Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Oil fell for a third day, heading for a weekly decline ahead of an OPEC+ meeting that may see the group sign off on another supply hike.

Oil fell for a third day, heading for a weekly decline ahead of an OPEC+ meeting that may see the group sign off on another supply hike.

West Texas Intermediate declined toward $63 a barrel after losing more than 3% over the prior two sessions, while Brent closed just below $67. The alliance is due to hold a virtual meeting on Sept. 7 to decide the next move after completing the restoration of 2.5 million barrels a day of supply at its previous gathering.

“The oil market will remain on edge ahead of this weekend’s meeting by OPEC producers,” ANZ Group Holdings Ltd. analysts including Daniel Hynes said in a note. “Expectations are growing that the group will continue to push more barrels into the market, in an effort to gain market share lost to US shale producers in recent years.”

US crude futures have retreated by 12% this year after the shift by OPEC+ — coupled with supply increases by drillers outside the group — exacerbated concerns about a glut. Sentiment has also been weighed down by growing worries over energy demand, driven in part by the impact of trade tariffs introduced by the Trump administration.

Japanese workers’ nominal pay rose at the fastest clip in seven months, with real wages increasing for the first time this year, supporting the case for the Bank of Japan to consider a rate hike in the months ahead.

Nominal wages increased 4.1% in July from a year earlier, accelerating from a revised 3.1% gain in June, the labor ministry reported Friday. The figure outpaced economists’ forecast of 3% growth and marked the steepest increase since December. Real cash earnings also advanced for the first time in seven months, rising 0.5% and beating the consensus estimate of a 0.6% decline.

Base salaries rose 2.5%, and a more stable measure, which avoids sampling issues and excludes bonuses and overtime, climbed 2.4% for regular workers.

Friday’s data showed that wage growth momentum continues, after Japan’s largest federation of unions won pledges from employers for pay increases exceeding 5% for a second consecutive year. This year’s gains, the largest in 34 years, are now mostly reflected in pay packets.

The figures will bolster expectations that the BOJ can hike its benchmark rate again this year. Economists generally expect authorities to hold settings steady when they next set policy on Sept. 19, but many see the possibility of a quarter-point hike as early as October.

BOJ Governor Kazuo Ueda reiterated Wednesday that the central bank will act if prices and the economy perform in line with expectations. Data due Monday are expected to confirm that the economy expanded for a fifth straight quarter in the three months through June.

Sustained increases in pay are a key component of the central bank’s quest to achieve a virtuous cycle in which wage growth fuels consumption, paving the way for demand-led price gains.

To be sure, the latest wage data were supported by robust summer bonuses, which climbed 7.9% from June. There’s no guarantee that increases in variable pay can be sustained as the nation’s largest manufacturers contend with President Donald Trump’s tariff campaign, which has hit automakers particularly hard. Trump signed an executive order Thursday implementing the July trade deal between the two nations. Under that agreement, levies on US imports of Japanese cars will be lowered to 15% from the current 27.5%.

Japan’s manufacturers recorded an 11.5% decline in pretax profit in the April-June period, with makers of transport equipment recording a 29.7% decline. So far automakers have borne much of the tariff impact, sacrificing profit margins in order to preserve market share. Toyota Motor Corp. recently warned of a ¥1.4 trillion ($9.4 billion) hit to its bottom line from the levies. It’s unclear how much room manufacturers will have to lift wages going forward if profits remain under pressure.

For now higher pay appears to be filtering into spending at a modest pace. Households boosted consumption by 1.4% in July from a year earlier, marking the third consecutive monthly increase, driven primarily by outlays for transport and communications. To further stimulate demand, Prime Minister Shigeru Ishiba is reportedly set to order the compilation of an economic package this week that includes ¥20,000 cash handouts.

Private consumption has been a positive component of overall economic growth for five straight quarters.

Ishiba’s ability to roll out stimulus steps is in doubt however as he remains under pressure from some lawmakers within his own party to step down after the Liberal Democratic Party suffered another election setback under his watch. The party is set to vote Monday on whether to move forward a leadership election, which would essentially lead to Ishiba’s ouster.

While it’s gradually cooling, sticky inflation has been a headache for Ishiba, as household discontent over soaring living costs was a factor behind the July upper election setback that left the ruling coalition without a majority in either chamber of parliament.

Looking ahead, wage dynamics may remain mixed. Persistent labor shortages are likely to keep upward pressure on pay as companies compete for talent. But prospects for exporters are clouded by headwinds for global commerce stemming from US trade policy. Japan’s exports have fallen for three straight months, with the decline in July the sharpest in four years.

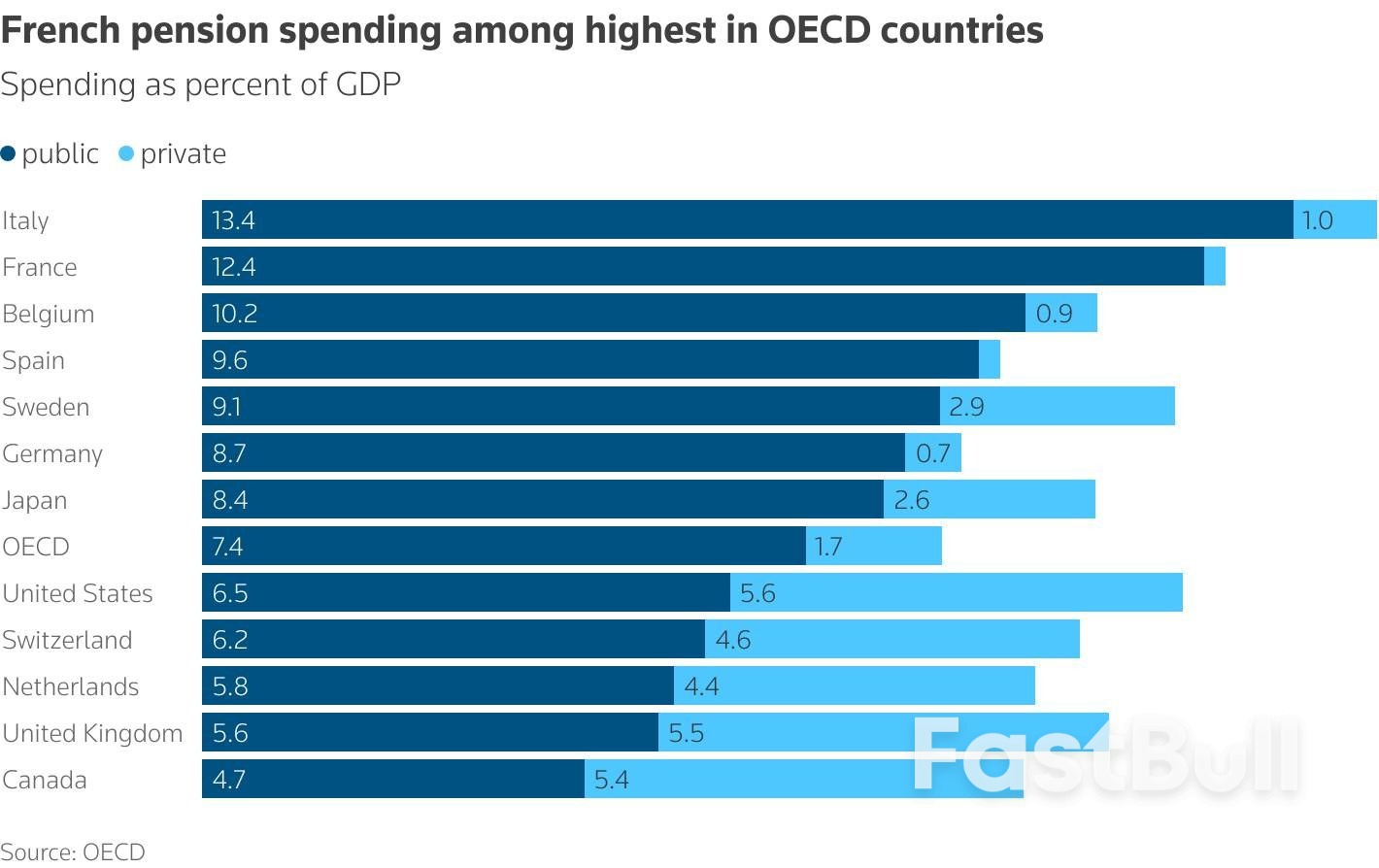

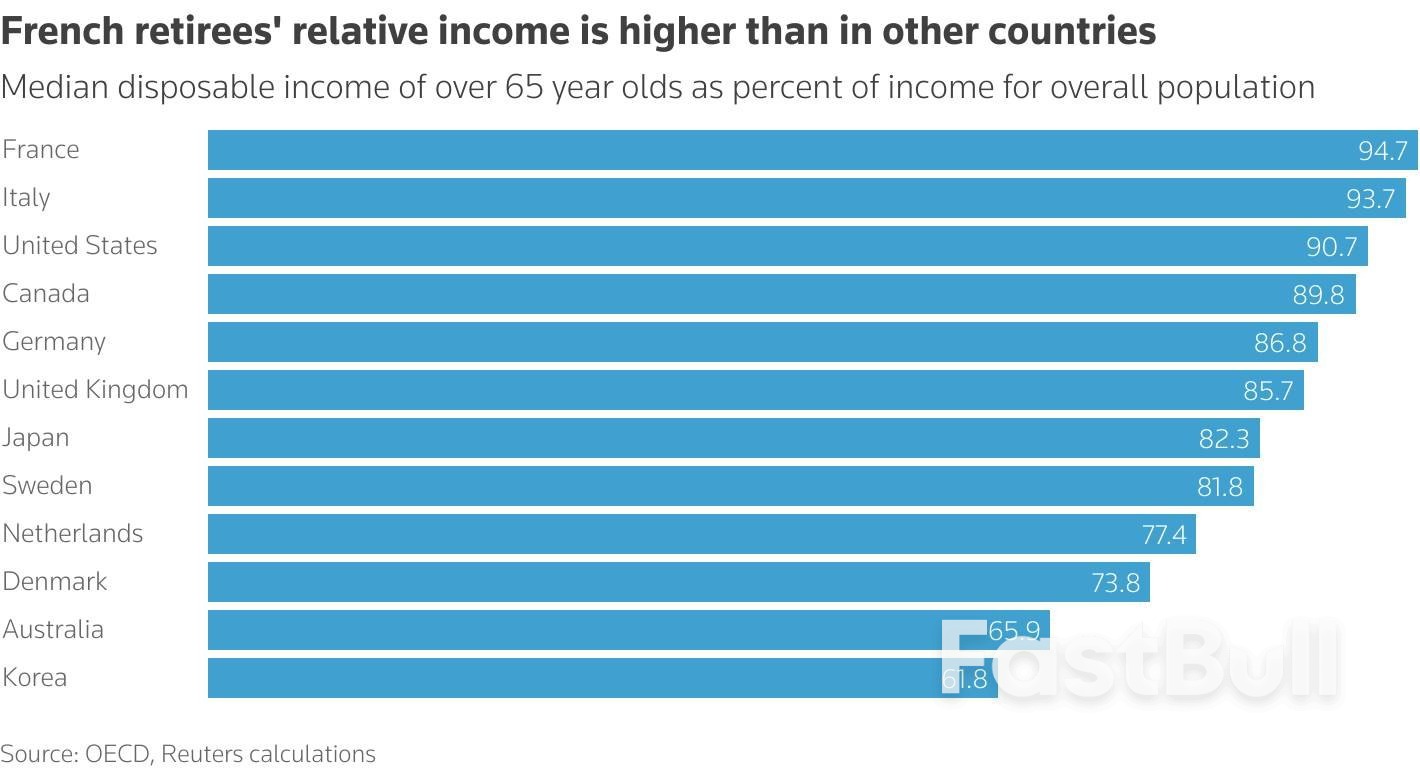

A viral French X account has tapped into rising generational tensions in France, where squeezed millennials rallying under the slogan "Nicolas foots the bill" say that better-off baby boomers should do more to fix the country's huge deficit.With the government facing collapse over how to plug the euro zone's biggest deficit, younger workers are increasingly accusing the boomer generation, those born between 1945 and 1964, of saddling France with unsustainable debt.

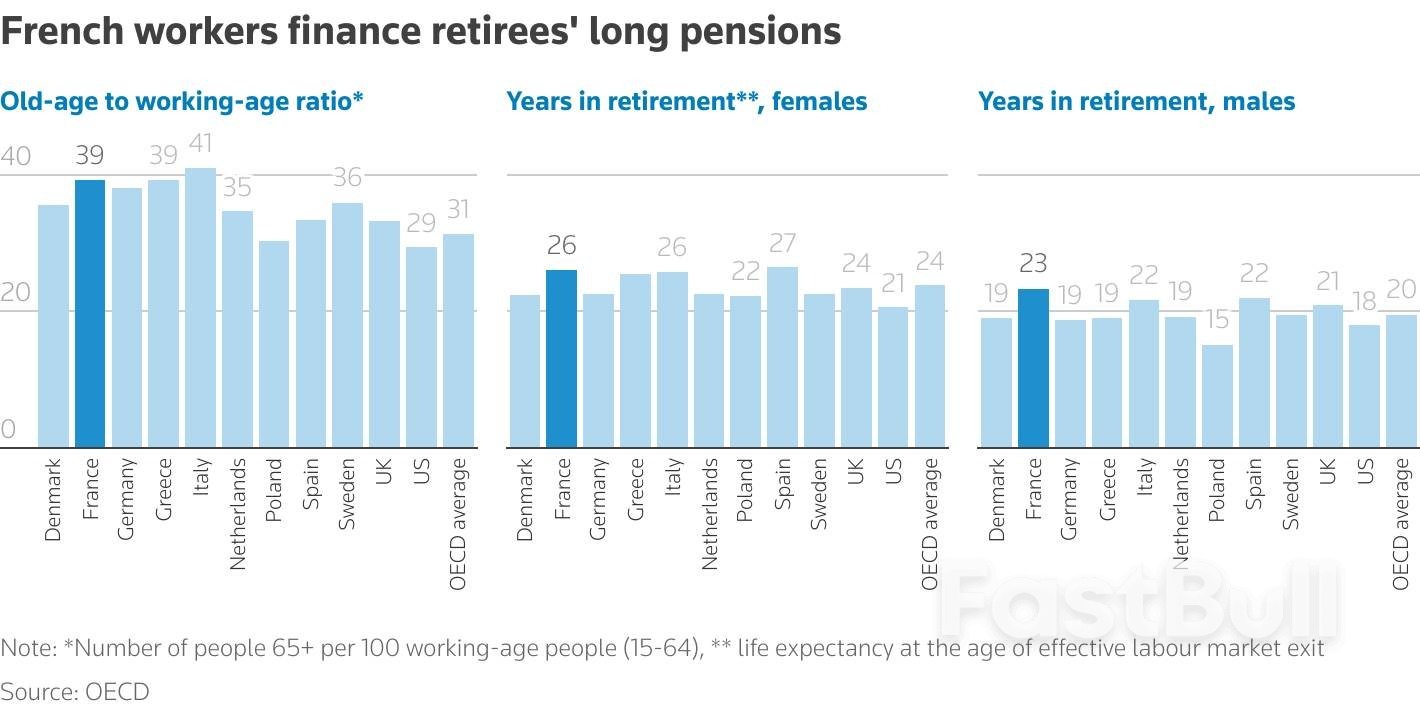

The creator of the "NicolasQuiPaie" X account, which has drawn over 74,000 followers, told Reuters he launched the movement to defend his generation, arguing politicians tend to cater to pensioners who vote more reliably."They have so much voting power that no effort is ever demanded of them. So politicians keep squeezing workers," he said in a written interview, asking to remain anonymous to protect his career.French pensioners retire early, and their generous pensions have risen with inflation, unlike wages, helping to shield them from cost-of-living crises. As they live longer, they are straining a post-war pension system that is struggling to keep pace with modern demographics. Meanwhile, their once-affordable homes are increasingly inaccessible for first-time buyers.

On social media, the hashtag #NicolasQuiPaie has gone viral, with thousands identifying with "Nicolas," a fictional millennial - people born in the 1980s and 90s - whose taxes they say disproportionately fund France's generous welfare state.While the left has largely dismissed #NicolasQuiPaie, politicians from the right and far right have sought to court the movement, hoping to marshal the grassroots anger at a time when every vote counts in France's deeply polarised parliament.

"There's a form of hypocrisy because those who want to take advantage of the movement are those who have constantly defended pensioners," Maxime Sbaihi, a demographics expert, told Reuters, adding that people over 50 now account for a majority of voters.A self-styled libertarian and "minarchist," a proponent of minimal state intervention, the creator of the X account told Reuters he comes from a middle-class background.

His memes often show a burned-out, 30-year-old Nicolas in a work shirt paying to sustain the lifestyle of 70-year-old "Bernard and Chantal" sipping cocktails on a chaise longue. He says clashes with older users have been "very tense.""Even when you raise the issue of pension-funding calmly and factually, there's a wave of hatred toward young people," he said, adding he had received insults like "slacker" or replies such as "do you want to euthanasia us?"

His portrayal of "Nicolas" also funding a fictional "Karmic" - a typically North African name - has sparked accusations of xenophobia and far-right leanings, which he denied.He says the movement has no formal structure, doesn't feel represented by any existing party, but hopes to exert pressure on governments and influence parties ahead of elections."It's up to them to get off the beaten track and bring concrete solutions to the economic and security problems we're going through," he said.

Some older French rejected being blamed for France's woes.

"We don't have a boomer problem, we have a budget problem," said Patrick Sorel, 67, as he walked in Paris with his baguette under his arm. "We paid for Nicolas' education and Nicolas' studies. Politicians need the courage to ask everyone to contribute."Yet some politicians - including several boomers high up in the government - have shown a degree of sympathy for the concerns of "Nicolas".

Conservative Interior Minister Bruno Retailleau said "there'll be a revolt" if employed people like "Nicolas" are the only ones asked to contribute to cutting the deficit, while centrist Prime Minister François Bayrou, who looks certain to lose his job in a parliamentary confidence vote on September 8, recently criticised "boomers who think everything is fine".According to an Elabe opinion poll published on Thursday, a majority of the under-35 agree with Bayrou, while 84% of the over-50 reject this view.Bayrou, 74, had proposed not indexing pensions to inflation in next year's budget to help reduce the deficit, prompting an outcry across party lines.

Sbaihi said that while generational inequality is widespread in developed countries, it's especially stark in France.The pension system relies on intergenerational transfers, meaning today's workers don't save for their own pension but fund retirees directly via mandatory levies on their payslips. With longer lifespans, millennials now support an unprecedentedly large cohort of ageing boomers.

It also shows French people spend longer in retirement than in most other countries."No country has ever treated pensioners better than today's France," Sbaihi said. "The baby-boom generation lived through a golden age, but doesn't quite grasp the impact of its demographic weight."

Key Points:

Federal Reserve Bank of New York President John Williams stated tariffs could increase U.S. inflation by 1.0% to 1.5% within the year, according to his recent speech.

Williams’ remarks highlight the persistent impact of tariffs on U.S. inflation without immediate interest rate changes, reflecting on monetary policy expectations and potential market adjustments.

John Williams, President of the New York Fed, stated that tariffs could contribute 1% to 1.5% to U.S. inflation in 2025. Historical trends support this estimation, aligning inflationary impacts with past tariff impositions.

The tariffs are expected to have an immediate impact on costs for U.S. consumers and industries, potentially increasing goods prices. The macroeconomic outlook projects inflation rates within 3.0%–3.5% in 2025. Although having a role in inflation, tariffs are not currently causing a notable inflation rise. Financial markets, including cryptocurrencies, remain largely unchanged by this news. The Federal Reserve maintains a strategy of watching inflation trends closely.

Tariffs' Inflationary Effects and Federal Reserve's Response

Despite the inflationary influences of tariffs, Williams's statements indicate there will be no sudden shifts in Fed policies related to interest rates. Future interest rate moderations are anticipated depending on economic conditions. The absence of major cryptocurrency market movements following the tariff prediction highlights their limited current effect on that sector. Historical patterns indicate similar inflation-pass-through scenarios resulting in transitory price volatility.

Most of the bidders seeking to buy a portion of Starbucks' China operations have submitted offers valuing the business at as much as $5 billion, said two people who have knowledge of the deal discussions.That quotation would make a potential deal one of the most valuable China unit divestments by a global consumer company in recent years.The offers, which have not been reported previously, would let Starbucks push ahead with the sale in a market where it faces sluggish economic growth and stiff competition from local brands.

Starbucks invited around 10 potential buyers to submit non-binding bids by early September, Reuters reported last month.Most of those bids set the value for Starbucks China at about 10 times its expected earnings before interest, taxes, depreciation, and amortisation (EBITDA) of $400 million to $500 million in 2025, said the people.At least one bidder offered an EBITDA multiple in the high teens, said one of the people.The multiple bidders offered for Starbucks China is similar to one of its main rivals Luckin Coffee, which is currently valued at nine times its projected EBITDA for the next 12 months.Luckin has been gaining market share against Starbucks by offering lower-priced products and increasing its presence in smaller Chinese cities.

The people asked to remain unidentified as the information is confidential.

In response to Reuters request for comment, a spokesperson for Starbucks referred to the chain's latest quarterly earnings which saw record-breaking sales growth in international business and the third consecutive quarterly revenue growth in China.The spokesperson declined to comment on the valuation of the China business or the latest status of the bidding process.Starbucks' enterprise value for the global business is 20.6 times its trailing 12-month EBITDA, and is projected to be 19.3 times the forecast of EBITDA for the next 12 months, according to LSEG data.The Seattle-headquartered company has a market value of about $99 billion as of Thursday.

Starbucks has not yet decided how large a stake it is selling in the China business, Reuters reported last month. The two sources said they did not have information on the stake size.In May, the company said it was not considering a full sale of the business. Starbucks CEO Brian Niccol said on the quarterly earnings call in July it would maintain a meaningful stake in the China business.Starbucks' market share in the world's second-largest economy - home to more than a fifth of its cafes - was 14% last year versus 34% in 2019, data from market researcher Euromonitor International showed.

The chain has since taken the rare step of reducing prices for some non-coffee drinks in China and increasing the pace of new and China-centric products.Comparable-store sales in China increased 2% in the quarter ended on June 29 versus zero growth in the previous quarter.Last month, Reuters reported the coffee chain invited interested parties including private equity firms Carlyle , EQT , Hillhouse Investment and Primavera Capital to submit initial bids.

Other potential buyers selected included Bain Capital, KKR & Co ,and technology major Tencent. It is not immediately clear if all of them submitted non-binding offers.Bain, EQT, Tencent, Carlyle and Primavera declined to comment. The others did not respond to a request for comment.It is not immediately clear what the next steps in the sale process are.Typically, the seller would select a smaller group of bidders from the initial round for a final round, when binding offers are expected.

I was favored with an invitation to the Federal Reserve’s Jackson Hole conference in 2007. Entitled Housing, Housing Finance, and Monetary Policy, the sessions illustrated troubling feedback loops between the mortgage markets and the global economy. The clouds I recall gathering over the Grand Tetons were symbolic; a little over a year later, the world was in crisis.

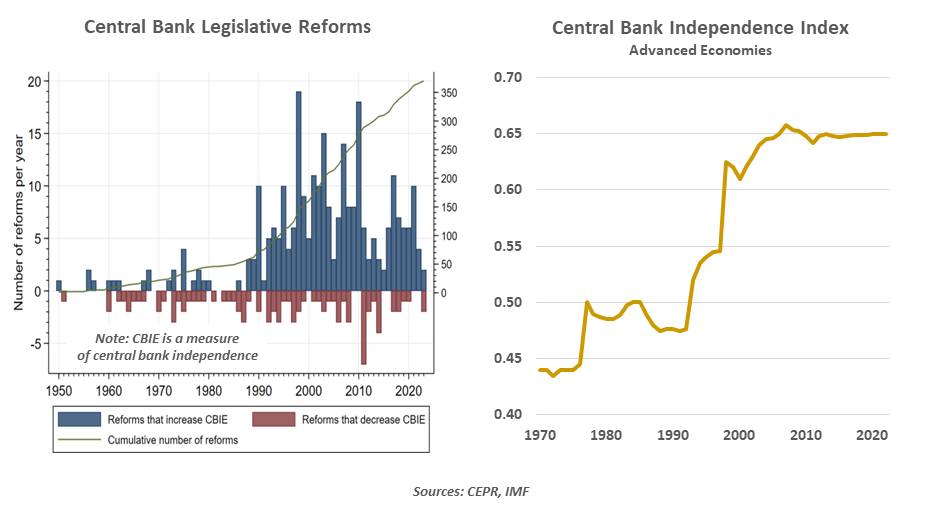

I don’t know what the weather was like in Wyoming this year, but the symbolic clouds that were gathering as the world’s financial dignitaries assembled there were ominous. Presentation topics focused on labor markets and inflation, but the main issue hovering over the event was whether the Fed can remain independent of political influence. Should it lose that battle, the aftershocks could be substantial.Independent central banks are a relatively recent concept. The Federal Reserve didn’t split cleanly from the Treasury Department until 1951; the Bank of England was a branch of the U.K. government until 1997. Debate over the proper degree of partition is still active in many places today.

Those favoring close alignment note the importance of accountability. Political leaders are democratically elected, and feel that their agendas reflect the public’s will. Central banks, in this view, should carry out the course agreed by leaders and their legislatures.To others, however, central banks provide a check on economic policy that is comparable to the role that courts have in adjudicating the law. Governments that accrue large deficits might wish to run the printing presses to finance themselves, leading to inflationary conditions. Creating space for central banks to focus on long-term goals like stable inflation raises the chances of achieving good outcomes. Terms for monetary authorities are long (14 years, in the case of Fed Governors), to immunize them from shifts in political cycles.

There is a substantial body of literature that links distance between governments and their central banks with lower rates of inflation. This, in turn, is positive for economic growth, employment and asset prices. The Fed’s success in fulfilling its mission over the past forty years inspired an increase in the level of central bank independence around the world.Countries that have opted not to follow this approach have been punished by the financial markets. A recent example is Turkey, whose central bank has been directed by a string of individuals close to its president. That country has experienced double digit inflation, a weak currency and capital flight.

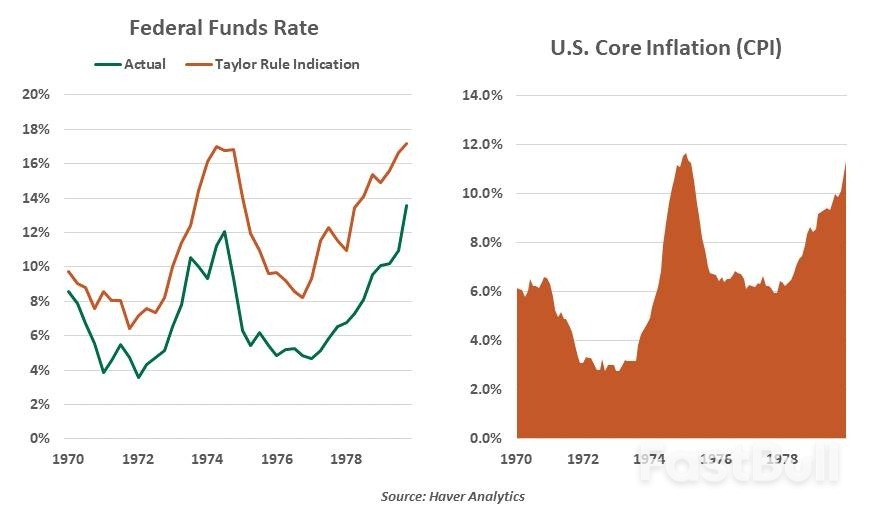

The experience of the 1970s is a cautionary tale for opponents of central bank independence.This evidence hasn’t stopped American leaders from trying to influence monetary policy. As we described last spring, political criticism of the Fed is the rule, not the exception. Most of the time, this has been limited to public statements.The most significant incursion of politics into U.S. monetary policy came during the 1970s, when Richard Nixon appointed his advisor Arthur Burns to head the Fed. Burns kept interest rates lower than they should have been, resulting in substantial inflation at the end of the decade. (The “Taylor Rule” estimation in the chart below provides an estimate of what interest rates should have been, given trends in growth and inflation.) That experience informed a “hands off” posture from the White House that lasted until 2017.

The Fed is an unelected group, but it is not unaccountable. Governors are subject to political approval; they are nominated by the White House and confirmed by the Senate. The Chair provides a monetary report to Congress twice each year, and fields pointed questions from both sides of the aisle. The Fed’s operations are independently audited each year, and they are subject to review by the Government Accountability Office, which is accountable to Congress. The communication surrounding the Fed’s decision-making has expanded substantially over the past forty years; some would say that there is actually too much of it.

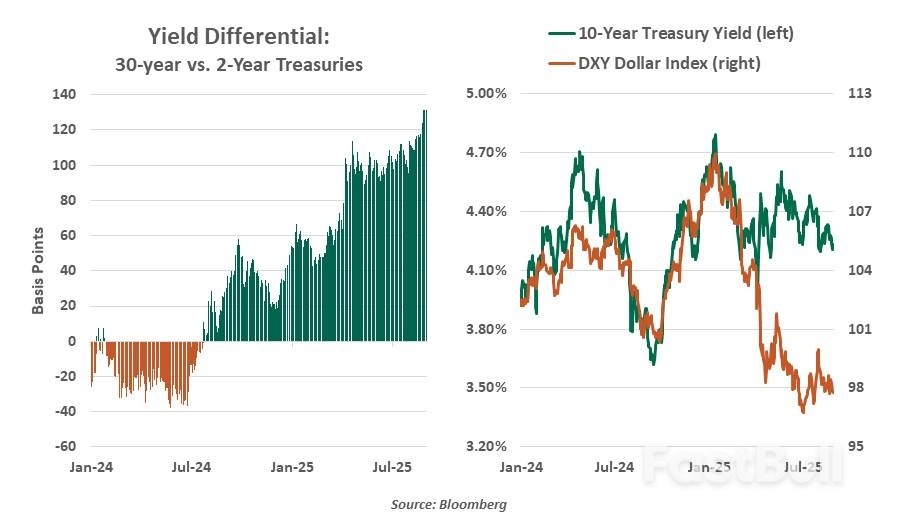

Under both Trump administrations, calls for lower rates and disparagement of Fed officials have been common. Nonetheless, monetary strategy has continued to be guided by fundamentals. Post-pandemic inflation, which remains above the 2% target, has kept policy on the restrictive side. This has increased the ire of the White House, which has called for overnight rates to be 300 basis points lower than they are today.The President has frequently mused about firing current Fed Chairman Jay Powell, whose term at the head of the table concludes next May. This has been seen by most market participants as posturing. But last month, the President took action to terminate Fed Governor Lisa Cook. Cook has sued to retain her position; the matter is now in the hands of the courts. At issue is what “cause” is sufficient to remove a senior official; the termination has no precedent.

The move is part of an effort by the White House to gain control of monetary policy. “We’ll have a majority very shortly,” said the President last week, referring to the makeup of the Fed’s Board of Governors. If Governor Cook loses her appeal to stay, four of the seven members will soon be Trump appointees.There is no assurance that this cohort will vote as a block. Governors Bowman and Waller have made strong statements this year in favor of Fed independence; Waller spent many years as the research director at the Federal Reserve Bank of St. Louis. But if the courts uphold Governor Cook’s dismissal, the Administration could seek grounds to terminate others.

What Would A More Political Fed Do?

A politically motivated majority of Governors could take a number of actions over time that would have been unimaginable before this year. Among them:

These still seem like extreme outcomes, but no possibility should be ruled out. The Project 2025 transition plan, which has influenced the Administration’s approach to a variety of policies, devoted a full chapter to musings on the Federal Reserve. The plan calls for ending the Fed’s maximum employment mandate, preemptively halting any future crisis lending, and exploring a move back to a gold- or other commodity-backed currency system. A lot would have to happen for any of these ideas to become reality. But the potential for personnel changes at the Federal Reserve over time has increased the odds of a tail event.

The reaction of financial markets could provide a check on the Administration’s ambition to control the Fed. A selloff in stocks and bonds could prompt a policy re-evaluation, as it did after the “Liberation Day” tariff announcement in April. Legal challenges are likely along the way; in a decision related to other administrative terminations this year, the Supreme Court gave specific deference to the Federal Reserve. Congress retains the right to reject appointments or proposals that might be viewed as too extreme.The U.S. economy is performing pretty well at the moment. Equity markets have enjoyed another favorable year. Unemployment is very low. Banks are very healthy. One might look at this evidence and wonder why the situation surrounding the Fed is such a big deal.

Borrowing a line from Casablanca, a compromised Fed may not be a problem today, or tomorrow; but it could be soon, and for the rest of our lives. If the Fed’s reputation is diminished, inflation could become unmoored. This would discourage investment, raise costs and damage asset values. The probability of this outcome is low, but rising; and the consequences are vast.A little over a year after my attendance at Jackson Hole, I found myself working at the Federal Reserve Bank of New York, trying to ascertain the extent of the global financial crisis. The courage to do the right thing in the face of immense outside pressure was a hallmark of the Fed’s leadership at that time, and of the institution. I am convinced that we were on the verge of a second Great Depression, which was averted because central banks had the latitude to act without waiting for political endorsement.

I certainly hope that central banks can maintain the respect and space they need to do their jobs. Our economic futures will depend on it.

President Donald Trump will sign an executive order on Friday changing the name of the Department of Defense to the Department of War, reverting to a moniker not used since the 1940s in line with his oft-expressed desire to pump up projections of US military might.

The plans to change the department’s name were described by a White House official on condition of anonymity ahead of the signing. The official said changes would include renaming the Pentagon’s briefing room the “Pentagon War Annex” and modifying the department’s website and signage. The plans were first reported by Fox News Digital.

Trump has long mused about changing the name of the department, even as he boasts about his efforts to end wars abroad and argues that he’s deserving of the Nobel Peace Prize. On social media, Trump repeatedly has referred to Defense Secretary Pete Hegseth as the “Secretary of War” and asked his followers whether he should rename the department.

“We won World War I, we won World War II, we won everything, and it just to me seems much more appropriate,” Trump told reporters in the Oval Office last month. “Defense is too defensive and we want to be defensive but we want to be offensive too if we have to be, so it just sounded to me like a better name.”

Hegseth shared the Fox News Digital report on X, with the new name of his department. He had hinted at the coming change during a speech at Fort Benning on Thursday, saying his job may have “a slightly different title tomorrow, we’ll see.”

Trump and Hegseth have sought to project a more muscular image for the Pentagon, and despite the president’s argument that he’s ended at least seven wars, he’s also launched several military strikes in his second term in the White House. That includes bombing Houthi rebels in Yemen, a strike on Iran’s nuclear program and, most recently, an attack on alleged drug-runners on a motorboat in the Caribbean Sea.

The president has also stoked controversy by enlisting the military to support immigration enforcement and border security, including by deploying the National Guard — and allowing them to carry their service weapons — as part of his takeover of the Washington DC police.

Trump has signaled that his efforts will not stop in the nation’s capital, where he possesses unique authority to oversee the local Guard, but could expand to other cities with Democratic mayors, such as Chicago and New York.

The president has appeared unbothered by the fact that an official name change for the Defense Department would likely require an act of Congress.

“We’re just going to do it, I’m sure Congress will go along, I don’t even think we need that,” he said last month.

The 1947 National Security Act merged the War Department, which dated to 1789, with the Department of the Navy and the Air Force into the National Military Establishment, led by the secretary of defense. The new entity was renamed the Defense Department in a 1949 amendment to the National Security Act.

Trump has charged Hegseth with rebuilding the military, which he says was greatly diminished under former President Joe Biden. His administration has touted strong recruiting numbers evidence that his moves have strong public support.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up