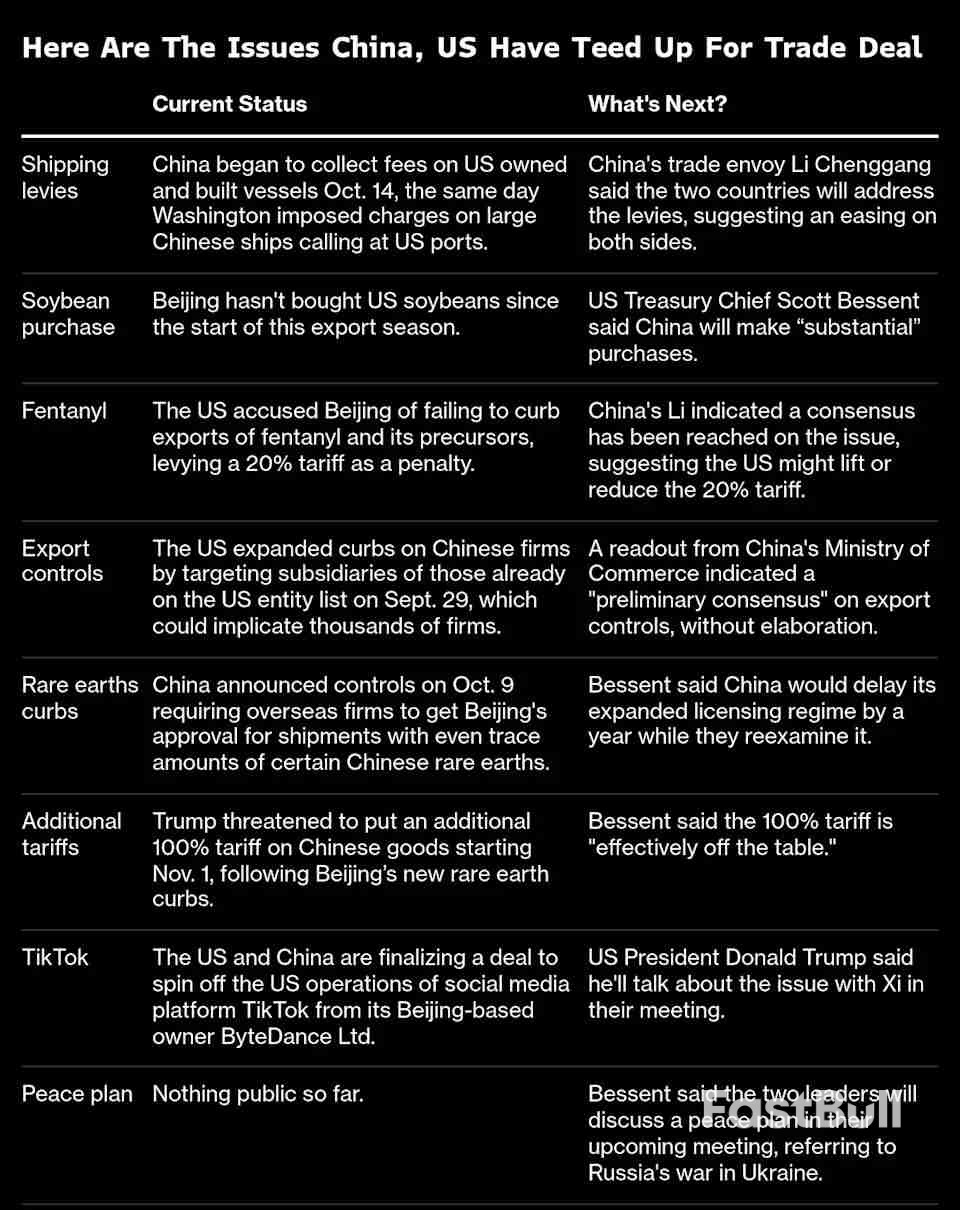

So much so, an emboldened Beijing earlier this month put extra controls on rare earth exports, and Washington responded with threats of 100% tariffs on U.S.-bound shipments of goods from China. U.S. Treasury Secretary Scott Bessent also publicly criticized top Chinese trade negotiator Li Chenggang as "unhinged".

However, the two men appear to have put these differences aside following talks in Malaysia over the weekend, agreeing to the roots of a preliminary deal in which China will delay its expanded licensing regime for rare earths and the U.S. will drastically lower its threatened tariffs on Chinese goods.

Soundings from the White House are upbeat, while the Chinese side is taking a more cautious line.

On the one hand, any deal that removes the worst-case scenario of a collapse in U.S.-China trade is good news. And all the evidence since the depths of 'Liberation Day' turmoil in April suggests that, if this doomsday threat is sidelined, the world economy will continue to muddle through, and markets will 'melt up' on policy stimulus, AI optimism and solid corporate earnings.

Cassandras say that's a dangerously complacent view. Whatever face-saving deal Trump and Xi eventually agree to will merely kick the can down the road.

Grace Fan at TS Lombard on Friday warned that a "perilous new chapter in geopolitics and global trade" has been opened, regardless of how the Trump-Xi meeting goes. The stakes are high, neither side wants to be seen backing down, and both will feel they hold the ace cards.

Trump leads the world's biggest economic, financial and military superpower, and every single trade deal he has signed so far this year has been in the United States' favor.

Meanwhile, Xi has huge leverage with something the U.S. needs - rare earths, the elements used in everything from lithium-ion batteries and semiconductors to cell phones, aircraft engines, LED TVs, electric vehicles and military radars.

China mines about 60% of the world's rare earths and makes 90% of rare earth magnets. On its face, the dollar value of the global rare earths market looks tiny at just $12 billion, according to management consultant firm IMARC. That figure, which is at the higher end of estimates, is a fraction of last year's $670 billion U.S.-China bilateral trade.

But these elements are tied to trillions of dollars of global economic output, making the relatively tiny market a critical part of U.S.-China relations.

It would thus be naive to think that a temporary lifting of China's export controls, if that is part of any deal, will be the end of the matter.

Instead, both sides are apt to use the "deal" as an opportunity to shore up their own weaknesses to ensure they are in a better position once tensions flare up again, whether that's Beijing further diversifying its export markets or Washington diversifying its sources of critical minerals.

One of the big takeaways from the International Monetary Fund and World Bank annual meetings in Washington this month was that China's decision to use its rare earth leverage over the U.S. signals a new and more dangerous stage in this geopolitical struggle.

Daniel Yergin, vice chairman of S&P Global, said in a discussion that trust between the U.S. and China has "gone". Goldman Sachs President John Waldron told another panel that "something more monumental" between the two countries is playing out.

In private, many delegates were even more pessimistic.

But pessimism is not something that has characterized financial markets much in the last six months, with stocks in Japan, Australia, South Korea, Britain and France, and the U.S. reaching all-time highs last week.

Many markets jumped even higher on Monday ahead of the Trump-Xi meeting, expected on Thursday, with investors calculating that a 'placeholder' trade deal is better than no deal at all.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up